User Reviews

More

User comment

2

CommentsWrite a review

2023-03-20 17:03

2023-03-20 17:03 2023-03-03 13:55

2023-03-03 13:55

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index6.22

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

Rubin Overseas AG

Company Abbreviation

Malfex

Platform registered country and region

United States

Company website

Company summary

Pyramid scheme complaint

Expose

| Malfex | Basic Information |

| Company Name | Malfex |

| Founded | 2019 |

| Headquarters | United States |

| Regulations | Unregulated |

| Tradable Assets | Forex, Metals, Shares, Indices, Commodities, Cryptocurrencies, Bonds |

| Account Types | Standard, Premium, VIP, Islamic Standard, Islamic Raw |

| Minimum Deposit | $500 USD |

| Maximum Leverage | 1:500 |

| Spreads | From 0.0 pips, Metals: From 1.6 pips, Shares: From 1.0 pips, Indices: Competitive, Cryptocurrencies: Low spreads |

| Commission | Forex, Metals, Indices, Cryptocurrencies: No commissions, Shares: Premium account - no commissions, VIP account - $3 per lot |

| Deposit Methods | Credit/Debit Card, Payment Wallets (Neteller, Skrill), Online Banking, Bank Wire Transfer |

| Trading Platforms | Malfex CTrader, MetaTrader 5 (MT5) |

| Customer Support | Email: support@malfex.com, Monday - Friday: 9 AM–9 PM |

| Education Resources | Educational materials, FAQs |

| Bonus Offerings | None |

Malfex is an online trading platform founded in 2019 and based in the United States. It offers various tradable assets, including Forex, metals, shares, indices, commodities, cryptocurrencies, and bonds. Traders have the option to choose from different account types, such as Standard, Premium, VIP, Islamic Standard, and Islamic Raw accounts. The maximum leverage offered is 1:500, and the spreads are competitive, starting from 0.0 pips.

However, it is crucial to note that Malfex operates without any regulatory oversight, making it an unregulated broker. This lack of regulation raises concerns about the safety and security of funds, as well as the fairness of trading practices. Additionally, the platform's educational resources are limited, which may hinder traders' ability to make well-informed decisions. Furthermore, Malfex does not provide bonus offerings to its traders. These factors should be carefully considered by traders before engaging with Malfex, as there are potential risks involved in trading with an unregulated broker and limited support for enhancing trading knowledge.

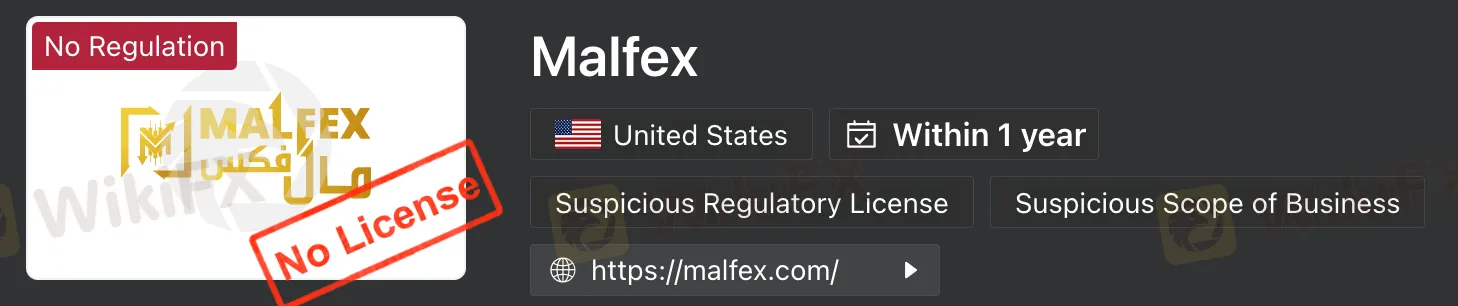

Malfex is not regulated by any recognized financial authority. This means that the broker operates without the oversight and supervision that regulation provides. Trading with an unregulated broker like Malfex exposes traders to significant risks, as there are no guarantees regarding the safety of funds, fair trading practices, or proper handling of client complaints. Regulated brokers, on the other hand, are subject to strict regulations and are required to adhere to certain standards and guidelines to protect the interests of their clients. It is generally advisable to choose a regulated broker to ensure a higher level of security and accountability in the trading process.

Malfex offers a wide selection of tradable assets and various account types to cater to different traders. The availability of multiple deposit and withdrawal methods enhances convenience for clients. Traders can access advanced trading platforms for a better trading experience, supported by comprehensive customer support.

However, a significant drawback is that Malfex operates as an unregulated broker, which can raise concerns about investor protection and transparency. The educational resources provided may be limited compared to regulated brokers. Additionally, Malfex does not offer many bonus incentives, and its geographic coverage might be limited due to regulatory restrictions. Traders should carefully consider the risks associated with trading with an unregulated broker before making a decision.

| Pros | Cons |

| Diverse Tradable Assets | Unregulated Broker |

| Wide Range of Account Types | Lack of Investor Protection |

| Multiple Deposit and Withdrawal Methods | Limited Education Resources |

| Access to Advanced Trading Platforms | Limited Bonus Offerings |

| Comprehensive Customer Support | Potentially Limited Geographic Coverage |

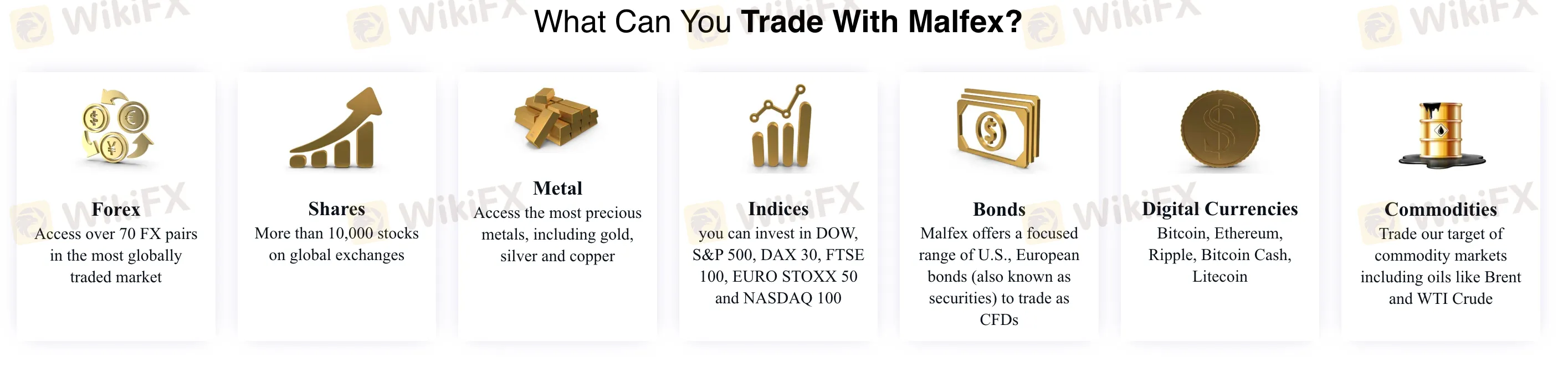

Malfex offers a wide array of trading instruments, providing traders with opportunities to access various financial markets. The available trading instruments include forex pairs, shares, metals, indices, bonds, digital currencies, and commodities.

1. Forex: Access over 70 FX pairs in the most globally traded market. Forex trading allows traders to participate in the foreign exchange market, where they can trade currency pairs and speculate on the fluctuations in exchange rates.

2. Shares: Trade more than 10,000 stocks on global exchanges through Malfex International LLC. Investing in shares allows traders to become partial owners of publicly listed companies and potentially benefit from their growth and dividends.

3. Metals: Access the most precious metals, including gold, silver, and copper. Precious metals are considered safe-haven assets and are commonly used as a store of value during times of economic uncertainty.

4. Indices: Invest in popular indices like DOW, S&P 500, DAX 30, FTSE 100, EURO STOXX 50, and NASDAQ 100. Indices represent the overall performance of specific markets and allow traders to diversify their investments across multiple companies.

5. Bonds: Malfex offers a focused range of U.S. and European bonds as CFDs. Bonds are debt securities issued by governments or corporations and are commonly used for income generation and risk diversification.

6. Digital Currencies: Trade digital currencies like Bitcoin, Ethereum, Ripple, and Bitcoin Cash. Cryptocurrencies have gained popularity as a volatile and innovative asset class, providing traders with opportunities for significant price movements.

7. Commodities: Trade in various commodity markets, including oils like Brent and WTI Crude. Commodities trading allows investors to speculate on the price movements of raw materials and natural resources.

Malfex's diverse range of trading instruments caters to different investment preferences and trading strategies, providing traders with ample opportunities to capitalize on various market conditions and achieve their financial goals.

Here is a comparison table of trading instruments offered by different brokers:

| Product | Malfex | IG Group | Just2Trade | Forex.com |

| CFDs | No | No | No | Yes |

| Forex | Yes | Yes | No | Yes |

| Indices | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | No | Yes |

| Futures | No | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Shares | Yes | Yes | No | No |

| Options | No | Yes | Yes | Yes |

| Spread Betting | No | Yes | No | No |

| Stocks | Yes | No | Yes | Yes |

| ADRs | No | No | Yes | No |

| Bonds | Yes | No | Yes | No |

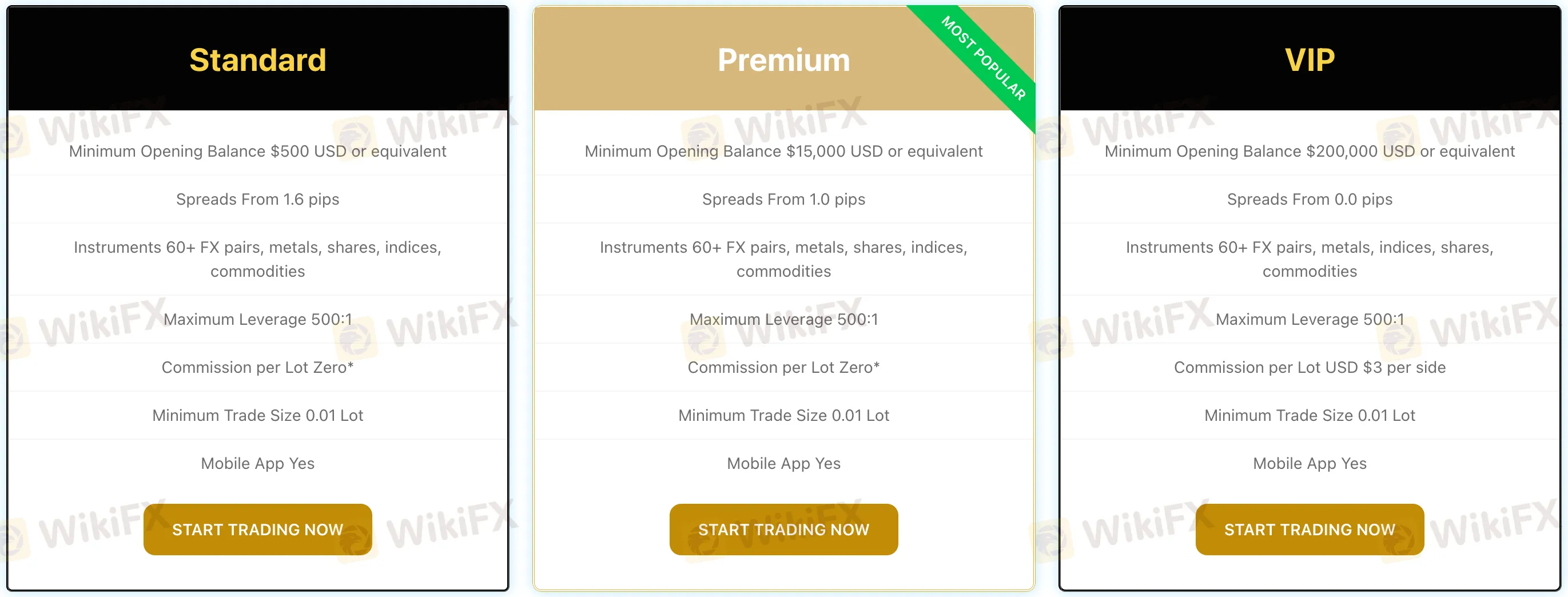

Malfex offers a range of account types tailored to meet the diverse needs of traders, providing them with flexible options to suit their trading preferences and experience levels. The three main account types available are Standard, Premium, and VIP.

The Standard account is an excellent choice for traders starting with a minimum opening balance of $500 USD or equivalent. It offers competitive spreads starting from 1.6 pips and access to over 60 FX pairs, metals, shares, indices, and commodities. The maximum leverage is set at 500:1, providing traders with the ability to control larger positions with a smaller capital investment. Moreover, the Standard account does not charge any commission per lot, making it suitable for those seeking commission-free trading.

For more experienced traders with a higher trading capital, the Premium account offers enhanced features. With a minimum opening balance of $15,000 USD or equivalent, traders can enjoy even tighter spreads starting from 1.0 pip. Similar to the Standard account, the Premium account provides access to over 60 trading instruments and a maximum leverage of 500:1. Additionally, there is no commission per lot, making it an attractive choice for traders looking for better trading conditions.

The VIP account is designed for high-net-worth individuals and institutions with a minimum opening balance of $200,000 USD or equivalent. With spreads starting from 0.0 pips, the VIP account provides the tightest spreads available. Traders can access the full range of over 60 trading instruments, including FX pairs, metals, indices, shares, and commodities. The maximum leverage remains at 500:1, and there is a commission of USD $3 per side per lot. The VIP account also offers mobile app accessibility for on-the-go trading convenience.

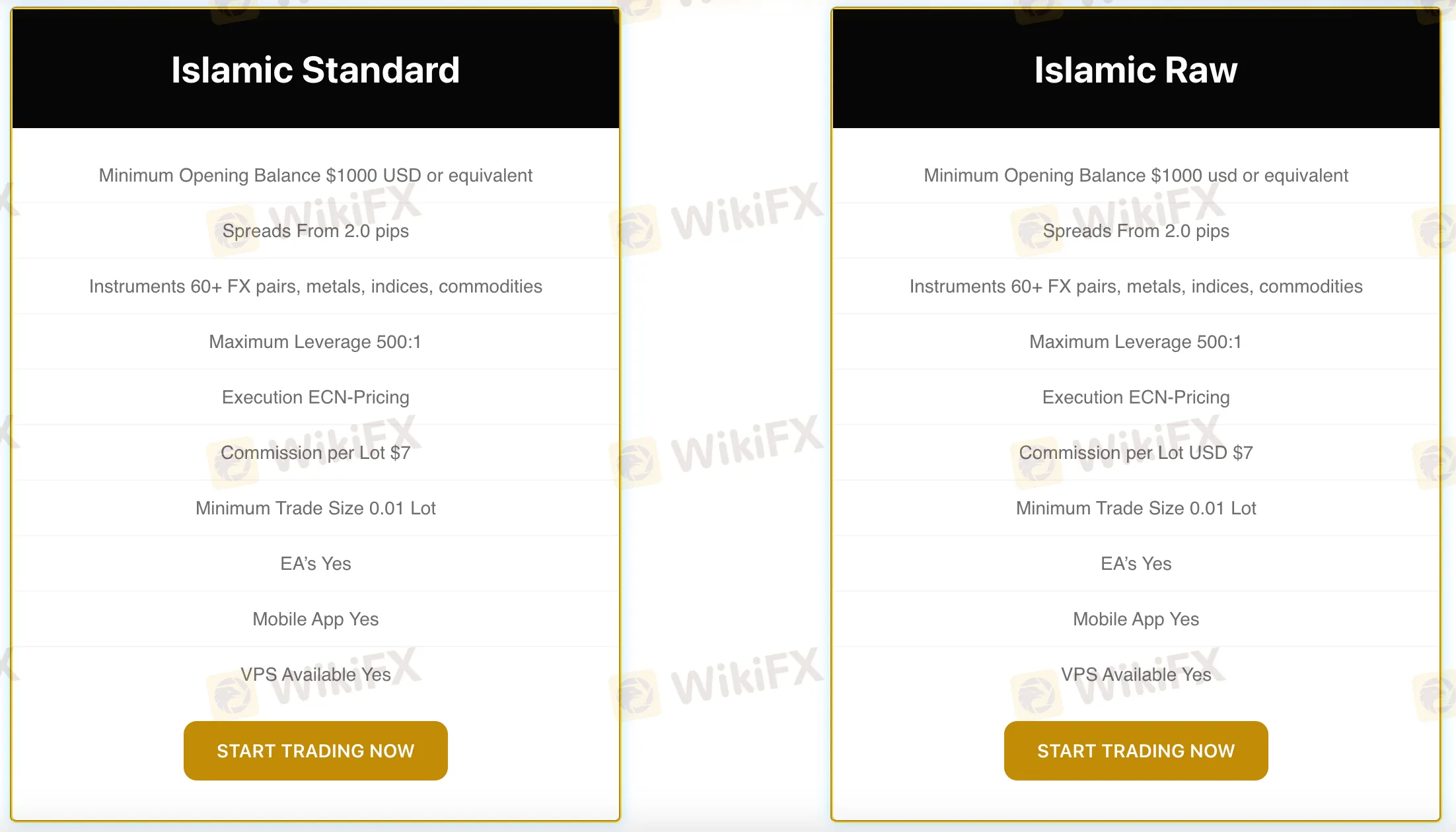

Malfex also caters to Islamic traders with Islamic trading accounts, adhering to Islamic finance principles. The Islamic Standard account requires a minimum opening balance of $1,000 USD or equivalent, offering spreads starting from 2.0 pips and ECN-pricing execution. Traders can access over 60 FX pairs, metals, indices, and commodities, with a maximum leverage of 500:1. A commission of $7 per lot is applicable, and the account allows the use of Expert Advisors (EAs) with mobile app accessibility and VPS availability.

Similarly, the Islamic Raw account also requires a minimum opening balance of $1,000 USD or equivalent, providing spreads starting from 2.0 pips and ECN-pricing execution. The account grants access to over 60 trading instruments, and the maximum leverage is set at 500:1. A commission of USD $7 per lot is charged, and traders can utilize Expert Advisors (EAs) for automated trading. Like the Islamic Standard account, the Islamic Raw account also offers mobile app accessibility and VPS availability.

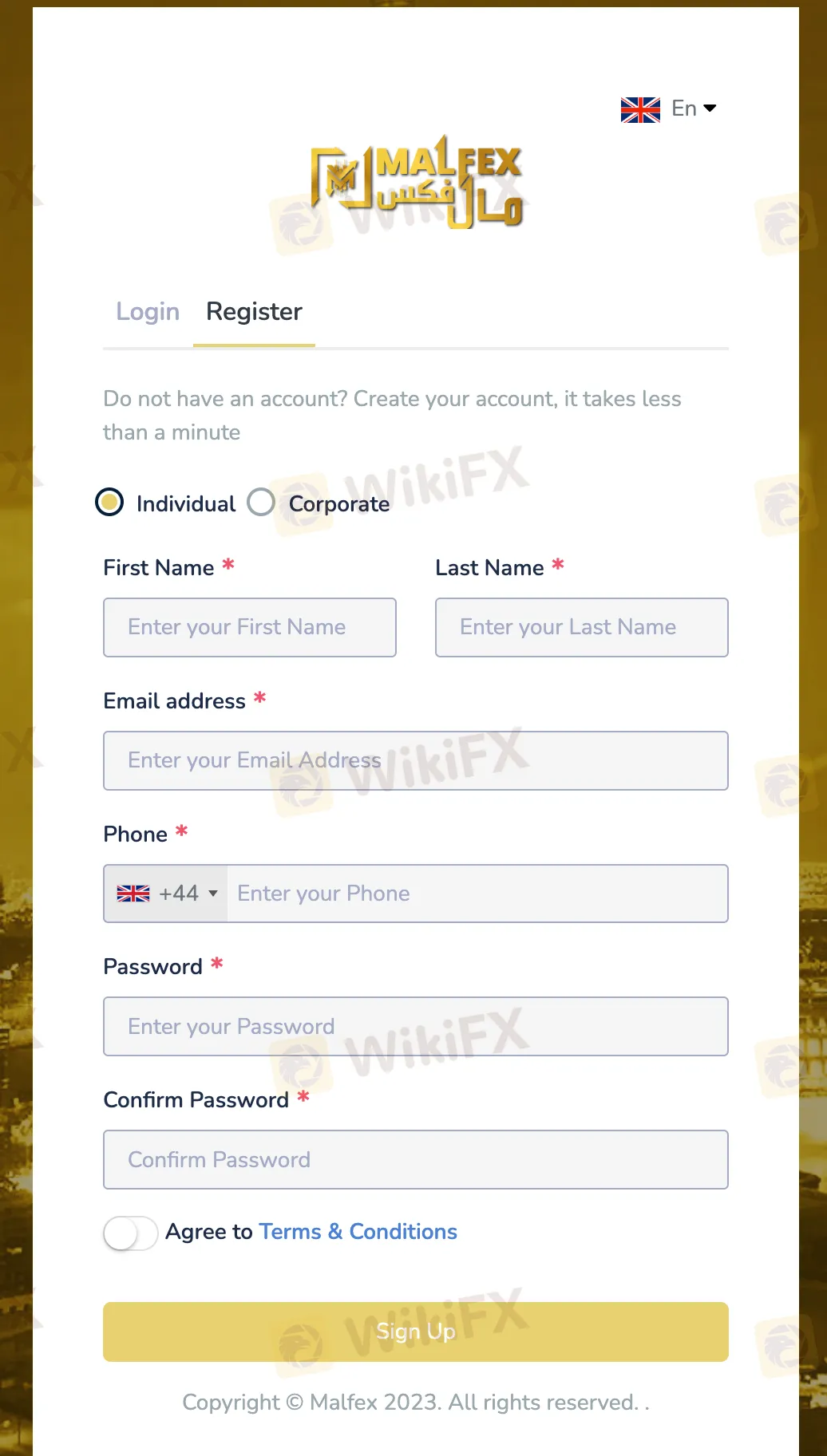

To open an account with Malfex, follow these steps.However, it's essential to keep in mind that Malfex is an unregulated broker. Trading with unregulated brokers carries inherent risks, including potential scams or fraudulent practices. As such, it is crucial to exercise extreme caution and conduct thorough research before deciding to trade with Malfex. Potential traders should be aware of the risks involved and consider seeking advice from trusted sources before opening an account with an unregulated broker.

Visit the Malfex website. Look for the “Open Account” button on the homepage and click on it.

Sign up on websites registration page.

Receive your personal account login from an automated email

Log in

Proceed to deposit funds to your account

Download the platform and start trading

Malfex offers a wide range of trading instruments with flexible leverage options of up to 500:1. Traders can access over 60+ FX pairs in the Forex market, more than 10,000 stocks in Share CFDs, spot prices for precious metals like Gold and Silver in Metals trading, a variety of commodities, and major global stock indices in Indices trading. Leverage allows traders to control larger positions with a smaller capital investment, maximizing trading opportunities. However, traders should use leverage responsibly and be aware of the risks involved in trading with higher leverage.

Malfex provides competitive spreads and commissions for its trading instruments. In Forex trading, spreads start from as low as 0.0 pips, and there are no commissions per lot in the Standard and Premium accounts. For Share CFDs, spreads begin at 1.0 pips in the Premium account, with no commissions per lot. In Metals CFDs, spreads start from 1.6 pips in the Standard account, and there are no commissions per lot. Trading Indices offers competitive leverage and spreads, and there are no commissions per lot. In Cryptocurrency CFDs, traders can benefit from low spreads and zero commissions per lot. Overall, Malfex aims to provide cost-effective trading opportunities for its clients.

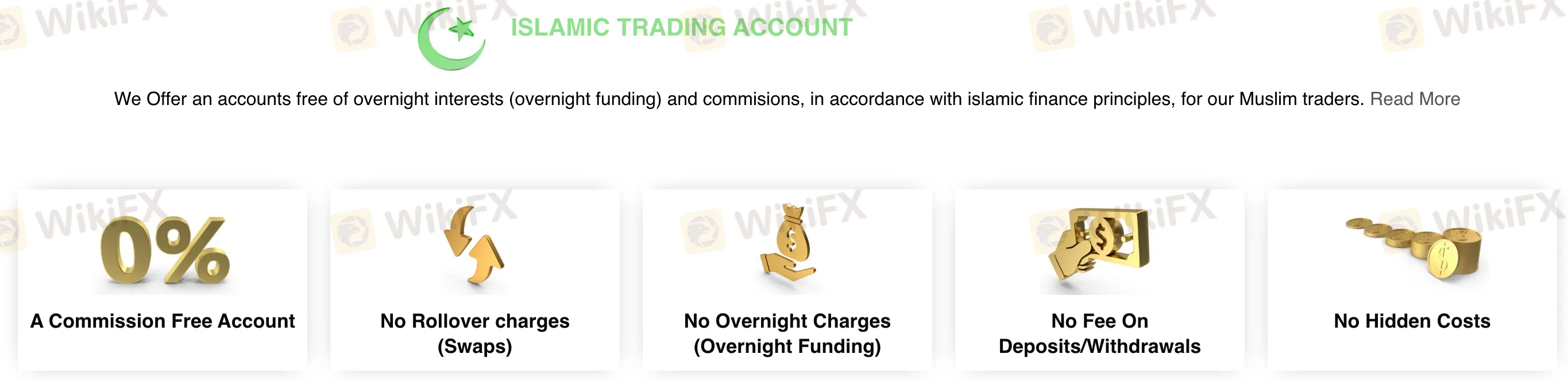

Malfex offers a commission-free Islamic trading account, which is free from rollover charges (swaps), overnight charges (overnight funding), and fees on deposits/withdrawals. The account is designed to adhere to Islamic finance principles, providing a transparent and cost-effective trading experience for Muslim traders. Malfex ensures that there are no hidden costs, allowing traders to trade and manage their funds without incurring additional fees.

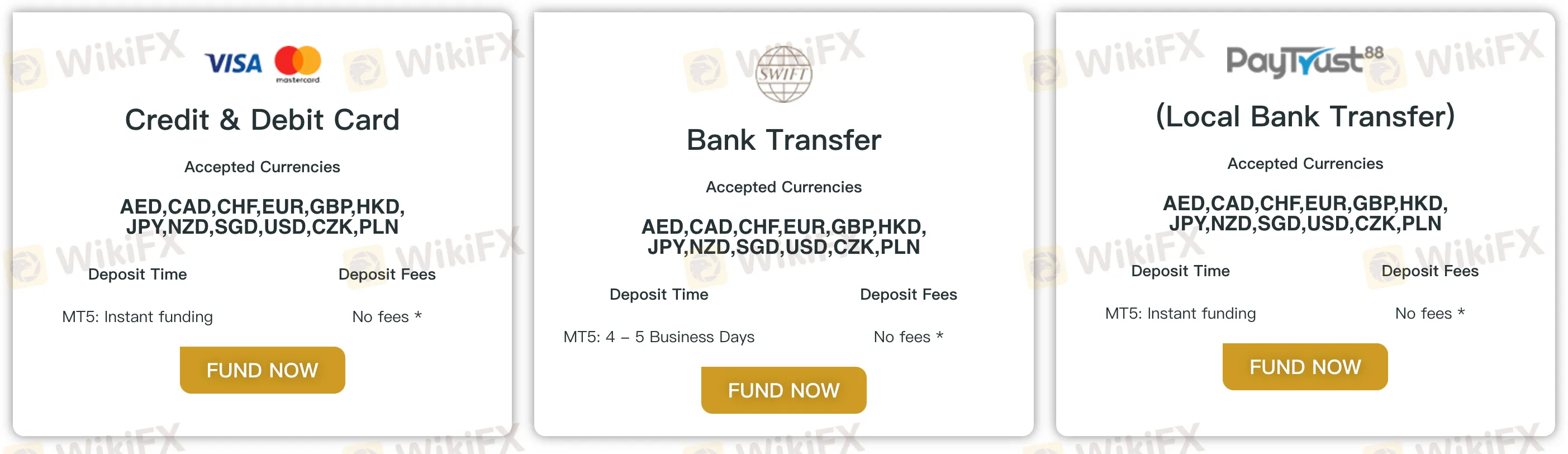

Malfex offers a range of deposit and withdrawal methods, making it convenient for traders to fund and withdraw funds from their trading accounts. Deposits can be made using various payment options, including credit cards, debit cards, payment wallets like Neteller and Skrill, online banking, and bank wire transfer. The deposit process is quick and easy, and Malfex accepts multiple currencies for deposits.

Malfex does not charge any deposit fees and covers internal bank fees for international deposits. However, clients may be responsible for any bank fees charged by their own banks. The minimum deposit for Standard account is $500 USD.

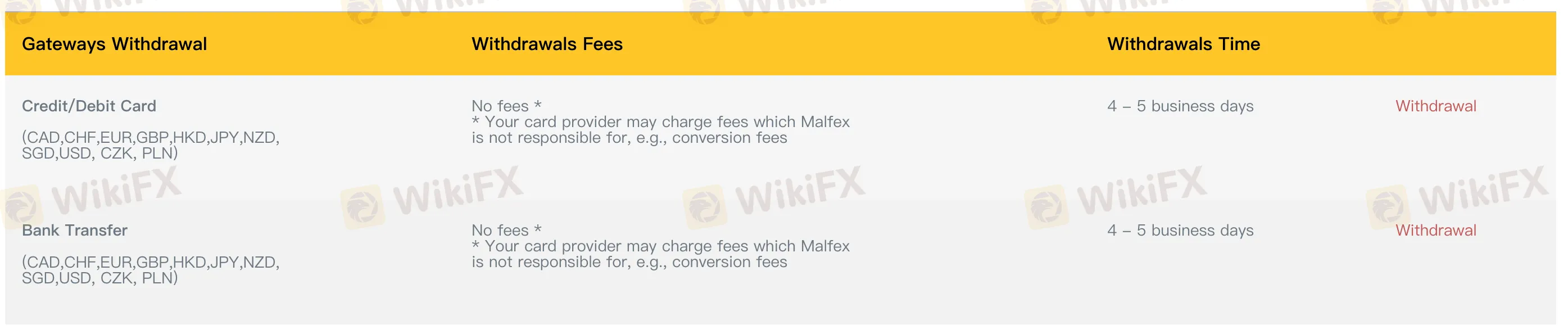

Withdrawals from Malfex trading accounts can be made through the secure client portal using methods such as credit cards, debit cards, payment wallets, online banking, and bank wire transfer. Malfex aims to process withdrawals promptly, and clients can expect their funds within 4-5 business days. It's important to note that any fees charged by card providers or intermediary transfer fees from overseas banking institutions are the responsibility of the client.

When making withdrawals, it is necessary for the withdrawal amount and method to match the initial deposit. If multiple deposit methods were used, the withdrawals should be made in the same order as the initial deposits. Malfex does not charge any additional internal fees for deposits or withdrawals. However, clients should be aware of any potential bank fees that may apply.

In case of any difficulties or inquiries regarding funding or withdrawals, clients can contact Malfex through their live chat or email support. The company strives to provide assistance and address any funding-related issues that may arise due to bank or country restrictions.

Malfex provides two advanced and versatile trading platforms: Malfex CTrader and MetaTrader 5 (MT5), designed to meet the demands of brokers and traders alike.

Malfex CTrader offers a user-friendly interface and aims to deliver deep liquidity, transparency, and low-latency execution. Traders can access a wide range of tradable products, including Forex, Metals, Shares, Indices, Commodities, and Cryptocurrencies. The platform features one-click trading, market depth of latest price quotes, VPS hosting, and alert notifications to track important market events. With over 80 technical analysis indicators and analytical tools, traders can make informed decisions. Malfex CTrader also supports algorithmic trading through the built-in MQL5 development environment, and social trading functionality is available.

On the other hand, MetaTrader 5 (MT5) is a multi-asset trading platform that offers all the advanced features of its predecessor, MT4, along with enhanced trading functionalities, improved scripting tools, and expert advisors. Traders can access a similar range of tradable products as in Malfex CTrader, including Forex, Metals, Shares, Indices, Commodities, and Cryptocurrencies. MT5 also provides one-click trading, market depth, VPS hosting, alert notifications, and comprehensive fundamental analysis, including financial news and an economic calendar. Like Malfex CTrader, MT5 supports algorithmic trading through the built-in MQL5 development environment and offers social trading functionality.

Clients can access both platforms through mobile apps for iPhone and Android devices, allowing them to trade on the go. Malfex also offers a feature-rich client portal for real-time tracking of trading activities and provides superior VPS solutions for traders using Expert Advisors (EAs), scalping, and auto-trading strategies.

Additionally, Malfex offers a web-based version of MetaTrader 5, making it convenient for traders to access the platform without downloading any software. The combination of these advanced trading platforms and cutting-edge technology empowers traders with efficient tools and flexibility in their trading activities.Here is a comparison table of trading platforms offered by different brokers:

Malfex is committed to providing excellent customer support to its traders. Whether you have questions about Forex trading, account-related inquiries, or need assistance with any aspect of the platform, the customer support team is available to help 24/7.

You can reach out to Malfex's customer support through various channels. For general inquiries and support, you can contact them via email at support@malfex.com. The customer support team is available from Monday to Friday, 9 AM to 9 PM, ensuring that you receive timely assistance during regular business hours.

If you have specific questions or need guidance related to trading, you can contact one of Malfex's experienced trading experts. The contact form on the website allows you to enter your name, email address, phone number, subject, and message. By filling out this form, you can directly connect with a trading expert who can address your queries and provide the necessary support.

Malfex understands the importance of being accessible to traders whenever they need assistance, and the dedicated customer support team is ready to ensure that your trading experience is as smooth and seamless as possible. Whether you are a beginner or an experienced trader, Malfex is there to support you on your trading journey.

Malfex provides extensive educational resources to support traders in Forex trading. Their educational materials cover the basics of Forex trading, including what it is, how it works, and what can be traded. Traders can learn about major currency pairs, tight spreads, and deep liquidity offered by Malfex.

The educational resources focus on using advanced trading platforms like Metatrader 5 and CTrader, providing traders with charting tools, technical and fundamental analysis, and real-time price streaming. Malfex emphasizes the importance of risk management and leverage in Forex trading to help traders understand potential risks and rewards.

Malfex offers a seamless user experience with additional features like the Liquidity API, providing access to pricing in 12,500+ FX, CFD, spread bet, and options through one trading account or API. The API is designed to be FIX compliant and supports various communication modes for easy integration with different systems. Traders can execute automated trading strategies using their own algorithms or trading systems with live streaming prices and advanced order types. The integrated account management feature allows real-time monitoring of orders, account balance, margin, positions, and trades.

For technical analysis, Malfex provides historical market data and charting tools to strengthen trading strategies. The API is easily compatible, allowing coding in various programming languages like Perl-script, C++, Python, or VB.NET. With Malfex's user-friendly interface and powerful features, traders can make informed decisions, execute trades efficiently, and manage their accounts effectively.

In conclusion, Malfex offers a diverse range of tradable assets and competitive spreads, making it cost-effective for traders. The availability of multiple account types, including Islamic accounts, caters to different traders' needs. However, the platform's major disadvantage lies in its lack of regulation, exposing traders to significant risks and uncertainties regarding the safety of funds and fair trading practices. Additionally, the limited educational resources and absence of bonus offerings may deter potential users. As such, traders should approach Malfex with caution and carefully consider the potential drawbacks before deciding to trade on the platform.

Q: Is Malfex a regulated broker?

A: No, Malfex is not regulated by any recognized financial authority. As an unregulated broker, it operates without the oversight and supervision that regulation provides, exposing traders to potential risks and uncertainties.

Q: What are the minimum deposit requirements for opening an account with Malfex?

A: The minimum deposit to open a Standard account with Malfex is $500 USD or equivalent in other currencies. For Islamic trading accounts, the minimum deposit is $1,000 USD or equivalent.

Q: What trading platforms does Malfex offer?

A: Malfex provides two advanced trading platforms: Malfex CTrader and MetaTrader 5 (MT5). These platforms offer a user-friendly interface, deep liquidity, low-latency execution, and a wide range of tradable assets.

Q: Are there any commissions on trading at Malfex?

A: Malfex does not charge any commissions on Forex, Metals, Indices, and Cryptocurrency trading. However, for Shares, there are commissions for Premium and VIP accounts, with $3 per lot.

Q: What are the available deposit and withdrawal methods on Malfex?

A: Malfex offers various deposit methods, including credit/debit cards, payment wallets like Neteller and Skrill, online banking, and bank wire transfer. Withdrawals can be made through the secure client portal using similar methods.

More

User comment

2

CommentsWrite a review

2023-03-20 17:03

2023-03-20 17:03 2023-03-03 13:55

2023-03-03 13:55