How to Choose A Forex Broker Today

Abstract:Learn how to choose a Forex Broker with a regulation‑first checklist, fee transparency tips, and risk safeguards to trade with confidence today.

Choosing a Forex Broker is a risk decision as much as it is a trading decision, because the firm you select holds your funds, sets your leverage, and executes every order that shapes your long‑term performance under stress. When the broker sits under a strong regulator, keeps client money segregated, and discloses costs in full, the odds of sudden loss from insolvency, withdrawal blocks, or abusive pricing practices decline, which is why the rule of law and public registers are the foundation of any shortlist.

Regulation first, always

Start by treating regulation as a pass‑fail test: identify the brokers legal entity, capture the license number on its site, and cross‑verify that number on the official registry of the jurisdiction where the entity claims authorization. Reputable frameworks include the FCA in the UK, ASIC in Australia, NFA/CFTC in the US, and CySEC under the EU umbrella with ESMA coordination; each maintains a searchable database showing permissions, sanctions, and warnings tied to specific entities and trading names. This step prevents a common trap—marketing brands piggybacking on similarly named licensed companies while funding actually flows to an offshore affiliate with minimal oversight.

How to verify authorizations

Collect the exact registered name, company number, license or firm reference, and the domains used for client onboarding, then match all of them line‑by‑line on the regulators site before you deposit a cent. Look at the scope of permissions, such as dealing on own account or arranging deals, and ensure the “trading as” names align with the site you intend to use, because mismatches are a hallmark of clone or umbrella setups that leave clients without recourse. Confirm status as “authorized” or “active,” note any restrictions or conditions, and check the disciplinary history page for fines, censures, or past failures to meet capital or conduct requirements.

What top‑tier regimes require

High‑standard jurisdictions mandate segregated client funds, minimum regulatory capital, periodic audited reports, and retail leverage caps that limit blow‑ups, while also providing complaint pathways and, in some regions, compensation coverage after firm failure. In practice, this means stronger daily controls on margin and risk, clearer disclosures about how your trades are executed, and better escalation routes through ombudsman services when disputes arise over pricing or withdrawals. For UK‑style frameworks aligned with MiFID II, firms must show suitability warnings and product risk summaries up front, which helps retail traders calibrate leverage and position size more conservatively.

The US guardrails

If you trade from the US or with a US‑facing firm, check for CFTC registration and current NFA membership, because those credentials are the backbone of enforcement in leveraged FX and futures. The NFAs BASIC system lets you search by name or ID to verify registration class, active status, and any enforcement actions, a simple filter that screens out many solicitations by unregistered entities. Given the strict US regime and limited number of retail‑facing providers, any firm soliciting US clients without visible NFA/CFTC credentials should be treated as a non‑starter for funding.

Why regulator quality matters

Not all licenses carry equal protection, because lighter offshore centers may allow extreme leverage, sparse audits, and thin conduct rules, which raises the probability of slippage abuses, widened spreads, or funds held “for compliance review” without timely resolution. ESMA, FCA, and ASIC environments typically impose leverage limits, negative balance protection, and marketing constraints that reduce harm during events, trading outages, or liquidity gaps. When traders chase higher leverage in looser regimes, they often swap short‑term convenience for weaker legal recourse, so weigh that trade‑off carefully against account size and strategy volatility.

Safety of funds checklist

Insist on segregated client money at recognized banks and look for explicit statements in legal disclosures, not just marketing banners, to ensure operational separation from the firms working capital. Confirm whether a statutory compensation scheme or trust arrangement applies to your account type and jurisdiction, because eligibility varies by country and retail classification. Review any available financial statements or regulator‑filed data to see whether capital buffers and auditor sign‑offs are consistent with what the register lists.

Platforms, infrastructure, and execution

Execution quality hinges on stable platforms, redundant servers, and robust market‑data feeds that hold up when spreads widen and volatility spikes, so test under load rather than only in quiet hours. Ask how orders are routed—STP/ECN or internalized—and look for formal conflict‑of‑interest policies and negative balance protection where rules require it, since documented policies indicate process maturity. Read the execution and order handling disclosures for re‑quote practices, partial fills, and slippage treatment, because those details define the true cost of trading beyond the quoted spread.

The real cost of trading

Total cost blends headline spreads with commissions, overnight financing (swaps), market‑data or platform fees, deposit and withdrawal charges, currency conversion, and inactivity penalties that can erode edge over time. ECN accounts with raw spreads plus per‑lot commission often suit higher‑volume styles, while fixed‑spread accounts help some day traders manage predictability—but both should be measured during volatile sessions to reveal true all‑in cost. Keep a simple ledger of average spread, slippage, and net fees per instrument to see which account type and broker configuration yields the lowest effective cost for your strategy.

Leverage, margin, and risk controls

Leverage magnifies both winners and losers, so review margin call thresholds, stop‑out levels, and weekend or event‑driven margin changes that can force liquidations at the worst moments. Retail leverage caps in strict jurisdictions may feel limiting, but they are designed to preserve capital during discontinuous moves or liquidity air pockets that widen spreads by dozens of pips. Prioritize brokers that offer reliable negative balance protection for retail accounts and publish how they handle gaps at market open or during scheduled macro releases.

Instruments and market access

Breadth matters when you need to diversify: confirm majors, minors, and exotics along with clear margin requirements, plus CFDs on indices, metals, energies, and bonds when your method rotates across asset classes. For ECN venues, depth‑of‑book visibility and stable liquidity provider rails can improve fill rates and reduce effective spread, which becomes critical for short‑holding strategies. Check trading hours, roll schedules, and corporate action treatment to avoid surprises around holidays or contract rolls.

Research, education, and tooling

Economic calendars, integrated news, position size calculators, and risk dashboards help traders systematize entries and avoid data landmines that upset stops or widen spreads unpredictably. Treat broker education skeptically when it leans on hype; prefer content aligned with regulatory standards that emphasizes scenario planning, drawdown math, and event risk. Tools should be evaluated in live market windows to ensure low latency and resilience, not just demo smoothness.

Complaints and dispute escalation

Before funding, read the firm‘s complaint procedures for submission steps, response timeframes, and escalation pathways to external bodies if the issue isn’t resolved. Strong jurisdictions require firms to maintain clear client‑facing processes and make alternative dispute resolution options visible, which gives you structured avenues beyond support chat. Map these steps and keep copies of all communications, because organized records materially improve outcomes when you engage regulators or ombudsmen.

Due diligence beyond the brochure

Take the product disclosure statements and terms seriously: these documents define pricing sources, swap calculations, corporate action treatment, and force‑majeure clauses that are invisible in marketing pages. Test live chat, ticket desks, and phone lines during both liquid and illiquid hours to see whether support can solve real account problems under time pressure. Validate every alias and domain against registrar and regulator information, because look‑alike domains are a common tactic for steering deposits to unlicensed entities.

Demo, then fund small

Run a demo only long enough to ensure platform familiarity, then place a small live deposit to measure spreads, slippage, swap accruals, and withdrawal speed under real settlement rules. Compare your observed fills during news windows to the execution disclosures to check if the brokers practices match its stated policy rather than its averages. Scale only after multiple clean withdrawal cycles and stable execution across different volatility regimes.

Regional context that matters

If you trade in the EU or UK, expect MiFID/MiFIR conduct rules to shape leverage limits, risk labels, and marketing claims, with enforcement against misleading promotions. ASIC takes a similarly hands‑on approach to retail FX/CFD oversight through licensing and product intervention powers, improving standards around conduct and disclosure. When comparing multi‑entity groups, prefer funding into their strongest jurisdiction rather than an offshore arm that offers looser rules in exchange for higher leverage.

Red flags to avoid

Walk away from firms without verifiable licenses, those that solicit in tightly regulated markets while booking clients to offshore subsidiaries, and any that promise guaranteed returns or “risk‑free” trading. Be wary of withdrawal‑blocking bonus terms, vague bank counterparties for client money, or evasiveness when you ask for the legal entity name and registration details. Cross‑check brand claims against the registers warnings page, because many clone and impersonation cases are called out explicitly with domain lists.

Using third‑party directories responsibly

Official registers are the source of truth; directories and review hubs can help you compile candidates but should never replace regulator confirmation. User‑review sites mix authentic testimony with paid or agenda‑driven posts, so treat sentiment as a signal to investigate further, not as evidence by itself. When a directory assigns scores without transparent criteria, assume incompleteness and look for primary documents before making funding decisions.

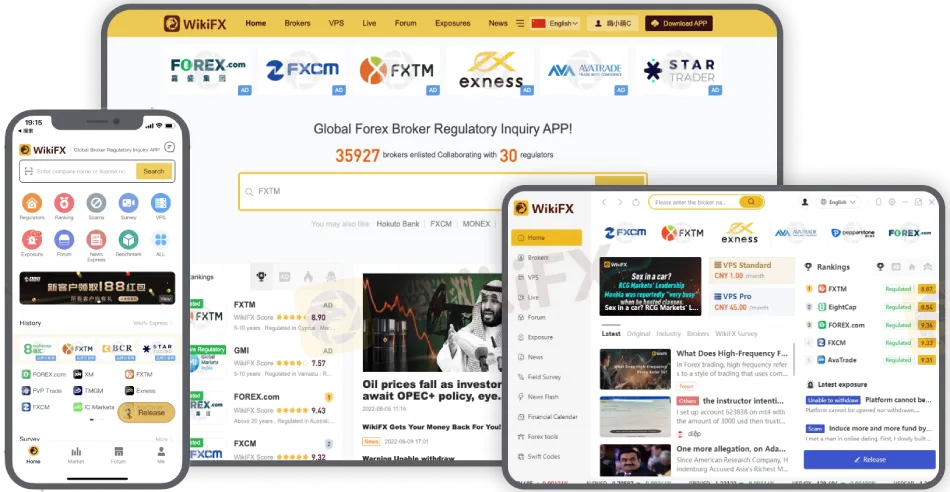

WikiFX markets itself as a mobile broker‑check and directory that aggregates firm profiles and regulatory references, making it convenient for quick lookups while researching on the go. App listings and promotional content position it as a discovery tool, but public user ratings and independent critiques are mixed, which underscores the importance of verifying anything you find there against official registers before acting. The practical approach is simple: use WikiFX to locate a firm and its claimed license, then confirm permissions and status on the FCA, ASIC, NFA/CFTC, CySEC, MAS, BaFin, or FINMA registers before you fund.

Practical 12‑step checklist

- Verify license and domain on the regulators register, not just the broker site.

- Confirm segregated client accounts and named banking counterparties.

- Review leverage caps, margin call, stop‑out, and event‑period margin policies.

- Calculate all‑in costs: spread, commissions, swaps, platform, and payment fees.

- Test platform uptime, order types, and execution speed during peak hours.

- Read PDS/Terms for pricing methodology and corporate action handling.

- Check complaint handling and external escalation routes.

- Inspect registers for warnings, sanctions, or restrictions.

- Stress‑test customer service responsiveness across channels.

- Trial live with a small size and complete multiple withdrawals.

- Avoid bonuses with withdrawal blockers and any guaranteed‑profit claims.

- Keep records of chats, tickets, statements, and platform logs.

Building a focused shortlist

Use reputable guides and comparative overviews to seed a candidate list, then narrow it to entities with top‑tier authorization and clean records before live testing. Regional lists—such as roundups of NFA members or ASIC‑licensed brokers—help keep your research anchored in jurisdictions known for consumer protections and active supervision. From there, select two to three brokers that fit your strategy and run side‑by‑side trials to compare real execution and funding friction.

ECN, STP, or market maker—what matters

These labels often blur in practice, so prioritize written execution policies describing internalization, liquidity routing, and markups over marketing shorthand. For active traders, raw‑spread ECN accounts with transparent per‑lot commissions can lower effective costs, but only if depth and slippage hold up during volatile conditions. Read the conflicts policy to see how a dealer mitigates the risks of acting as a counterparty when it makes markets against client flow.

Risk controls that actually help

Negative balance protection, tested margin engines, and scheduled leverage changes during elections or major data releases reduce tail risk that wipes accounts through gap moves. Brokers that notify clients ahead of such changes and publish post‑mortems after incidents tend to run tighter risk and technology governance, a sign that client outcomes matter. Make these controls part of your broker scorecard so they weigh as heavily as spreads or bonuses.

Mobile, APIs, and automation

If you place or modify orders on mobile, evaluate chart stability, secure login flows, and order amendment speed during busy sessions to avoid freezes that degrade fills. Where automation is core to your edge, ask about API rate limits, VPS offerings, and any broker‑level restrictions on order frequency that could throttle your strategy. Align your infrastructure expectations with the brokers tech footprint, because misalignment leads to avoidable slippage and rejected orders.

Funding, withdrawals, and record‑keeping

Map the settlement times for cards, bank wires, and e‑wallets, and identify who bears conversion spreads so you arent surprised by hidden costs on the way in or out. Run a small withdrawal early and log timestamps, reference numbers, and bank confirmations to create a baseline expectation and paper trail for future escalations. Good hygiene with records often makes the difference when disputing swap accruals, rejected orders, or delayed payouts.

Using WikiFX alongside registers

On mobile, directory apps can speed up the early screening process by consolidating profiles, but they should serve as a starting point rather than a final verdict. Always cross‑check status, permissions, and warnings on official registers, because only those sources confer legal authorization and enforceable protections. Treat any discrepancy between an app profile and a regulator page as a red flag that requires resolution before proceeding.

Keep the process current

Regulatory rules evolve, leverage caps adjust, and firms update execution terms as liquidity relationships change, so put a quarterly reminder on your calendar to re‑verify licensing and key policies. Re‑test execution conditions after platform upgrades or new liquidity provider integrations, because those shifts can alter slippage patterns and effective costs without changing the published spread. A living checklist preserves discipline as market structure and firm practices move with the cycle.

Final takeaways

A reliable Forex Broker is licensed in a respected jurisdiction, discloses true costs, executes consistently in fast markets, and offers clear complaint and escalation paths that stand up under stress. Build your shortlist with official registers and live tests, use directory apps like WikiFX only as secondary references, and scale funding only after clean withdrawals and stable performance across multiple conditions.

Read more

The New Way of Hacking Your Crypto Using Fake Phones

Cybercriminals are using fake phones to hack crypto wallets. Discover how counterfeit devices are weaponized to steal your digital assets and how to stay safe.

Identifying 4 Key Features of "Cloned Platforms": Teach You to Spot Fake Websites at a Glance

Unmask phishing clones in forex trading—4 key signs like shady domains and no HTTPS. Arm yourself with verification tools from WikiFX for secure, scam-proof trading.

Forex Scam Checker Philippines: Verify Brokers with WikiFX

Protect your investments in the Philippines with WikiFX, the trusted forex scam checker app that helps traders verify brokers and avoid fraud.

Trusted Forex Broker Reviews Search Tool

Discover the most trusted forex broker reviews and ratings. Use the WikiFX app to compare and find top brokers safely and confidently.

WikiFX Broker

Latest News

Latest FCA Daily Alerts and Consumer Warnings for 2025

Webull Widens Crypto Futures with Coinbase Derivatives

Is Nash Markets Regulated or Risk? Truth About Nash Markets’ License & Withdrawal Issues

Angel one 2025 Review & Complaints

Exclusive Markets Under the Scanner: Traders Report High Swap Charges, Deposit Discrepancies & More

CySEC Blocks Certification Access to Combat Advisor Impersonation

Annual Sales Of New Vehicles Expected To Hit Only 15.7 Million Units: Cox

Saxo Bank Japan Expands European Stock Portfolio with UBS, Ferrari, and Other Major Names

Amillex Broker Affiliate Program: A Complete Guide to Earning with Referrals

New SC Rules Take Effect in November 2025: What’s Next for Finfluencers?

Rate Calc