Classic Global Ltd Review 2025: A Complete Look at Its Services and Warning Signs

Abstract:Classic Global Ltd says it is an online forex and CFD broker that offers many trading products to users worldwide. Its website looks modern, gives access to the popular MetaTrader 5 platform, and offers different account types. However, when we look deeper, we find serious questions about how this company really operates. There is a big difference between what the broker claims and what our research shows. We found major concerns about whether it follows regulations, its business history, and what users say about it. This paints a worrying picture for people thinking about investing. This Classic Global Ltd review aims to give you a complete and fair overview, breaking down what the broker offers and showing you the critical warning signs. Our goal is to give traders the information they need to understand all the risks that come with Classic Global Ltd.

Introduction: Looking at Claims vs Reality

Classic Global Ltd says it is an online forex and CFD broker that offers many trading products to users worldwide. Its website looks modern, gives access to the popular MetaTrader 5 platform, and offers different account types. However, when we look deeper, we find serious questions about how this company really operates. There is a big difference between what the broker claims and what our research shows. We found major concerns about whether it follows regulations, its business history, and what users say about it. This paints a worrying picture for people thinking about investing. This Classic Global Ltd review aims to give you a complete and fair overview, breaking down what the broker offers and showing you the critical warning signs. Our goal is to give traders the information they need to understand all the risks that come with Classic Global Ltd.

Basic Company Information: An Unusual Profile

A broker's company identity gives us the foundation for checking if it's trustworthy. With Classic Global Ltd, the basic details show several immediate problems and concerning points. The company's claimed founding year, when it was incorporated, and when its website domain was registered all point to a business with a very short and confusing history. Also, the fact that its registered address is in an offshore location while its stated office is somewhere else adds another layer of complexity.

It's important to know that registering as an International Business Company (IBC) in Saint Lucia, as the broker claims, is just a simple corporate filing. It does not mean they have a financial services license or regulatory oversight for activities like forex and CFD trading.

Classic Global Ltd at a Glance

| Detail | Information Provided | Notes |

| Company Name | Classic Global Ltd | |

| Claimed Business | Online Forex & CFD Broker | |

| Stated Founding Year | 2025 | This future date is very unusual and raises immediate questions about credibility. |

| Date of Incorporation | August 20, 2025 | As per available IFC data. |

| Domain Registered | August 18, 2025 | classicglobal.io. This shows an extremely short business history. |

| Registered Address | Ground Floor, The Sotheby Building, Rodney Bay, Saint Lucia | An offshore registration address. |

| Stated Office Address | 106 Akaki Beliashvili Street, Tbilisi, Georgia | Note the geographical separation from the registered address. |

| Contact Methods | Phone: +27 21 891 3459, Email: support@classicglobal.io |

The Critical Issue: Regulation and Safety Analysis

For any investor, the most important factor when choosing a broker is whether it follows regulations. Regulation provides a framework for accountability, protecting client funds, and fair dealing. Without it, traders have little to no help if there are disputes or bad practices. Our analysis of Classic Global Ltd's regulatory standing shows a critical and serious weakness.

What the Broker Claims About Regulation

Classic Global Ltd makes unclear references to its regulatory standing. In its FAQ section, it mentions the following “regulatory compliance” as part of its security measures. More specifically, the broker has claimed to be regulated by the Financial Services Regulatory Authority (FSRA) of Saint Lucia. This claim forms the basis of its assertion of legitimacy.

The Reality When We Check

Despite these claims, when we check the official public registry of the Saint Lucia FSRA, we don't find any results for a licensed entity named “Classic Global Ltd.” The claim cannot be verified through official channels.

This lack of verification is made worse by important context: Saint Lucia does not currently have a strong or specialized regulatory framework for overseeing high-risk financial activities like forex and CFD trading. Even if a registration were present, its value in terms of protecting investors would be minimal compared to licenses from top-tier regulators such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus).

Third-Party Risk Assessments

Our findings are supported by multiple independent third-party risk assessment platforms that specialize in broker analysis. The consensus across these platforms is overwhelmingly negative and serves as a severe warning to potential investors. Their conclusions can be summarized as follows:

· Status: The broker is consistently labeled as “Suspected Fraud” and “Untrustworthy.”

· License: It is described as “Unregulated and suspected of illegal operation.”

· Expert Conclusion: Analysts conclude that Classic Global Ltd operates without authorization from any recognized financial regulatory body.

This collective assessment from the wider industry points to a broker operating outside the established norms of financial safety. For traders looking to get the most current risk assessment and a detailed breakdown of the regulatory status, we recommend checking the broker's profile on a comprehensive platform like WikiFX.

An Overview of Trading Services

While the regulatory issue is most important, it's also useful to understand what products and services a broker offers. Classic Global Ltd promotes a diverse range of trading instruments and a well-regarded platform, which can look appealing at first glance. However, a closer look reveals a significant lack of transparency regarding the actual trading conditions, which is another major concern.

Available Trading Instruments

Based on information from its website, the broker provides access to a wide variety of markets, allowing for diversified trading strategies. The available asset classes include:

· Forex Pairs

· Stocks/Shares

· Precious Metals (Gold, Silver, etc.)

· Commodities

· Indices

· Cryptocurrencies

This broad selection is typical of modern CFD brokers aiming to cater to a wide range of trader interests.

Trading Platform: MetaTrader 5

The primary trading platform offered is MetaTrader 5 (MT5), the industry-standard software known for its advanced charting tools, support for automated trading via Expert Advisors (EAs), and strong performance. Classic Global Ltd provides access to MT5 across multiple devices:

· MT5 Desktop

· MT5 WebTrader

· MT5 Mobile App

We noted a minor inconsistency where the FAQ page makes a passing reference to “MetaTrader 4 and 5,” but all other promotional materials and platform pages focus exclusively on MT5.

Account Types and Trading Conditions

Classic Global Ltd claims to offer a tiered account structure designed for different levels of traders. However, the broker fails to provide specific, verifiable details about the conditions for these accounts. This lack of transparency is a significant warning sign, as traders cannot assess the true cost of trading.

| Account Type | Claimed Target Audience | Key Differentiating Factors (Known) | Critical Missing Information |

| Standard | Novice/Entry-level traders | Different spreads, leverage, and commissions than other tiers. | Minimum Deposit, Exact Spreads, Leverage Ratios, Commission Fees |

| ECN | Experienced traders | Claims to offer tighter spreads and a commission-based model. | Minimum Deposit, Commission Structure, Average Spreads, Leverage |

| VIP | High-volume/High-capital traders | Promises premium conditions and services. | Minimum Deposit, Special Conditions, All Fee Structures, Leverage |

The complete absence of public information on essential trading conditions like minimum deposits, spreads, commissions, and leverage ratios is deeply concerning. Reputable brokers are transparent about these costs. This lack of clarity prevents potential clients from making an informed decision and raises questions about potential hidden fees or unfavorable terms.

Reported User Experiences and Service Quality

A broker's claims about its services must be weighed against the actual experiences of its clients. In the case of Classic Global Ltd, the gap between what is promised and what is reportedly delivered is vast. While the broker advertises reliable support and useful tools, user complaints and formal warnings from legal entities tell a story of financial harm and operational misconduct.

Customer Support and Educational Resources

The broker claims to offer 24/5 customer support through live chat, email, and phone. It also lists educational tools such as an economic calendar and various tutorials. However, reports from users suggest a different reality. Customer support is often described as slow to respond, particularly outside of standard business hours, and lacking the professionalism required to handle complex issues, especially those related to fund withdrawals. The educational resources are reported to be basic, infrequently updated, and insufficient for genuinely educating new traders.

Alarming User Complaints and Legal Warnings

The most disturbing findings of our Classic Global Ltd broker overview come from direct user complaints and public warnings issued against the broker. These are not minor service issues; they are serious allegations of financial misconduct.

Blocked Accounts & Withheld Funds

Multiple complaints have been filed by investors, particularly from Turkey. These users report a consistent and devastating pattern of behavior. In some cases, traders operating on the platform (sometimes referred to as “Intrade Finance” but linked to Classic Global Ltd) found their accounts blocked without warning.

· Accounts with significant balances, including one reportedly around $55,000, were suddenly made inaccessible.

· The reason provided by the broker was often a vague reference to “leverage changes.”

· Following the block, users were unable to log in, contact support, or execute withdrawals, effectively losing their entire investment.

Formal Accusations of Fraud

The situation has escalated to the point where a Turkish law firm, Savun Hukuk Danışmanlık, has published a public article d “Classic Global LTD Forex Dolandırıcılığı” (Classic Global LTD Forex Scam). This is a severe and direct accusation from a legal entity. The firm's article, based on cases it has received, alleges that the broker engages in:

· Using deceptive promises and false claims to attract investors.

· Systematically creating obstacles and excuses to prevent clients from withdrawing their funds.

· Unauthorized interference with client accounts, leading to losses that are then blamed on the trader.

· The law firm explicitly describes the activity as “organized fraudulent behavior.”

These specific, detailed allegations of blocking accounts, withholding funds, and engaging in fraudulent practices represent the most serious warning signs a trader can encounter.

Final Verdict: A High-Risk Proposition

After a thorough analysis of Classic Global Ltd's corporate structure, regulatory status, service offerings, and user feedback, our conclusion is clear. The broker presents an unacceptably high level of risk to any potential investor. The appearance of a legitimate operation, complete with a modern website and a wide range of assets, falls apart under the weight of overwhelming negative evidence.

Claims vs Reality: A Summary

To provide a clear final overview, we have contrasted the broker's claims with the verifiable reality.

| Stated Positives (The Claims) | Significant Warning Signs (The Reality) |

| Wide range of tradable assets | No verifiable financial regulation |

| Industry-standard MT5 platform | Rated as “Suspected Fraud” by third-party analysts |

| Multiple account tiers offered | Extremely short operational history (founded in 2025) |

| Specific, credible user complaints of blocked accounts and withheld funds | |

| A law firm has publicly labeled it a “Forex Scam” | |

| Total lack of transparency on fees, spreads, and withdrawal terms | |

| Discrepancy between registered (St. Lucia) and office (Georgia) addresses |

Our Concluding Recommendation

While Classic Global Ltd may appear to be a viable brokerage option on the surface, the evidence points to an entity that should be approached with extreme caution. The combination of an unverified regulatory status, an almost non-existent operational history, severe and specific user complaints about fund withdrawals, and a public denouncement by a legal firm constitutes a collection of critical warning signs that cannot be ignored. The risks associated with depositing funds with this broker are substantial and, in our expert opinion, unjustifiable. Before engaging with any broker, especially one with this profile, traders must perform exhaustive due diligence. We strongly encourage investors to check the full broker profile, including real-time risk alerts and user feedback, on established verification platforms, such as WikiFX, to protect their capital.

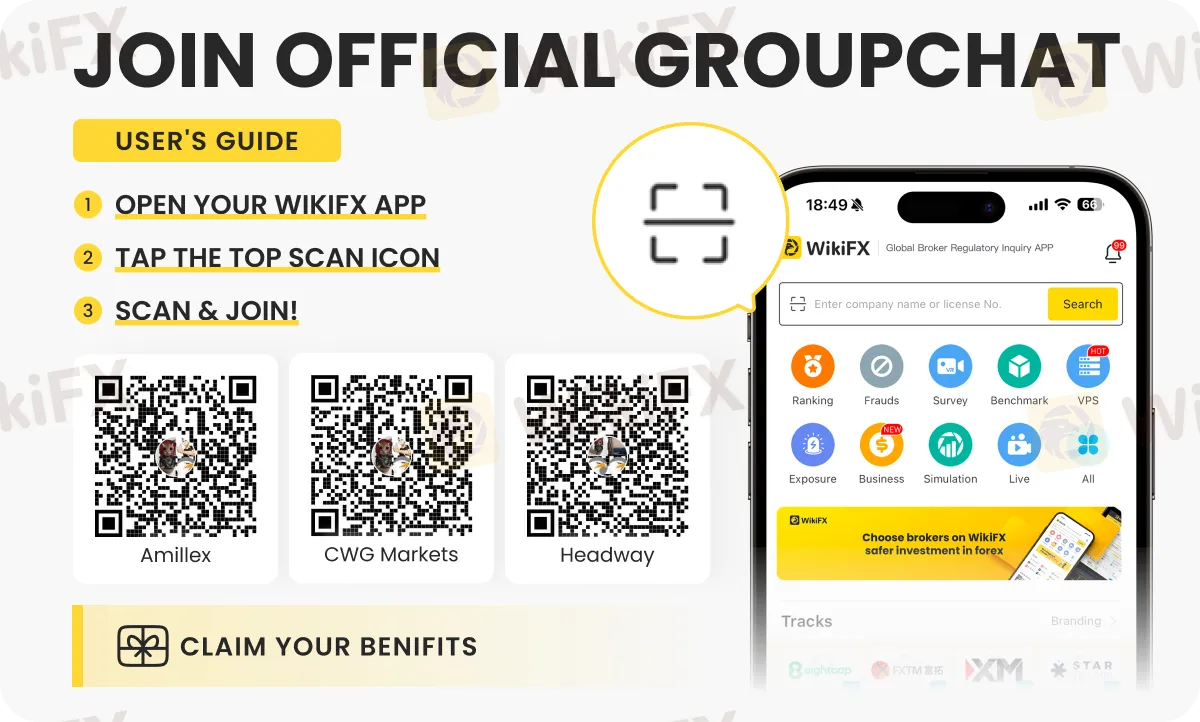

Get the latest forex updates first on these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Check the instructions on joining the group/s below.

Read more

XBTFX Exposed: Do Traders Witness Withdrawal Denials & Poor Customer Support Service?

Do you constantly witness withdrawal denials or delays by XBTFX, an Antigua and Barbuda-based forex broker? Have you been constantly unsuccessful when transferring funds from your forex trading account to your wallet? Did you have to pay a charge on a funds transfer to your wallet? Did you witness withdrawal blocks even after paying the transfer fee? Such has been the story for many traders at XBTFX. Read on as we share the XBTFX review, containing traders’ complaints.

Can You Trust Tauro Markets? A Complete Guide for New Traders

When picking a broker, the first question is always: Can you trust Tauro Markets? Is Tauro Markets reliable? For any trader, keeping your money safe is the most important thing, even more important than talking about fees, trading platforms, or what you can trade. A broker's trustworthiness isn't demonstrated by their advertisements, but by their actual licenses and their transparency about their business. The most important factor in determining whether you can trust a broker is whether they are properly regulated. This one thing decides whether your money is protected, whether you can get legal help if there's a problem, and whether the broker follows international rules for fairness and financial safety. This review will look closely at Tauro Markets' regulation, company history, trading conditions, and how they operate. We will study the facts to give you a clear, evidence-based answer about whether they're reliable for traders in 2025.

RM310,000 Gone: Jobless Man Duped by “Sure-Win” Investment

A 47-year-old unemployed man in Muar lost RM310,000 after a YouTube “high-return” investment led him to an app promoted via WhatsApp, showing fake profits of RM2.5 million before demanding an extra RM382,811.60 in “fees” to withdraw.

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

Dear astute traders and diligent knowledge-seekers, Do you aspire to gain insight ahead of market movements? Do you wish to transform every learning moment into tangible rewards? Now, your opportunity has arrived! WikiFX proudly presents the “Forex Knowledge Challenge” — a mental feast meticulously designed to enhance your trading core. No capital required, only wisdom is needed. Easily reap 1,000 points daily, allowing your knowledge and wealth to grow in sync!

WikiFX Broker

Latest News

Is Tauro Markets Safe? A 2025 Deep Look into Its Risks and Openness

QuickTrade Review: Multiple Reports of Account Freezes and Login Failures by Users

The TikTok Scam That Cost a Retiree Nearly RM470,000

The "Arbitrage" Accusation: How Winning Trades Turn Into Account Reviews at ACY Securities

IC Markets Formula 1 Partnership Debuts at Abu Dhabi GP 2025

FCA Waning list of Unauthorised firms

Trading Knowledge is Wealth! Take the Daily Quiz Challenge and Win 1,000 Points!

CommSec Regulation, Login Information & User Review : A Comprehensive Review

OneRoyal Review 2025: Multiple Licenses Yet Flooded with Scam Complaints

Inside the BSN Scandal: Bank Officer Stole Over RM11 Million from Victims

Rate Calc