User Reviews

More

User comment

3

CommentsWrite a review

2024-02-03 16:07

2024-02-03 16:07 2023-03-16 13:45

2023-03-16 13:45

Score

2-5 years

2-5 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index0.00

Business Index5.50

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

365 FX MARKETS

Company Abbreviation

365 FX MARKETS

Platform registered country and region

Saint Vincent and the Grenadines

Company website

Company summary

Pyramid scheme complaint

Expose

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | Within 1 year |

| Company Name | 365 FX MARKETS |

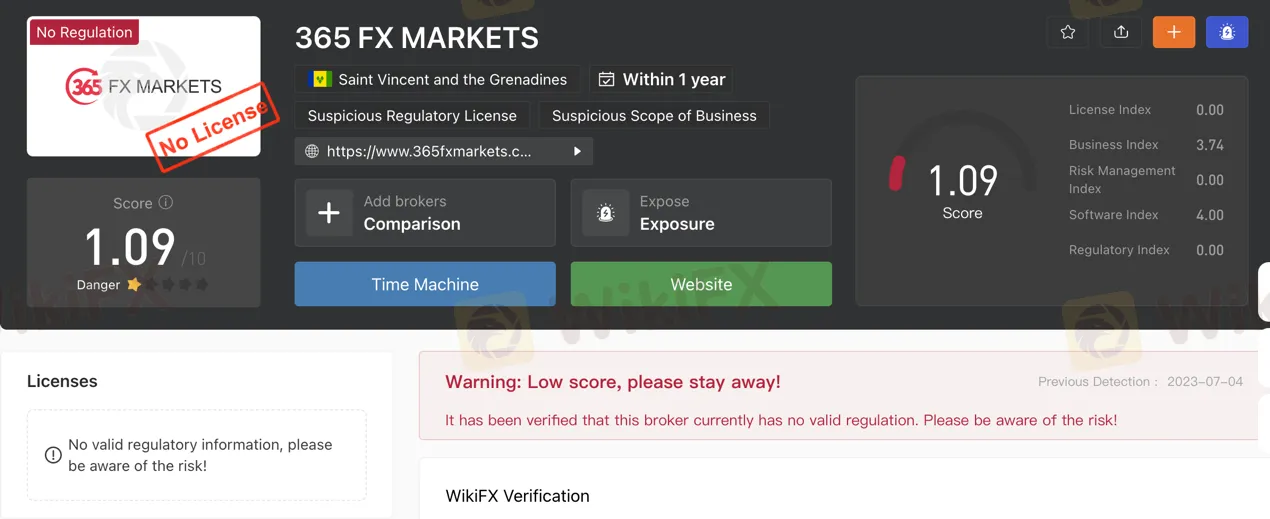

| Regulation | No valid regulation |

| Minimum Deposit | $100 (Beginner), $150 (Professional), $200 (PMS) |

| Maximum Leverage | 1:10 to 1:1000 |

| Spreads | Beginner: 2 pips, Professional: 1 pip, PMS: 0.5 pips |

| Trading Platforms | Meta Trader 4 (MT4) and Meta Trader 5 (MT5) for Windows, MT4 mobile app for iOS and Android |

| Tradable Assets | Forex, Indices, Metals, CFDs |

| Account Types | Beginner, Professional, PMS (Premium Management Services) |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Available 24/5 |

| Payment Methods | Debit cards, credit cards, net banking, wire transfers, e-wallets (PhonePe, Paytm, UPI, G-Pay) |

| Educational Tools | For beginners and professionals |

365 FX MARKETS is an unregulated broker based in Saint Vincent and the Grenadines, which poses risks for potential investors. The absence of valid regulation raises concerns about transparency and accountability. Traders should exercise caution when considering trading on this platform.

The broker offers a range of market instruments, including forex, indices, metals, and CFDs. Forex trading involves currency pairs such as EURUSD and GBPUSD, allowing investors to speculate on exchange rate fluctuations. Access to global stock market indices like the S&P 500 and NASDAQ100 is provided, enabling traders to take positions on overall market performance. Precious metals like gold and silver are also available for trading, providing diversification and a hedge against economic uncertainties. Additionally, contract for difference (CFD) trading is offered on a wide range of financial instruments.

365 FX MARKETS offers different account types with varying minimum deposit requirements. The Beginner account is designed for novice traders, while the Professional account caters to experienced traders. The Premium Management Services (PMS) account provides premium services. Each account type offers different features such as leverage options and spread levels. Traders can also utilize a demo account for practice trading. It is important for traders to consider the mixed reviews regarding 365 FX MARKETS and the potential risks associated with trading on an unregulated platform.

365 FX MARKETS offers several advantages and disadvantages for traders. On the positive side, the platform provides a diverse range of trading instruments, including Forex, Indices, and Metals. Traders can choose from multiple account types tailored to their trading experience levels. The broker also offers low spreads, starting from 0.5 pips, and access to popular trading platforms like MT4 and MT5. Additionally, high leverage up to 1:1000 and a quick deposit process with various payment methods are available. On the downside, 365 FX MARKETS operates without valid regulation, which raises concerns about transparency and accountability. User reviews are mixed, indicating both positive and negative experiences. The platform also has limited market instruments and does not offer Islamic accounts. Traders should be cautious about the potential risks of spread manipulation and high swap fees. The withdrawal process may take up to 40 business days, and there are limited educational resources and advanced trading tools provided.

| Pros | Cons |

| Offers Forex, Indices, Metals | Operates without valid regulation |

| Provides multiple account types for different trading levels | Mixed reviews from users, indicating both positive and negative experiences |

| Offers low spreads from 0.5 pips | Limited market instruments available |

| Accessible trading platforms (MT4, MT5) | No Islamic accounts available |

| Leverage up to1:1000 | Potential risk of spread manipulation and high swap fees |

| Quick deposit process with various payment methods | Withdrawal process may take up to 40 business days |

| Customer support available 24/5 | Limited educational resources and advanced trading tools |

365 FX MARKETS operates without valid regulation, which poses a significant risk to potential investors. The absence of regulatory oversight raises concerns about the broker's transparency and accountability. It is crucial for individuals to exercise caution and carefully consider the potential hazards associated with trading on an unregulated platform like 365 FX MARKETS.

1. Forex: 365 FX MARKETS offers a range of currency pairs for trading, including EURUSD, USDJPY, GBPUSD, USDCAD, USDCHF, AUDUSD, and NZDUSD. Forex trading involves the buying and selling of different currencies, allowing investors to speculate on the fluctuations in exchange rates.

2. Indices: The broker provides access to various global stock market indices, such as the S&P 500, FTSE 100, DJ EURO STOXX 50 and NASDAQ100. Trading indices allows investors to take positions on the overall performance of specific stock markets, providing exposure to a diverse range of companies.

3. Metals: 365 FX MARKETS offers trading opportunities in precious metals like gold and silver. These metals have long been considered as a store of value and are traded as commodities. Investing in metals can provide diversification and a hedge against inflation or economic uncertainties.

4. CFDs: Contract for Difference (CFD) trading is available on 365 FX MARKETS. CFDs allow investors to speculate on the price movements of various underlying assets without owning the assets themselves. This includes a wide range of financial instruments such as stocks, commodities, indices, and cryptocurrencies.

Pros and Cons

| Pros | Cons |

| Offers Forex, Indices, Metals, CFDs | Limited types of market instruments |

| No charts listing available instruments |

BEGINNER: The Beginner account type offered by 365 FX MARKETS is designed for novice traders. It requires a minimum deposit of $100. With this account, traders can enjoy a spread of 2 pips, leverage ranging from 1:10 to 1:100, and the ability to trade across four different types of trading. The stop-out level varies between 50% and 100%. There is no commission charged, and traders have access to one-click trading. The account also provides negative balance protection. Additionally, swap charges are applicable, and the lot size is set at 0.01. There are no specific restrictions imposed on this account type.

PROFESSIONAL: The Professional account type caters to experienced traders on 365 FX MARKETS. It requires a minimum deposit of $150. Traders can benefit from a spread of 1 pip and leverage ranging from 1:10 to 1:200. Similar to the Beginner account, there are four types of trading available, and the stop-out level ranges from 50% to 100%. No commission is charged, and one-click trading is available. Negative balance protection is provided, and swap charges are applicable. The lot size remains at 0.01, and there are no specific restrictions imposed on this account type.

PMS (PREMIUM MANAGEMENT SERVICES): For traders seeking premium services, 365 FX MARKETS offers the PMS account type. It requires a minimum deposit of $200. Traders can enjoy a spread of 0.5 pips and leverage ranging from 1:10 to 1:1000. The account provides access to the same four types of trading as the previous account types. The stop-out level is between 50% and 100%, and no commission is charged. Traders can benefit from one-click trading, negative balance protection, and swap charges. The lot size remains at 0.01, and there are no specific restrictions imposed on this account type. Additionally, for traders selecting the Premium or VIP account, there is the added advantage of free access to the Virtual Private Server (VPS), which facilitates Forex trading.

A demo account is also available with 365 FX MARKETS, allowing users to practice trading without risking real money. This feature provides an opportunity for individuals to familiarize themselves with the platform's functionalities, test trading strategies, and gain valuable experience in a simulated environment.

Pros and Cons

| Pros | Cons |

| Access to various trading types | Minimum deposit requirement |

| Demo account available | Potential risk of swap charges |

| Spreads from 0.5 pips | |

| No commissions |

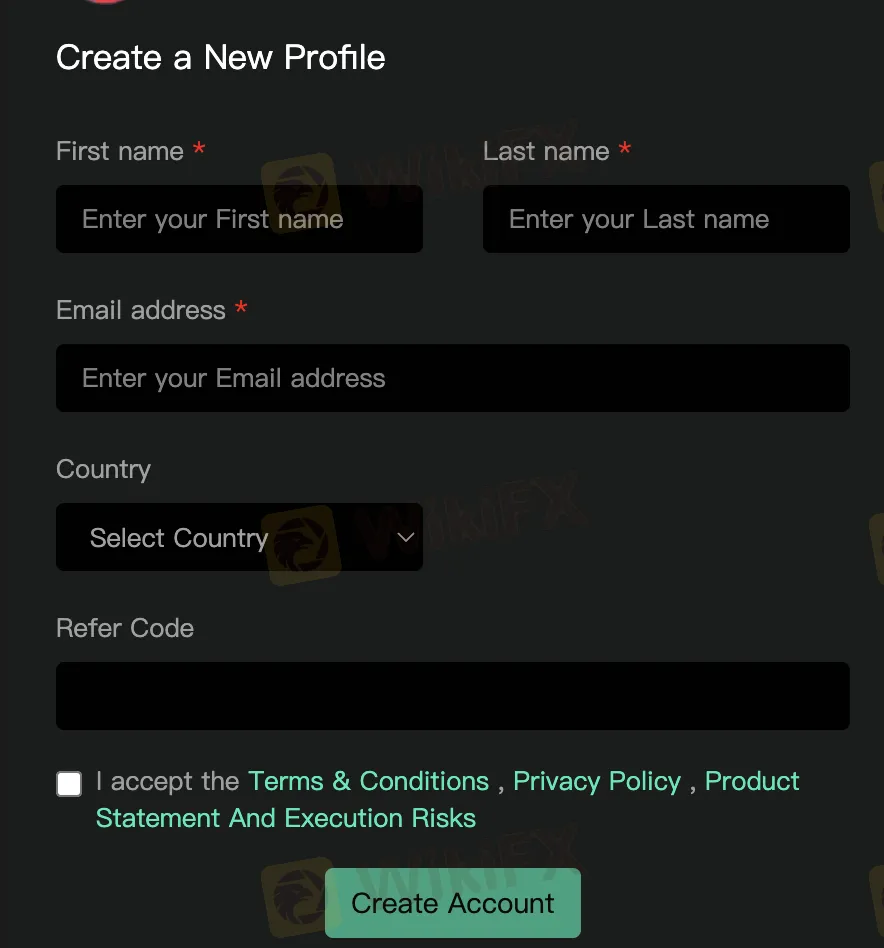

To open an account with 365 FX MARKETS, follow these steps:

Register: Visit the 365 FX MARKETS website and click on the “Register” button.

Create a New Profile: Fill in the required information, including your first name, last name, email address, country, and any applicable referral code.

Accept Terms & Conditions: Read and accept the Terms & Conditions, Privacy Policy, and Product Statement, which outline the rules and regulations governing your account and trading activities.

Create Account: Once you have provided all the necessary information and agreed to the terms, click on the “Create Account” button to complete the registration process.

365 FX MARKETS provides leverage options ranging from 1:10 to 1:1000 for traders, allowing them to amplify their trading positions.

365 FX MARKETS offers spreads for its trading accounts, with the Beginner account having a spread of 2 pips, the Professional account offering a spread of 1 pip, and the PMS account providing an even narrower spread of 0.5 pips. Notably, there are no commissions charged for any of these account types.

365 FX MARKETS has a minimum deposit requirement for different account types, starting at $100 for the Beginner account, $150 for the Professional account, and $200 for the PMS (Premium Management Services) account.

When it comes to depositing funds with 365 FX MARKETS, the process is relatively quick. Once the verification is completed, deposits are processed instantly. However, it's important to note that there is a charge of 2INR based on the current USD price for each deposit. Various options are available for depositing, including debit cards, credit cards, net banking, wire transfers, and e-wallets like PhonePe, Paytm, UPI, and G-Pay.

For withdrawing funds from 365 FX MARKETS, the timeframe is generally within 6 to 24 hours, excluding public holidays and weekends. A fee is applicable for withdrawals, amounting to 1-2INR based on the current USD price. If you wish to close your trading account, it is advised to contact your Relationship Manager (RM) for further assistance. The closure process itself takes approximately 7 to 30 working days. In cases where wire transfers are involved and the account verification process has been completed and approved by the Liquidity Provider (L.P), it can take up to 40 business days for the funds to reflect in your account. Delays may also occur based on your banking institution, so it's recommended to verify the specific delay times with them.

Pros and Cons

| Pros | Cons |

| Quick deposit process | Charge of 2INR per deposit |

| Availability of various e-wallets | Withdrawal timeframe of 6-24 hours |

| Withdrawal timeframe of 6-24 hours | Fee applicable for withdrawals |

365 FX MARKETS offers the widely recognized Meta Trader 4 (MT4) and Meta Trader 5 (MT5) platforms for Windows users. These platforms are popular among traders and investors worldwide, facilitating the trading of Forex, CFDs, and exchange-traded instruments. With advanced charting and trading tools, as well as automated trading options, MT4 and MT5 provide a comprehensive solution for multi-asset trading on Windows devices.

For iPhone and iPad users, 365 FX MARKETS provides the Meta Trader 4 (MT4) mobile application, enabling trading in the global financial market. The user-friendly MT4 app is compatible with all iOS devices, allowing traders to execute trades on the go. By downloading the app, users gain access to a range of features and tools that enhance their trading experience.

The Meta Trader 4 (MT4) Android app offered by 365 FX MARKETS empowers traders with market information and functionality on their Android mobile devices. This mobile application grants users access to comprehensive data, charting capabilities, and various useful trading functions. By leveraging the MT4 Android app, traders can trade from their Android devices while staying informed about the market dynamics.

Pros and Cons

| Pros | Cons |

| Widely recognized MT4 & MT5 platforms | Potential technical issues |

| Advanced charting and trading tools | |

| Mobile trading for iOS users and Android users |

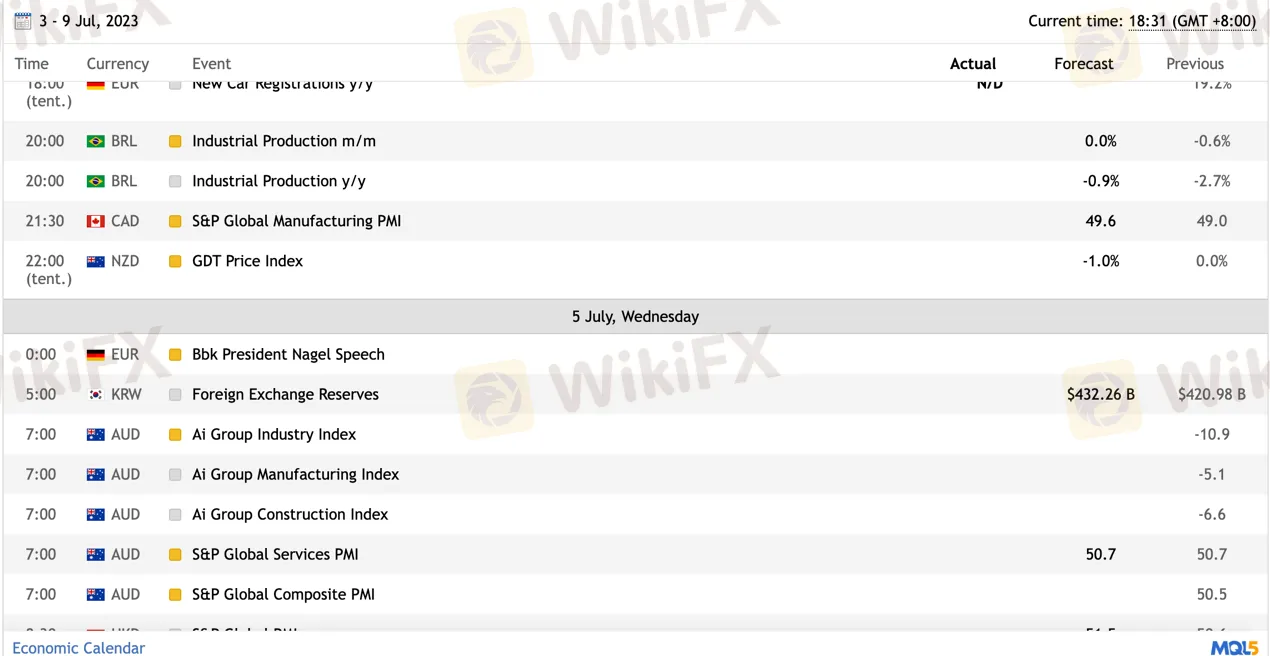

365 FX MARKETS offers an Economic Calendar as one of its trading tools. This tool provides users with important economic events, such as key economic indicators, interest rate announcements, and geopolitical events, that can potentially impact the financial markets. The Economic Calendar assists traders in staying informed and making well-informed trading decisions based on upcoming market events. By providing a comprehensive overview of scheduled events, the Economic Calendar enables users to analyze and anticipate market movements effectively. Traders can utilize this tool to align their trading strategies with significant economic events and potentially maximize their trading opportunities.

365 FX MARKETS offers educational resources covering a wide range of topics for traders of different skill levels. They provide comprehensive materials for beginners, introducing them to the basics of forex trading, risk management, and trading platforms. For professionals, the platform offers advanced resources on technical analysis, market indicators, and trading strategies. Additionally, they provide explanations on the concept of forex trading and the role of spreads in the forex market. These educational resources aim to equip traders with the knowledge needed to make informed decisions and enhance their trading skills.

365 FX MARKETS provides customer support available 24/5 from Monday to Sunday, ensuring a high priority immediate response. The fastest way to reach their Customer Support team is through the provided contact details. The Customer Care Department operates from 09:00 to 20:00 (IST), while the Finance Department and KYC Department are available 24/7 (IST). The company's office is located at First Floor, First Saint Vincent Bank Ltd. Building, P.O. Box 1574, James Street, Kingstown, St. Vincent and the Grenadines. For inquiries, customers can contact +441133204712.

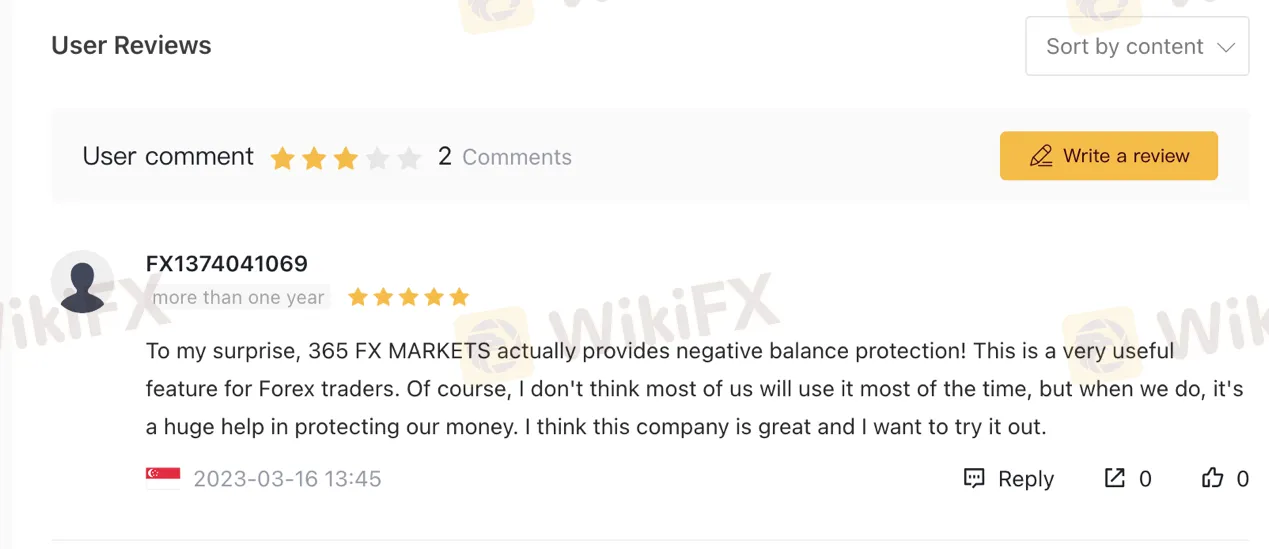

According to reviews on WikiFX, there are mixed opinions about 365 FX MARKETS. One user was pleasantly surprised by the negative balance protection feature, considering it beneficial for Forex traders. They expressed interest in trying out the company. However, another user complained about invalid stop-out levels, spread manipulation, and high swap fees, cautioning others that this offshore broker may not be ideal. Overall, the reviews showcase both positive and negative experiences with 365 FX MARKETS.

In conclusion, 365 FX MARKETS operates without valid regulation, which raises concerns about transparency and accountability. Trading on an unregulated platform like 365 FX MARKETS poses a significant risk to potential investors. The broker offers a variety of market instruments, including forex, indices, metals, and CFDs, providing opportunities for diversification. However, it is important to exercise caution and carefully consider the potential hazards associated with trading on an unregulated platform. The account types offered cater to both novice and experienced traders, with different minimum deposit requirements and leverage options. The broker provides the popular Meta Trader 4 (MT4) and Meta Trader 5 (MT5) platforms for trading on Windows devices, as well as mobile applications for iOS and Android users. Educational resources are available to enhance traders' knowledge and skills. Customer support is provided 24/5, and the company's office is located in Saint Vincent and the Grenadines. Reviews on WikiFX showcase mixed opinions about 365 FX MARKETS, highlighting both positive and negative experiences with the broker.

Q: Is 365 FX MARKETS a regulated broker?

A: No, 365 FX MARKETS operates without valid regulation, which poses risks to investors.

Q: What trading instruments are available on 365 FX MARKETS?

A: 365 FX MARKETS offers Forex, indices, metals, and CFDs for trading.

Q: What are the account types offered by 365 FX MARKETS?

A: 365 FX MARKETS offers Beginner, Professional, and PMS (Premium Management Services) accounts.

Q: What leverage options are available on 365 FX MARKETS?

A: 365 FX MARKETS provides leverage options ranging from 1:10 to 1:1000.

Q: What are the spreads and commissions on 365 FX MARKETS?

A: The spreads range from 2 pips to 0.5 pips, and there are no commissions charged.

Q: What is the minimum deposit for 365 FX MARKETS?

A: The minimum deposit requirement varies from $100 to $200, depending on the account type.

Q: How can I deposit and withdraw funds on 365 FX MARKETS?

A: Deposits can be made using various methods, including cards, net banking, and e-wallets. Withdrawals take 6 to 24 hours.

Q: What trading platforms are available on 365 FX MARKETS?

A: 365 FX MARKETS offers Meta Trader 4 (MT4) and Meta Trader 5 (MT5) for Windows, iOS, and Android devices.

Q: Does 365 FX MARKETS provide educational resources?

A: Yes, 365 FX MARKETS offers educational resources for traders of different skill levels.

Q: What is the customer support availability on 365 FX MARKETS?

A: Customer support is available 24/5, and contact details can be found on the website.

Q: What do the reviews say about 365 FX MARKETS?

A: Reviews show mixed opinions, with some positive and negative experiences reported by users.

More

User comment

3

CommentsWrite a review

2024-02-03 16:07

2024-02-03 16:07 2023-03-16 13:45

2023-03-16 13:45