User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

1-2 years

1-2 yearsRegulated in Seychelles

Derivatives Trading License (EP)

White label MT4

Global Business

Medium potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index1.76

Business Index4.58

Risk Management Index8.90

Software Index8.41

License Index1.76

Single Core

1G

40G

More

Company Name

TM Trading Limited

Company Abbreviation

tradingmoon

Platform registered country and region

Seychelles

Company website

X

Company summary

Pyramid scheme complaint

Expose

| TradingMoon Review Summary | |

| Founded | 2005 |

| Registered Country/Region | Seychelles |

| Regulation | FSA( Offshore Regulated) |

| Market Instruments | Forex, Stocks, Indices, Cryptocurrencies, Commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 0.7 pips (Standard account) |

| Trading Platform | Moon Trader, cTrader, MT4 |

| Copy Trading | ✅ |

| Minimum Deposit | $25 |

| Customer Support | Live Chat, Contact Form |

| Phone: +248 463 2031 | |

| Email: support@tradingmoon.com | |

| Social Media: LinkedIn, Instagram, Twitter | |

| Regional Restrictions | United States, United Kingdom, Iran, North Korea |

TradingMoon was founded in 2005, registered in Seychelles, offshore regulated by the Seychelles Financial Services Authority (FSA), and holds a retail foreign exchange license. The company offers more than 1,000 tradable assets, including foreign exchange, stocks, indices, cryptocurrencies, and commodities, and supports multiple trading platforms such as Moon Trader, cTrader, and MT4. Account types include Standard and Premium accounts, with a minimum deposit of USD 25, maximum leverage of 1:1000, and floating spreads. While the company offers demo accounts, multiple payment options, and various customer support channels, its offshore regulation may weaken regulatory oversight.

| Pros | Cons |

| Various trading instruments | Offshore regulation risks |

| Demo accounts available | Regional restrictions |

| Low minimum deposit | |

| MT4 support available | |

| Live chat support | |

| Copy trading supported | |

| Promotions offered |

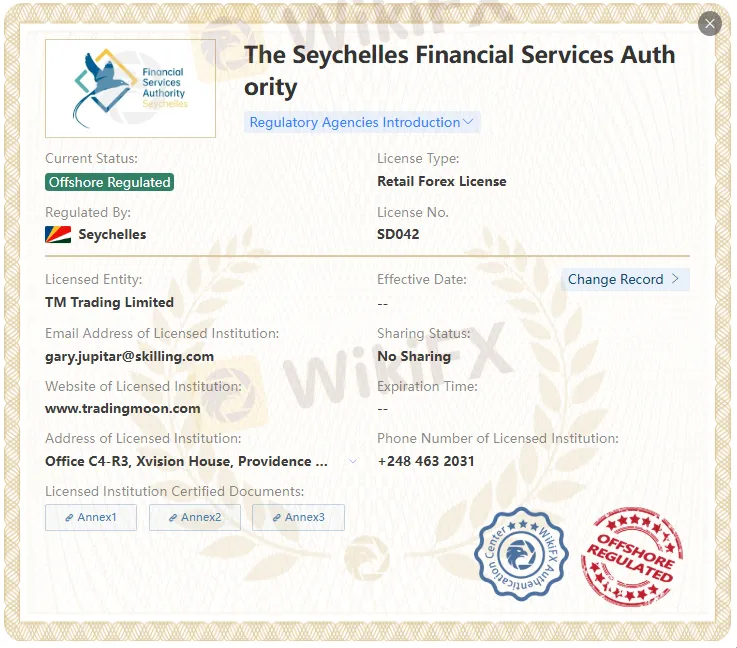

TradingMoon holds an FSA license, Retail Forex License, license number SD042. However, it is offshore regulated, so to a certain extent, regulatory enforcement may not be as strict.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Seychelles | Seychelles Financial Services Authority (FSA) | Offshore Regulated | TM Trading Limited | Retail Forex License | SD042 |

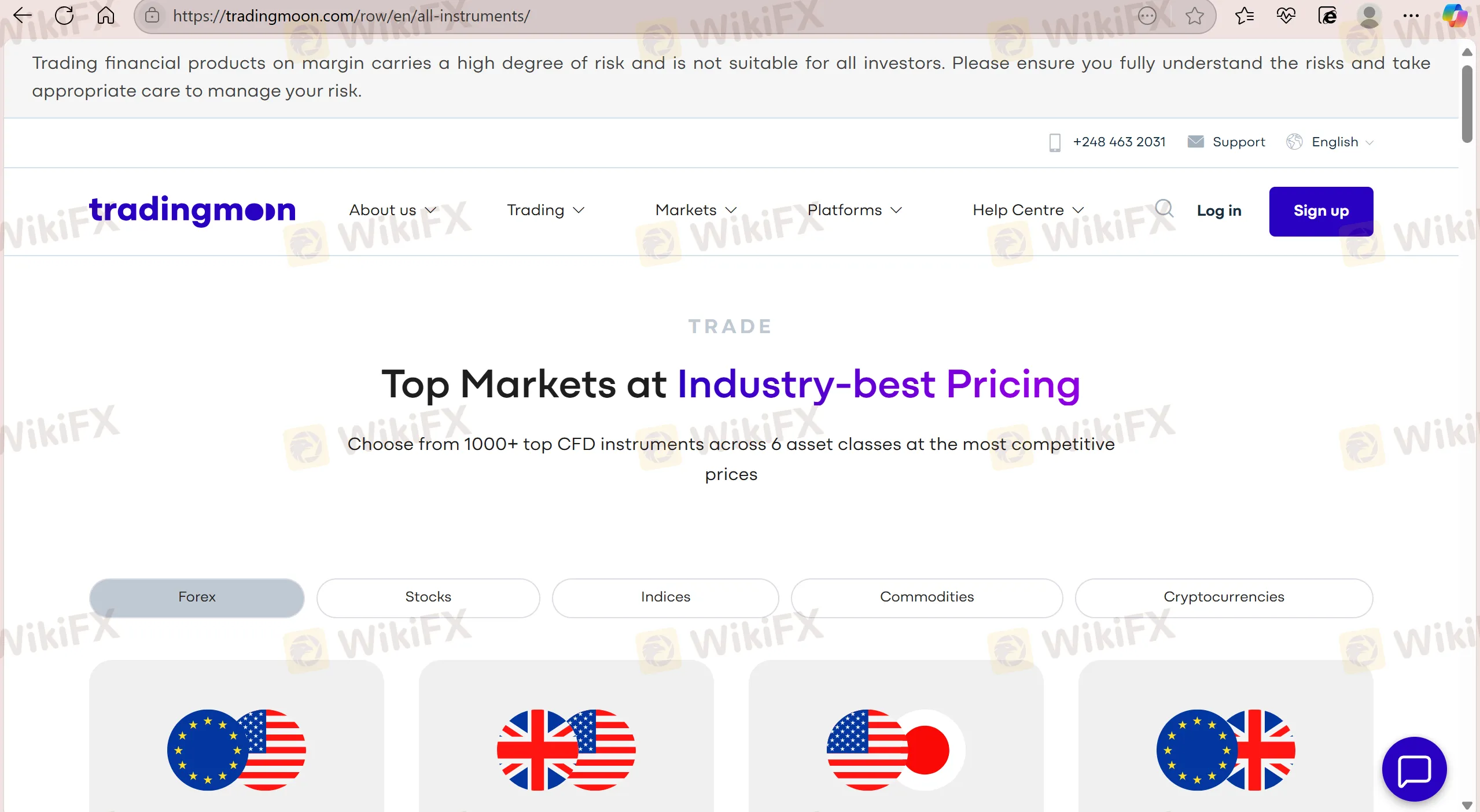

TradingMoon offers over 1,000 tradable assets, including: Forex, Stocks, Indices, Cryptocurrencies, and Commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Commodities | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Funds | ❌ |

TradingMoon provides demo accounts for traders to practice trading.

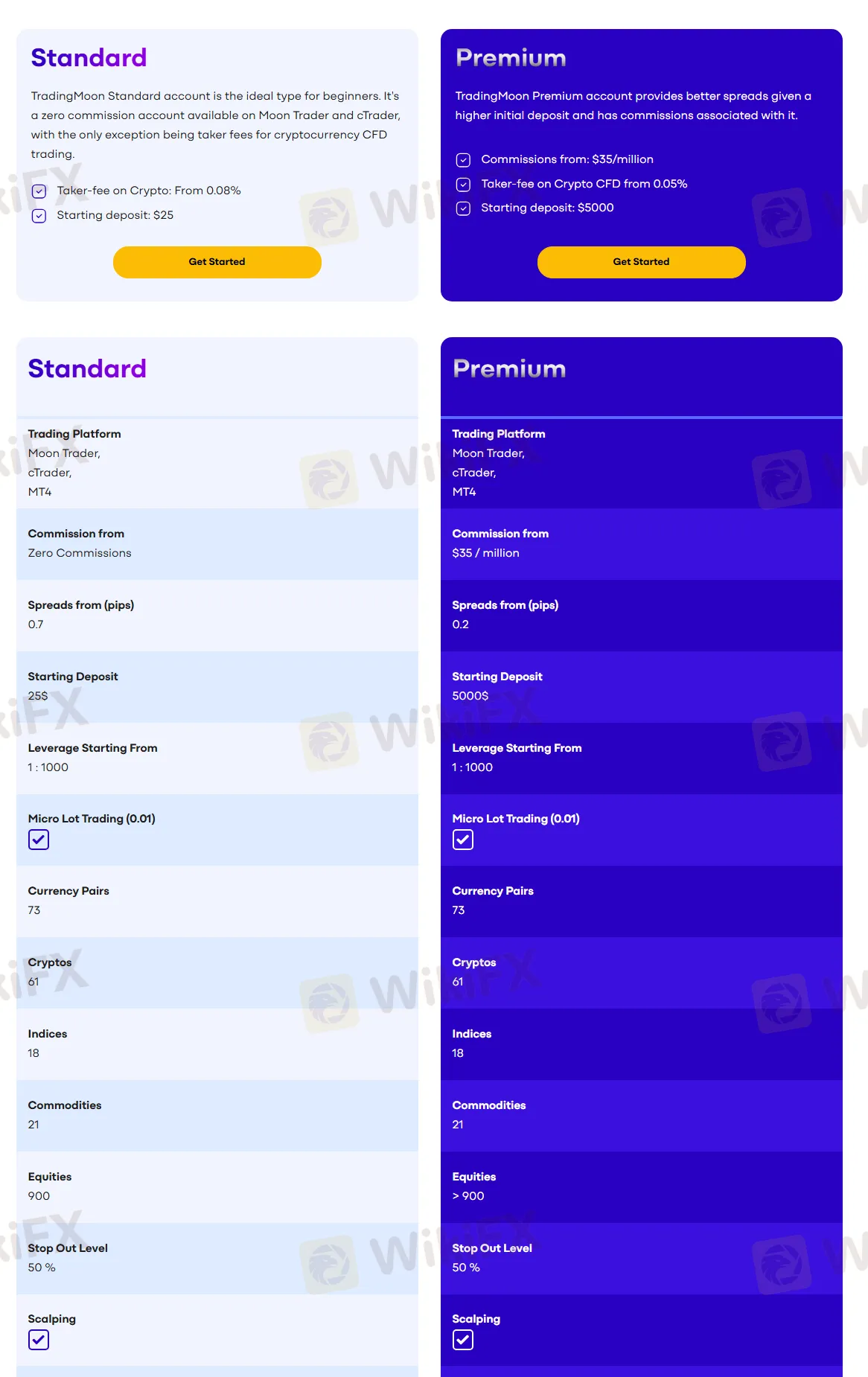

TradingMoon also offers two types of real trading accounts: Standard accounts and Premium accounts.

| Account Type | Minimum Deposit | Minimum Leverage | Spread | Commission |

| Standard | $25 | 1:1000 | From 0.7 pips | Zero |

| Premium | $5,000 | 1:1000 | From 0.2 pips | From $35/million |

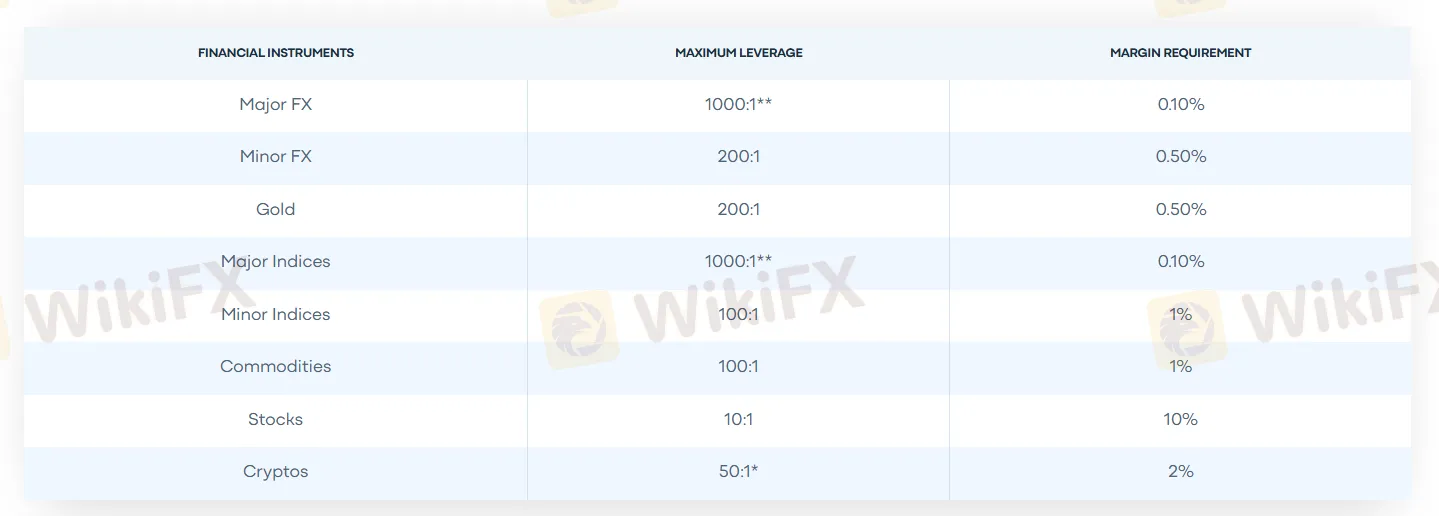

TradingMoon uses a dynamic leverage model for forex, indices, commodities, and stocks, with a maximum leverage of 1:1000. Please note that high leverage can amplify not only profits but also losses.

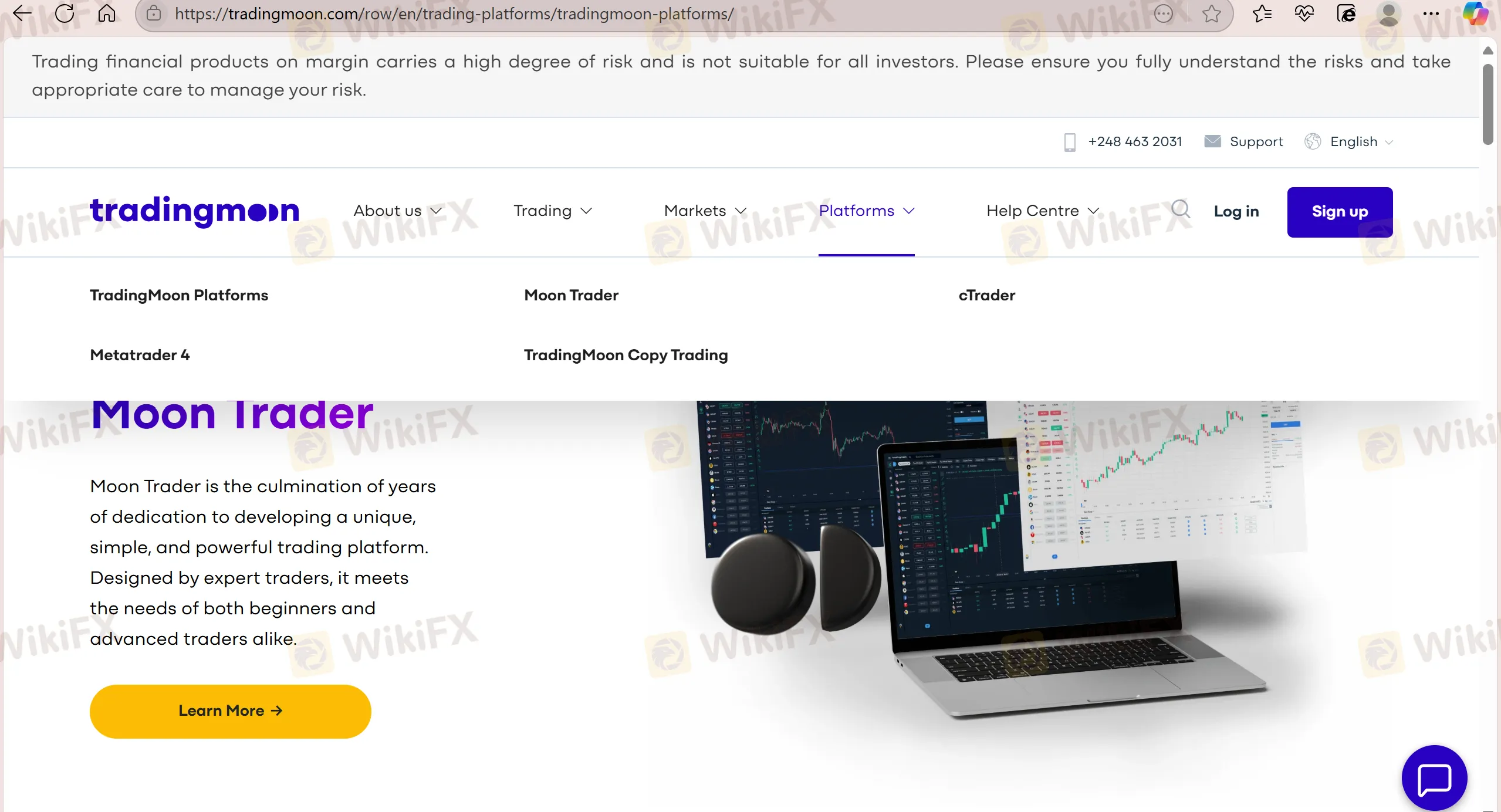

TradingMoon supports traders in conducting transactions through its proprietary platform Moon Trader, cTrader, and MT4.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginner |

| Moon Trader | ✔ | Mobile, Web | / |

| cTrader | ✔ | Mobile, Web | Experienced traders |

| MT5 | ❌ | / | Experienced traders |

TradingMoon accepts a variety of payment methods, including Neteller, Mastercard, Skrill, Binance Pay, Apple Pay, Google Pay, bank transfers, cryptocurrencies, and VISA, providing users with flexible deposit and withdrawal options.

Note: TradingMoon does not charge fees for deposits and withdrawals, but TradingMoon will charge a 2.9% fee for deposits and withdrawals made via Neteller and Skrill. TradingMoon does not support third-party payments.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment