Exposing The Trading Pit: Traders Blame the Broker for Unfair Withdrawal Denials & Account Blocks

Abstract:Did you receive contradictory emails from The Trading Pit, with one approving payout and another rejecting it, citing trading rule violations? Did you purchase multiple trading accounts but receive a payout on only one of them? Did The Trading Pit prop firm refund you for the remaining accounts without clear reasoning? Did you face account bans despite using limited margins and keeping investment risks to a minimum? These are some raging complaints found under The Trading Pit review. We will share some of these complaints in this article. Take a look.

Did you receive contradictory emails from The Trading Pit, with one approving payout and another rejecting it, citing trading rule violations? Did you purchase multiple trading accounts but receive a payout on only one of them? Did The Trading Pit prop firm refund you for the remaining accounts without clear reasoning? Did you face account bans despite using limited margins and keeping investment risks to a minimum? These are some raging complaints found under The Trading Pit review. We will share some of these complaints in this article. Take a look.

Top Trading Complaints Against The Trading Pit

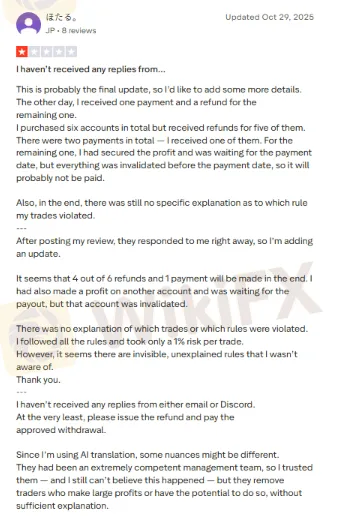

Trader Reports Partial Refunds, Unpaid Profits & Unexplained Account Invalidation

A trader reported that out of six purchased accounts, five were refunded and one received a payout. However, another account where profits had already been secured was invalidated before the payment date, resulting in non-payment. Despite asking the customer support service for clarification, the trader never received a clear explanation of which rule or trade was violated. They claim to have followed all visible trading rules, maintaining only a 1% risk per trade, but believe there are hidden or unexplained rules that led to their accounts disqualification. To know more about the complaint, check this screenshot.

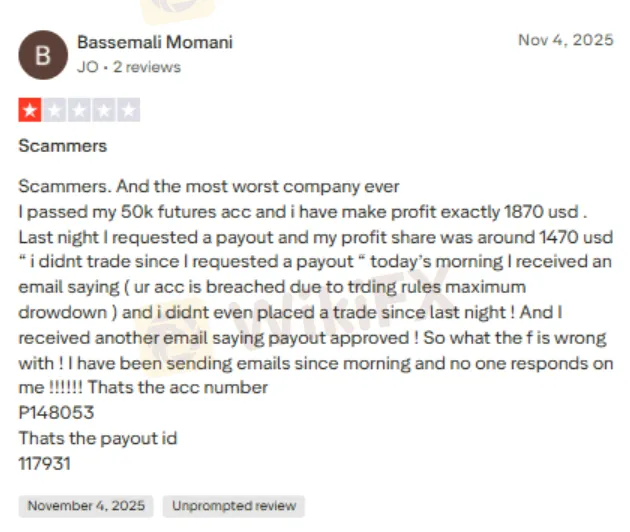

Contradictory Emails on the Payout Date

A trader reported having done so well by registering a profit worth 1870 USD. As he requested the payout, the profit share stood at approximately 1470 USD. The trader did not trade since he requested a payout. The trader received two emails, one showing payout rejections owing to the trading rule violation, and another showing payout approval. As it turned out, the trader sought clarification from the broker. However, the trader did not receive any response. This made him give The Trading Pit review, this way.

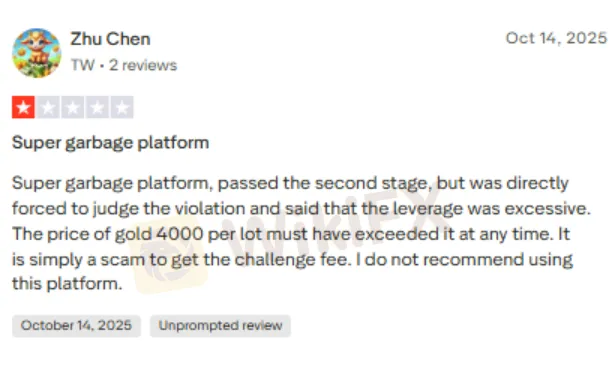

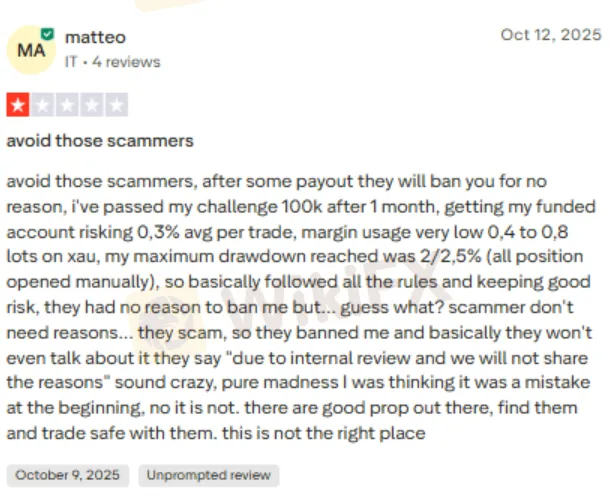

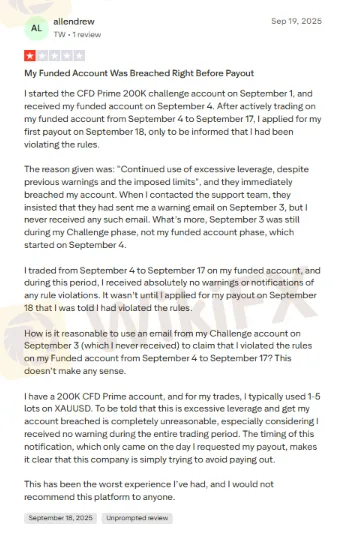

Traders Report Account Bans Despite Adherence to Challenge Norms

The Trading Pit prop firm is accused of banning trading accounts of even those traders who meet challenge norms by keeping the risk down and using minimum margins. The Germany-based forex broker delivers account ban notices to traders, citing excessive leverage use and other inefficiencies, which, according to the traders, are not true. Here are some screenshots explaining the problem in greater detail.

WikiFX Shares The Trading Pit Review: Score & Regulatory Details

The Trading Pit review by WikiFX is made after considering numerous trading complaints on funding and the brokers regulatory status. Viewing the complaints seriously, the team investigated the broker thoroughly, only to find that it is not regulated by any competent financial authority. This explains all the problems traders found while dealing with account bans despite adherence to norms, as claimed by them. This made the WikiFX team give the broker a poor score of 1.43 out of 10.

To know the latest about forex brokers and their products and services, be part of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the instructions shown below.

Read more

Fidelity Exposed: Traders Complain About Withdrawal Denials, Frozen Accounts & Platform Glitches

Does Fidelity Investments prevent you from accessing funds despite numerous assurances on your requests? Do you witness an account freeze by the US-based forex broker every time you request withdrawal access? Do you struggle with an unstable trading platform here? Is the slow Fidelity customer service making you face forced liquidation? These issues haunt traders, with many of them voicing their frustration on several broker review platforms such as WikiFX. In this Fidelity review article, we have shared quite a few complaints for you to look at. Read on!

M&G Review: Traders Report Fund Scams, Misleading Market Info & False Return Promises

Applying for multiple withdrawals at M&G Investments but not getting it into your bank account? Do you see the uncredited withdrawal funds out of your forex trading account on the M&G login? Does the customer support service fail to address this trading issue? Does the misleading market information provided on this forex broker’s trading platform make you lose all your invested capital? Were you lured into investing under the promise of guaranteed forex returns? These issues have become highly common for traders at M&G Investments. In this M&G review article, we have echoed investor sentiments through their complaint screenshots. Take a look!

INZO Broker MT5 Review 2025: A Trader's Guide to Features, Fees and Risks

INZO is a foreign exchange (Forex) and Contracts for Difference (CFD) brokerage company that started working in 2021. The company is registered in Saint Vincent and the Grenadines and regulated offshore. It focuses on serving clients around the world by giving them access to popular trading platforms, especially MetaTrader 5 (MT5) and cTrader. The company offers different types of trading instruments, from currency pairs to cryptocurrencies. It aims to help both new and experienced traders. Read on to know more about it.

Interactive Brokers Expands Client Portal with IBKR Forum

Interactive Brokers adds IBKR Forum to its Client Portal, giving traders a new way to share insights, join discussions, and access broker support.

WikiFX Broker

Latest News

Forex Expert Recruitment Event – Sharing Insights, Building Rewards

Admirals Cancels UAE License as Part of Global Restructuring

Moomoo Singapore Opens Investor Boutiques to Strengthen Community

OmegaPro Review: Traders Flood Comment Sections with Withdrawal Denials & Scam Complaints

An Unbiased Review of INZO Broker for Indian Traders: What You Must Know

BotBro’s “30% Return” Scheme Raises New Red Flags Amid Ongoing Fraud Allegations

The 5%ers Review: Is it a Scam or Legit? Find Out from These Trader Comments

WikiEXPO Dubai 2025 Concludes Successfully — Shaping a Transparent, Innovative Future

2 Malaysians Arrested in $1 Million Gold Scam Impersonating Singapore Officials

Is FXPesa Regulated? Real User Reviews & Regulation Check

Rate Calc