Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

Abstract: Discover if INGOT Brokers is safe or scam in 2025. Our in-depth review examines their dual licensing, trader complaints, and regulatory warnings to help protect your investments.

A Broker of Contradictions

When traders ask, “Is INGOT Brokers safe or scam?”, the answer isn't simple. The broker shows a complex picture that needs careful study. On one side, INGOT Brokers has been running for over ten years, has a license from a top regulator, and has a real office you can visit. This suggests it is legitimate and stable. On the other side, this good image is badly hurt by many serious complaints from users, official risk warnings, and an offshore license that gives very little protection.

This INGOT Brokers safety review for 2025 will carefully examine all the evidence. We will look at its two different licenses, study patterns in what users report, and clearly explain what it officially offers. The goal is to go beyond marketing claims and give you a clear, complete answer, helping you understand the details and make a smart decision about your capitals safety.

A Tale of Two Licenses

A broker's safety depends mainly on how it's regulated. Strong regulation creates strict rules about how a company handles client money, makes sure trading is fair, and provides ways to solve disputes. INGOT Brokers works under two different licenses, which creates a big difference in the level of safety offered to clients. Potential traders must understand which company they are signing up with, as the protections are very different.

The ASIC Regulation

INGOT Brokers, through its company INGOT AU PTY LTD, holds a Market Maker (MM) license (No. 428015) from the Australian Securities & Investments Commission (ASIC). This is a big point in its favor. ASIC is known worldwide as a top regulator, famous for its strict rules and strong investor protection measures. These measures often include keeping client funds in separate accounts and access to compensation plans if the broker fails. For traders under this Australian company, the regulatory watch is strong, providing a solid foundation of trust and security. This license is a key reason why the broker cannot be simply dismissed as a scam operation.

The FSA Seychelles Concern

The second license is held by the company INGOT SC LTD and is given by the Financial Services Authority (FSA) of Seychelles (No. SD117). This is called an offshore license. Offshore regulation is a major concern for traders. These places typically have less strict rules, lower money requirements, and much weaker enforcement compared to top regulators like ASIC. Importantly, investor protection and compensation plans are often limited or don't exist. If a dispute happens with an offshore-regulated broker, a trader's legal options can be difficult and expensive to pursue. Many brokers use offshore companies to offer services, such as high leverage, that are restricted in stricter places, but this flexibility comes at the cost of client safety.

Official Risk Warnings

Adding to the complexity, the broker has been marked for “High potential risk.” This warning is made worse by the fact that it has received at least 11 formal user complaints, which have hurt its overall safety score. Also, there is an active warning about a “Clone” company pretending to be INGOT, which creates another layer of risk for traders who might accidentally work with a fake site. Anyone considering this broker must be aware of these official alerts.

*Disclaimer: This information is based on publicly available data as of early 2025 and may change. Traders should always check regulatory details independently before opening an account.*

| Feature | ASIC (Australia) | FSA (Seychelles) |

| Regulatory Tier | Top-Tier | Offshore |

| Investor Protection | High (Strict compensation schemes) | Low to Limited |

| Entity | INGOT AU PTY LTD | INGOT SC LTD |

| Perceived Risk | Lower | Higher |

Trader Experiences

While regulation tells one part of the story, user reviews show the practical, day-to-day reality of trading with a broker. The number and seriousness of complaints against INGOT Brokers form the core of the “scam” claims and paint a troubling picture of how it operates. By organizing and studying the patterns in this feedback, we can get a clear view of the broker's alleged behavior.

Severe Allegations

The most alarming feedback involves the most basic aspect of trading: getting your funds out. Multiple users have reported serious problems with withdrawals, which is a major red flag for any financial service provider.

· Withdrawal Failures: The accusations are specific and serious. One user reported being unable to withdraw $48,000, claiming the process was severely delayed with no intention from the broker to release the funds. Another trader said they have been unable to get back $5,230 since their account was frozen in late 2018.

· Forced Deposits: A deeply concerning claim comes from a user who, after trying to withdraw money, was allegedly denied and then told to deposit more funds into their account. This tactic is commonly used for fraudulent operations.

· Ponzi Scheme Allegations: One of the most serious accusations calls INGOT a “Ponzi Scheme.” The user claims the company illegally raised $80 million for a project called “INGOT COIN” and then failed to return the money to investors, using various excuses to avoid questions.

· Account Suspension: Several reports from 2018 and 2019 detail a pattern where the broker allegedly stopped operations in China. Users claim that after this period, their accounts were suspended and both trading and withdrawals became impossible, locking them out of their capital.

Performance Complaints

Beyond the severe allegations of financial wrongdoing, a second layer of complaints points to significant operational and service issues that can hurt trading performance.

· Slippage and Plugins: A user with technical knowledge claimed to have tested the broker's MT4 and MT5 platforms and found “illegal plugins” designed to cause significant slippage, which can turn profitable trades into losses.

· Extreme Weekend Spreads: Another trader warned against holding positions over the weekend, citing extreme spreads of 40-50 pips. This can lead to unfair stop-outs where a position is closed at a loss even if the market price never reached the stop-loss level.

· Hidden Fees: Despite claims of “no fees,” one user reported being charged a 1% fee on a BTC withdrawal, highlighting a lack of honesty in the broker's pricing structure.

· Unhelpful Support: Even neutral feedback often mentions slow customer support. One user noted that when questioning order execution, they received generic, unhelpful responses blaming “market volatility” without providing a real investigation or solution.

Positive and Neutral Feedback

To maintain a balanced view, it is important to acknowledge the positive and neutral experiences reported by some users. These reviews suggest that for certain clients in specific regions, the experience has been satisfactory.

· Reliable for Specific Regions: Several positive reviews come from Iranian clients who praise INGOT as a “reliable broker” with “fast and safe deposit and withdrawal” and professional support.

· Platform and Offerings: Some users have expressed satisfaction with the user-friendly platform, diverse account types, and the availability of good risk management tools.

· Responsive Support: Contrary to the largely negative reports, one user praised the support team for being “responsive in any situation.”

To gain a complete understanding of these user experiences, you can review the full breakdown of positive, neutral, and exposure reports on the broker's detailed profile.

Disclaimer on Reviews

*The following reviews are contributed by users and are presented for informational purposes. Their authenticity has not all been independently verified. They reflect individual experiences and may not represent all clients.*

INGOT Brokers' Offerings

Separating the safety concerns from the product itself, it's important to objectively detail the broker's trading conditions, platforms, and account features. This allows a trader to assess if the services, on paper, match their strategic needs.

Account Types

INGOT Brokers mainly offers two account types, serving different levels of traders. Both accounts provide access to the full range of instruments and platforms, with the main differences being the minimum deposit and spread structure.

| Account Feature | EVO Account | Standard Account |

| Minimum Deposit | $10 | $100 |

| Spreads (EUR/USD) | Starting from 0.7 pips | Starting from 1.2 pips |

| Commission | Zero | Zero |

| Max Leverage (Forex) | Up to 1:5000 | Up to 1:5000 |

| Swap-Free Option | ✅ Available on request | ✅ Available on request |

Instruments and Platforms

The broker provides access to a wide selection of markets through industry-standard trading platforms, giving traders flexibility in what and how they trade.

· Instruments: Over 1,000 financial products are available, including:

· Forex (Majors & Minors)

· Metals, Energies, Indices (Spot & Futures)

· Cryptocurrencies

· US, UK & EU Stocks and ETFs

· Platforms:

· MetaTrader 4 (MT4)

· MetaTrader 5 (MT5)

· INGOT Copy Trader

· INGOT Mobile App

Deposits and Leverage

The stated minimum deposit is an accessible $10, and the broker officially claims to charge no fees on deposits or withdrawals. However, traders should remember the user complaint alleging a hidden 1% fee on BTC withdrawals. The broker offers dynamic leverage up to an extremely high 1:5000. While this provides the potential for bigger profits from a small capital amount, it is a double-edged sword. Such a high leverage dramatically increases risk and can lead to rapid and substantial losses, often exceeding the initial deposit.

Corporate Profile

To form a complete picture, we must also consider the company's public-facing identity and operational history. INGOT Brokers is not a new or anonymous company; it is an active business that has been expanding its global footprint, a fact that complicates a simple “scam” label.

Decades and Expansion

Founded in 2013, INGOT Brokers has been operating for over a decade. In recent years, the company has actively pursued global expansion. Public news indicates it has successfully obtained new licenses in key markets, including from the FSCA in South Africa and the CMA in Kenya. Furthermore, it secured a multi-year partnership with the major football league LaLiga to be its regional financial partner in the MENA region. These moves signal an ongoing, legitimate business operation focused on growth and public visibility.

Verified Physical Presence

Unlike many questionable brokers that operate from virtual addresses, a field survey has confirmed that the broker's registered office in Australia physically exists. This verification adds a real degree of legitimacy and accountability, as it confirms a real-world presence in a top regulatory jurisdiction. This is a crucial data point that separates INGOT from anonymous, fly-by-night operations.

The Final Verdict

So, is INGOT Brokers safe, or is it a high-risk gamble? After putting together all the evidence, the verdict is clear: INGOT Brokers operates in a grey area of deep contradiction.

On one side, it is a long-standing, officially regulated broker. The ASIC license, in particular, provides a strong pillar of legitimacy. Combined with a verified physical office and a public record of global expansion and partnerships, it's difficult to label the company as an outright scam. These are not the characteristics of a typical fraudulent entity.

However, this positive image is severely damaged by the overwhelming number and seriousness of user allegations. The pattern of complaints, especially those concerning the basic inability to withdraw funds, is too significant to ignore. Accusations of forced deposits, illegal plugins, and a failed $80 million “INGOT COIN” project paint a picture of a company with serious operational and ethical issues.

Therefore, while not a clear-cut scam due to its regulatory status, INGOT Brokers undeniably falls into the high-risk category. The risk here is complex; it does not come from it being an unregulated ghost company, but from a significant, documented history of client disputes and severe withdrawal problems that call its integrity into question.

Weighing the robust ASIC regulation against the severe and numerous user complaints is crucial. The decision to trade with INGOT Brokers should not be taken lightly. We strongly advise traders to conduct thorough research and carefully review the complete history of user feedback and the broker's current regulatory standing before committing any capital. The potential benefits of its offerings must be carefully weighed against the significant risks highlighted by fellow traders.

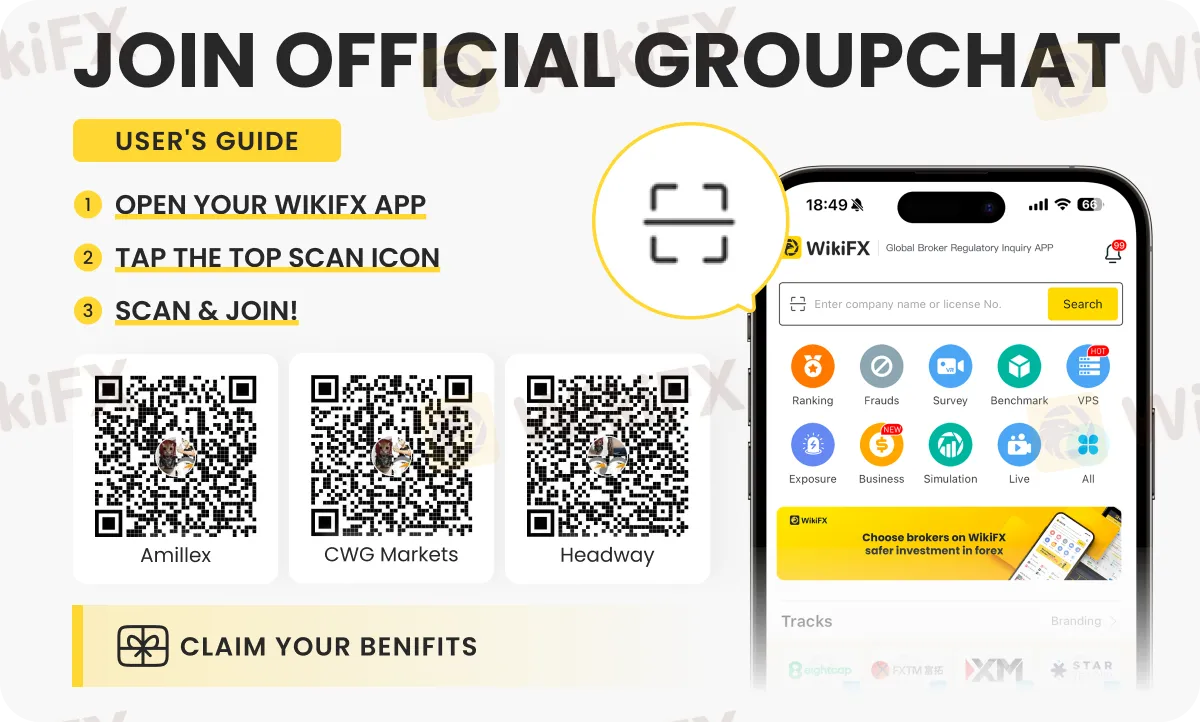

Want to join a group where forex remains central? Consider joining any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

Has your Trillium Financial Broker trading account failed to accept the deposit? Do the broker’s customer support officials fail to resolve your deposit query? Do you face unending fund withdrawal issues when trading through this forex broker? Have you faced capital scams? These are nothing new for Trillium Financial Broker’s traders. In this Trillium Financial Broker review article, we have expressed traders’ sentiments through their own complaints. Read on!

FXCL Review: Broker License Revoked, No Regulation

FXCL Review shows revoked VFSC license, no valid regulation, and multiple withdrawal complaints. Traders should proceed with caution.

Netflix Confirms 2025 Stock Split, FxPro Issues Update

Netflix announces 10-for-1 stock split set for Nov 2025. FxPro alerts clients on CFD trading access before and after the NFLX adjustment.

XM Broker Launches $150K Partners Rising League

XM Broker unveils the Partners Rising League, a $150K affiliate promotion with expanded rewards, competitive tiers, and global partner incentives.

WikiFX Broker

Latest News

The Debt-Reduction Playbook: Can Today's Governments Learn From The Past?

FIBO Group Ltd Review 2025: Find out whether FIBO Group Is Legit or Scam?

Amillex Withdrawal Problems

Is INGOT Brokers Safe or Scam? Critical 2025 Safety Review & Red Flags

Trillium Financial Broker Exposed: Top Reasons Why Traders are Losing Trust Here

Netflix Confirms 2025 Stock Split, FxPro Issues Update

XM Broker Launches $150K Partners Rising League

The Hidden Reason Malaysian Traders Lose Money And How Timing Can Fix It

FXCL Review: Broker License Revoked, No Regulation

Is WinproFx Safe or a Scam? A 2025 Simple Safety Review

Rate Calc