User Reviews

More

User comment

0

CommentsWrite a review

No comment yet

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.88

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

| MXFReview Summary | |

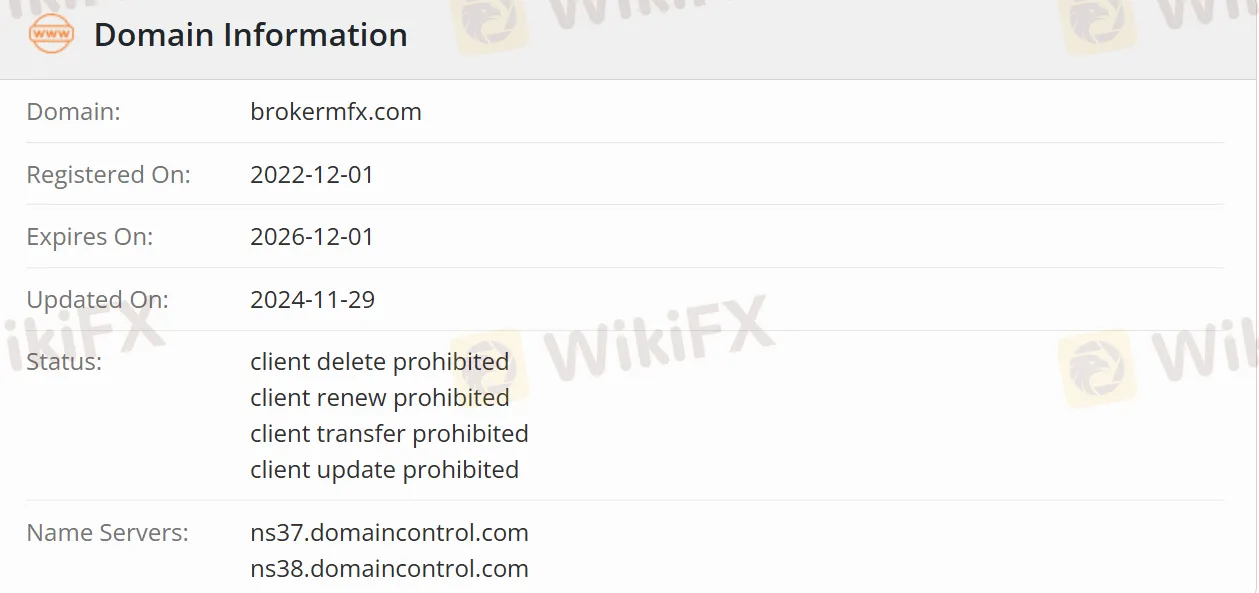

| Founded | 2022 |

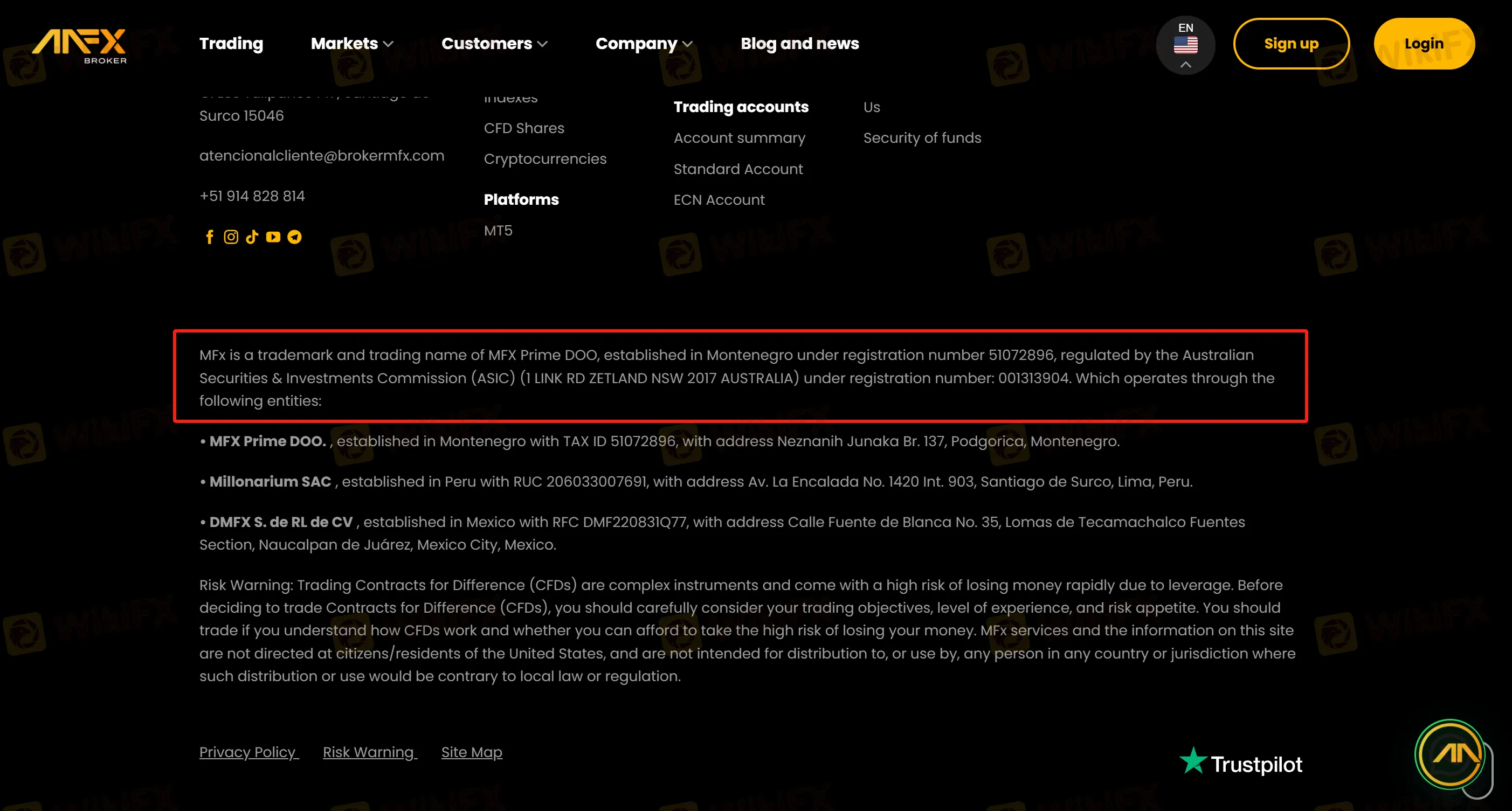

| Registered Country/Region | Montenegro |

| Regulation | No regulation |

| Market Instruments | Forex, Metals, Commodities, Indices, Actions, Cryptocurrencies |

| Demo Account | ✔ |

| Leverage | Up to 1:1000 |

| Spread | From 0.0 pip (INSTITUTIONAL) |

| Trading Platform | MT5 |

| Minimum Deposit | $0 |

| Customer Support | Email: atencionalcliente@brokermfx.com |

| Phone: +51 914 828 814 | |

| Social Media: WhatsApp, Facebook, Instagram, TikTok, YouTube, Telegram | |

| Address: C. Los Tulipanes 147, Santiago de Surco 15046 | |

| Regional Restrictions | USA |

MXF is an unregulated broker registered in Montenegro. It operates in the foreign exchange trading market. Traders on this platform can access MetaTrader 5 as well as market instruments including forex, indices, commodities, and bonds. With no deposits and high leverage, MXF enables traders to achieve significant market positions even with a small initial investment. However, MXF does not provide services to residents of the United States.

| Pros | Cons |

| Demo account available | Unregulated |

| MT5 available | Account inactivity fees are charged |

| Various payment methods | No 24/7 customer service |

| Multiple customer support | Regional restrictions |

| Various trading instruments | |

| Low minimum deposit of $0 |

MXF is an unregulated brokerage firm even if it claims to be regulated. Traders should take care while engaging with this platform.

These are the instruments that can be traded on MXF: 70 forex, 30 cryptocurrencies, 74 stocks, 30 indices, metals, commodities, and actions.

| Trading Assets | Available |

| Forex | ✔ |

| Metals | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| Actions | ✔ |

| Stocks /Shares | ✔ |

| Energies | ❌ |

| Options | ❌ |

| Mutual Funds | ❌ |

| ETFs | ❌ |

MXF offers a demo account, which allows traders to test out this platform without risking real money.

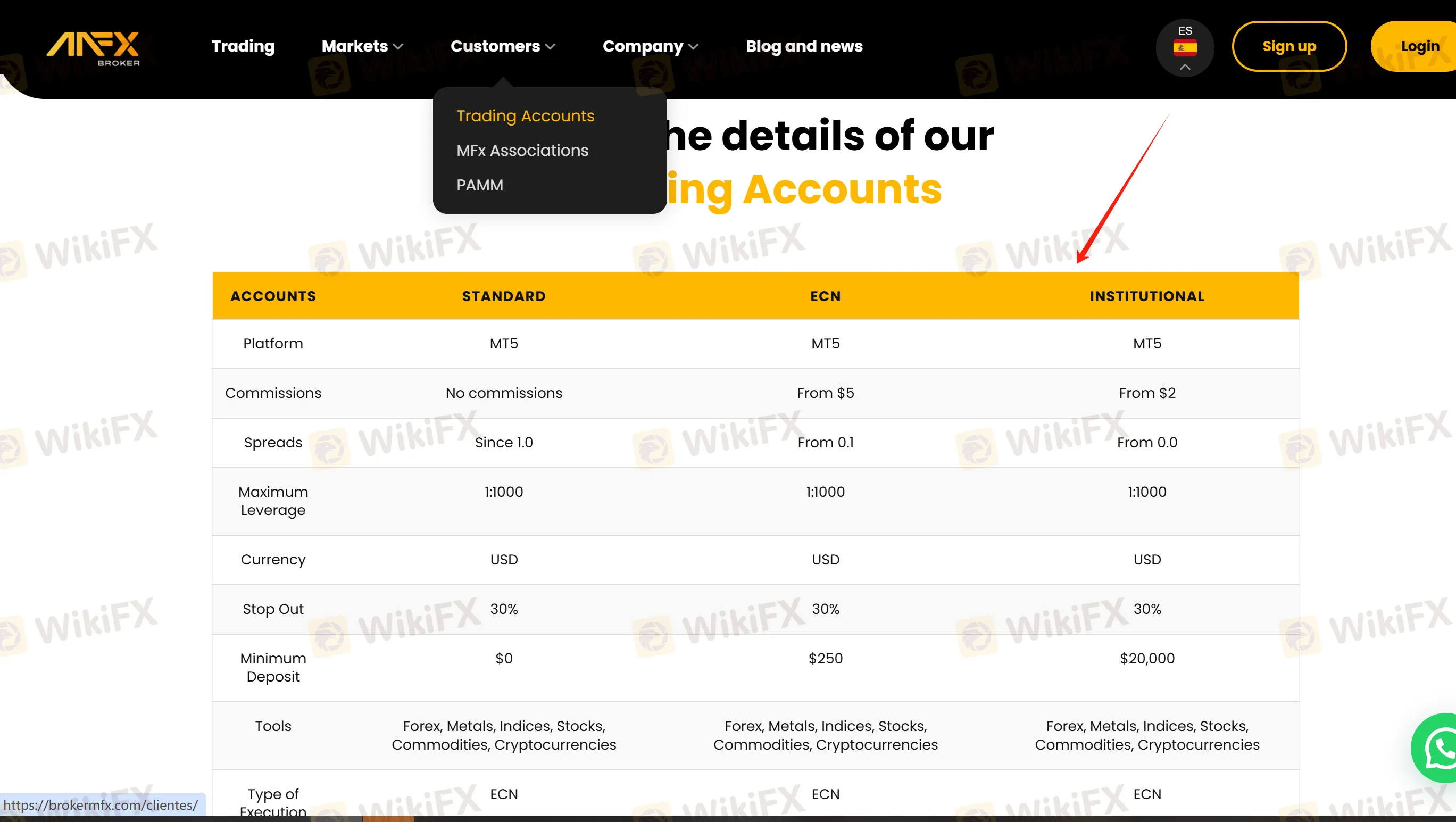

MXF offers two types of live trading accounts: Standard Accounts and ECN Accounts. Each has distinct trading conditions.

| STANDARD | ECN | INSTITUTIONAL | |

| Platform | MT5 | MT5 | MT5 |

| Commissions | No commissions | From $5 | From $2 |

| Spreads | From 1.0 pips | From 0.1 pips | From 0.0 pip |

| Maximum Leverage | 1:1000 | 1:1000 | 1:1000 |

| Currency | USD | USD | USD |

| Stop Out | 30% | 30% | 30% |

| Minimum Deposit | $0 | $250 | $20,000 |

| Type of Execution | ECN | ECN | ECN |

The leverage of this platform is up to 1:1000. High leverage means high returns, but at the same time, high risk.

Commission: Standard accounts incur zero commissions, while ECN and Institutional accounts charge per lot ($5/$2 per lot).

Spread: The spread varies for different assets, such as EUR/USD (0.1 pips), gold (1.4 pips), and Bitcoin (1.1 pips).

MFX does not charge any fees for deposits or withdrawals. However, certain platforms (such as cryptocurrency wallets or virtual wallets) may impose their own fees.

If a user's account remains inactive for more than three months, the account will be archived, and the balance will be transferred to the wallet. Starting from the fourth month, an additional maintenance fee of 10 USD per month will be charged.

MT5 is an advanced platform that supports the trading of multiple financial products, providing an automated trading system, technical tools, and copy trading functions.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced trader |

| MT4 | ❌ | / | Beginner |

MFX offers the following payment methods: Mastercard, Ethereum, Tether (USDT), Bitcoin, Visa, Skrill, American Express, and Bank Transfer.

More

User comment

0

CommentsWrite a review

No comment yet

start to write first comment