The "Verify Until You Quit" Strategy: Why Winning Traders Are Being Locked Out of IQ Option

Abstract:IQ Option presents itself as a titan of the industry—slick apps, massive advertising campaigns, and an "AA" influence ranking that spans the globe. But beneath this polished veneer, our investigative team has uncovered a disturbing pattern emerging from hundreds of trader complaints. The data suggests a "roach motel" operational model: deposits are instant, but for a growing number of profitable traders, the exit doors are bolted shut.

IQ Option presents itself as a titan of the industry—slick apps, massive advertising campaigns, and an “AA” influence ranking that spans the globe. But beneath this polished veneer, our investigative team has uncovered a disturbing pattern emerging from hundreds of trader complaints. The data suggests a “roach motel” operational model: deposits are instant, but for a growing number of profitable traders, the exit doors are bolted shut.

Anonymity Disclaimer: All cases detailed below are based on real records lodged with WikiFX. Identities have been obscured to protect the traders involved.

The “Profit Punishment” Phenomenon

In the world of trading, the ultimate goal is to win. However, recent records from 2025 indicate that on this platform, winning may be the quickest way to get banned.

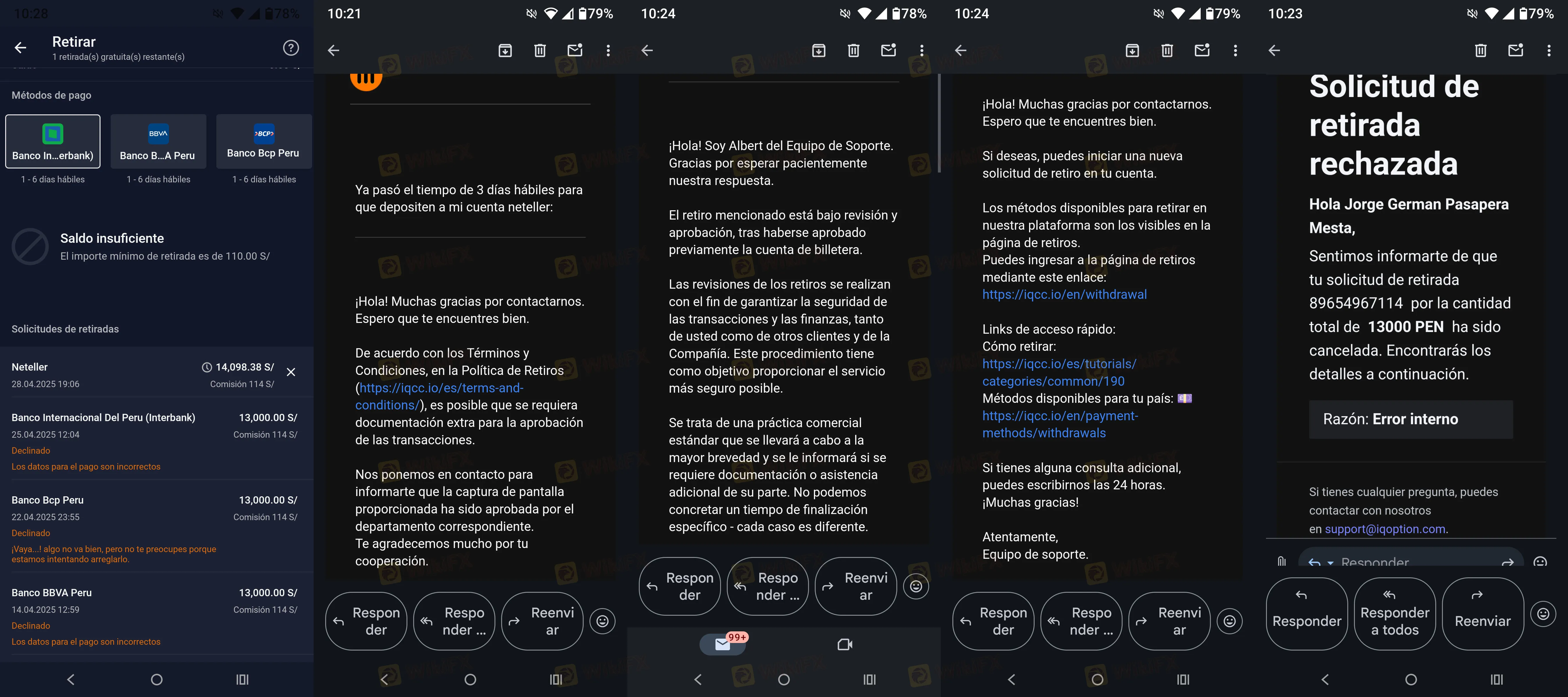

Our analysis of recent inputs reveals a terrifying correlation: as soon as a trader generates significant profit, technical barriers appear instantly. One trader, who participated in a monthly tournament in September 2025, reported earning a substantial prize. Instead of a payout, they faced a brick wall. The platform allegedly requested a cascade of verification documents. Once provided, communication was cut, and the account was blocked. The profit—and the initial deposit—remained inside.

This is not an isolated incident. Reports from October 2025 describe traders growing their accounts from small deposits (e.g., $20 to over $50) only to find their withdrawal function disabled. When they attempted to transfer funds to bank cards, the transactions were marked as “Failed,” yet no explanation was given. Shortly after, access to the accounts was restricted entirely.

The Administrative Labyrinth

When silence doesn't work, the platform appears to deploy bureaucratic hurdles designed to exhaust the trader.

The “Time Travel” Verification

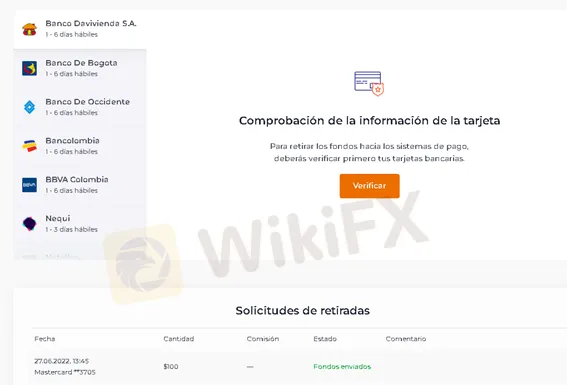

In a baffling case recorded in February 2025, a trader looking to withdraw funds was suddenly required to verify every credit card they had ever used to deposit funds over the history of their account. This included requests for photos of cards from four years ago—cards that had long since been destroyed, expired, or lost. Because the trader could not physically produce a plastic card from 2021, their current funds were held hostage.

The Bonus Trap

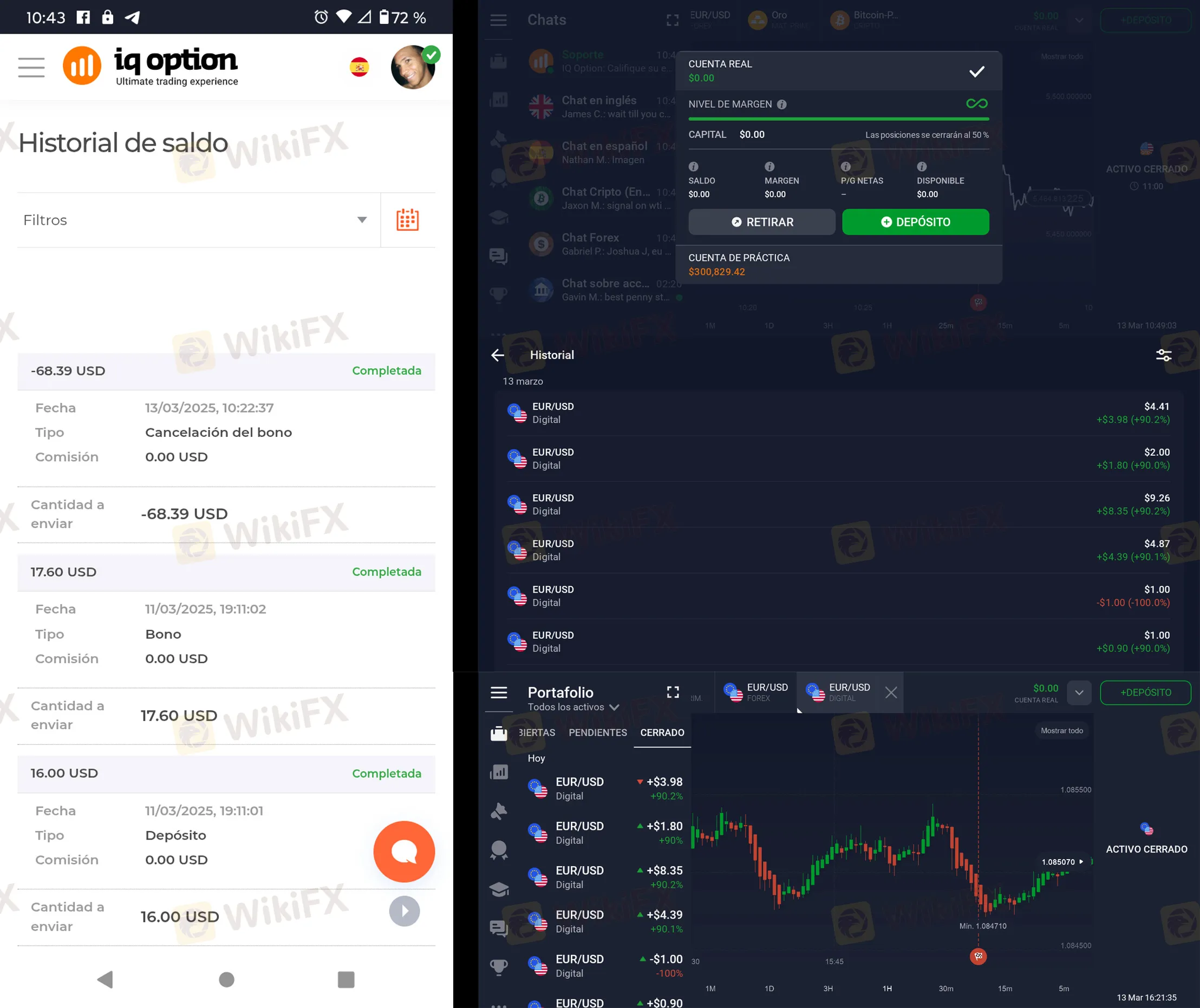

Another disturbing mechanism involves the weaponization of bonuses. A case from March 2025 highlights a trader who accepted a small deposit bonus (approx. $17). After trading their account up to nearly $70, they decided to cancel the bonus to free up their withdrawal. The terms implied that only the bonus amount would be deducted. Instead, upon cancellation, the entire balance was wiped to zero, including the trader's own capital and profits.

Regulatory Reality vs. Marketing Myth

IQ Option operates under a complex regulatory framework. While they tout their “regulated” status loudly, a closer look at the WikiFX regulatory database reveals a fractured picture. Traders must understand that a license in one jurisdiction does not guarantee safety in another, especially when warnings are flashing elsewhere.

The Regulatory Breakdown:

- Cyprus (CySEC):

- Status: Regulated (License 247/14)

- Reality: While this is a valid Tier-2 license, it primarily protects European clients. It has not prevented the deluge of complaints regarding withdrawal failures from other regions.

- Malaysia (SCM):

- Status: Unauthorized / Investor Alert List

- Meaning: The Malaysian Securities Commission has explicitly flagged this entity for carrying out capital market activities without authorization.

- Singapore (MAS):

- Status: Investor Alert List

- Meaning: The Monetary Authority of Singapore has warned that this entity may be perceived as licensed when it is not.

Silence from the Support Team

A recurring theme in almost every complaint from late 2024 through 2025 is the degradation of customer support. Traders report that the “Live Chat” functions work perfectly when asking how to deposit. However, once a withdrawal inquiry is lodged, response times stretch from hours to weeks.

One trader noted in May 2025 that after their withdrawal was canceled three times without reason, they sent all requested documents to the support email. The verification team confirmed receipt and approval, yet the withdrawal remained “frozen” for weeks. Eventually, the support team simply stopped replying.

Risk Warning

WikiFX Score: 5.47 / 10

While IQ Option holds a valid regulatory license in Cyprus, the sheer volume of severe complaints regarding withdrawals—specifically targeting profitable accounts—poses a critical risk. The existence of a license has not shielded recent traders from losing access to their capital.

The level of risk associated with this broker is currently High. Please exercise extreme caution.

Read more

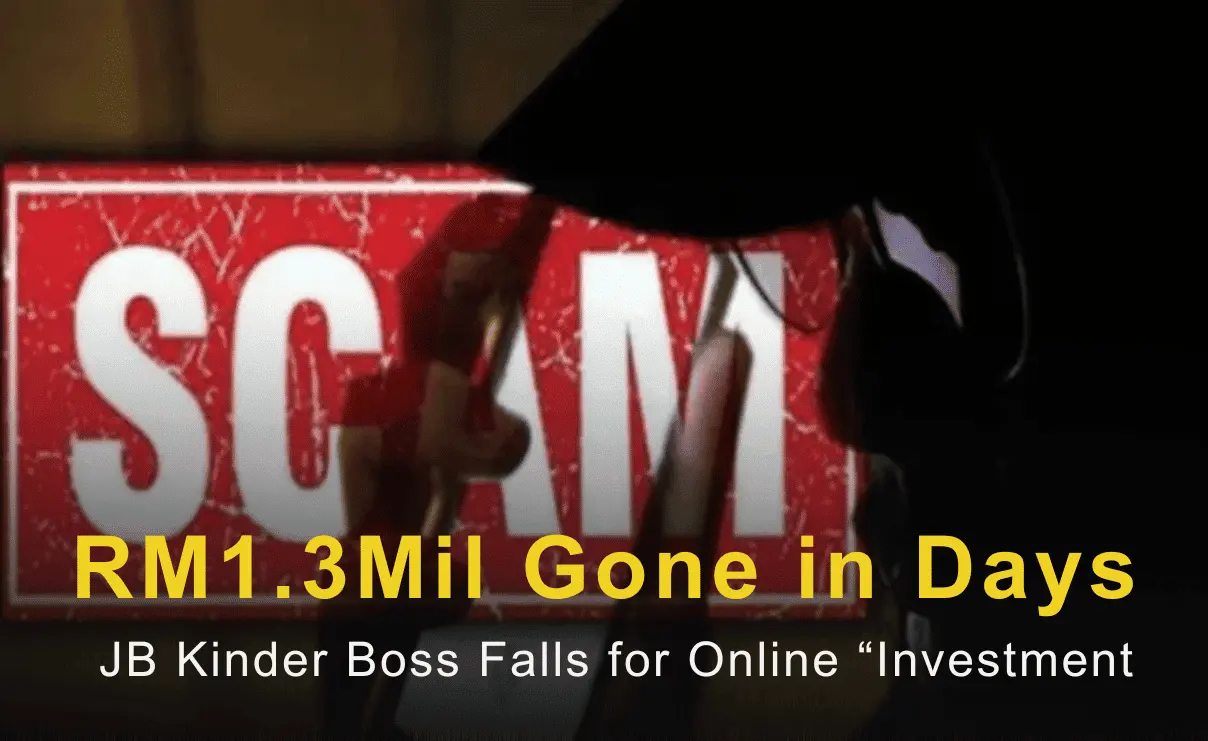

RM1.3Mil Gone in Days: JB Kinder Boss Falls for Online “Investment”

A Johor Baru kindergarten owner lost her life savings of RM1.3 million to a non-existent online investment scheme after responding to a social media ad promising returns of up to 41%. Between Nov 6–21, she made multiple transfers to several accounts and was later pressured to “add funds” to release profits that never materialised. She lodged a police report on Nov 28; the case is being probed under Section 420 (cheating).

They’ve Moved: Fraud Rings Hiding in Remote Towns

A raid in Triang uncovers eight Chinese nationals allegedly running an investment scam via Telegram, Investigation shows that a local individual is believed to be the mastermind behind the operation

Neotrades Review: Traders Claim Profit Cuts, False Assurances & Unfair Terms

Do you feel constant pressure from Neotrades to deposit your forex capital? Were you given a false assurance by the broker on recovering your trade losses? Have all your profits been wiped to ZERO on the Neotrades login? Does the Mauritius-based forex broker apply stringent terms and conditions for profit withdrawals? In this Neotrades review article, we have showcased these complaints. Read them below.

Thailand Strikes Back: Online Scam Losses Plunge ฿195M+

Thailand’s Anti-Cyber Scam Centre (ACSC) reported 392 fewer online scam cases and a 31.4% week-on-week drop in losses—over ฿195 million saved—driven by police suppression and public awareness. Authorities caution that syndicates are relocating and exploiting events (e.g., southern floods). While online purchase fraud remains most common, “reward transfer” scams now cause the highest losses, surpassing investment scams.

WikiFX Broker

Latest News

Absolute Markets 2025: Is It Scam or Safe? Suitable for Traders in Pakistan?

Offshore Forex Brokers Ramp Up Expansion in Vietnam as Authorities Crack Down on Scams

'Worse Than COVID': Weak US Manufacturing Surveys Signal Stagflation In November

UK snack brand Graze to be sold to Jamie Laing\s Candy Kittens

FTMO Completes Acquisition of Global CFDs Broker OANDA, Marking a Major Milestone

ThinkMarkets Review: Why High Ratings Are Masking a "Withdrawal Black Hole"

Delta Fx Review: Are Technical Glitches and Scam-Like Practices Draining Trader Profits?

Deriv Review and Global Regulation Explained

FXGROW Exposed: Complete Review & Customer Complaints Analysis

The Impossible Two Percent: Why Central Banks Cannot Afford Price Stability

Rate Calc