Smart People, Costly Scams: Education Isn’t Enough

Abstract:Sundramoorthy said investment scams continued to ensnare victims from all walks of life, including highly educated professionals accustomed to analytical and evidence-based thinking

Education and professional standing offer little protection against investment scams, which are becoming increasingly sophisticated and psychologically driven, a senior criminologist has warned.

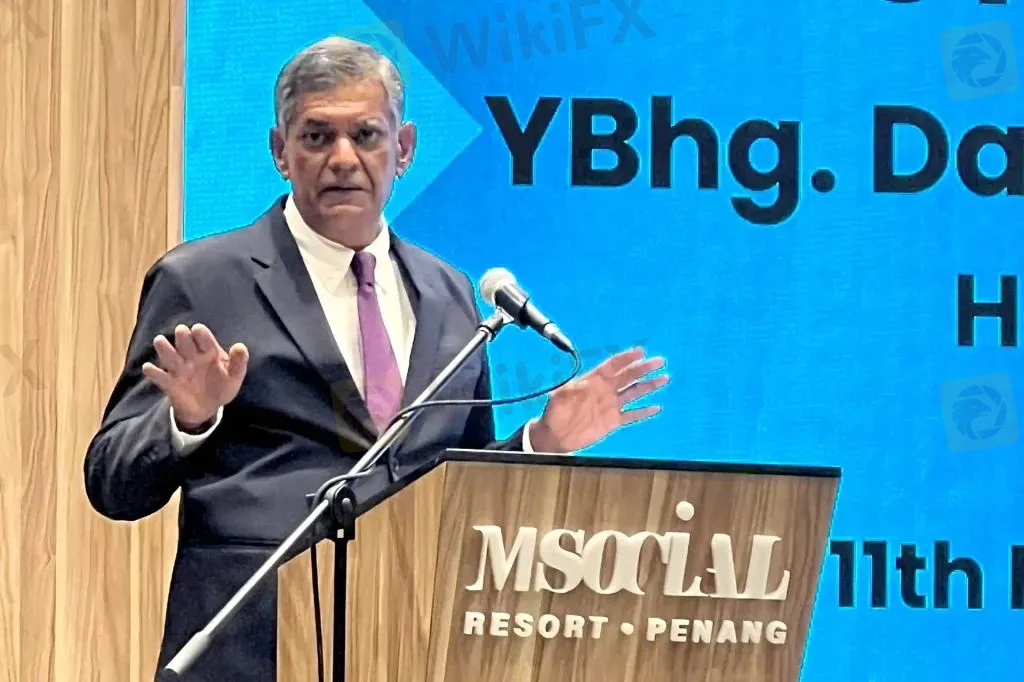

Datuk Dr P. Sundramoorthy said a recent case involving a medical specialist who allegedly lost more than RM500,000 to a non-existent cryptocurrency investment highlights how even highly educated individuals can fall victim, despite widespread public warnings and extensive media coverage.

From a criminological perspective, he said scam victimisation should not be dismissed as a matter of greed or ignorance. Instead, it is the result of a complex mix of psychological manipulation, social engineering and weaknesses within todays digital environment.

According to Sundramoorthy, investment scams continue to trap people from all backgrounds, including professionals who are trained to think critically and rely on evidence in their work. One of the main reasons these scams succeed, he said, is the careful exploitation of trust.

When an investment link or opportunity comes through social media from someone familiar, such as a colleague or acquaintance, suspicion is immediately reduced. Trust, familiarity and the appearance of legitimacy strongly influence decision-making, particularly when scams are embedded within personal or professional networks. In such situations, individuals may overlook warning signs and suspend critical judgement.

He added that emotional manipulation plays an equally important role. Many scams do not rely purely on promises of wealth but tap into deeper fears and hopes, including anxiety about financial security, optimism about future gains and the fear of missing out on opportunities.

Cryptocurrency scams, in particular, are often framed as innovative and time-sensitive, creating pressure to act quickly. Once emotions are triggered, rational thinking can give way to impulsive decisions, even among experienced professionals.

Cognitive biases further increase vulnerability. Sundramoorthy noted that overconfidence can lead educated individuals to believe they are capable of distinguishing legitimate investments from scams. Confirmation bias then reinforces this belief when scammers present fake profits or convincing indicators of success. Authority bias also comes into play when fraudsters pose as investment experts, lawyers or recovery agents, using official-sounding language and professional-looking documents.

The digital environment, he said, amplifies these risks. Social media platforms enable rapid sharing of information and create a false sense of credibility through repeated exposure and perceived social approval. When an investment appears popular or widely endorsed online, it is more likely to be trusted.

At the same time, the blurred line between social interaction and financial promotion allows scams to spread more easily without detection. This has also led to an increase in secondary victimisation, where individuals who have already been scammed are targeted again.

After realising they have been cheated, victims often become desperate to recover their losses. Scammers exploit this vulnerability by posing as recovery agents or legal representatives, causing further financial and emotional harm.

Sundramoorthy said investment scams continue to thrive because they exploit human psychology, technological systems and regulatory gaps at the same time. Victims, he stressed, are not irrational but are targeted by highly organised fraud networks operating in low-risk, high-reward environments.

He added that addressing the issue requires moving away from blaming victims and towards stronger regulation, greater accountability from digital platforms and public education that reflects the reality of how even well-educated individuals can be deceived in the digital age.

Recent figures underline the scale of the problem. Online scams surged sharply last year, with losses reaching RM2 billion in the first nine months alone, based on more than 47,000 reports. This represented a 94 per cent increase compared to the previous year.

Younger age groups have been particularly affected, with Generation Z and millennials emerging as the most vulnerable, reflecting their higher engagement with digital platforms and online financial activity.

Investment scams have now overtaken romance scams as the most common form of fraud, typically luring victims with promises of extraordinary returns through fake apps and platforms. Phone scams involving impersonation of authorities remain widespread, while online shopping and loan scams continue to contribute to significant financial losses.

Read more

Forex Brokers with Strong Profit Potential in 2026

As global markets enter 2026 amid shifting interest-rate cycles, AI-driven trading tools, and rising retail participation, choosing the right forex broker has become more critical than ever. While no broker can guarantee profits, some platforms offer better trading conditions, stronger regulation, and lower execution costs, which significantly improve a trader’s long-term profitability potential.

BlackBull Markets Regulation: A Complete 2026 Guide to Their Licenses

Before trusting any broker, you need to check if it is properly regulated. The safety of your capital and fair trading conditions depend completely on how well the broker is supervised. For a thorough check on brokers like BlackBull Markets, websites like WikiFX can give you collected information, license tracking and user reviews, providing an important independent check. This article aims to answer a key question: Is BlackBull Markets a safe and regulated broker? The simple answer is yes, but the regulation setup uses two different licenses that every trader needs to understand. We will break down the BlackBull Markets regulation system, explain each BlackBull Markets license, and make clear what this setup means for you as a trader. Our review is based on facts you can check and aims to give you an unbiased, expert view.

Voices of the Golden Insight Award Jury | Takashi Matsumoto, Founder&CEO of TJ Tech

WikiFX Golden Insight Award uniting industry forces to build a safe and healthy forex ecosystem, driving industry innovation and sustainable development, launches a new feature series — “Voices of the Golden Insight Awards Jury.” Through in-depth conversations with distinguished judges, this series explores the evolving landscape of the forex industry and the shared mission to promote innovation, ethics, and sustainability.

20 Seconds to Get Started! Complete Guide to Joining and Using the WikiFX Community

Say goodbye to trading alone! Join the community to discuss market trends, avoid scams, and claim exclusive benefits.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

SGFX Review 2026: A Trader's Warning on Spectra Global

Is UEXO Legit or a Scam? 5 Key Questions Answered (2025)

Oil Markets: Saudi Price War Signals Oversupply Amidst Venezuelan Chaos

Commodities Super-Cycle: Copper hits Records as Gold Flashes Warning Signs

Velocity Trade Review 2025: Institutional Audit & Risk Assessment

Fed Minutes Expose Policy Rifts: Rare Split Vote Signals Bumpy Path for Dollar

Rate Calc