Warning: VexPro Withdrawal Complaints

Abstract:A trader faces a withdrawal delay at VexPro. Learn how to avoid scams and secure your funds. Read more now!

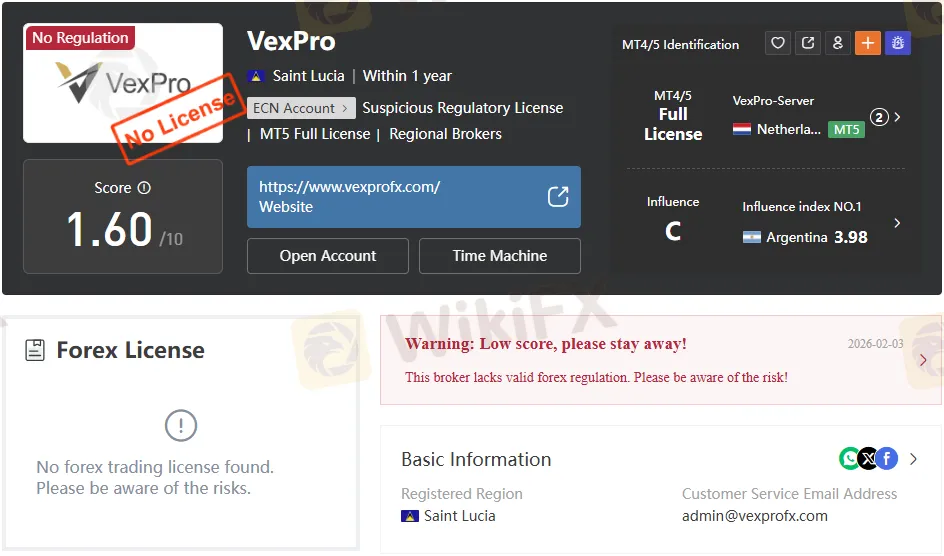

Investors dealing with VexPro should be aware of a serious withdrawal complaint in which a trader's account was blocked immediately after a payout request, and the funds remain inaccessible despite repeated formal requests. The case raises major concerns about how VexPro handles client money, especially when clients try to withdraw funds rather than deposit them.

What Happened in This VexPro Withdrawal Case?

According to the investors report, they first deposited funds into their VexPro account and traded normally on the platform. Problems began only after they submitted a withdrawal request, at which point VexPro allegedly blocked the trading account without warning, rather than processing the payout.

The trader explains that the account block occurred immediately after the withdrawal request, not during earlier trading activity. This timing led them to believe that the restriction was directly linked to their attempt to access their own funds, rather than to any change in trading behaviour.

How Did VexPro Justify Blocking the Account?

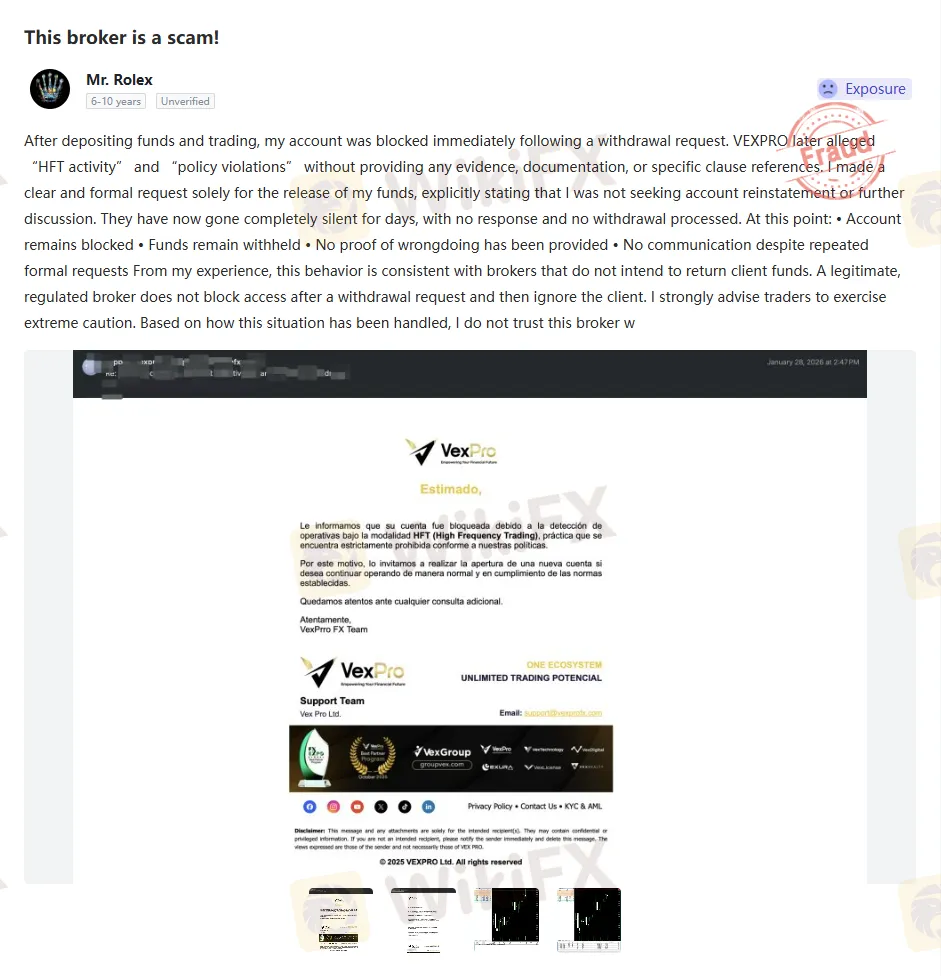

After the account was blocked, VexPro later accused the client of engaging in “HFT activity” (high‑frequency trading) and unspecified “policy violations.” However, the broker reportedly did not provide any concrete documentation, detailed evidence, or references to specific clauses in the client agreement to support these accusations.

From the investors perspective, these claims appeared vague and unsubstantiated, especially given that no prior warnings had been issued during the trading period. Without clear proof or a transparent explanation, the trader viewed these allegations as a pretext to avoid processing the requested withdrawal.

What Did the Investor Request from VexPro?

In response to the account block, the trader states that they made a clear and formal request to VexPro focused solely on the release of their funds. They emphasised that they were not asking for the account to be reinstated or for any further trading privileges, but only for their existing balance to be withdrawn and returned.

This distinction is important because it shows the client tried to narrow the issue to a straightforward refund of their own money. By removing the question of continued trading, the investor aimed to make it easier for VexPro to resolve the situation fairly and quickly.

What Is the Current Status of the Account and Funds?

In the latest update from the complaint, the trader reports that the following situation persists:

- The account remains blocked and cannot be used for trading or account management.

- The funds remain withheld, and no withdrawal has been made to the clients bank account or payment method.

- No proof of wrongdoing has been provided to substantiate the allegations of HFT or policy violations.

- There has been no communication from VexPro despite repeated formal requests for clarification and payout.

The investor describes this combination of a blocked account, frozen funds, unsupported accusations, and prolonged silence as deeply alarming and inconsistent with how a legitimate broker should behave.

Why Does the Investor View VexPros Behaviour as Scam‑Like?

The investor notes that during the deposit and trading phases, VexPro allowed activity without complaint, and issues began only after they tried to withdraw. This pattern—easy deposits but difficult or blocked withdrawals—is widely recognised by traders as a classic warning sign associated with scam‑like brokers.

They argue that a genuine, well‑run, and properly supervised broker does not typically block a clients account immediately after a withdrawal request and then ignore all follow‑up communication. In their view, this behaviour suggests that VexPro may have no genuine intention of returning client funds once they are deposited, which is why they publicly warn others to exercise extreme caution.

How Should Traders Interpret Allegations of “HFT Activity” and “Policy Violations”?

Terms like “HFT activity” and “policy violations” can sound technical and serious, but without specific evidence, they do little to reassure a client whose funds have been frozen. In this case, the trader reports that VexPro did not provide trade logs, concrete examples, or contractual clauses that clearly show how their behaviour broke the rules.

For retail traders, this is an important lesson: vague references to internal policies are not an acceptable substitute for transparent, case‑by‑case explanations. If a broker accuses you of violations, they should be able to clearly show which trades, which rules, and why those issues justify any restrictions on your account or funds.

What Red Flags Does This VexPro Case Highlight?

This exposure story around VexPro showcases several major red flags that traders should watch for when choosing or evaluating a broker:

- Account blocked immediately after a withdrawal request rather than during normal trading.

- Accusations of rule violations without evidence, documentation, or precise contract references.

- Funds were withheld despite formal written requests for withdrawal.

- Prolonged silence from the broker, with no meaningful response for days.

When these elements appear together, they strongly suggest that a broker may be trying to retain client funds rather than honour withdrawal obligations. For many traders, encountering even one of these issues is a sign to reassess their relationship with the broker.

What Can You Do If You Face a Similar Problem with VexPro?

If you experience behaviour similar to this case—such as blocked withdrawals or unsubstantiated accusations—the first step is to keep thorough records of everything. Save transaction histories, screenshots of your balance, withdrawal requests, and all emails or chat messages with VexPro, especially those that show your formal requests for payout.

Next, continue to request clear, written explanations that reference specific terms and conditions, and ask for a concrete timeline for the release of your funds. If the broker remains silent or evasive, you may consider filing a public complaint on independent platforms, consulting local consumer‑protection agencies, or seeking legal advice, depending on your jurisdiction.

How Can Traders Protect Themselves Before Problems Arise?

This VexPro case underscores the importance of testing a broker's withdrawal process early, before committing large sums. A small deposit followed by a modest withdrawal request can reveal a lot about how a broker handles payouts and whether its internal processes are transparent and timely.

Traders should also research other users experiences and pay close attention to exposure reports that describe patterns of account blocks or withdrawal delays. Being proactive with due diligence—rather than reacting only after issues arise—can greatly reduce the chances of getting trapped with a broker that might withhold funds.

Why Is the Investor Urging Extreme Caution with VexPro?

After going through a deposit, trading, a withdrawal request, an account block, vague allegations, and then days of complete silence, the investor no longer trusts VexPro with their money. Their conclusion is that the brokers actions are consistent with those of firms that do not intend to return client funds once they have been deposited.

By sharing their story publicly, they aim to warn other traders before they face the same situation. The key message is simple: if a brokers behaviour around withdrawals mirrors what this investor reports at VexPro, traders should treat it as a serious warning and reconsider whether to deposit—or keep—any funds there.

Read more

Is XeOne Regulated? A Complete Look at XeOne License and Company Status

As of 2026, the main question about XeOne regulation has a clear answer based on facts: this broker works without a real financial license from any trusted, top-level regulatory authority. Our research into public records and watchdog websites shows serious concerns that potential traders need to understand before working with this company. While the company, XeOne Prime Ltd, does have a business registration in Mauritius, this is an important difference that should not be confused with financial regulation. A business registration lets a company legally exist, but it does not give it permission to offer financial services, and it does not put it under the strict oversight needed to protect client capital. This article gives a detailed, fact-based analysis of XeOne's operating status. We will break down its business standing, look at the serious complaints from users, and examine its product offerings to show the risks involved. The goal is to give you the facts needed to make a smart

XeOne Safety Check: Is This a Fake Broker or a Real Trading Company?

If you're asking 'Is XeOne legit?' or have heard talk about a 'XeOne scam,' you are doing important research. Your capital's safety depends on finding the right answers. In the complicated world of online trading, telling the difference between a trustworthy company and a dangerous one is the most important skill any trader can learn. This review aims to give you a clear, fact-based answer to your questions. We will examine how XeOne works, what regulations it follows, and what users say about it to give you a final answer. To be honest, our research shows that XeOne presents serious risks to traders and works without proper government oversight. This entire review is based on checkable facts gathered by WikiFX, a worldwide platform for checking broker regulations, making sure our findings are clear and based on real information. We will explain exactly why we reached this conclusion and what it means for anyone thinking about investing in this company.

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

When choosing a new forex broker, the first question every trader should ask is: Will my capital be safe? This XeOne review for 2026 is a complete analysis designed to answer exactly that question. We will look beyond the advertising materials to check the facts using information anyone can find. Our detailed look will cover the most important areas for any trader: regulation (or the complete lack of it), account features, real user feedback, and how trustworthy the broker actually is. The information here is meant to help you make a smart decision, pointing out several important safety concerns that all potential users need to know about.

UniPrime Broker Exposed: Blocked Account Alert

Unicorn Prime Liquidity (UniPrime) exposed: user reports a blocked account and unresponsive support. Protect your funds and file a complaint.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Rate Calc