User Reviews

More

User comment

1

CommentsWrite a review

2025-07-29 04:20

2025-07-29 04:20

Score

15-20 years

15-20 yearsRegulated in Japan

Market Making License (MM)

Suspicious Scope of Business

Medium potential risk

Capital Ratio

Influence

Add brokers

Comparison

Expose

Exposure

Score

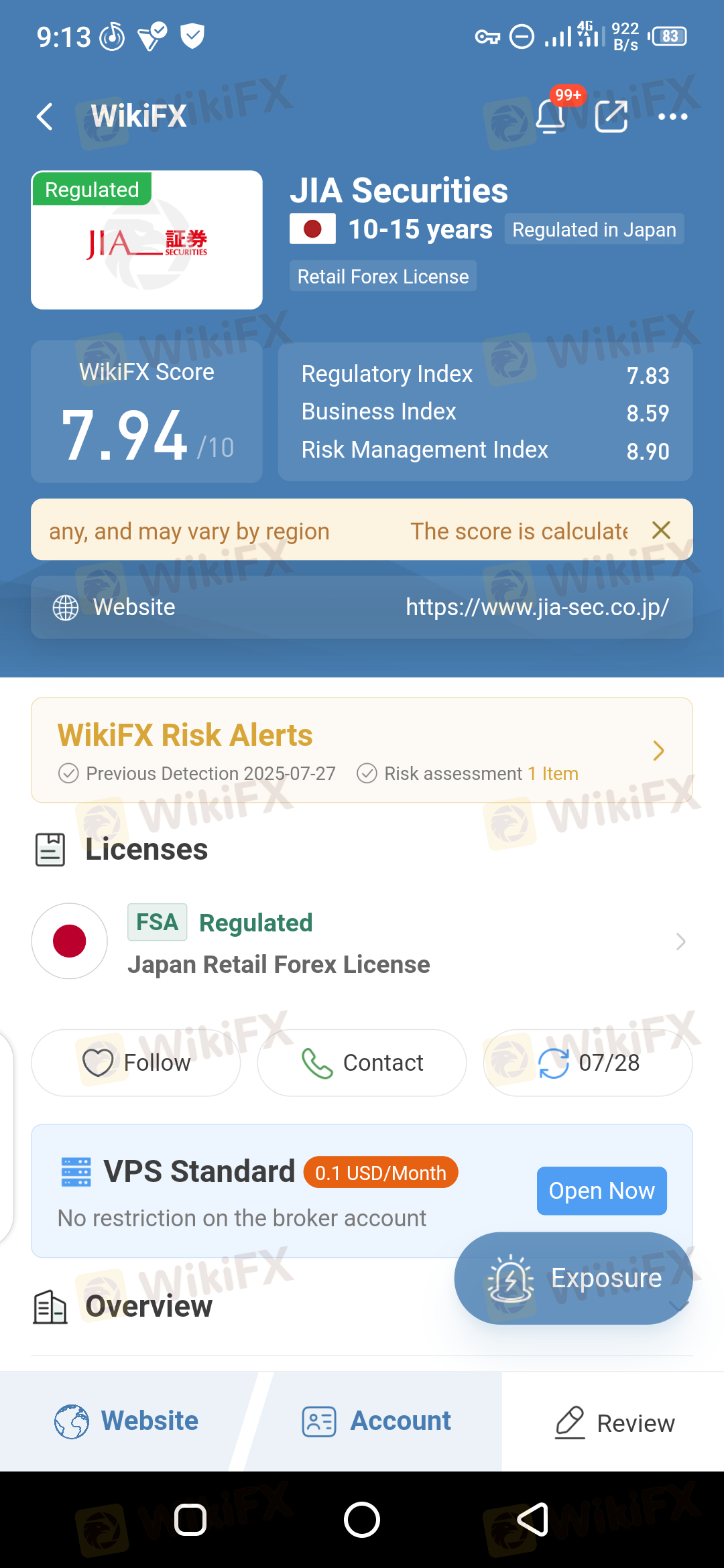

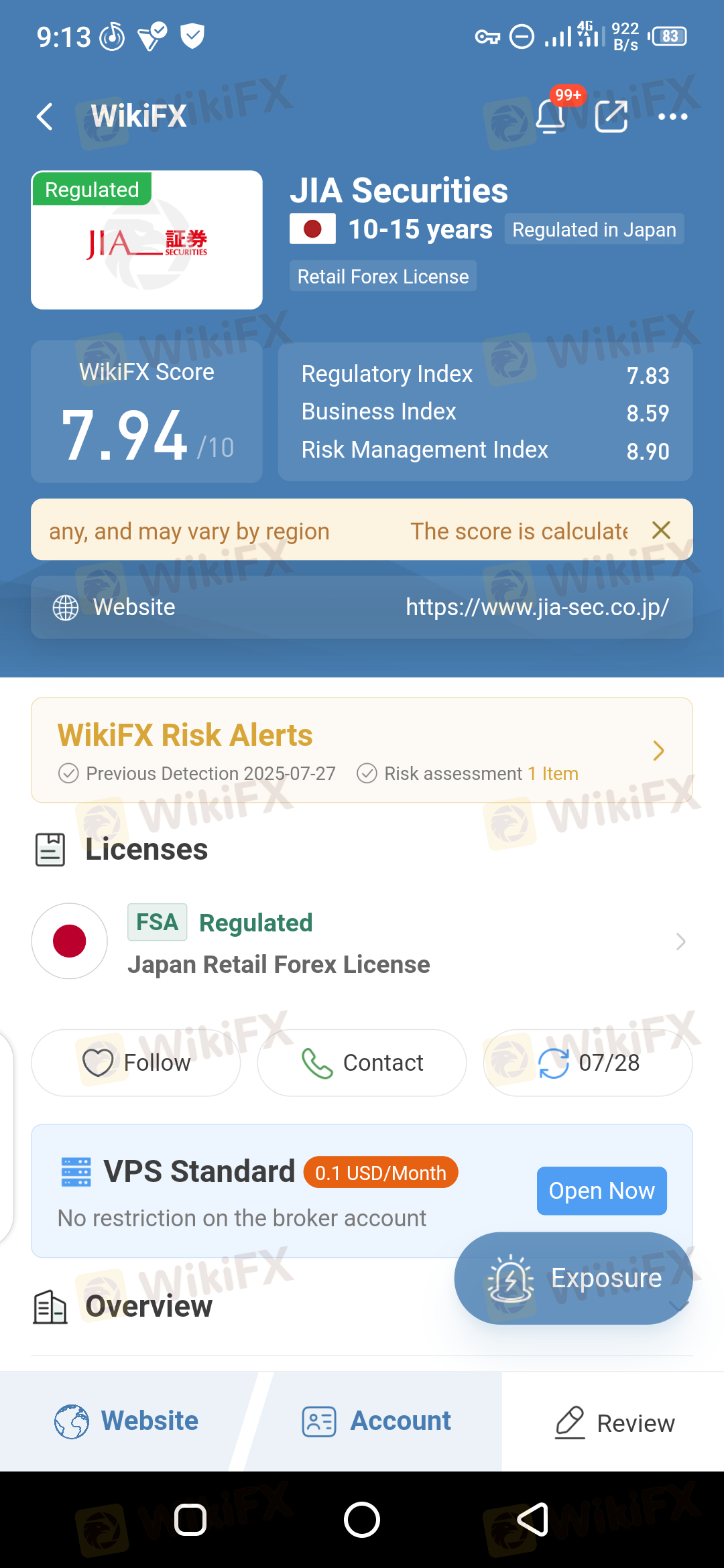

Regulatory Index7.83

Business Index8.00

Risk Management Index8.90

Software Index7.05

License Index7.85

Single Core

1G

40G

More

Company Name

JIA証券株式会社

Company Abbreviation

JIA Securities

Platform registered country and region

Japan

Number of employees

Company website

Company summary

Pyramid scheme complaint

Expose

Capital

Higher than 99% Japanese brokers $4,939,535(USD)

| JIA Securities Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Japan |

| Regulation | FSA |

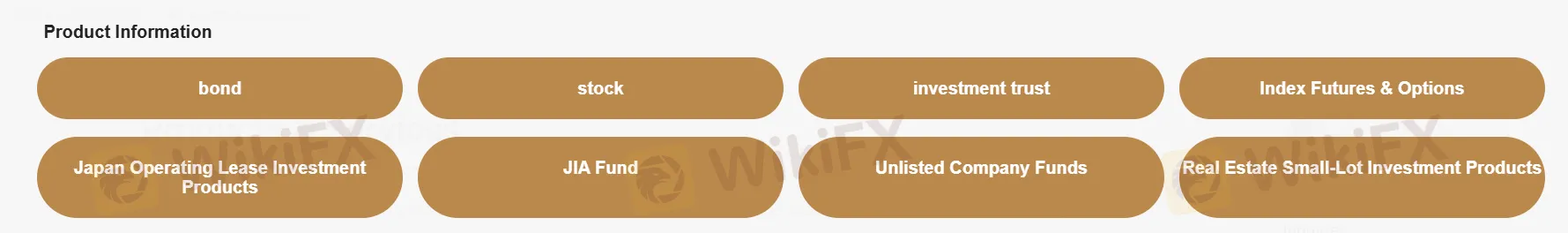

| Market Instruments | Bonds, stocks, investment trusts, Index Futures, Japan Operating Lease Investment Products, JIA Fund, Unlisted Company Funds, and Real Estate Small-Lot Investment Products |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | 24/5 support, contact form |

| Phone: 0120-69-1424 | |

| Address: 〒104-0033 1-5-17 Shinkawa, Chuo-ku, Tokyo Eiha Shinkawa 6F | |

JIA Securities is a broker. The tradable instruments include bonds, stocks, investment trusts, Index Futures, Japan Operating Lease Investment Products, JIA Fund, Unlisted Company Funds, and Real Estate Small-Lot Investment Products. Although JIA Securities is regulated by the FSA, risks cannot be avoided completely.

| Pros | Cons |

| Regulated by FSA | Limited payment methods |

| Various tradable products | Limited information transparency |

| Clear fee structure | |

| 24/5 customer support |

JIA Securities is regulated by the FSA with the Retail Forex License, making it safer than unregulated brokers.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | JIA証券株式会社 | Japan | Retial Forex License | 関東財務局長(金商)第2444号 |

JIA Securities offers a wide range of market instruments, including bonds, stocks, investment trusts, Index Futures, Japan Operating Lease Investment Products, JIA Fund, Unlisted Company Funds, and Real Estate Small-Lot Investment Products.

| Tradable Products | Supported |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Stocks | ✔ |

| Index Futures | ✔ |

| Japan Operating Lease Investment Products | ✔ |

| JIA Fund | ✔ |

| Unlisted Company Funds | ✔ |

| Real Estate Small-Lot Investment Products | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

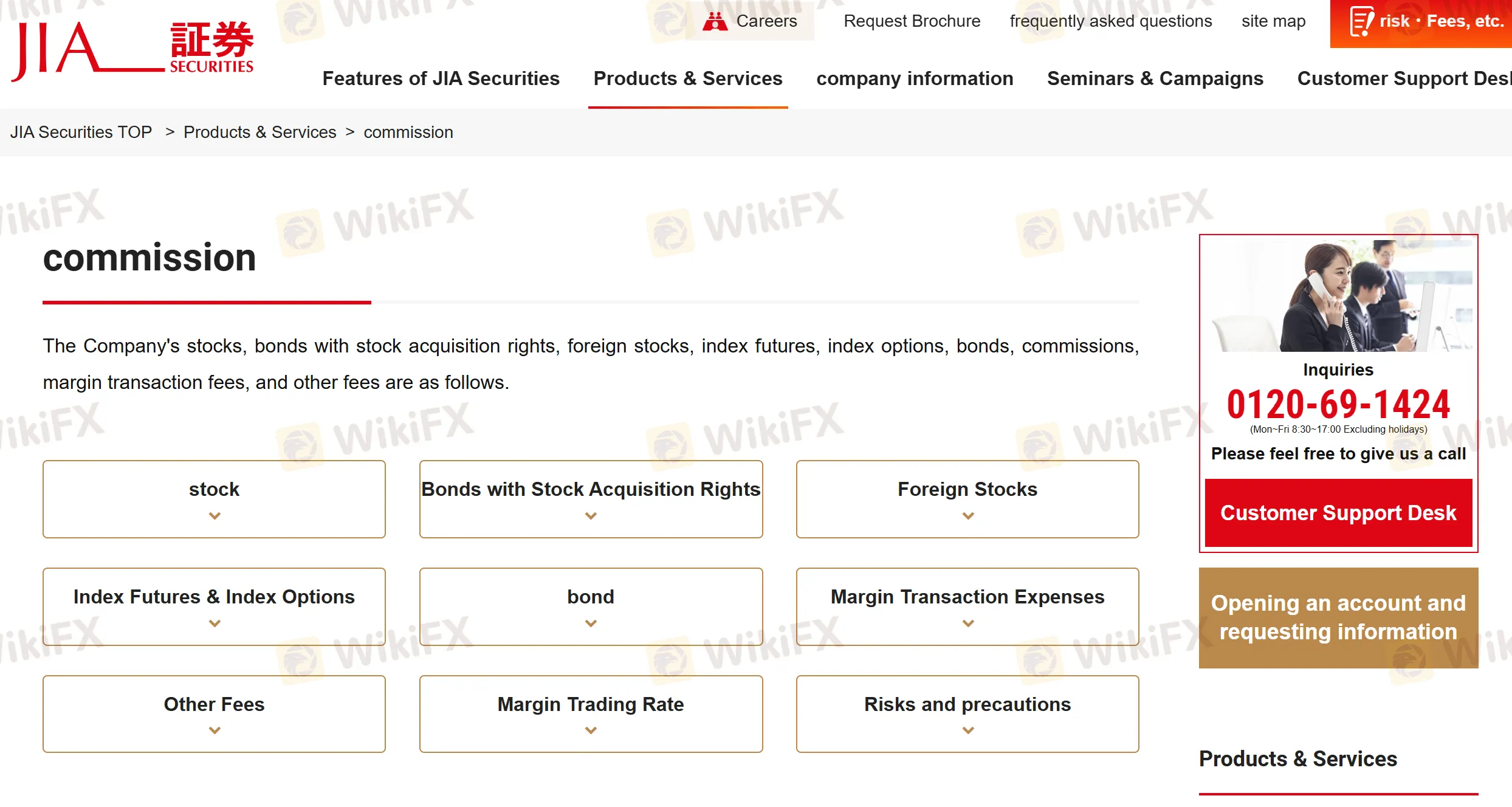

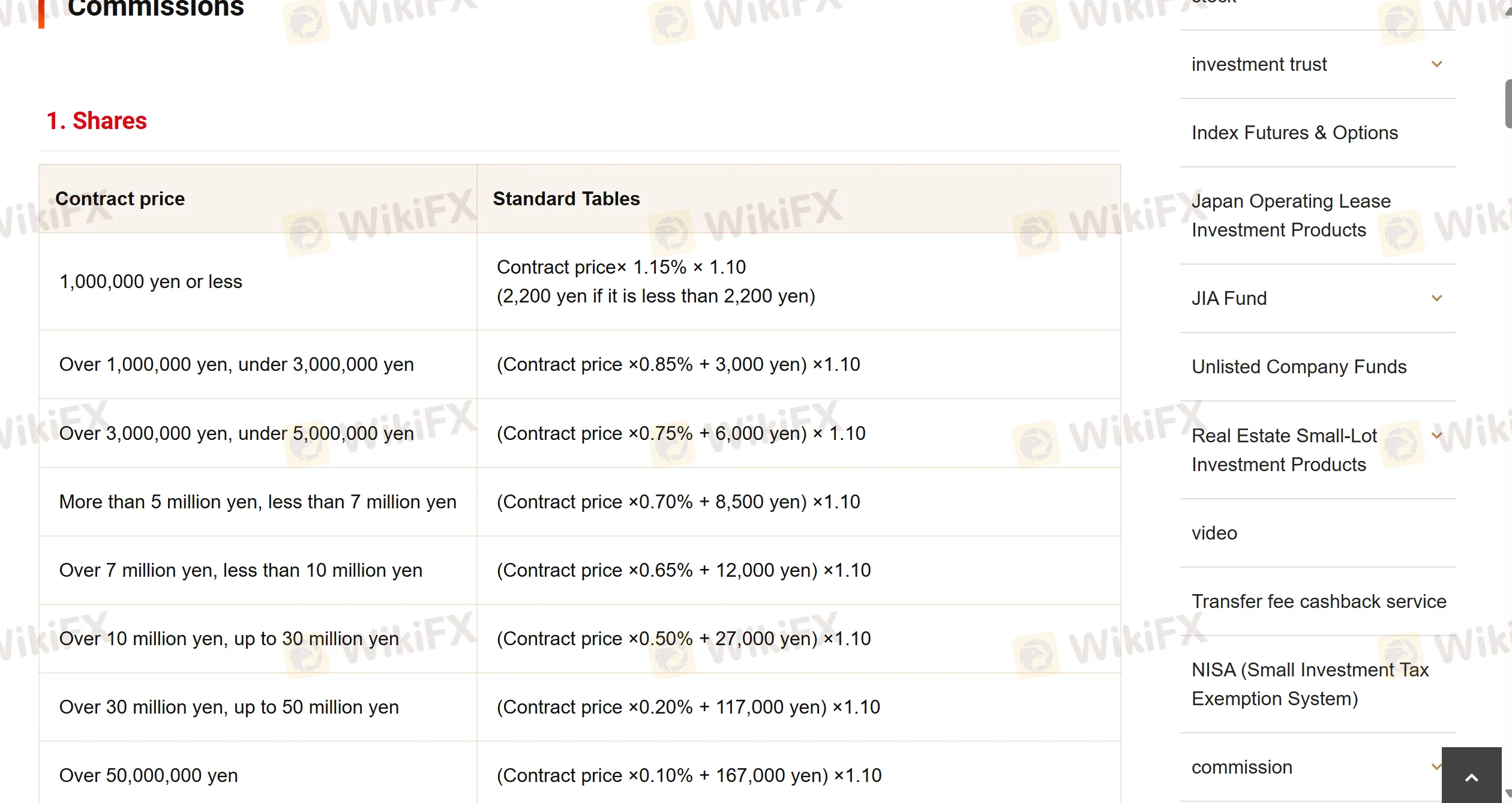

| Shares (Contract Price) | Fees |

| 1,000,000 yen or less | Contract price× 1.15% × 1.10; (2,200 yen if it is less than 2,200 yen) |

| Over 1,000,000 yen, under 3,000,000 yen | (Contract price ×0.85% + 3,000 yen) ×1.10 |

| Over 3,000,000 yen, under 5,000,000 yen | (Contract price ×0.75% + 6,000 yen) × 1.10 |

| More than 5 million yen, less than 7 million yen | (Contract price ×0.70% + 8,500 yen) ×1.10 |

| Over 7 million yen, less than 10 million yen | (Contract price ×0.65% + 12,000 yen) ×1.10 |

| Bonds (Contract Price) | Fees |

| 1,000,000 yen or less | Contract price× 1.00% × 1.10; (2,200 yen if it is less than 2,200 yen) |

| Over 1,000,000 yen, under 3,000,000 yen | (Contract price ×0.85% + 1,500 yen) ×1.10 |

| Over 3,000,000 yen, under 5,000,000 yen | (Contract price ×0.75% + 4,500 yen) ×1.10 |

| More than 5 million yen, less than 7 million yen | (Contract price ×0.70% + 7,000 yen)×1.10 |

| Over 7 million yen, less than 10 million yen | (Contract price ×0.65% + 10,500 yen) ×1.10 |

| Foreign Shares (Contract Price) | Fees |

| 1,000,000 yen or less | Trading Value× 1.25% × 1.10 |

| Over 1,000,000 yen, under 3,000,000 yen | (Trading amount×1.20% + 500 yen)×1.10 |

| Over 3,000,000 yen, under 5,000,000 yen | (Trading amount×1.00% + 6,500 yen)×1.10 |

| Over 5 million yen, less than 10 million yen | (Trading amount× 0.80% + 16,500 yen)×1.10 |

| Over 10 million yen, up to 30 million yen | (Trading amount×0.60% + 36,500 JPY)×1.10 |

Bank transfers (domestic Japanese banks) are implied for real estate and bond purchases, but specific payment methods are not listed. In the case of shares, withdrawals can be made 2 business days after the sale date (delivery date). In the case of foreign bonds, withdrawals can be made from 3 business days (delivery date).

More

User comment

1

CommentsWrite a review

2025-07-29 04:20

2025-07-29 04:20