Scammers Behind the Crypto Hype | Beware of These Scams in Malaysia

Abstract:Bitcoin, Ethereum, and the other cryptocurrencies are soaring again, and so are the scams! As fraudsters rush to exploit the renewed hype, Malaysian investors face growing risks. This article outlines the most common investment scams associated with cryptocurrency in Malaysia. Make sure to read it thoroughly to protect yourself.

The surge in Bitcoin and Ethereum prices has reignited global interest in cryptocurrencies. However, as the spotlight on digital assets brightens, so too does the activity of fraudsters eager to capitalise on the hype. Malaysia, like many other countries, has witnessed a sharp rise in crypto-related scams targeting both seasoned investors and newcomers alike.

Cryptocurrency has long been associated with dubious schemes. While digital assets promise innovation and financial opportunity, they have also provided fertile ground for Ponzi schemes, impersonation fraud, and pump-and-dump operations. In Malaysia, these scams have taken on familiar yet increasingly sophisticated forms.

Phishing Attacks and Fake Crypto Platforms

One of the most common tactics involves phishing, where unsuspecting users receive fraudulent emails or messages that appear to be official communications from banks or cryptocurrency exchanges. These often contain links leading to fake websites that mimic legitimate platforms. Victims who enter their login credentials or private keys unknowingly hand control of their wallets to scammers.

Security experts emphasise the importance of vigilance. Users are urged to verify website URLs, avoid clicking suspicious links, and enable two-factor authentication to secure their accounts.

Ponzi Schemes Promising High Returns

Ponzi schemes remain a recurring problem in Malaysia. These operations typically lure participants with the promise of extraordinarily high returns on minimal investments. Early investors may receive payouts, but these funds are often drawn from the contributions of newer participants. When recruitment slows, the scheme collapses, leaving many with heavy losses.

Such schemes frequently resurface during market upswings. In past bull runs, promoters capitalised on public enthusiasm for Bitcoin, presenting it as a quick path to wealth. The lesson, financial analysts warn, is simple: if returns sound too good to be true, they usually are.

Impersonation on Social Media

Scammers also exploit social medias anonymity. Fake accounts impersonating well-known traders, influencers, or even celebrities often promise giveaways that require users to send cryptocurrency to a wallet in exchange for inflated returns. These schemes continue to deceive unsuspecting followers, despite being relatively easy to identify through inconsistencies in account details.

Pump-and-Dump Groups on Telegram

Telegram has become a notorious hub for coordinated “pump-and-dump” operations. These groups encourage members to pool funds, buying up little-known altcoins to artificially inflate prices before selling en masse. While not always illegal, these schemes can devastate retail investors and destabilise already fragile markets.

The real danger lies in the lack of accountability. Group administrators may vanish overnight, taking participants deposits with them. Analysts caution investors to avoid groups promising quick profits and to remain wary of thinly traded cryptocurrencies vulnerable to manipulation.

Fraudulent Offers on Facebook

Facebook remains another breeding ground for scams. Public groups, often unmoderated or operated by scammers, are filled with posts advertising risk-free investments, guaranteed monthly returns, or “exclusive” opportunities. Others direct users to so-called faucet sites claiming to give away free cryptocurrency, which more often than not serve as fronts for data theft or small-scale fraud.

Investors are reminded of a fundamental principle: in financial markets, there is no such thing as free money. Genuine investment success requires careful research, patience, and discipline.

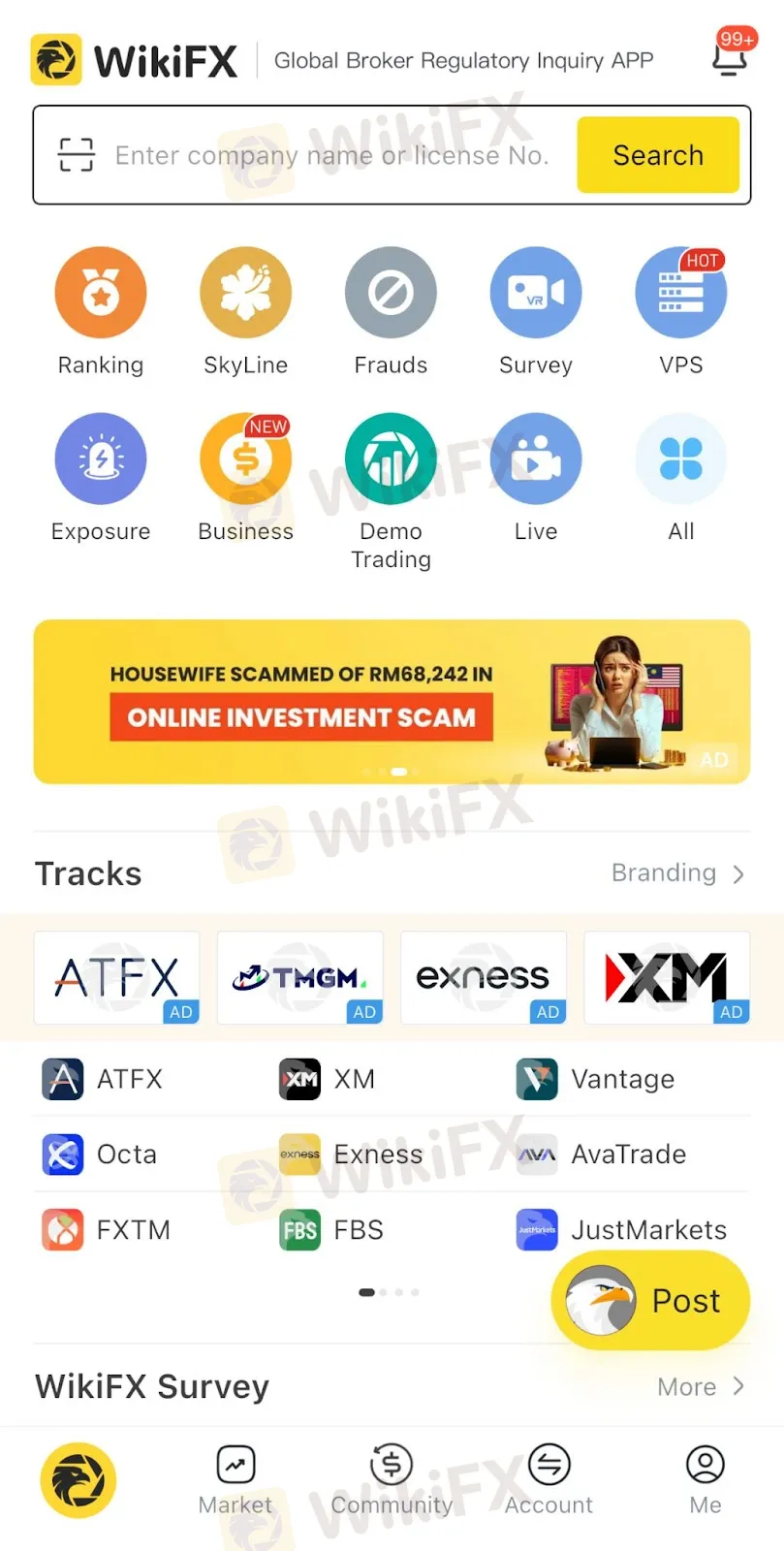

Nothing to Lose and Everything to Gain with WikiFX

As incidents like this become increasingly common, tools such as WikiFX can play a vital role in helping individuals verify the legitimacy of brokers and financial platforms. WikiFX offers an extensive database of global broker profiles, regulatory status updates, and user reviews, enabling users to make informed decisions before committing to any financial investment. Its risk ratings and alerts for unlicensed or suspicious entities help investors easily spot red flags and avoid potential scams. By using tools like WikiFX to research a brokers background, individuals can safeguard their hard-earned savings and reduce the risk of falling victim to fraudulent scams.

Read more

How a Facebook Investment Scam Cost a Retiree RM76,740

A 62-year-old retiree in Terengganu lost RM76,740 to a fraudulent stock investment scheme promoted on Facebook, highlighting the urgent dangers of social media scams targeting unsuspecting individuals.

One WhatsApp Message Wiped Out All Her Life Savings

One WhatsApp message wiped out nearly RM250,000 from a university lecturer in Terengganu. If even the smartest minds can fall for scams like this, what makes you think you’re untouchable?

WikiFX Broker

Latest News

WikiEXPO Global Expert Interviews:Stanislav Bublik Building Market Integrity and Product Innovation

Germany's Machinery Industry Faces Catastrophic Collapse

IQ Option Scam Alert: Withdrawal Issues and Fraud

How a Facebook Investment Scam Cost a Retiree RM76,740

IG Group Acquires Independent Reserve for £86.8M

JP Markets Review: Is This FX Broker Really Worth Investing? Know the Truth!

Defcofx Review – Is This Platform Right for Investing in Forex?

Binarycent’s Traders are Hopeless and Hapless as Withdrawal Denials, Login Issues & More

GST: Modi\s tax cuts will give India a festive spending boost

Invitation to WikiEXPO 2025 Cyprus, One of the World’s Largest Fintech Expos

Rate Calc