User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index7.48

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| Goldmoney Review Summary | |

| Founded | 2001 |

| Registered Country | Canada |

| Regulation | No regulation |

| Products & Services | Precious metal trading, custody & storage, jewelry manufacturing |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Contact form |

Goldmoney, which started in Canada in 2001, is not regulated by any major financial authority. Through its subsidiaries, the corporation offers bullion trading, safe storage for precious metals, and jewelry making.

| Pros | Cons |

| Long history | No regulatin |

| Wide range of precious metals supported | $10 minimum monthly storage fee |

| Supports retirement account options | No info on deposit and withdrawal |

| Competitive storage fees | |

| Clear fee structure |

Goldmoney is not regulated in Canada, where it is registered. It does not have a license from Canadian regulators to offer financial services. Please be aware of the risk!

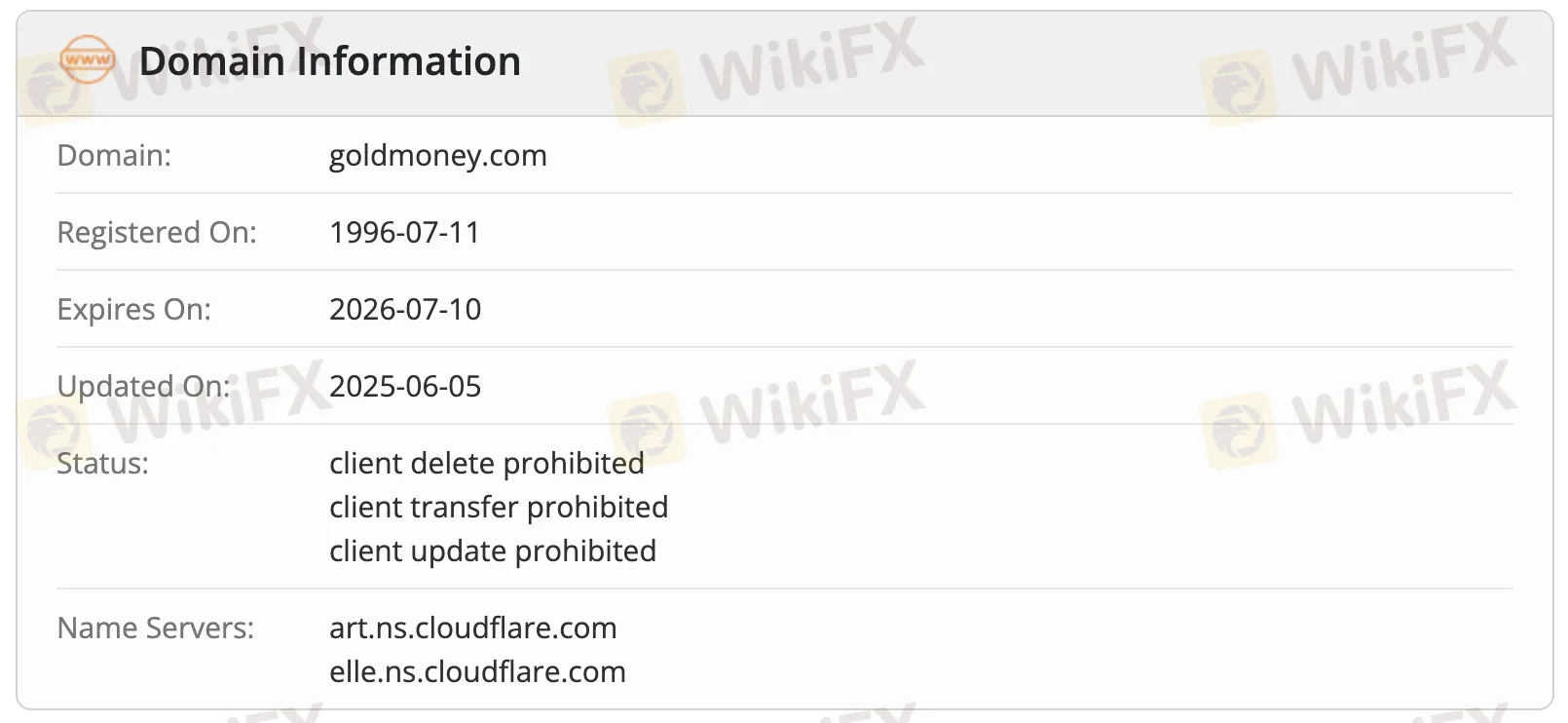

The WHOIS query results for the domain goldmoney.com show that it was registered on July 11, 1996. It is now active, and the following protections are in place: clients cannot delete, move, or alter their accounts. The last time the domain was updated was on June 5, 2025, and it will expire on July 10, 2026.

Goldmoney's subsidiaries make jewelry and trade precious metal bullion. They also offer safe storage for precious metals.

| Trading Instruments | Supported |

| Precious Metals | ✔ |

| Forex | ❌ |

| Other Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

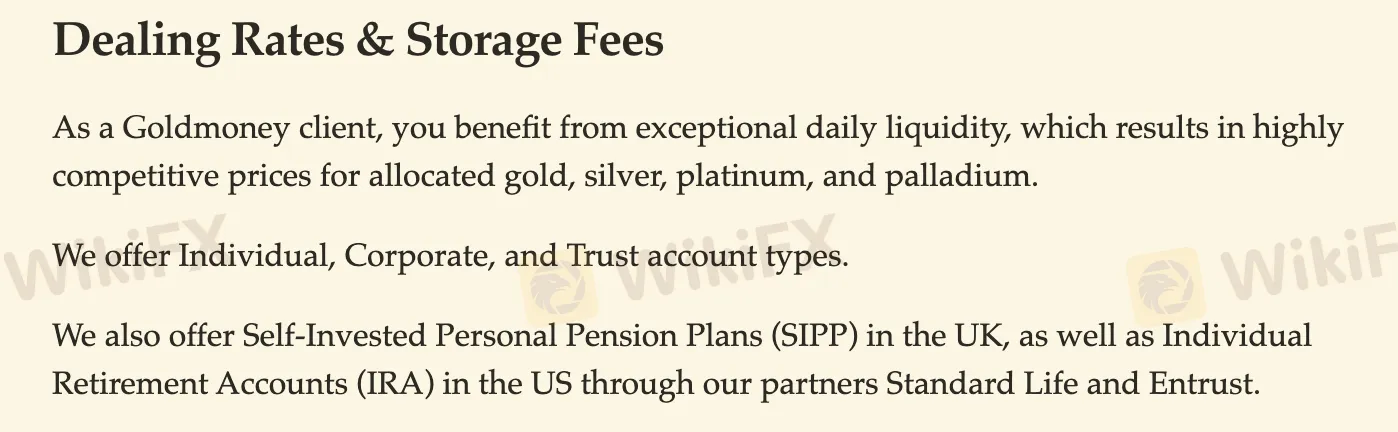

There are three primary types of live (financed) accounts that Goldmoney offers: Individual, Corporate, and Trust accounts. The company also offers accounts that help people save for retirement, like Self-Invested Personal Pension Plans (SIPP) in the UK and Individual Retirement Accounts (IRA) in the US. These accounts are offered through its partners Standard Life and Entrust.

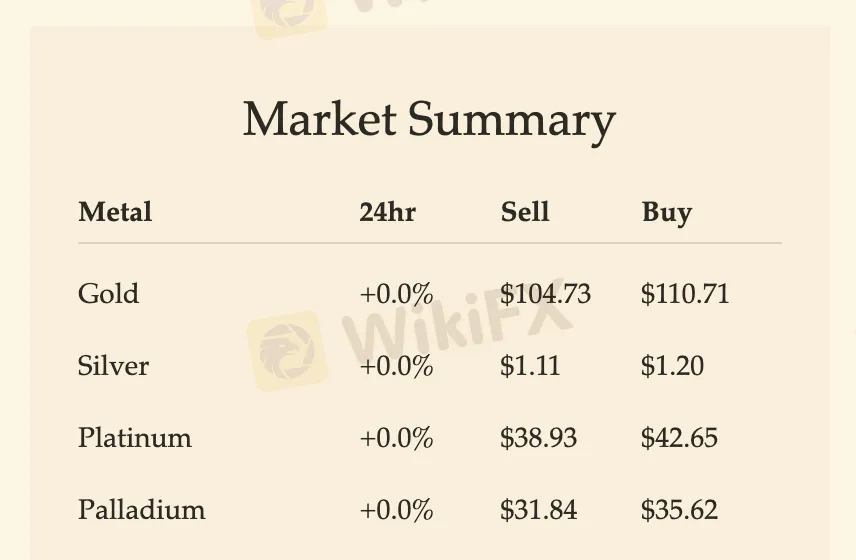

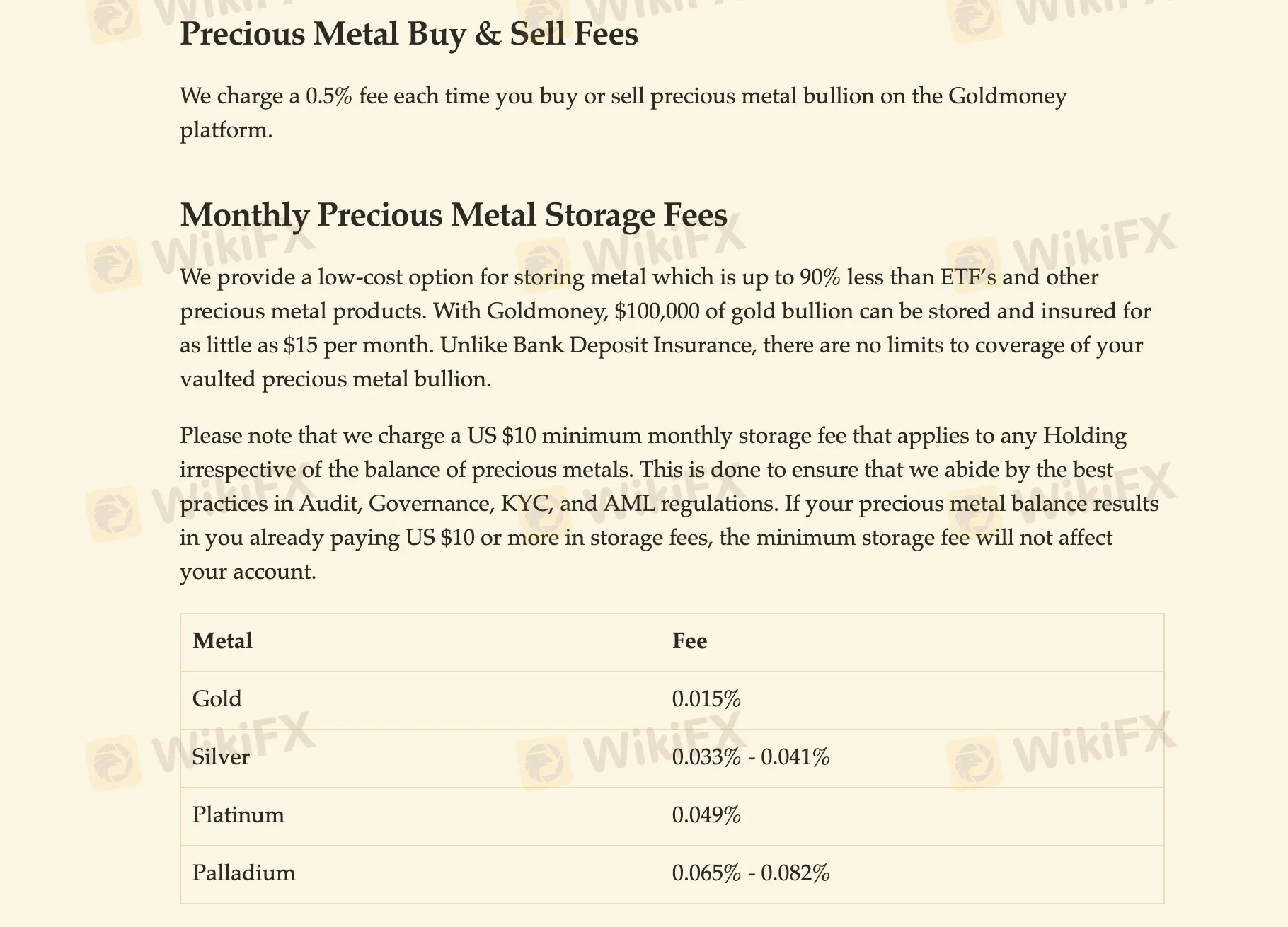

Goldmoney's prices are usually low to moderate compared to other companies in the same field. For example, it says that its storage fees are up to 90% lower than those of ETFs and other similar products. Fees for trading are reasonable. However, some fees for withdrawing money and registering for a bar might pile up depending on how much you use them.

| Fees | Amount |

| Buy/Sell Fees | 0.5% per transaction for all precious metals |

| Monthly Storage Fees | Gold: 0.015% |

| Silver: 0.033–0.041% | |

| Platinum: 0.049% | |

| Palladium: 0.065–0.082% | |

| Minimum Monthly Storage | $10 minimum (applies if storage cost is below this threshold) |

| Funding Fees | Free via bank wire or CHAPS (your bank may charge separately) |

| Withdrawal Fees | Varies by currency (e.g., $25 for USD, €25 for EUR wire, €10 for SEPA, £20 for GBP wire) |

| Bar Registration Fees | Additional metal cost depending on size/type (e.g., 1g of gold for a Good Delivery bar) |

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment