Carlton Exposed: Complaints of Missing Withdrawals

Abstract:Carlton exposed reveals unregulated status, blocked withdrawals, support delays, and why traders worldwide are warning others about this FX broker.

Carlton Exposure: A Broker Under Scrutiny

Carlton Financial Limited, operating under the brand Carlton FX, has become the subject of mounting complaints from traders across multiple regions. Reports highlight blocked withdrawals, unresponsive support, and suspicious regulatory claims, raising serious questions about the brokers legitimacy.

The company advertises itself as a global FX provider with leverage up to 1:500 and access to 40,000+ instruments. Yet behind the marketing veneer lies a troubling reality: Carlton Exposure cases reveal repeated withdrawal failures and regulatory inconsistencies.

Carlton Withdrawal Issues Reported by Traders

Multiple verified users have documented Carlton Withdrawal Issues spanning months.

- Case 1 (Pakistan, Verified): A trader reported that every withdrawal request was met with vague emails asking for “elaboration,” while funds remained inaccessible.

- Case 2 (Sri Lanka, Verified): Another trader stated their account balance dropped to zero after waiting 1.5 months for a withdrawal. Carlton admitted a “technical error” but failed to release funds.

- Case 3 (Global Complaints): Several accounts show Carlton refusing withdrawals due to alleged “profit errors,” shifting blame onto clients while withholding money.

These cases demonstrate a pattern of delayed or denied withdrawals, contradicting Carltons promotional claims of “quick withdrawals” and “no hidden fees.”

Regulatory Status: Carltons Suspicious License

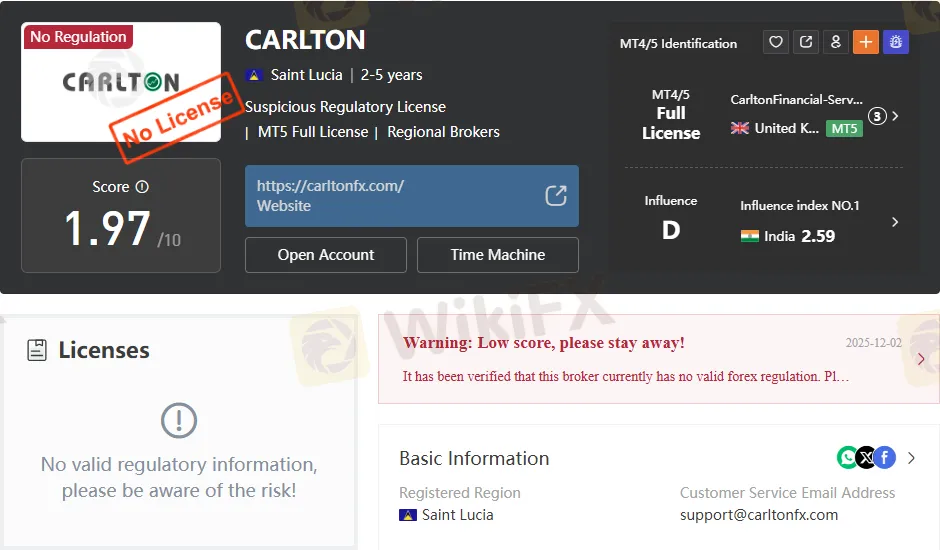

Carlton Financial Limited is incorporated in Saint Lucia under registration number 2024-00131. The broker claims to hold MT4/MT5 licenses, yet independent verification shows:

- No recognized regulation from Tier-1 authorities (FCA, ASIC, CySEC).

- Suspicious license score of 1.97/10, indicating high risk.

- Marketing claims of “Guinness World Record Holder” and “Dubai Awards” appear promotional rather than regulatory safeguards.

This lack of credible oversight places Carlton firmly in the high-risk, unregulated broker category.

Trading Accounts and Exposures

Carlton offers four account types—Zero, Premium, Pro, and Standard—with minimum deposits starting at $10.

| Account Type | Spread (Forex) | Commission | Leverage | Instruments |

| Zero | <10 | $25 | 1:500 | Forex, metals, crypto, indices |

| Premium | 30–40 | None | 1:500 | Forex, metals, crypto, indices |

| Pro | 25–35 | None | 1:500 | Forex, metals, crypto, indices |

| Standard | 40–50 | None | 1:500 | Forex, metals, crypto, indices |

While the broker promotes “swap-free” accounts and high leverage, the real exposure lies in withdrawal failures and regulatory uncertainty.

Carlton Exposure vs Safer Alternatives

To contextualize Carlton‘s risks, let’s compare with regulated competitors:

| Broker | Regulation | Withdrawal Reliability | Trust Score |

| Carlton FX | Unregulated (Saint Lucia) | Multiple complaints, blocked withdrawals | 1.97/10 |

| IG Group | FCA (UK) | Fast, verified withdrawals | 9.2/10 |

| Pepperstone | ASIC (Australia), FCA (UK) | Transparent, reliable | 8.9/10 |

| XM | CySEC, ASIC | Strong client protection | 8.5/10 |

Unlike Carlton, these brokers hold Tier-1 licenses, ensuring client funds are segregated and withdrawals processed under strict oversight.

Pros and Cons of Carlton

Pros

- Low minimum deposit ($10)

- High leverage (1:500)

- Wide range of instruments (forex, metals, crypto, indices)

Cons (Exposure Risks)

- Unregulated status in Saint Lucia

- Suspicious license score (1.97/10)

- Withdrawal issues reported globally

- Unresponsive customer support

- Promotional claims without verifiable backing

Complaint Records and Transparency

The evidence shows repeated Carlton Exposure cases where traders:

- Waited months for withdrawals without resolution.

- Received contradictory explanations citing “technical errors.”

- Escalated complaints to financial authorities and social media.

These records underscore a systemic withdrawal issue, not isolated incidents.

Bottom Line: Carltons Legitimacy in Question

Carlton Financial Limited positions itself as a global FX broker, but Carlton Exposure reports reveal a troubling pattern of withdrawal failures, regulatory ambiguity, and client dissatisfaction.

With a suspicious regulatory license, unverified awards, and a trust score below 2/10, Carlton cannot be considered a safe trading partner. Traders seeking reliability should prioritize regulated brokers with Tier-1 oversight and transparent withdrawal policies.

Verdict: Carlton FX is an unregulated, high-risk broker. The evidence strongly suggests traders should avoid this platform and opt for safer, regulated alternatives.

Read more

GatesFX Review: No Valid Regulation, Scam Reports Exposed

GatesFX is an unregulated broker with no valid forex license. Read our review on its platforms, account types, and potential risks before trading.

ITB Review: Top Reasons Why Traders Say NO to This Trading Platform

Finding it hard to withdraw profits from the ITB forex trading platform? Complying with the ITB no deposit bonus norms, but finding a NIL forex trading account balance upon withdrawal? Contacting the broker’s support officials, but not receiving any help from them? You are not alone! There are many such complaints against the Saint Lucia-based forex broker. In this ITB broker review article, we have highlighted some of these complaints. Take a look!

Capital.com Applies for South Africa Trading Licence

Capital.com South Africa licence bid highlights growth as CFD brokers in South Africa compete for ODP approval.

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

In a major revelation, the Economic Intelligence Unit of the Police Economic Offices Wing (EOW) is overseeing a cheating case where around 8,500 people were scammed in the name of 7-8% monthly return promises from forex and stock investments. While inquiring about the investment scheme, the Enforcement Directorate (ED), Surat, confiscated illegal cash worth INR 1.33 crore, foreign currency worth INR 3 lakh, and digital proof related to fraudulent transactions.

WikiFX Broker

Latest News

'Worse Than COVID': Weak US Manufacturing Surveys Signal Stagflation In November

Offshore Forex Brokers Ramp Up Expansion in Vietnam as Authorities Crack Down on Scams

Absolute Markets 2025: Is It Scam or Safe? Suitable for Traders in Pakistan?

UK snack brand Graze to be sold to Jamie Laing\s Candy Kittens

Scam Alert: 8,500 People Duped with Fake 8% Monthly Return Promises from Forex and Stock Investments

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

ThinkMarkets Review: Why High Ratings Are Masking a "Withdrawal Black Hole"

Delta Fx Review: Are Technical Glitches and Scam-Like Practices Draining Trader Profits?

Deriv Review and Global Regulation Explained

FXGROW Exposed: Complete Review & Customer Complaints Analysis

Rate Calc