TOPONE Markets Review: Allegations of Withdrawal Denials, Forced Liquidations & Questionable Rules

Abstract:Do you think that TOPONE Markets’ forex trading rules need to change? Do these rules prevent you from earning profits? Does the forex broker adopt a dubious approach by ensuring fast deposits but delayed withdrawals? Have you witnessed forced liquidations of forex positions by the Cayman Islands-based broker? In this TOPONE Markets review guide, we have shared several complaints against the broker. Read on!

Do you think that TOPONE Markets forex trading rules need to change? Do these rules prevent you from earning profits? Does the forex broker adopt a dubious approach by ensuring fast deposits but delayed withdrawals? Have you witnessed forced liquidations of forex positions by the Cayman Islands-based broker? In this TOPONE Markets review guide, we have shared several complaints against the broker. Read on!

Top Forex Trading Complaints Against TOPONE Markets

Questionable Trading Rules Lead to Capital Losses, Traders Allege

Traders seem to be losing because of trading rules that seem illogical by traders. In one complaint, a trader commented about the three-minute rule that does not allow individuals to earn profits. Recounting his incident, the trader stated that, as he made profits over 100% within a week, he lost the TOPONE Markets login access. Despite contacting customer support officials, the trader could not get the access back. The trader alleged that when losses occur, the broker does not snatch the login access. Sharing the traders full TOPONE Markets review below.

Fast Deposits, But Delayed Withdrawals

While some traders appreciate the fast deposit service, they do not say the same thing about the TOPONE Markets withdrawal process. Withdrawals take a lot of time to execute. Adding to the poor advisory services by the trading firm, the trading experience only worsens for traders. Here is a screenshot capturing the essence of this complaint.

The Income Tax Payment Allegation Against TOPONE Markets

In an explosive claim, a trader complained that TOPONE Markets induced him to purchase forex and XAU through a dating platform. As per the traders admission, he made profits but was forced to pay a hefty income tax. Frustrated by the poor trading experience, the trader shared a poor TOPONE Markets review.

Manipulative Closure of Forex Trading Positions

Several traders have complained about the manipulative tactic TOPONE Markets uses to defraud its clients. They have reported that the closure price comes lower than the lowest offer price. Some traders alleged that they witnessed a negative trading account balance upon execution even though the price looked far better when they gave the sell order on the TOPONE Markets login. Here are multiple price manipulation complaints against the broker.

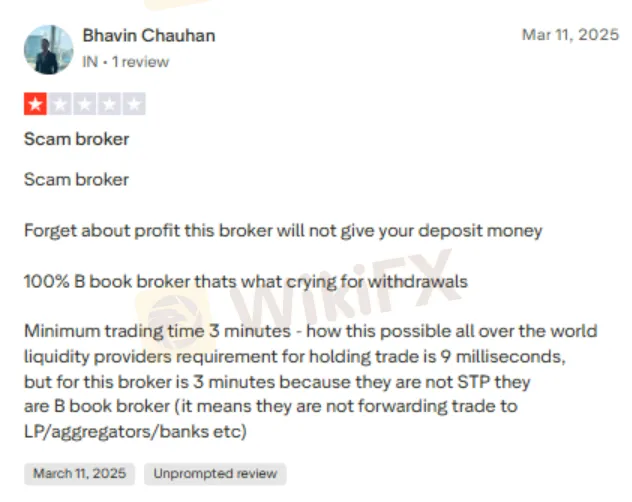

TOPONE Markets Faces the B-book Broker Allegation

A trader criticized TOPONE Markets heavily for carrying out the minimum 3-minute trading time, whereas the time requirement for liquidity providers globally remains 9 milliseconds. This made the trader comment that TOPONE Markets is a B-book broker, which means that it internalizes client trades instead of transferring to the external market. This activity raises the scope for traders‘ losses while magnifying the broker’s profits. Check out this explosive TOPONE Markets review to understand the trading issue better.

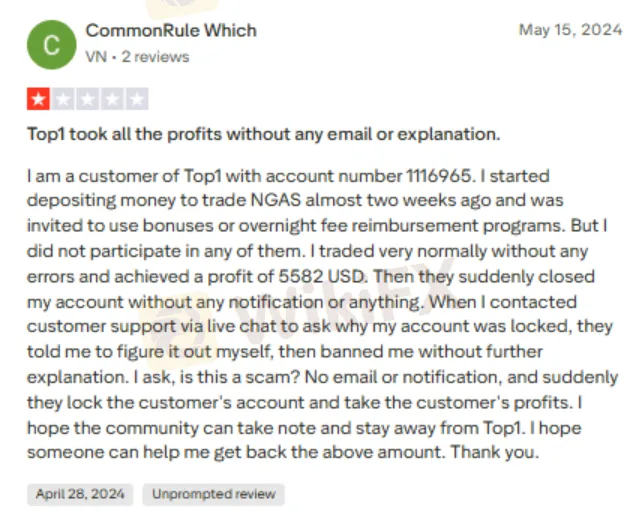

The ‘Profit Hack’ Complaint Against TOPONE Markets

This just adds to the numerous forex trading issues for traders at TOPONE Markets. Recounting the financial tragic incident, the trader denied participating in any of the bonus or reimbursement programs. He admitted to having traded normally and earned profits worth USD 5582. However, the broker closed the account without any reason, taking away all his profits, the trader alleged. The TOPONE Markets customer support officials, when contacted, left the issue squarely on the trader to solve. Receiving no response against this issue, the trader vented out with this review of TOPONE Markets.

TOPONE Markets Review by WikiFX: The Score & Regulatory Oversight Update

The seemingly serious allegations made the WikiFX team investigate TOPONE Markets thoroughly on different aspects, including the regulatory status. As we delved deeper, we found the broker to be regulated in Australia. However, the complaints do make for a thorough operational review by the brokers top management. Keeping all these in mind, TOPONE Markets could only receive a score of 2.26 out of 10.

For more forex updates, insights and tips, keep following us on special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G).

Read more

NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

Inside the Elite Committee: Talk with Ahmed Hassan

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

NaFa Markets Regulation: A Deep Dive Investigation Exposing a Major Scam

WARNING: Do not put any money into NaFa Markets. Our research shows it has all the signs of a clever financial scam. This platform lies about its legal status and uses tricks that are the same as fake investment schemes designed to steal your funds. When people search for information about NaFa Markets regulation, they need to know the truth: it is fake and made up.

WikiFX Broker

Latest News

AI Revolutionizes Modern Medicine and Diagnostics

Geopolitics meets Liquidity: EU Freezes Trade Talks as Trump 'Greenland' Gambit Rattles Alliance

De-Dollarization Reality: Gold Overtakes Treasuries in Central Bank Reserves

JGB Meltdown: Japan's Debt Crisis Deepens as Snap Election Stirs Fiscal Panic

Oil Markets Boxed In: Supply Glut Overpowers Geopolitical Floor

iq option Review 2026: Is this Forex Broker Legit or a Scam?

Pocket Option Review: The Offshore Mirage Luring Traders into a Withdrawal Abyss

Markets Rally as Trump Suspends EU Tariffs on 'Greenland Framework'

Weltrade Review: Assessing the Critical Risks Behind the "A" Influence Rank

JGB Market Turmoil: Volatility Spikes as BOJ Ownership Dips Below 50%

Rate Calc