Finalto Financial Services Consolidates UK Operations

Abstract:Finalto Financial Services consolidates UK entities, sees revenue gains but lower profits amid client migration and shifting trading volumes.

Finalto Restructures UK Business

Finalto Group has completed the consolidation of its United Kingdom operations, finalizing the client migration from Finalto Trading to Finalto Financial Services by the close of 2024. The move significantly reshaped financial outcomes for both units, according to recent Companies House filings.

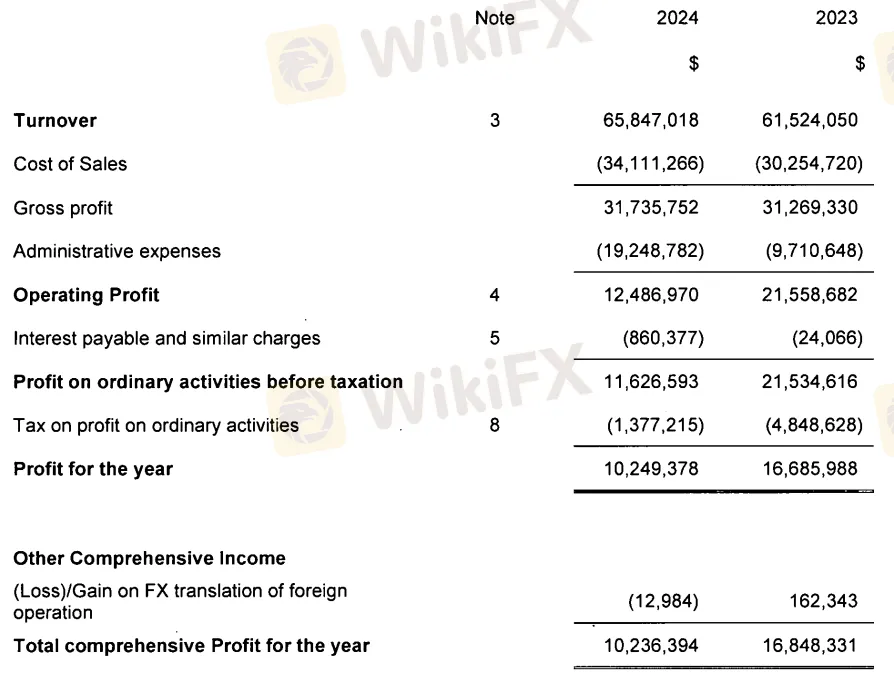

Finalto Financial Services, now serving as the sole UK entity, reported 2024 revenue of $65.8 million, marking a 7 percent year-on-year increase. In contrast, Finalto Tradings revenue declined sharply to $6.6 million, reflecting the client migration strategy that began in 2023.

Profits and Client Migration

Despite increased top-line revenue, pre-tax profits at Finalto Financial Services fell to $11.6 million, down from $21.5 million the year prior. The firm attributed this decline to higher operating expenses, including costs absorbed from Finalto Trading and payments for services provided by other group companies.Trading volume on Finaltos platform also contracted slightly, registering $1.3 trillion for the year compared with $1.4 trillion in 2023. Management explained this was partly due to certain clients onboarding with other Finalto Group entities. Nevertheless, the company emphasized its strong pipeline of geographically diverse clients and ongoing investments in technology platforms.

Finalto Trading Winds Down

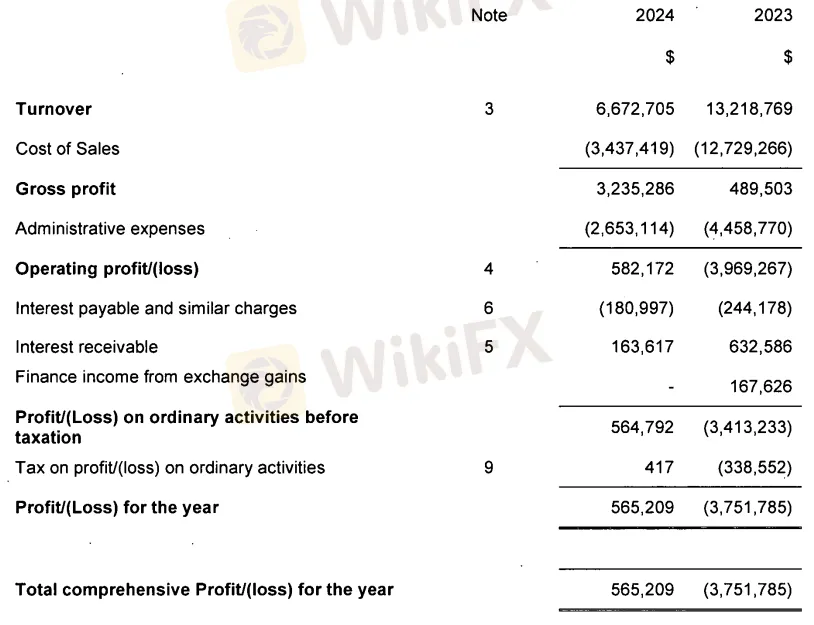

Finalto Trading, formerly Tradetech Alpha, wound down most of its activities by the end of 2024. Despite reduced activity, it reported a post-tax profit of $565,209, reversing a prior-year loss of more than $3.7 million. The turnaround was mainly driven by stronger performance in the first quarter, when the firm was still active. Finalto Trading also highlighted its solid liquidity management, asserting that it had sufficient cash reserves to meet all obligations.

Broader Impact on UK Services

The consolidation underscores the shifting landscape of UK financial services and the ongoing focus on efficiency in forex and trading volumes. With technology investment continuing and client migration effectively completed, Finalto Financial Services is positioned as the central hub of the groups UK operations heading into 2025.

About Finalto

Finatlo is a global provider of multi-asset trading solutions, offering liquidity, risk management, and technology-driven services to brokers, banks, and professional clients. Would you like me to also add a brief timeline of Finaltos UK restructuring for stronger SEO value?

Read more

Multibank Group Faces Rising Withdrawal Allegations: Scam

Multibank Group faces mounting withdrawal complaints, regulatory scrutiny, and scam warnings from traders worldwide. Learn the facts before investing.

The Latest Scams That Have Hit Trendo’s Investors Hard

Winning the forex trading challenge but failing to receive bonuses as promised by Trendo? Have you faced losses due to the manipulative trade practices employed by the broker? Do your withdrawal requests remain pending for months? It may be time to pull your funds from Trendo, even if that means taking legal action. Given the numerous trader complaints recently, it only makes sense to leave this trader. In this article, we have shared their complaints. Read on!

Disadvantages of Investing with Bulenox! Must Read

Bulenox is currently operating in the forex market, but before you invest or even engage with it, there are some things you need to know. Whether you stumbled upon it yourself or were contacted directly, understanding the facts is crucial to protect your hard-earned money. Our in-depth investigation uncovered several red flags that every trader should be aware of. Read on and stay informed.

GMZ Global Exposed: Investors Cry Foul Play as Investment Scams Take Precedence

Do you fail to encash the profitable trade executed through GMZ Global? Have you been tricked into depositing a hefty volume in your GMZ Global forex trading account? Are you annoyed over the lack of support from its customer service team? These indicate a potential forex investment scam. Keep reading to know more.

WikiFX Broker

Latest News

BLS About To Announce Another Huge Payrolls Revision: Here's What To Expect

Lacalle: The Fed Caused High Inflation And The Current Jobs Slump

How to Open a Forex Trading Account: The Complete 2025 Guide

How to Start Forex Trading in 2025: A Simple 9-Step Guide for Beginners

Latest Scam Allegations Against Billionext Revealed

What is the Best Forex Trading Platform? The 2025 Guide for Your Trading Style

Scammed by a Broker? See How WikiFX Gets Traders’ Money Back

Important inflation reports this week expected to show prices still on the rise

Featuring Europe’s Premium Service Provider of the Year – Dynamic Works Syntellicore

5 takeaways from the producer price inflation report with another key reading on tap

Rate Calc