INGOT Brokers Regulation 2025: ASIC vs Offshore License - What Traders Must Know

Abstract:Explore INGOT Brokers regulation in 2025: Compare their ASIC and Seychelles FSA licenses, understand trader protection levels, and learn about potential risks in this detailed guide.

The Main Question

Is INGOT Brokers regulated? The simple answer is yes. But the complete story is much more complicated. INGOT Brokers works under two different regulatory systems that tell a story of two very different locations. This creates an important problem for any trader doing their research.

One of the broker's companies is licensed by the Australian Securities & Investments Commission (ASIC), a well-respected, high-quality authority around the world. Another company works under the watch of the Financial Services Authority (FSA) of Seychelles, a well-known offshore regulator. This double status, combined with many user complaints, creates a complex picture. The level of safety and protection a trader gets is not simple to understand. This complete guide will explain every part of the INGOT Brokers regulation, look at reported user experiences, and explain the possible risks involved, helping you make an informed decision.

Understanding Double Regulation

Understanding the INGOT Brokers regulation needs a clear distinction between its two main licenses. The protections, oversight, and possible risks connected with each are very different. For a trader, knowing which company holds their account is the most important factor in determining how safe their capital is. This double framework is the main issue that any potential client must carefully think about.

The ASIC Regulated Company

The “best quality” license in INGOT Brokers' collection comes from the Australian Securities & Investments Commission (ASIC), one of the world's strictest financial regulators.

· Authority: Australian Securities & Investments Commission (ASIC)

· Licensed Company: INGOT AU PTY LTD

· License Number: 428015

For traders, being under a top-quality regulator such as ASIC usually means significant protections. These often include the required separation of client funds from company funds, access to outside dispute resolution programs, and following strict operational and capital standards. However, it's important to note that even a strong license is not complete protection. For example, a notable user complaint from 2018 claimed that the Australian-licensed company had stopped processing withdrawals for certain clients, a serious claim that shows the need for continuous careful watching.

The Offshore Operation

The second part of the regulatory puzzle is the company registered in Seychelles, an offshore location.

· Authority: Financial Services Authority (FSA), Seychelles

· Licensed Company: INGOT SC LTD

· License Number: SD117

Offshore regulation is basically different. These locations are often characterized by lower capital requirements for brokers, more relaxed oversight, and, critically, limited legal options for traders if there is a dispute or bankruptcy. This company is connected with labels such as “Offshore Regulated” and “High potential risk,” which serve as clear warnings to traders about the reduced safety net. Most international clients are likely brought on through this offshore company, which offers higher leverage but fewer protections.

Regulatory Comparison

To see the difference, a direct comparison is essential.

| Feature | ASIC (Australia) | FSA (Seychelles) |

| Regulatory Level | Top-Level | Offshore |

| Investor Protection | High (Compensation programs may apply) | Low to None |

| Oversight | Strict and Active | Relaxed |

| Associated Risk | Lower | High Potential Risk |

| Company | INGOT AU PTY LTD | INGOT SC LTD |

What “Market Maker” Means

INGOT Brokers works under a Market Maker (MM) model. This means the broker can act as the opposite party to a client's trades. In simple terms, when a trader loses, the broker may win, and vice versa. This business model creates a possible conflict of interest that exists in all market makers. While common in the industry, it's a factor traders should know about, as it can influence trade execution, especially during unstable market conditions.

A Range of User Experiences

Beyond regulatory frameworks, the true measure of a broker often lies in the combined experience of its users. INGOT Brokers presents a landscape of sharp contradictions, with reports ranging from high praise to severe accusations.

Warning: Unconfirmed Reports

The following section summarizes user-submitted reviews and complaints. These are individual experiences and have not been independently confirmed by us. They are presented for informational purposes to provide a broad view of customer feelings and should be considered as part of a larger research process.

The Warning Signs

A pattern of serious complaints has appeared over the years, raising significant warning signs for potential clients.

· Withdrawal Problems: This is the most common and critical complaint. Multiple users have reported severe delays or a complete inability to withdraw their funds. Specific cases mention stuck amounts as high as $48,000 and $5,230. These are not small differences but basic failures in a broker's most basic duty.

· Claims of Scam Methods: Some reports go further, accusing the broker of being a “Ponzi Scheme.” One user conducted detailed testing on MT4 and MT5 platforms and found what they described as “illegal plugins” designed to create artificial slippage. Another user claimed that the broker demanded additional deposits before a withdrawal could be processed—a classic method of unregulated operations.

· Past Problems: The problems are not new. Complaints dating back to 2018-2019 from users in Hong Kong and China describe a situation where the broker allegedly stopped operations, froze accounts, and blocked withdrawals. These reports also connect the company to an “INGOT COIN” project, with claims of illegal fundraising.

· Unfair Trading Conditions: A trader specifically warned against holding positions over the weekend, citing extreme spread widening to 40-50 pips and unfair stop-outs where their position was closed even though the price chart never reached the stop-loss level.

These serious and varied complaints highlight significant potential risks. For a continuously updated feed of user reviews and official alerts, traders considering this broker should explore the INGOT Brokers page on WikiFX.

Neutral and Mixed Observations

Not all feedback is negative, but even neutral reviews often contain points of concern.

· Platform vs. Support: A common theme is praise for the availability of MT4 and MT5 platforms, contrasted with frustration over slow customer support and technical problems.

· Good Features, Remaining Doubts: Some users appreciate the wide range of tradable instruments but express unease about the “questionable” Seychelles regulation, recognizing the risk it involves.

· Slow Withdrawals Confirmed: One user described the platform as user-friendly but confirmed that withdrawal processing is “too slow,” supporting the more severe complaints.

· Unresponsive Support: Another trader mentioned receiving generic, unhelpful, copy-paste responses when asking about specific trade execution issues, indicating a lack of meaningful support.

The Positive Feedback

To provide a balanced view, it is important to acknowledge that some users report positive experiences.

· Good Trading Conditions: Several reviews praise the broker for responsive support, tight spreads, low slippage, and, in direct contradiction to other reports, fast deposits and withdrawals.

· Service for Specific Regions: The broker receives positive mentions for being a reliable option for Iranian customers, a region where many international brokers do not operate.

· User-Friendly Experience: Users have commented on the diverse account types and user-friendly platform, considering it suitable for traders of all experience levels.

· Long-Term Satisfaction: One user reported trading with the broker for three years without any deposit or withdrawal issues, suggesting that, at least for some, the experience has been smooth.

Trading Offerings at a Glance

A broker's trading conditions, platforms, and instrument range are key factors in a trader's decision. Here is a factual summary of what INGOT Brokers offers.

Account Types and Conditions

INGOT Brokers provides two main account types, catering to different deposit levels and trading preferences.

| Account Feature | EVO Account | Standard Account |

| Minimum Deposit | $10 | $100 |

| Spreads (from) | 0.7 pips | 1.2 pips |

| Commission | Zero | Zero |

| Leverage | Up to 1:5000 (Forex) | Same as EVO |

| Swap-Free | Available on request | Available on request |

The extremely low minimum deposit of $10 for the EVO account makes the broker highly accessible, while the high leverage of up to 1:5000 is a major draw for traders seeking to maximize their market exposure.

Tradable Instruments & Platforms

The broker offers a comprehensive selection of instruments, allowing for diverse trading strategies.

· Instruments:

· Forex (Majors & Minors)

· Metals (Spot & Futures)

· Indices (Spot & Futures)

· Energies (Spot & Futures)

· Cryptocurrencies

· US, UK & EU Stocks & ETFs

· Platforms:

· MetaTrader 4 (MT4)

· MetaTrader 5 (MT5)

· INGOT Copy Trader

· INGOT Mobile App

This extensive range, combined with the industry-standard MT4 and MT5 platforms, is a clear strength of the broker's offering.

Deposits, Withdrawals, and Fees

On paper, the broker's payment policies appear favorable.

· Minimum Deposit: $10

· Stated Fees: The broker officially claims there are no fees for deposits or withdrawals.

· Contradictory User Experience: This “no fees” claim is directly challenged by at least one user report, which claimed a hidden 1% fee was charged for a BTC withdrawal. This difference is a point of concern.

· Methods: Payment options include Wire Transfer, Bank Transfer, various Mobile Payments, and Cryptocurrencies (BTC, ETH, XRP, USDT, etc.).

Conclusion: A Broker of Contradictions

After a deep dive into the INGOT Brokers regulation, user feedback, and trading services, a clear picture emerges: this is a broker of deep contradictions, demanding extreme caution from any potential client.

Weighing Pros and Cons

On the surface, INGOT Brokers presents a highly attractive package. The presence of an ASIC license provides an appearance of legitimacy. This is complemented by a very low $10 minimum deposit, an exceptionally wide range of over 1,000 tradable instruments, and access to extremely high leverage. This combination is designed to appeal to both new and experienced traders.

However, this appeal is heavily clouded by the operational reality. The co-existence of an offshore company in Seychelles, which carries a “High potential risk” warning, is a major concern. More importantly, this risk is not just theoretical; it appears to be realized in the large volume of credible-sounding user complaints detailing basic problems with withdrawals, trade execution, and business practices. The difference between the broker's official claims and the volume of negative user experiences is significant. It is crucial for traders to perform their own in-depth investigation before making any financial commitment.

Final Verdict: Proceed with Caution

The central issue of INGOT Brokers regulation is that traders safety is entirely dependent on the company they are associated with. While the Australian company offers strong protection, it is likely that most international clients are brought on through the Seychelles-based operation, where protections are minimal.

The sheer volume and severity of complaints, particularly concerning the inability to withdraw funds, suggest a significant operational risk that cannot be ignored, regardless of the ASIC license held by its sister company. Therefore, we cannot recommend this broker without expressing strong concerns.

Ultimately, the decision rests with the individual trader's risk tolerance. We strongly advise a thorough review of all available information. To access a complete and current broker profile, including all user reviews and regulatory details, it is wise to visit the INGOT Brokers page on WikiFX before proceeding.

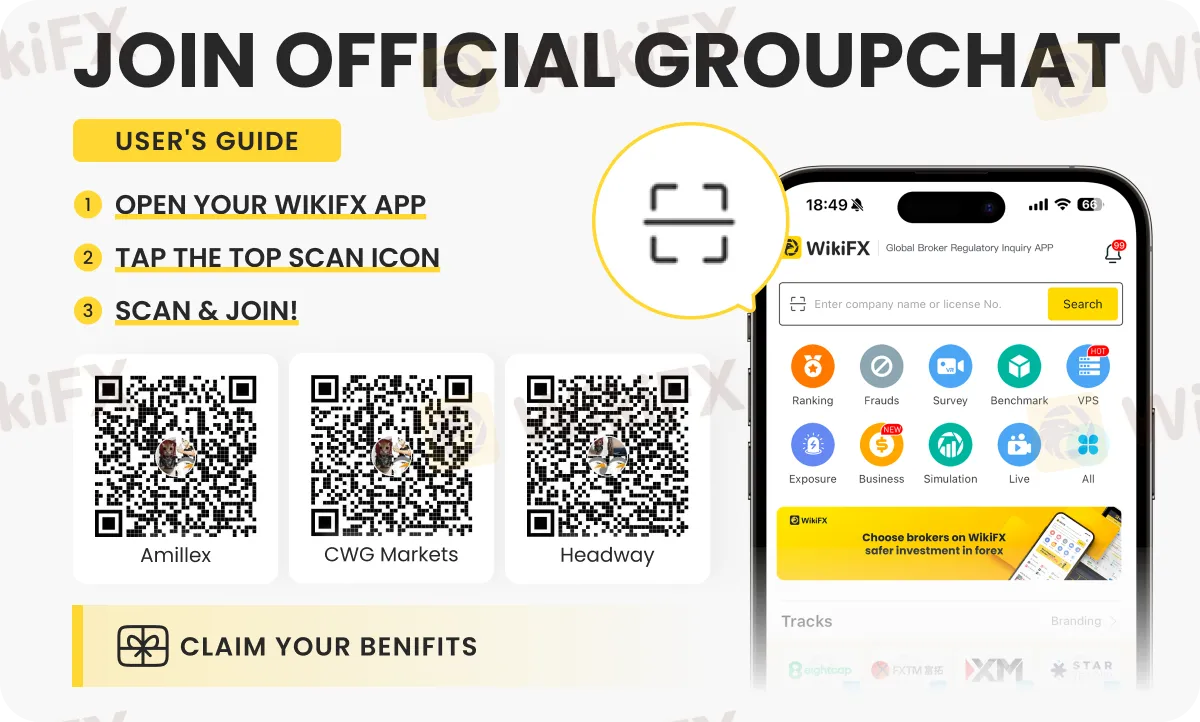

For more forex details, consider joining any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

EmiraX Markets Withdrawal Issues Exposed

EmiraX Markets Review reveals unregulated status, fake license claims, and withdrawal issues. Stay safe and avoid this broker.

ADSS Review: Traders Say NO to Trading B’coz of Withdrawal Blocks, Account Freeze & Trade Issues

Does ADSS give you plenty of excuses to deny you access to withdrawals? Is your withdrawal request pending for months or years? Do you witness account freezes from the United Arab Emirates-based forex broker? Do you struggle to open and close your forex positions on the ADSS app? Does the customer support service fail to respond to your trading queries? All these issues have become a rage online. In this ADSS Broker review article, we have highlighted actual trader wordings on these issues. Keep reading!

Mitrade Arabic Platform Targets MENA Gold Trading Boom

Mitrade launches its Arabic trading platform as gold hits record highs, giving MENA traders regulated CFD access to global markets and real-time insights.

INGOT Brokers Review 2025: High Risk or Hidden Gem? Expert Analysis Reveals All

Comprehensive INGOT Brokers review exploring the broker's mixed reputation in 2025. Discover the truth about regulation, trading options, and user experiences before opening an account.

WikiFX Broker

Latest News

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Exness Broker Expands in South Africa with Cape Town Hub

Fraud Mastermind Zhimin Qian Sentenced to 11 Years for $6.6 Billion Bitcoin Ponzi Scheme

Is FXPesa Regulated? Real User Reviews & Regulation Check

Almahfaza Broker – 2025 Review: Safe or Scam?

Uniglobe Markets Review 2025: A Complete Guide to an Unregulated Broker

INZO Broker No Deposit Bonus: A 2025 Deep Dive into Its Offers and Risks

Global Guide to Finding Forex IBs/Brokers — Share Your Pick and Win Big!

Consob Targets Political Deepfake “Clone Sites” and Unlicensed Platforms in Latest Enforcement Round

WikiEXPO Global Expert Interviews: Gustavo Antonio Montero: ESG in Finance

Rate Calc