Uniglobe Markets India Review 2025: A Complete Guide to Safety, Costs, and Features

Abstract:Started in 2014, Uniglobe Markets, a forex and CFD broker, has become known in the Indian trading community. The company offers different types of accounts, access to popular trading software, and high leverage options. However, every trader's main concern should be whether their money is safe and if the broker is legitimate. This article gives you a detailed and factual look at Uniglobe Markets, focusing on its services, trading conditions, and most importantly, how safe it is. To answer the main question about legitimacy right away: Uniglobe Markets operates without any valid financial regulation. This one fact is the most important thing to know about our entire review, as it has serious consequences for trader safety. Our goal is to break down all the available information to help you make a smart decision.

Started in 2014, Uniglobe Markets, a forex and CFD broker, has become known in the Indian trading community. The company offers different types of accounts, access to popular trading software, and high leverage options. However, every trader's main concern should be whether their money is safe and if the broker is legitimate. This article gives you a detailed and factual look at Uniglobe Markets, focusing on its services, trading conditions, and most importantly, how safe it is. To answer the main question about legitimacy right away: Uniglobe Markets operates without any valid financial regulation. This one fact is the most important thing to know about our entire review, as it has serious consequences for trader safety. Our goal is to break down all the available information to help you make a smart decision.

Quick Overview

To give you a fast summary, we have put together the essential facts about this broker. This lets you form an immediate opinion and decide if the broker's basic profile meets your needs or if the problems are immediate deal-breakers.

Key Information

| Feature | Detail |

| Founded | 2014 |

| Registered Region | United Kingdom (Company: Uniglobe Markets Ltd) |

| Regulation | No Valid Regulation |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:500 |

| Trading Platforms | MT4, MT5 |

| Key Markets | Forex, Stock CFDs, Indices, Metals, Commodities, Cryptocurrencies |

Possible Benefits

· Many different account types are designed for different deposit amounts and trader experience levels.

· Access to the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

· Maximum leverage is available up to 1:500 on certain accounts.

· A fairly low minimum deposit of $100 makes the entry-level Micro account affordable.

· Support for multiple deposit and withdrawal methods, including e-wallets and bank transfers.

· The broker claims to charge no fees for either deposits or withdrawals.

Major Problems

· Critical Lack of Regulation: The broker operates without oversight from any major, trusted financial authority, which is a serious red flag.

· Multiple Regulatory Warnings: Financial regulators in several countries have issued official warnings and blacklisted the company.

· Reported User Problems: A pattern of negative user feedback exists, with serious complaints about withdrawal processing and trade execution.

· High-Risk Profile: The broker is flagged with a “High potential risk” warning and has a low trust score based on its operational history and lack of oversight.

Red Flag Analysis

This section brings together all the risk factors into a focused analysis to provide a clear, evidence-based answer to the question of safety. For any trader, checking a broker's trustworthiness is the most important step before investing capital.

The Main Problem

The most serious and unacceptable issue with Uniglobe Markets is its complete lack of valid regulation. A regulated broker must follow strict standards, including keeping client funds separate from company funds, maintaining sufficient operational capital, and providing a clear path for dispute resolution. With an unregulated broker, none of these protections are guaranteed. Your capital is not protected by any compensation scheme, and if you face problems such as withdrawal denials, there is no official regulatory body you can turn to for help. The broker has also been marked with a “Suspicious Regulatory License” tag, which further shows a major trust and transparency problem. You can learn more about the specifics of their corporate structure and see the full regulatory breakdown on their detailed profile page.

A History of Warnings

A history of official warnings from financial authorities is a serious sign that a broker may be operating illegally or unethically. Several international regulators have flagged Uniglobe Markets for trying to get clients without the necessary authorization.

· CYSEC (Cyprus): Issued warnings on August 14, 2025, and October 26, 2023.

· AMF (France): Added the broker to its blacklist on February 27, 2020.

· CNMV (Spain): Issued a warning against the firm on February 10, 2020.

These warnings should be taken very seriously. They are public notices from government financial watchdogs informing consumers that the company is not licensed to provide investment services in their area, reinforcing the high risk of dealing with them.

Reported User Experiences

Beyond regulatory status, the experiences of other users provide valuable insights into a broker's operational practices. In the case of Uniglobe Markets, there are reports of significant challenges that directly impact a trader's ability to profit and access their funds. Users have reported problems, including:

· Withdrawal Denials: Multiple reports describe cases where the broker refuses withdrawal requests, often providing a series of excuses or stopping communication. This is one of the most serious complaints a broker can receive.

· High Slippage: Traders have complained about severe slippage, where their trades are executed at a price much worse than the one they requested. This can quickly reduce profits or increase losses, especially during volatile market conditions.

· Account Blockage: There are mentions of users being locked out of their trading accounts without clear justification, preventing them from managing their positions or accessing their funds.

For traders considering any broker, it's always a smart step to check for the latest user reviews and regulatory updates on a comprehensive platform, such as WikiFX, before depositing funds.

Account Types Comparison

Uniglobe Markets offers a tiered account structure, designed to serve traders with different levels of capital and experience. Higher-tier accounts generally offer better trading conditions, such as lower spreads, but require a much larger initial investment.

Account Tier Comparison

| Account Type | Minimum Deposit | Maximum Leverage | Intended User (Inferred) |

| Micro | $100 | 1:500 | Beginners, small-volume traders |

| Uniglobe Premium | $500 | 1:300 | Intermediate traders |

| ECN | $1,000 | 1:200 | Experienced traders seeking better conditions |

| ECN Elite | $10,000 | 1:100 | High-volume, serious traders |

| Uniglobe VIP | $50,000 | 1:100 | Professional, high-net-worth clients |

This structure shows a clear progression, but traders should be careful. The large amount of capital required for the ECN and VIP accounts is a significant risk to place with an unregulated company.

Trading Conditions

The core trading environment, including software, available instruments, and leverage, determines a broker's suitability for a specific trading strategy. Here is a breakdown of what Uniglobe Markets offers.

Platforms: MT4 & MT5

Uniglobe Markets provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the two most popular trading platforms in the world.

· MetaTrader 4 (MT4): Widely considered the ideal platform for beginners and forex-focused traders due to its user-friendly interface and huge library of custom indicators and expert advisors (EAs).

· MetaTrader 5 (MT5): A more advanced platform offering more timeframes, technical indicators, and access to a broader range of markets. It is often preferred by more professional or multi-asset traders.

The broker offers full license versions of these platforms, which generally suggests a more stable service and better technical support compared to white-label solutions. Detailed server performance metrics, including live ping and server locations, are often available on a broker's full profile, which can be important for traders sensitive to latency.

What Can You Trade?

The range of tradable instruments is a key factor for traders looking to diversify their portfolios. Uniglobe Markets provides access to several major asset classes.

Available Instruments:

· ✅ Forex

· ✅ Share CFDs

· ✅ Indices

· ✅ Metals

· ✅ Commodities

Unavailable Instruments:

· ❌ Cryptocurrencies

· ❌ Bonds

· ❌ Options

· ❌ ETFs

*Disclaimer: Please note that while the broker's summary mentions cryptocurrencies as a market instrument, the detailed tradable instruments list shows they are not available. This conflicting information should be clarified directly with the broker, though it highlights a potential lack of clarity in their communications.*

Understanding High Leverage

Uniglobe Markets offers maximum leverage of up to 1:500, which is very high by industry standards. This leverage varies by account type, with higher-tier accounts having lower maximums. While leverage can be a powerful tool, it is a double-edged sword. It allows traders to control a large position with a small amount of capital, which can increase profits. However, it equally increases losses, and a small market movement against your position can result in the loss of your entire deposited capital. Traders should use high leverage with extreme caution, especially when dealing with an unregulated broker where risk management tools and fund safety are not guaranteed.

Deposits and Withdrawals

The process of funding an account and accessing profits is critical. Uniglobe Markets supports a variety of payment methods and makes specific claims about its fee structure.

Payment Methods and Fees

The broker supports a decent range of payment options to accommodate traders from different regions.

Supported Methods:

· Neteller

· Skrill

· Bank Wire

· VISA

· Cashiu

· OK Pay

· Perfect Money

The company states that it does not charge any fees for deposits or withdrawals. However, traders should be aware that this claim may not cover third-party costs. Payment processors, banks, and e-wallet services often impose their own transaction fees, which would be deducted from your transfer amount.

A Critical Look at Promotions

Promotional offers and deposit bonuses are common marketing tools used by brokers to attract new clients. While they can seem attractive, they almost always come with strict terms and conditions that can complicate the trading and withdrawal process.

· Deposit Bonuses (100% & 200%): These offers match a client's deposit with bonus credit. Key terms include a minimum deposit of $100, a bonus expiry of 60 days, and significant leverage restrictions. For example, the 100% bonus caps leverage at 1:200.

· Refer a Friend: This program offers a 10% commission on the initial deposit of a referred client. Both parties must have verified live accounts.

The full terms and conditions for these promotions can be extensive. It's advisable to review the complete offer details on the broker's profile before participating in any bonus scheme. Traders should be aware that bonus funds are typically non-withdrawable and are intended for trading purposes only. Often, they can create complex withdrawal requirements that may make it difficult to access your own deposited capital.

Final Verdict

After a thorough analysis of Uniglobe Markets, we can now provide a final perspective for Indian traders considering this broker.

Weighing the Features

On the surface, Uniglobe Markets offers a functional trading environment. The availability of MT4 and MT5, a low entry barrier with a $100 minimum deposit, and high leverage are all features that might appeal to new and intermediate traders. The variety of account types and payment methods also adds a layer of flexibility.

However, these features are completely overshadowed by the fundamental and unacceptable risks associated with its operational and regulatory status. The positive aspects of its trading conditions do not exist in a vacuum; they are offered by a company that operates without any credible financial oversight.

The Bottom Line

The absence of valid regulation is the single most important factor to consider. This alone should be enough to give any serious trader pause. The situation is made worse by the multiple official warnings from global financial authorities and the consistent pattern of user complaints about fundamental issues like withdrawal denials and poor trade execution.

For traders in India, the potential for financial loss due to a lack of oversight, combined with reported operational problems, far outweighs any benefits offered by the platform's features. The core purpose of a broker is to provide a safe and reliable venue for trading, and based on the available evidence, Uniglobe Markets India fails to meet this essential standard.

We strongly advise traders to prioritize safety and choose brokers with robust regulation from reputable authorities. You can use the tools on WikiFX to verify the regulatory status of any broker and explore well-regulated alternatives that offer genuine protection for your investment.

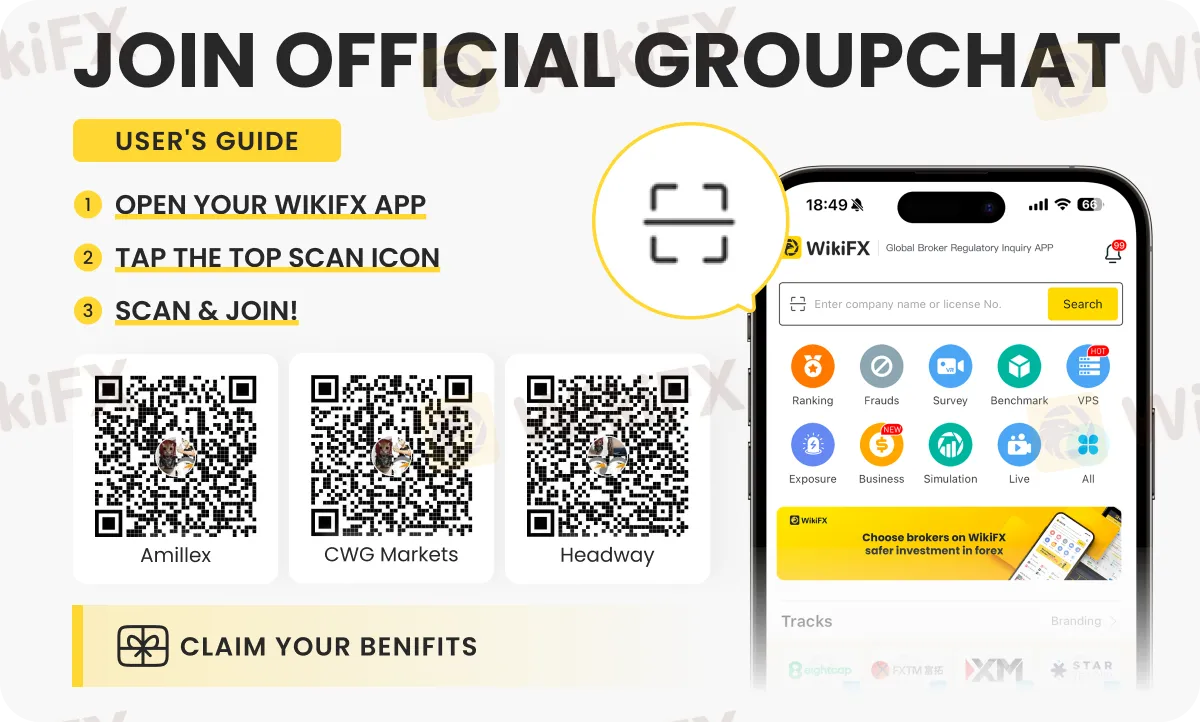

To know more about the forex landscape, we have dedicated chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G). Join any of these by following the instructions shown in the image below.

Read more

CMS Prime Review: Traders Report Withdrawal Blocks, Fund Scams & Unprofessional Support

Is your CMS Prime forex trading experience financially distressing? Does the broker constantly deny you to withdraw your funds? Has the broker defaulted on swap charges? Has the CMS Prime scammed you at every stage of your forex journey with it? Do you also have to witness unprofessional behavior from the broker officials? Well, these trading issues have become headlines on the CMS Prime broker’s review platforms. We have shared some complaints in this CMS Prime review article. Read on!

BingX Review: Traders Angry Over Withdrawal Denials, Account Blocks & More

Are BingX officials with you when you lose your trade? Do these officials apply restrictions on withdrawals as you earn profits? Do you lose access to BingX com login after earning profits? Does the US-based forex broker block your trading account in such situations? Failing to get key trading data access from the broker? These issues have been affecting many traders at BingX. In this BingX review article, we have shared some complaints. Take a look!

TD Markets Exposed: Price Manipulation, Withdrawal Issues & False Promises Hurt Traders

Is your winning trade converted into a loss upon closing it at TD Markets due to heavy price manipulation? Is withdrawing funds too much of a hassle at this South Africa-based forex broker? Does even the customer support fail to respond to your withdrawal requests? Have you been defrauded on the promise of zero commission upon withdrawal? Have you failed to close the trade due to the systemic issue at TD Markets? You are not alone! Many traders have commented while sharing the negative TD Markets review. We have shared some of them in this article. Take a look!

B2PRIME Retail Brings Pro-Level Trading to Everyone

B2PRIME unveils B2PRIME Retail, delivering pro-level execution and transparent pricing to retail traders with institutional-grade tech and multi-asset offerings.

WikiFX Broker

Latest News

Private payrolls rose 42,000 in October, more than expected and countering labor market fears, ADP says

Yields Rise, Rate-Cut Odds Slide As ISM Services Survey Signal Inflation Fears

Op-ed: The fuel for the AI boom driving the markets is advertising. It is also an existential risk.

Stonefort Broker Review 2025: Legit or Risky? A Complete Analysis

The United States Outgrows All Its Major Peers

PINAKINE Broker India Review 2025: A Complete Guide to Safety and Services

PINAKINE Broker Review: A Complete Look at Its Services and Risks

Voices of the Golden Insight Award Jury - Simon So, Chief Experience Officer of Hantec Financial

Seychelles FSA Flags Clone Website Impersonating Admiral Markets

Canary Wharf Address Scam Resurfaces: FCA Exposes 20+ Clone Template Forex Platforms

Rate Calc