User Reviews

More

User comment

12

CommentsWrite a review

2025-07-25 10:36

2025-07-25 10:36

2024-07-16 18:44

2024-07-16 18:44

Score

10-15 years

10-15 yearsRegulated in Cyprus

Market Making License (MM)

MT4 Full License

Regional Brokers

Medium potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index6.72

Business Index8.00

Risk Management Index8.90

Software Index9.32

License Index6.72

Single Core

1G

40G

Danger

More

Company Name

Instant Trading EU Ltd.

Company Abbreviation

ForexMart

Platform registered country and region

Cyprus

Company website

35795923053

35795526329

Company summary

Pyramid scheme complaint

Expose

| ForexMart Review Summary | |

| Founded | 2015 |

| Registered Country/Region | Cyprus |

| Regulation | CySEC; FCA(Suspicious Clone) |

| Market Instruments | Forex, stocks, spot metals, cryptocurrencies, energy, indices, commodities |

| Demo Account | ✅ |

| Leverage | Up to 1:30 |

| Spread | From 4 pips (Basic account) |

| Trading Platform | MetaTrader 4 |

| Minimum Deposit | €200 |

| Customer Support | Live chat |

| Phone: +357 250 57 236 | |

| Email: support@forexmart.eu | |

ForexMart, which was founded in 2015 and is regulated by CySEC, provides a wide range of trading instruments such as forex, stocks, cryptocurrency, and commodities. While it offers cheap spreads and no-commission Forex trading, its FCA registration claim is marked as a questionable clone.

| Pros | Cons |

| Regulated by CySEC | Suspicious cloned licence with FCA |

| Multiple account types | Wide spreads |

| Wide range of tradable instruments | No MT5 |

| MT4 supported | High minimum deposit |

| Live chat support |

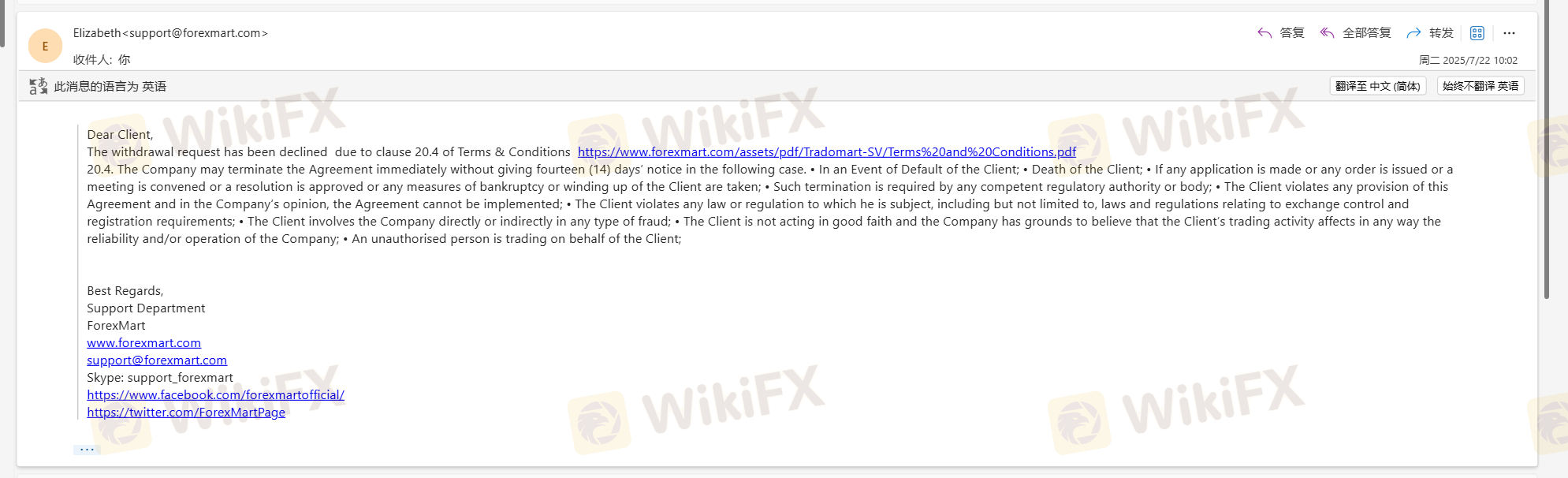

ForexMart is legally regulated in Cyprus by CySEC, but its claim to be regulated by the FCA in the UK is identified as a suspicious clone. This means that it is not fully authorized by the FCA and may be employing a false or misleading claim.

| Licensed Entity | Licensed by | Licensed Institution | License Type | License Number | Current Status |

| Instant Trading EU Ltd | Cyprus | Cyprus Securities and Exchange Commission (CySEC) | Market Maker (MM) | 266/15 | Regulated |

| Instant Trading EU Ltd | United Kingdom | Financial Conduct Authority (FCA) | European Authorized Representative (EEA) | 728735 | Suspicious Clone |

ForexMart has a lot of different trading instruments, such as equities, spot metals, cryptocurrencies, energy, indexes, and commodities.

| Trading Instruments | Supported |

| Forex | ✔ |

| Stocks | ✔ |

| Spot metals | ✔ |

| Cryotocurrencies | ✔ |

| Energy | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Bonds | ✘ |

| Options | ✘ |

| ETFs | ✘ |

ForexMart has three categories of live trading accounts: Basic, Gold, and Platinum. Each one is made for a particular sort of trader, from novices to experts who trade a lot. It also lets you practice with a demo account.

| Account Type | Minimum Deposit | Spread (Fixed) | Commission | Min Lot Size | Execution Type | Suitable for |

| Basic | €200 | from 4 pips | 0 | 0.01 | Market Execution | Beginners, small retail traders |

| Gold | €300,000 | from 2 pips | Advanced retail traders, professionals | |||

| Platinum | €1,000,000 | from 1.5 pips | Institutional or high-volume traders |

ForexMart provides varying leverage levels based on the product category (up to 1:30). Higher leverage can improve profit potential while also increasing risk, therefore appropriate risk management is crucial.

| Asset Class | Maximum Leverage |

| Forex | 1:30 |

| Stocks (CFD) | 1:5 |

| Spot Metals | 1:20 |

| Cryptocurrencies | 1:2 |

| Energy | 1:2 |

| Indices | 1:20 |

| Commodities | 1:10 |

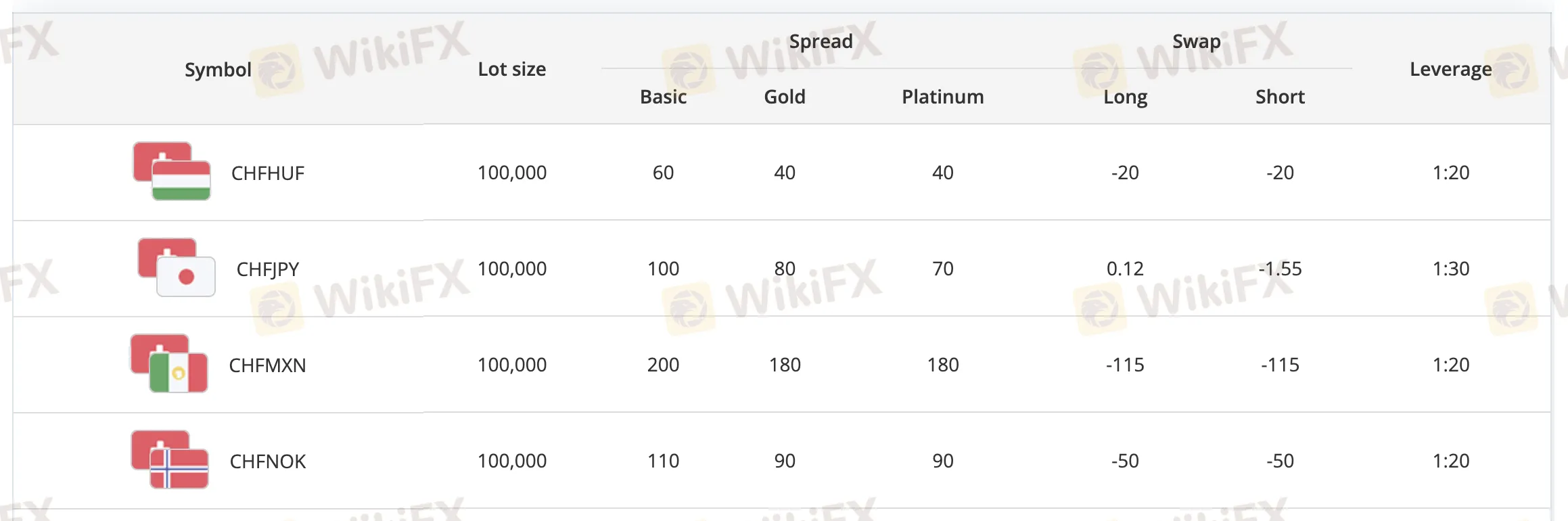

ForexMart's prices are average for the industry as a whole. For example, spreads are average for entry-level accounts and more competitive for higher-tier accounts. Trading without commissions helps keep expenses down, but swap rates (overnight fees) do apply.

ForexMart Spreads

The Basic Account offers the biggest spreads (e.g., ~60-200 pips on Forex) with no Forex commission, making it ideal for beginners. Active traders benefit from the Gold Account, which minimizes spreads (e.g., ~40-180 pips on Forex) and commissions (e.g., stocks ~0.70%). Platinum Account is suitable for high-volume or professional traders, as it provides the tightest spreads (e.g., ~40-180 pips on Forex) and the lowest commissions (e.g., stocks ~0.15%).

| Trading Symbol | Basic Spread | Gold Spread | Platinum Spread |

| CHF/HUF | 60 pips | 40 pips | 40 pips |

| CHF/JPY | 100 pips | 80 pips | 70 pips |

| CHF/MXN | 200 pips | 180 pips | 180 pips |

| CHF/NOK | 110 pips | 90 pips | 90 pips |

Swap Rates

ForexMart charges standard swap rates (long/short) on overnight positions, varying by instrument. Example swap rates (AUD/CAD on Basic account): Long: -0.53; Short: -0.12.

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 |

| Withdrawal Fee | Varies by method |

| Inactivity Fee | Not mentioned |

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 | ✔ | Mac, Windows, Mobile (iOS, Android), Web | Beginners |

| MetaTrader 5 | ✘ | — | Experienced traders |

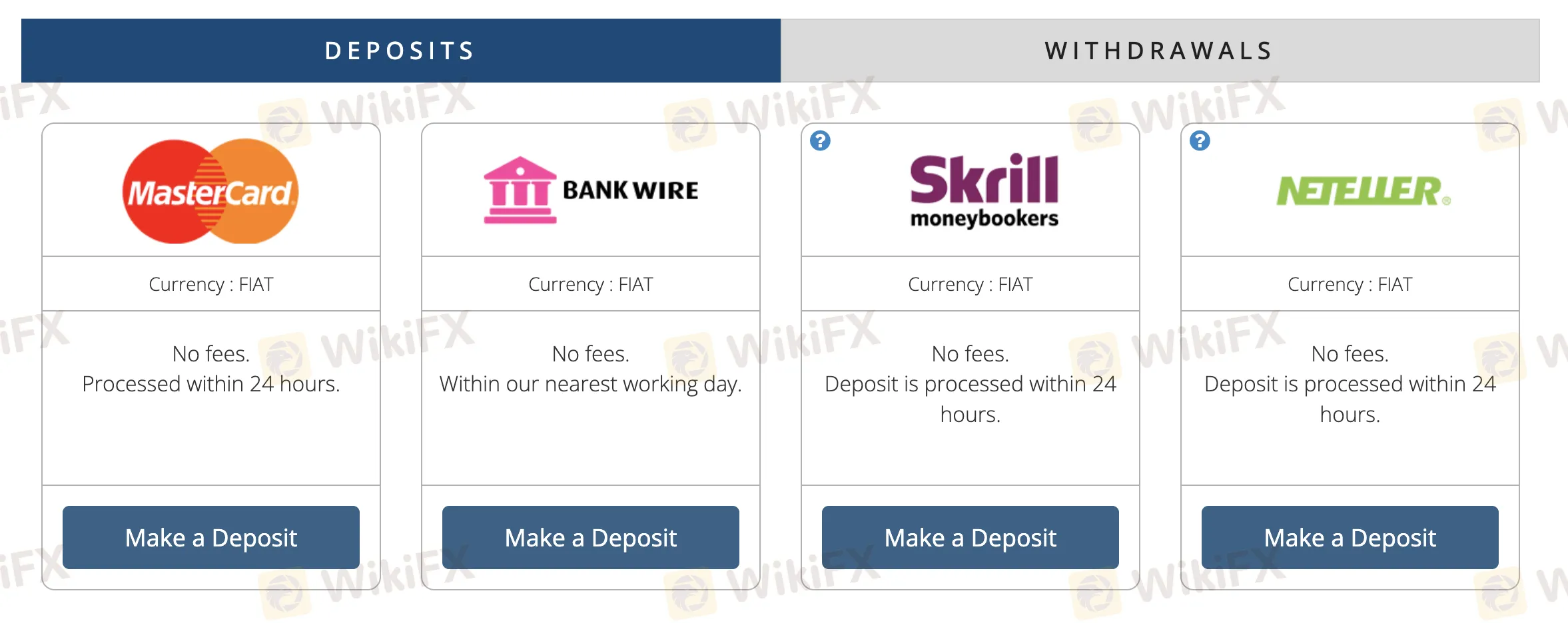

ForexMart doesn't impose deposit fees, and in some cases, it will even pay back the price of deposits. The fees for withdrawing money depend on how you pay. The minimum deposit for a Basic Account is €200.

Deposit Options

| Deposit Method | Minimum Deposit | Deposit Fees | Deposit Time |

| MasterCard | €200 | 0 | Processed within 24 hours |

| Bank Wire | Within nearest working day | ||

| Skrill (Moneybookers) | Processed within 24 hours | ||

| Neteller |

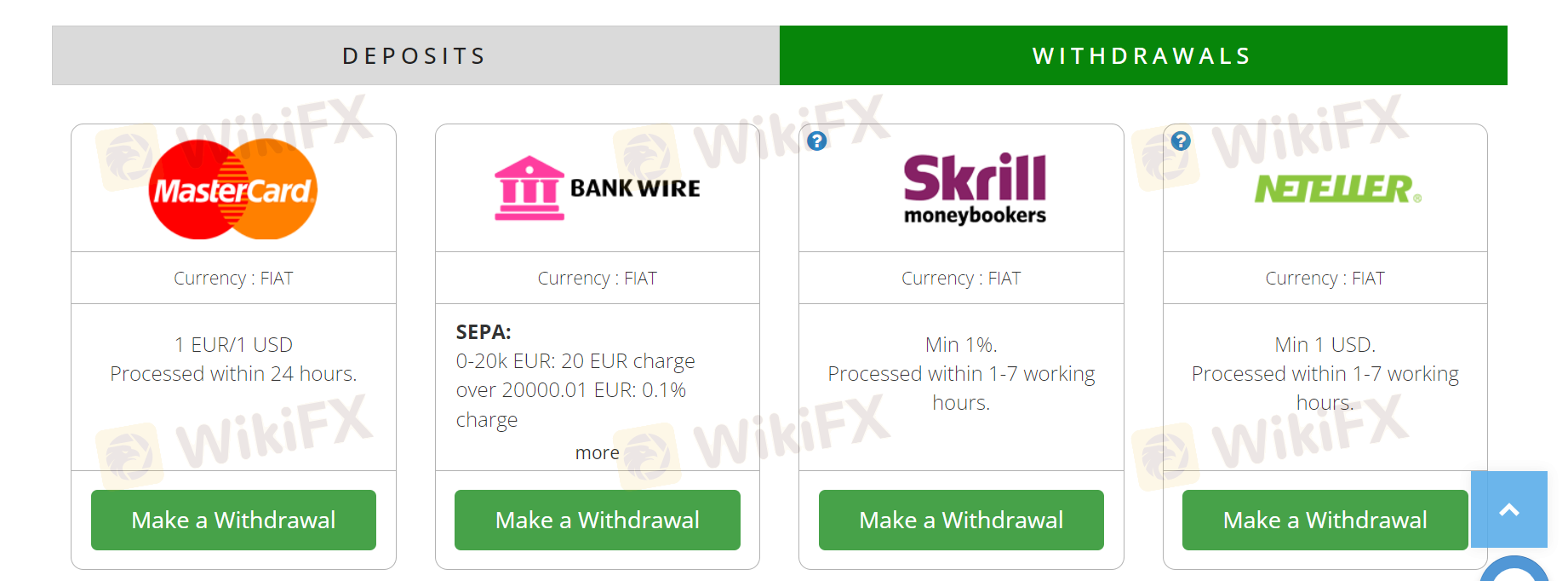

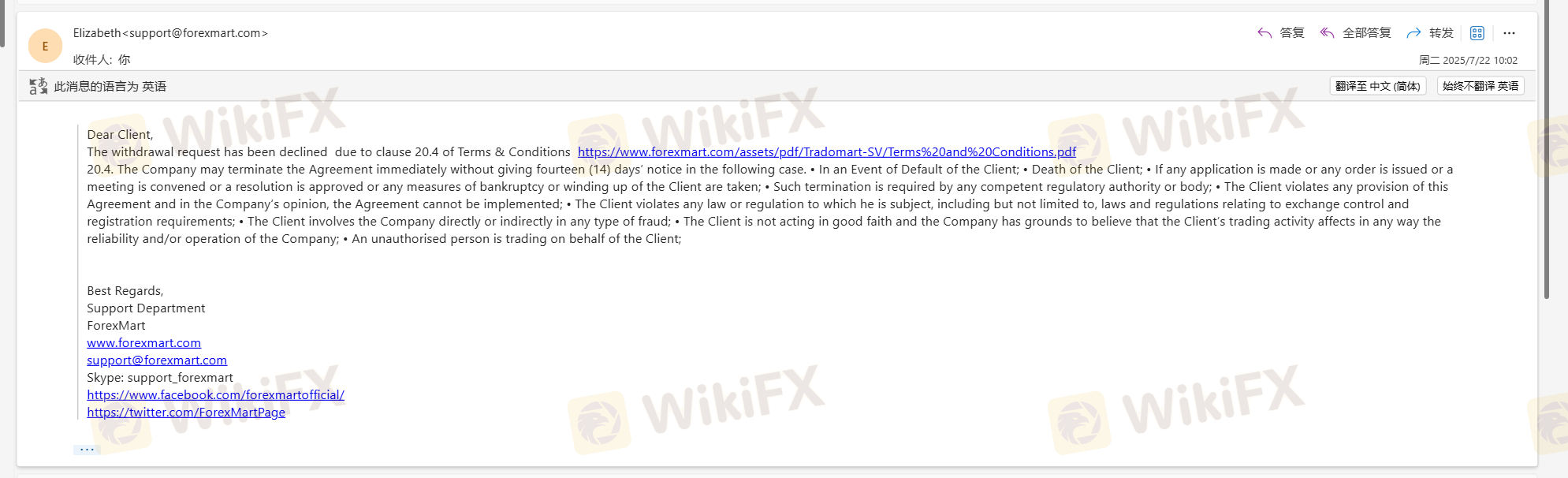

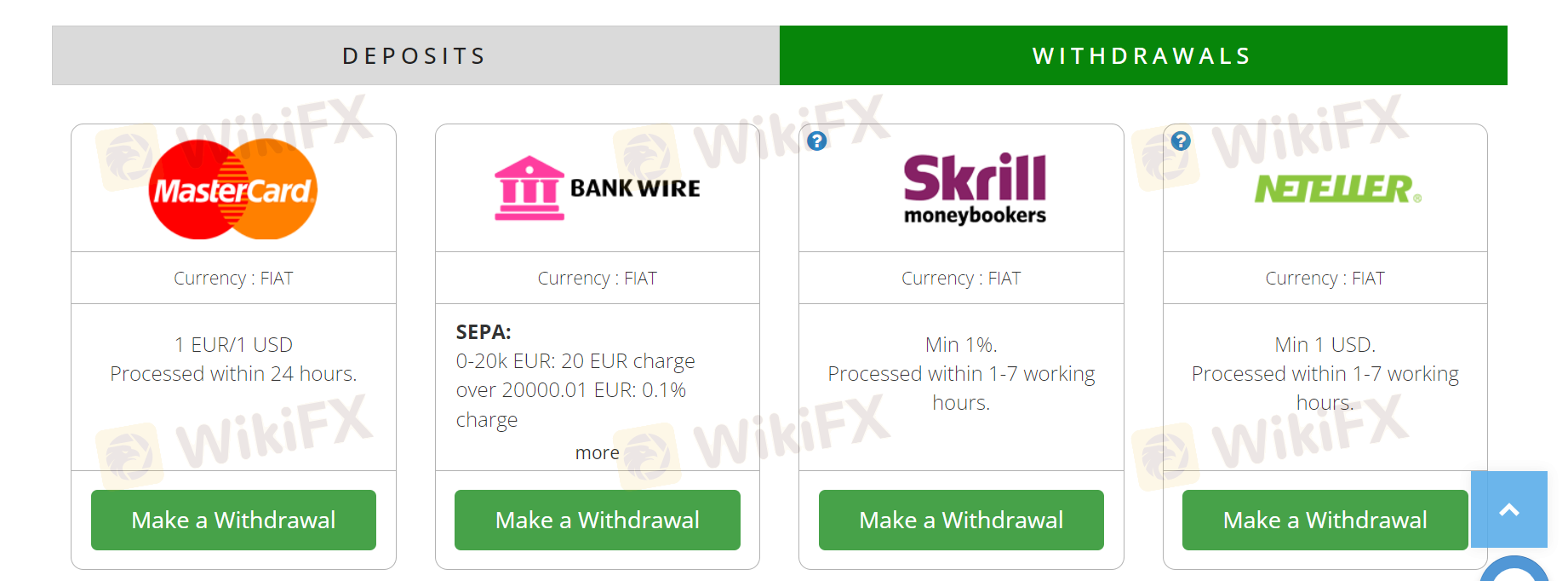

Withdrawal Options

| Withdrawal Method | Withdrawal Fees | Withdrawal Time |

| MasterCard | 1 EUR/USD | Processed within 24 hours |

| Bank Wire (SEPA) | ≤20k EUR → 20 EUR; >20k EUR → 0.1% fee | Not mentioned (likely 1–7 hours) |

| Skrill (Moneybookers) | Minimum 1% | Processed within 1–7 working hours |

| Neteller | Minimum 1 USD |

Analyzing Key Signals in the GBP/USD Currency Pair

WikiFX

WikiFX

In November, the volume of Chinese exports increased for the first time in six months, and this is due to the active actions of Chinese factories, which began to attract buyers with discounts to cope with the ongoing decline in demand.

WikiFX

WikiFX

Oil prices increased their growth on Monday evening after the publication of an updated OPEC forecast regarding the prospects for global fuel demand. The current price of Brent oil is $82.80 per barrel. Before the forecast was published, the asset was trading near $80.50.

WikiFX

WikiFX

The US currency confidently started the week, gaining ground and surpassing the euro. The stability of the dollar, which is carefully overcoming obstacles, is supported by expectations of a soft landing for the US economy.

WikiFX

WikiFX

More

User comment

12

CommentsWrite a review

2025-07-25 10:36

2025-07-25 10:36

2024-07-16 18:44

2024-07-16 18:44