Why Caution Is Needed with SuperFin! Know the Risks

Abstract:SuperFin Scam Alert! Financial fraud is on the rise; shady brokers are ready to drain your money and disappear without a trace. SuperFin has come under the radar for all the wrong reasons, and if you're not informed, you could be their next target. Don’t fall for the trap- stay alert and read on to protect yourself from being looted.

SuperFin Scam Alert! Financial fraud is on the rise; shady brokers are ready to drain your money and disappear without a trace. SuperFin has come under the radar for all the wrong reasons, and if you're not informed, you could be their next target. Dont fall for the trap- stay alert and read on to protect yourself from being looted.

1. Lack of Strong Regulatory Supervision

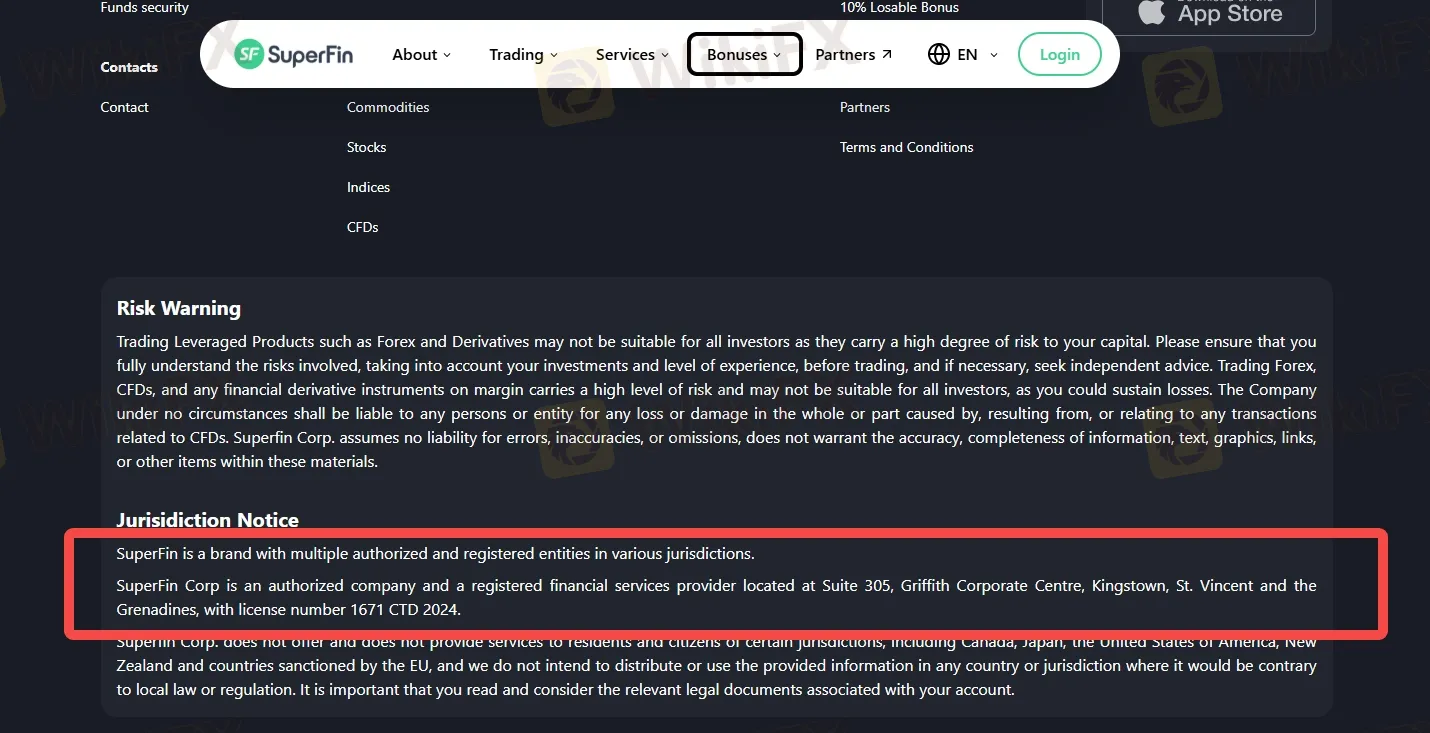

SuperFin Corp is registered in St. Vincent and the Grenadines and operates under license number 1671 CTD 2024. While this registration gives the company a legal business identity, it's important to note that this offshore jurisdiction is known for its limited investor protection. Unlike brokers regulated by tier-one authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), entities licensed in St. Vincent and the Grenadines are not held to the same rigorous standards of transparency, capital adequacy, or client fund segregation.

2. Attractive Yet Flashy Promotions

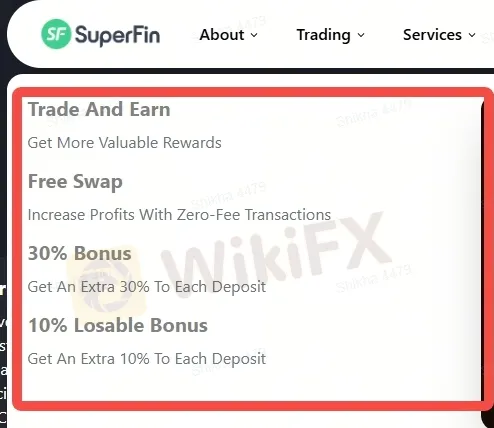

SuperFin aggressively markets itself with bold and flashy promotions designed to attract new traders and retain existing ones. Campaigns like “Trade and Earn” promise valuable rewards, while financial incentives such as a 30% deposit bonus and a 10% losable bonus aim to boost traders capital. SuperFin offers a free swap feature, which allows traders to hold positions overnight without paying swap fees, potentially increasing profitability. However, while these offers may look appealing on the surface, traders should be cautious.

3. Limited Platform Availability

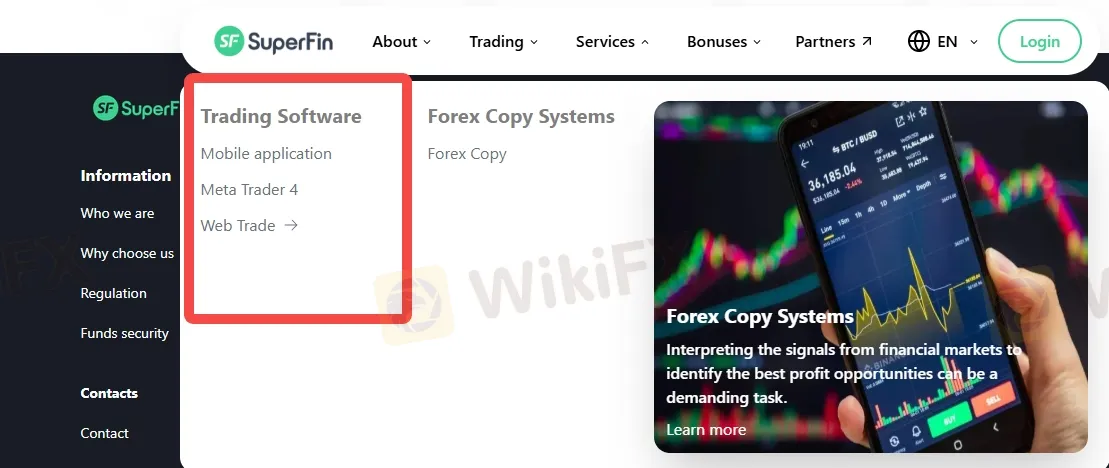

SuperFin currently offers trading exclusively through the MetaTrader 4 (MT4) platform. While MT4 is one of the most widely used platforms in the forex industry, known for its user-friendly interface, advanced charting tools, and automated trading capabilities via Expert Advisors (EAs), it is also somewhat outdated compared to newer platforms like MetaTrader 5 (MT5) or cTrader.

The absence of platform diversity could be a disadvantage for professional or multi-asset traders who expect broader functionality and integration across different devices and asset classes.

What WikiFX Reveals about SuperFin?

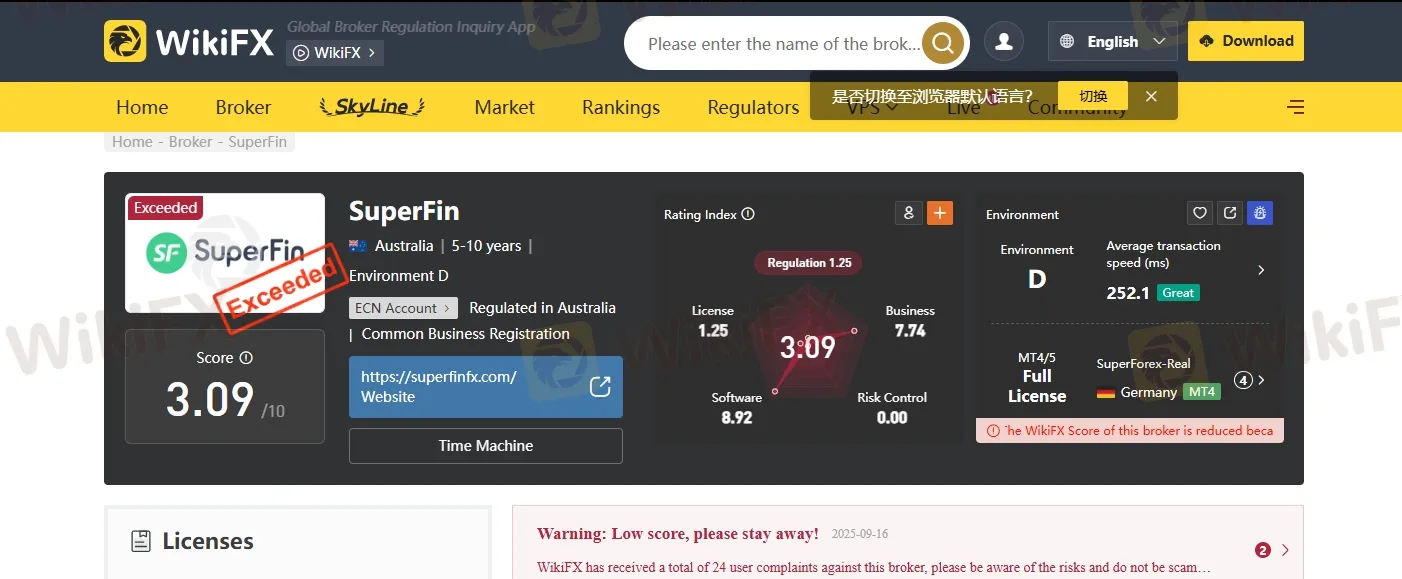

According to WikiFX, SuperFin has received a poor trust score of just 3.09 out of 10, indicating serious concerns about the brokers credibility and overall reliability. WikiFX has also issued an explicit warning against using the platform, stating: “Warning: Low score, please stay away!”

This low rating reflects multiple risk factors, including weak regulatory oversight, questionable transparency, and potentially unsafe trading conditions. For traders seeking a secure and trustworthy trading environment, such a low score should serve as a major red flag and a strong reason to reconsider opening an account with SuperFin.

Join WikiFX Community

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

Forex Compounding Calculator: Powering Your Earnings to Greater Heights Over Time

More is always good if it is about forex trading income. The earning potential is always more with forex trading. You can make it even more using compounding that reinvests your trading profits. It is like earning interest on interest. This calls for using a forex compounding calculator that can allow traders to know beforehand the potential exponential growth of their forex investments. In this article, we will talk about the compound calculator forex and the value it adds to your trading journey.

City Index License: FCA Regulatory Status Check

City Index operates under FCA oversight via GAIN Capital UK Limited (FRN 113942); learn how to verify its license and avoid clone scams.

U.S. financial regulators imposed more than $4M in penalties against fraudsters in a single day.

U.S. financial regulators delivered a strong message to bad actors in the markets, announcing enforcement actions that imposed more than $4 million in penalties in a single day. The coordinated cases targeted three separate firms and individuals involved in fraud and market manipulation, underscoring the commitment of the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to protecting investors.

MH Markets partners with Paysafe

MH Markets, a multi-asset global broker focused on delivering transparent and reliable trading solutions, has announced a new merchant service agreement with Paysafe, a leading global payments platform. According to the report, the collaboration is designed to provide traders with more secure, compliant, and efficient payment options, particularly for deposits and withdrawals.

WikiFX Broker

Latest News

Simulated Trading Competition Experience Sharing

Neex Secures UAE License, Expands Middle East Ops

Exness Redefines Forex Trading Standards

Robo Trading Explained: What It Is and How It Works?

Robinhood Sues Massachusetts Over Sports Bet Rules

Forex Pips Explained: Definition, Importance & Key Insights for Traders

CySEC Updates CFD Restrictions to Enhance Retail Investor Protection

Top 5 Forex MAM Brokers for 2025: A Complete Comparison Guide

Chase-Plaid Deal Sets Banking Fee Precedent

Uncovering! The Real Problems with "Fair Markets"

Rate Calc