GMI to Stop Global Operations from Dec 31, 2025; Don’t Miss the Final Withdrawal Deadline

Abstract:Taking the financial market by surprise, GMI, one of the leading global forex and CFD brokers, announced its intention to close its global operations from December 31, 2025. Since the official shutdown announcement, traders have been concerned about the status of fund deposits and withdrawals. They have understandably been searching for answers to these questions amid this announcement made by the group. Read on as we share with you key details emerging from the development.

Taking the financial market by surprise, GMI, one of the leading global forex and CFD brokers, announced its intention to close its global operations from December 31, 2025. Since the official shutdown announcement, traders have been concerned about the status of fund deposits and withdrawals. They have understandably been searching for answers to these questions amid this announcement made by the group. Read on as we share with you key details emerging from the development.

A Major Announcement on Deposit & Withdrawal Options

The GMI management has allowed its existing traders to deposit until Dec 24, 2025, only. However, it has declined to accept new client and agent registrations. As per the announcement, customers can only close their market positions. On the other hand, the brokerage house has allowed traders to apply for fund withdrawals until January 31, 2026. Sharing a screenshot containing an official shutdown announcement from GMI.

What Led to the GMI Shutdown Announcement?

Founded in 2009, the brokerage house has been contemplating an exit amid an old and ailing boss. Over the past two years, the brokerage management tried to recruit a new boss to spearhead GMI. Many wealthy financial groups and major investment houses evinced interest in acquiring the group at attractive prices. However, the brokerage house could not find a suitable, honest and qualified boss to steer the company ahead despite screening many applicants during the review period. Acknowledging that it was an extremely difficult decision, the brokerage management decided to close the company and its clientele base to an operator, but not without potential future risks and doubts. As shown above, the brokerage management thanked everyone for their support and contributions over the last 16 years.

The Geographical Presence

GMI is a regulated forex broker with more than 1 million registered accounts in 30+ countries, including key South Asian markets such as India and Bangladesh. It meets the diverse needs of several clients, including experienced traders, beginners, and fund managers.

The Markets Where GMI is Present

The GMI group offers clients with a wide range of markets, such as forex, stock CFDs, indices, and commodities (gold, silver, oil).

Forex Pairs

- EUR/USD

- USD/JPY

- GBPUSD

- EURGBP

- EURJPY

- USDCAD

- AUDUSD

- NZDUSD

- AUDCAD

- USDCNH

Popular US Shares

- AAPL

- MSFT

- AMZN

- NVDA

- TSLA

- META

- JNJ

- JPM

- BRK.B

Commodity Pairs

- XAUUSD

- USOUSD

- XAGUSD

- UKOUSD

- XAGEUR

- XAUEUR

- XNGUSD

- UKOUSD

Top Company Indices

- U30USD

- NASUSD

- SPXUSD

- D40EUR

- 100 GBP

- HSIHKD

- F40EUR

- CHN50U

Trading Accounts Available at GMI

- Demo Account

- ECN Account

- Sen Account

- Standard Account

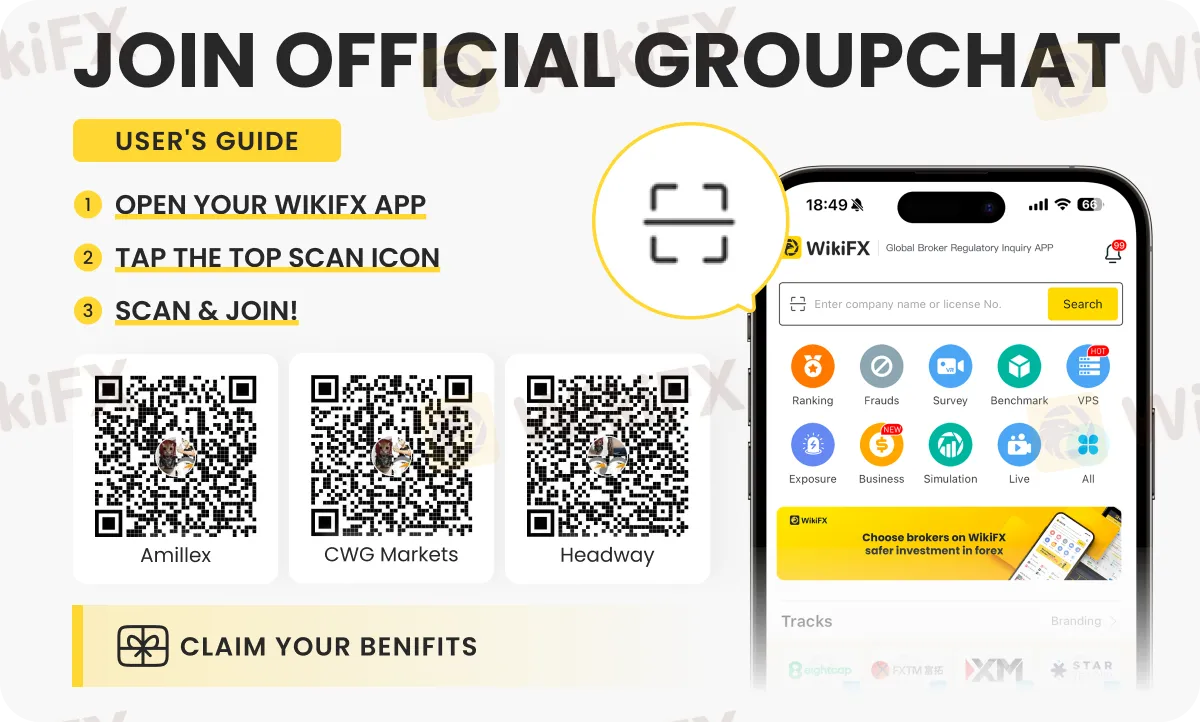

For major financial news, including that from the forex market, join our special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G.

Read more

Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Pemaxx Review: Fund Scams & No Withdrawals, Say Traders

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Fortune Prime Global Exposure: Withdrawal Denials & Profit Cancellations Frustrate Traders

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

UNIGLOBEMARKET Analysis Report

UNIGLOBEMARKET presents a mixed picture that demands careful consideration from prospective traders, earning an overall rating of 5.5 out of 10 with a "Use with Caution" designation. Based on 55 trader reviews, the broker shows a concerning 40% negative rate, though it's worth noting that positive reviews still outnumber negative ones with 31 favorable assessments compared to 22 unfavorable ones. Read on for an insightful review.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Rate Calc