My Forex Funds Broker Review and Risk Warning

Abstract:My Forex Funds review reveals CFTC fraud allegations, court dismissal, and regulatory warnings. Get facts on this unregulated prop firm's controversies.

The My Forex Funds proprietary trading platform has become one of the most controversial cases in the forex industry, culminating in a dramatic legal battle with U.S. regulators that ended with the CFTC facing unprecedented sanctions. Founded by Murtuza Kazmi through Traders Global Group Inc. in 2020, this Canadian-registered firm attracted over 135,000 traders before regulatory intervention forced its closure in August 2023.

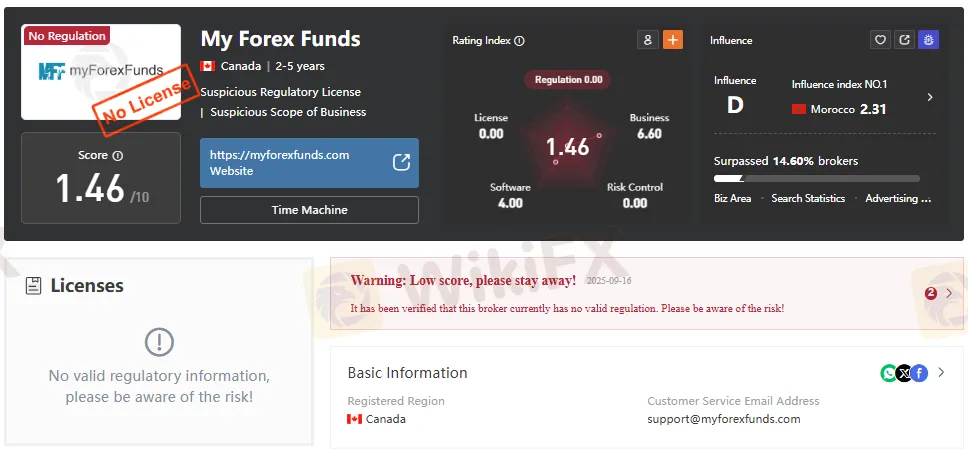

Regulatory Status and Compliance Issues

My Forex Funds operates without proper regulation, positioning itself as an unregulated proprietary trading firm registered in Canada. The platform's regulatory status remains problematic, as it lacks oversight from major financial authorities, including the CFTC, OSC, or other recognized regulatory bodies. This unregulated status creates significant risks for traders, as the firm operates outside traditional financial protections.

The CFTC enforcement action began in August 2023 when regulators accused the company of fraudulent activities involving over $310 million in trader fees. However, in a stunning reversal, a federal judge dismissed the CFTC's case in May 2025, finding that the agency acted in bad faith and made false statements to the court. The judge ordered the CFTC to pay My Forex Funds' legal costs exceeding $3.1 million, marking a rare sanctions order against a U.S. regulatory agency.

Business Model and Trading Structure

The prop firm business model of My Forex Funds centers on evaluation programs where traders purchase assessment opportunities rather than trading live capital. The company offers three account types: Rapid, Evaluation, and Accelerated programs with minimum deposits starting at $2,000. Traders can access maximum leverage up to 1:500 while trading forex and CFDs on cryptocurrencies, indices, and metals.

Proprietary trading evaluation processes require traders to demonstrate consistent profitability before receiving funded accounts. The firm's funded trader program promised access to company capital for successful participants, though regulatory allegations suggested most trades occurred in simulated environments rather than live markets. This trading account structure became central to the CFTC's fraud allegations, which claimed traders were misled about the nature of their trading environment.

CFTC Allegations and Legal Proceedings

The CFTC fraud allegations centered on claims that My Forex Funds misrepresented its trading operations to customers. Regulators alleged the company acted as a counterparty to substantially all customer trades while representing itself as aligned with trader interests. The CFTC enforcement action included accusations of artificial trade delays, manipulated price slippage, and hidden commissions designed to reduce trader profitability.

Related article: My Forex Funds was shut down by the CFTC

Forex investment fraud charges included claims that the firm employed unfair tactics to terminate profitable accounts and minimize customer success. The complaint alleged My Forex Funds used specialized software to execute customer orders at worse prices and handicapped successful traders to decrease profits. These deceptive forex trading practices allegedly generated over $310 million in fees from more than 135,000 customers between November 2021 and the firm's closure.

However, the case took a dramatic turn when court-appointed Special Master Jose Linares found that CFTC employees had received evidence contradicting key allegations but failed to disclose this information. The master discovered that a contested $31.5 million transfer, which the CFTC claimed was evidence of asset dissipation, was actually a legitimate tax payment to Canadian authorities.

Court Dismissal and CFTC Sanctions

In an unprecedented decision, U.S. District Judge Edward Kiel dismissed the CFTC case with prejudice in May 2025, finding the agency had acted in bad faith. The court's ruling adopted Special Master Linares' recommendations, which concluded that CFTC attorneys made false statements and withheld exculpatory evidence for over six months. The forex broker regulation case became a cautionary tale about prosecutorial misconduct rather than industry fraud.

The court imposed sanctions against the CFTC, ordering the agency to pay My Forex Funds' legal costs totaling $3.1 million. Acting CFTC Chairman Caroline Pham acknowledged the agency's failures, stating that the CFTC “must rebuild trust through transparency and accountability”. The regulator placed at least four staff members on administrative leave following the judicial criticism.

Platform Features and Trading Conditions

My Forex Funds offered trading through the MetaTrader 4 platform with spreads starting from 0.0 pips and $3 per round commission structure. The firm provided 24/7 customer support and accepted deposits through credit/debit cards, cryptocurrencies, and bank transfers. Trading platform access included various market instruments with flexible leverage options up to 1:500.

The prop trading company marketed itself as providing premium service with instant execution capabilities. However, the proprietary trading evaluation process became controversial when regulators alleged that successful traders were trading simulated rather than live accounts. This discrepancy between marketed services and actual delivery formed a core component of the initial fraud allegations.

Risk Warnings and Industry Impact

The My Forex Funds controversy has significantly impacted the prop trading industry, prompting other firms to modify their website language and add terms like “simulated” and “virtual” to clarify service nature. The case highlights risks associated with unregulated prop firms and the importance of transparency in funded trader programs. Forex prop firm warnings now emphasize the need for clear disclosure about the trading environment reality.

Trading account termination practices remain a concern across the industry, as the My Forex Funds case revealed how firms might exploit evaluation criteria to minimize successful traders. The prop firm requirements and evaluation standards require careful scrutiny from prospective traders seeking legitimate opportunities. Canadian prop traders face particular challenges due to the regulatory gray area in which many firms operate.

Current Status and Future Outlook

Following the court dismissal, My Forex Funds' operational status remains unclear, as the firm has not resumed normal business operations since the August 2023 regulatory intervention. The company's website continues to display notices about frozen assets and regulatory orders, despite the favorable court ruling. Settlement negotiations between the firm and regulators may determine future operational possibilities.

The CFTC enforcement trends show increasing scrutiny of proprietary trading firms, though the My Forex Funds case outcome may influence future regulatory approaches. Prop firms in Canada continue operating in a regulatory gray area, with limited oversight compared to traditional investment firms. The case underscores the importance of thorough due diligence when evaluating prop trading opportunities and the need for clear regulatory frameworks.

Always check the broker's negative cases on the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone.

Read more

Thinking of Trading with Topstep? Check These Complaints First!

Many traders at Topstep, a US-based forex broker, have reported frustrating experiences. These include delayed KYC verification, unexpected account blowups, constantly changing trading rules and technical chart glitches. In this article, we have uncovered some of the most concerning complaints shared by traders. Take a look!

Robinhood Sues Massachusetts Over Sports Bet Rules

Robinhood files federal suit to block Massachusetts from enforcing state sports betting laws on its event contracts trading with Kalshi.

9 Best Forex Trading Strategies You Must Know

Forex trading is one of the most popular financial markets in the world. It offers opportunities to earn profits by buying and selling currencies. However, success in forex trading depends on having the right strategies. Using effective forex trading strategies can help you make better decisions and reduce risks.

Exness Redefines Forex Trading Standards

A review of how Exness, a leading retail forex broker, excels in trading execution quality, low spreads, and instant withdrawals, leveraging AI and robust infrastructure for superior trader experiences amid market volatility.

WikiFX Broker

Latest News

Valutrades Reports Rising Revenue—But Is the Broker Reliable?

Q3 Trading Results Analysis: Season's End, Shared Growth

SkyLine Review —— XM: Building Lasting Trust Through a Superior Trading Experience

FCA Charges UK Finfluencers Over High-Risk CFD Ads

The Fed Models Were Wrong About The US Economy

Simulated Trading Competition Experience Sharing

Neex Secures UAE License, Expands Middle East Ops

Exness Redefines Forex Trading Standards

Robo Trading Explained: What It Is and How It Works?

Forex Pips Explained: Definition, Importance & Key Insights for Traders

Rate Calc