User Reviews

More

User comment

6

CommentsWrite a review

2024-08-06 18:44

2024-08-06 18:44

2023-02-21 21:55

2023-02-21 21:55

Score

5-10 years

5-10 yearsSuspicious Regulatory License

Suspicious Scope of Business

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index7.16

Risk Management Index0.00

Software Index4.00

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

Danger

More

Company Name

FlowBank

Company Abbreviation

FlowBank

Platform registered country and region

Switzerland

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Registered in | Switzerland |

| Regulated by | Suspicious clone |

| Year(s) of establishment | 2-5 years |

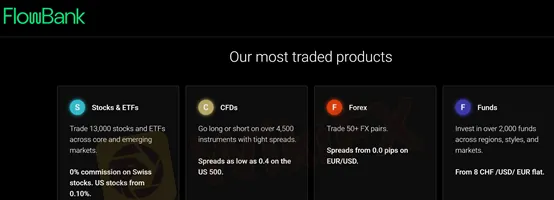

| Trading instruments | Currency pairs, CFDs, stocks, ETFs, funds, cryptocurrencies |

| Minimum Initial Deposit | $0 |

| Maximum Leverage | N/A |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MT4, MT5, FlowBank APP, FlowBank pro |

| Deposit and withdrawal method | N/A |

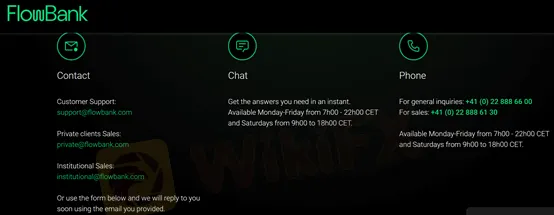

| Customer Service | Email/phone number/address/live chat |

| Fraud Complaints Exposure | No for now |

FlowBank is licensed as a suspicious clone by FINMA, which poses significant risks including potential financial losses for investors who might believe they are dealing with a legitimate entity.

| Pros | Cons |

| Multiple useful trading platforms | Suspicious clone |

| Convenient trading App for trading everywhere | Commissions for per share |

| Demo account available | |

| Supporting financial news and insights | |

| Clear fee structure |

Currency pairs, CFDs, stocks, ETFs, funds .... FlowBank allows clients to access a huge range of trading markets. Therefore, both beginners and experienced traders can find what they want to trade on FlowBank. cryptocurrencies are also available.

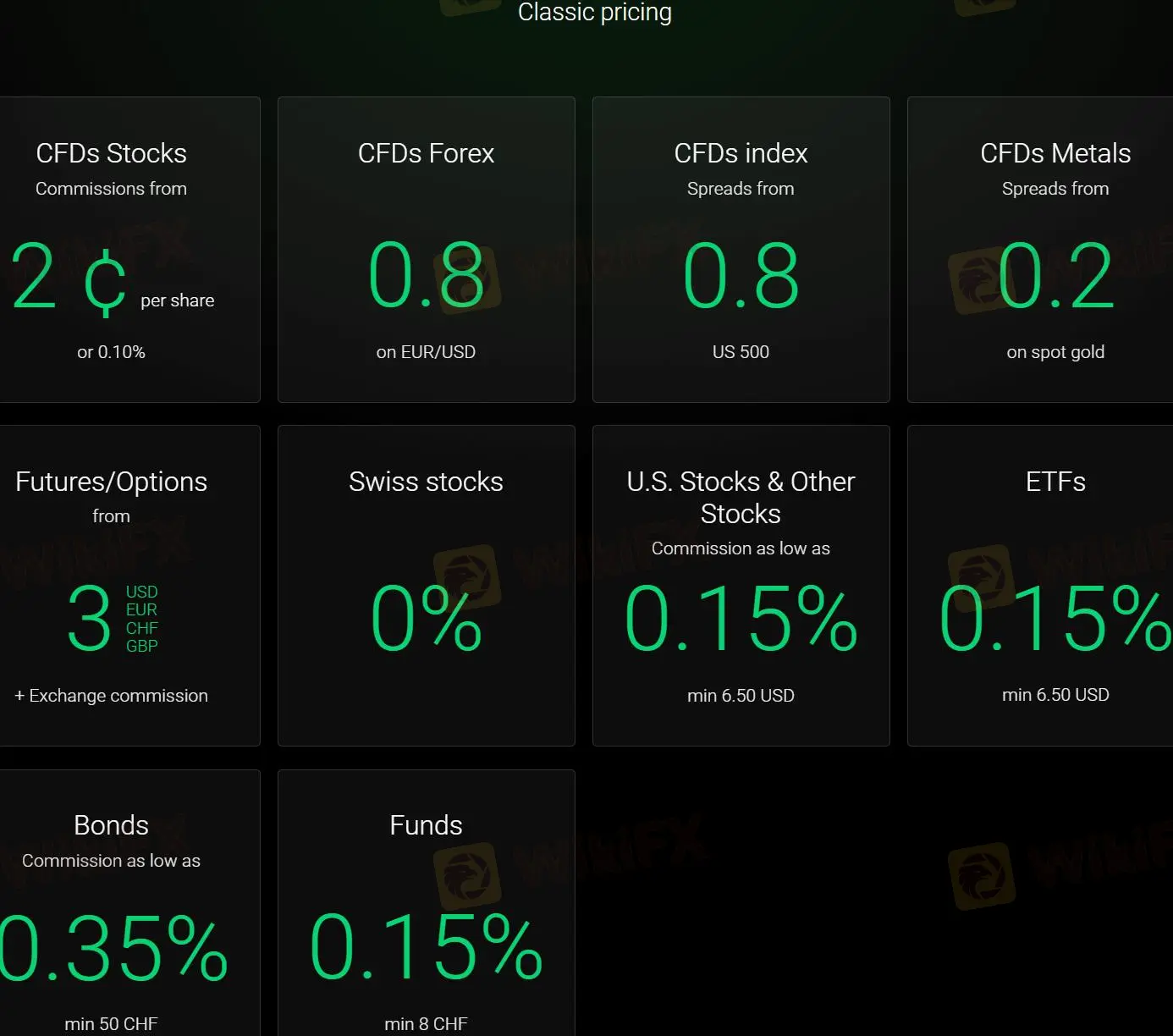

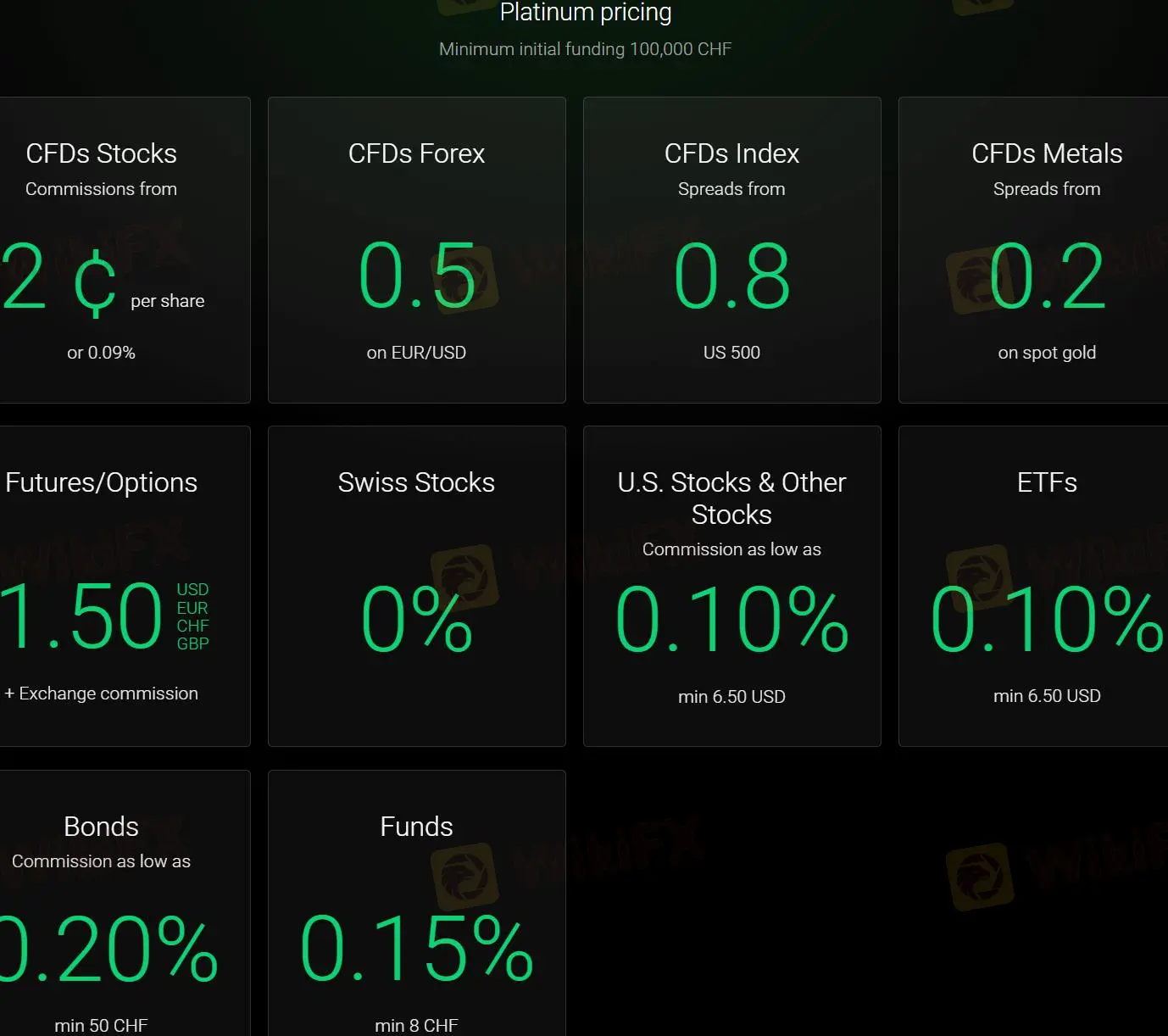

FlowBank offers three distinct trading pricing structures to cater to different trader needs: Classic Pricing, Platinum Pricing, and CFD Rebates.

Monthly cash rebates structure for Forex, Indices, and Commodities:

As what weve shown in the pricing page, there are two account types in FlowBank: classic and platinum. However, further information is not available. We can only know that there is no minimum deposit for an account, and their trading conditions, of course, are different. The platinum account has a more favorable pricing.

FlowBank offers four distinct trading platforms, each designed to cater to the varying needs of traders:

MetaTrader 4 (MT4): Renowned as the worlds most popular Forex trading platform, MT4 allows for automated trading with robust scripting tools and provides comprehensive analytical capabilities that are favored by experienced traders.

FlowBank offers a robust array of educational resources designed to enhance the investing knowledge of its clients. These educational tools are structured to support continuous learning and enable traders to make informed decisions based on current market trends and fundamental investment principles, including:

FlowBank provides comprehensive customer service with several contact options to ensure accessibility and support for its clients:

No, it is currently not effectively regulated and you are advised to be aware of its potential risks.

Yes, FlowBank offers both MT4 and MT5 for you to choose from.

Yes, FlowBank currently offers trading services for cryptocurrencies.

Online trading involves huge risks and you can lose all your invested capital. It is not suitable for all traders or investors.

Dukascopy offers a 50% CashBack on volume commissions for former FlowBank clients, ensuring a seamless trading transition.

WikiFX

WikiFX

Swiss neobank FlowBank stops new client applications and onboarding as financial regulator FINMA initiates bankruptcy proceedings.

WikiFX

WikiFX

Is FlowBank a regulated forex broker or just claiming to be? Explore their review, history, and regulatory status. Make informed trading decisions today!

WikiFX

WikiFX

More

User comment

6

CommentsWrite a review

2024-08-06 18:44

2024-08-06 18:44

2023-02-21 21:55

2023-02-21 21:55