Checkout List of 7 "FCA WARNED" Unauthorized Brokers

Abstract:The FCA (Financial Conduct Authority) once again warns forex traders and reveals a new list of unauthorized brokers operating in the forex market without FCA permission. Check the list to stay safe.

The FCA (Financial Conduct Authority) once again warns forex traders and reveals a new list of unauthorized brokers operating in the forex market without FCA permission. Check the list to stay safe.

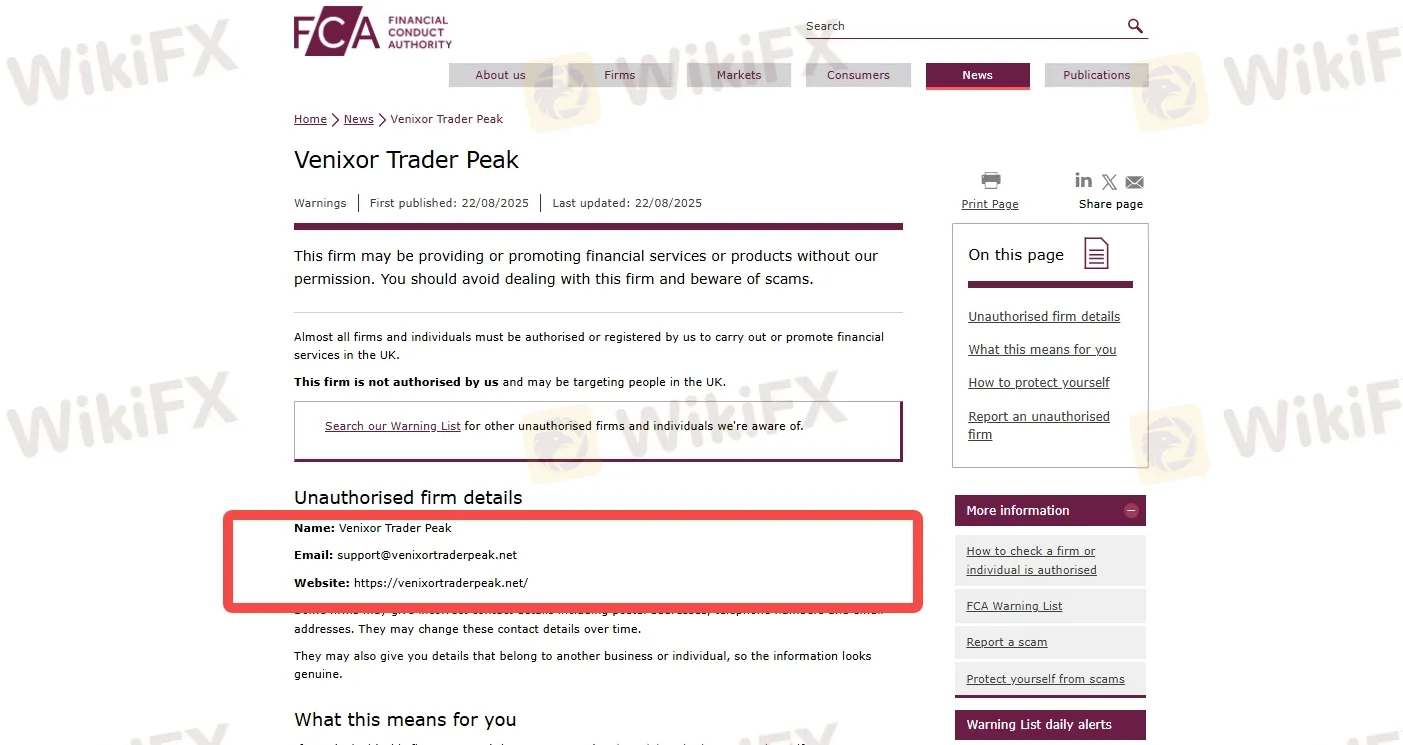

1. Name: Venixor Trader Peak

Email: support@venixortraderpeak.net

Website: https://venixortraderpeak.net/

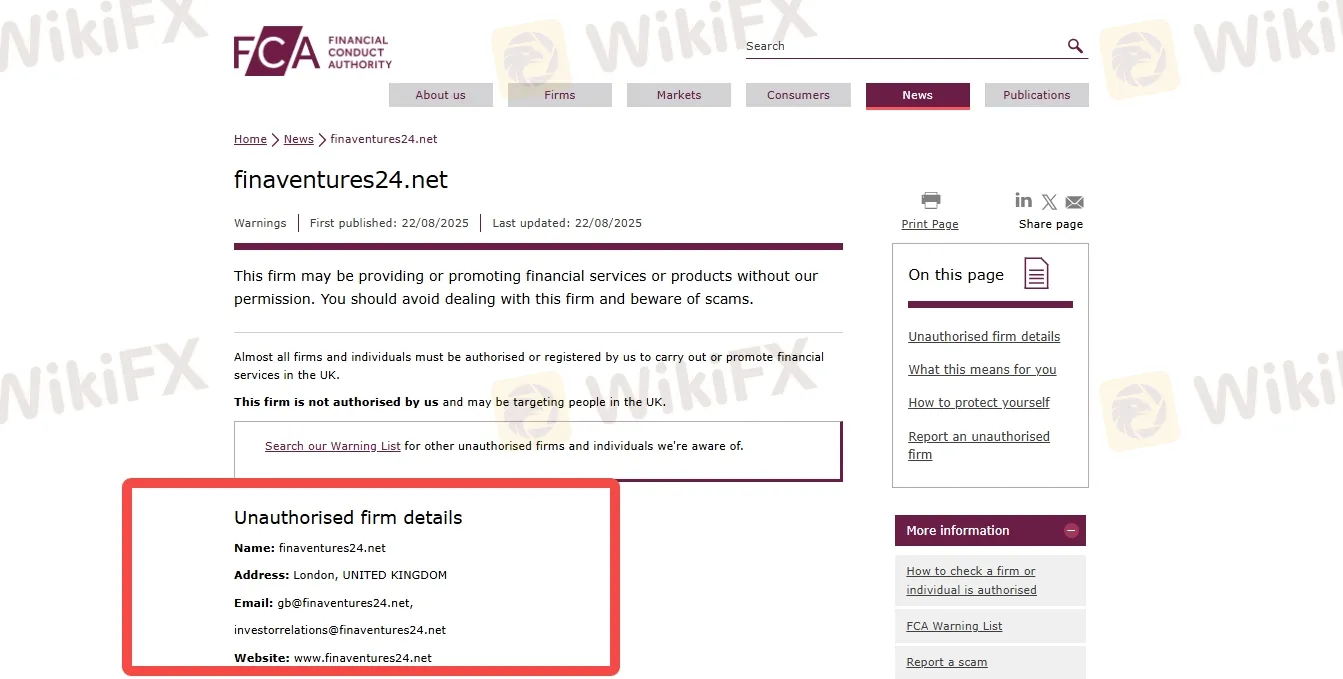

2. Name: finaventures24.net

Address: London, UNITED KINGDOM

Email: gb@finaventures24.net,

investorrelations@finaventures24.net

Website: www.finaventures24.net

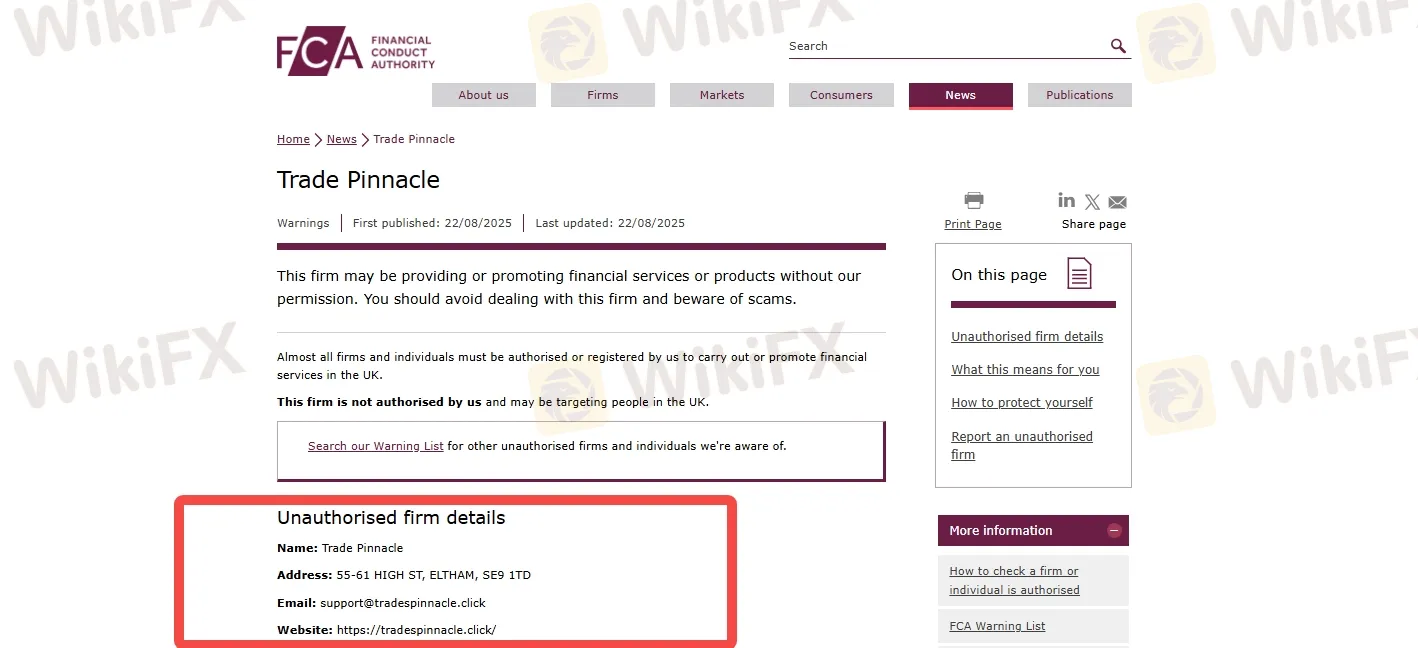

3. Name: Trade Pinnacle

Address: 55-61 HIGH ST, ELTHAM, SE9 1TD

Email: support@tradespinnacle.click

Website: https://tradespinnacle.click/

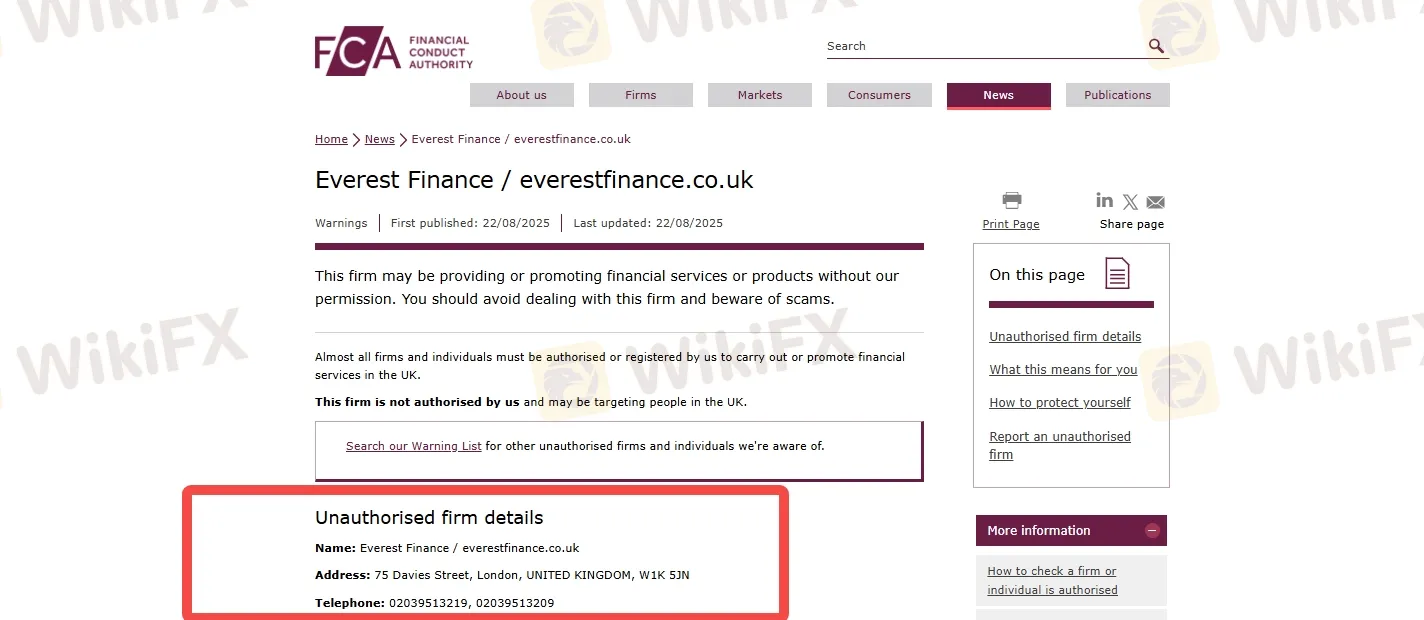

4. Name: Everest Finance / everestfinance.co.uk

Address: 75 Davies Street, London, UNITED KINGDOM, W1K 5JN

Telephone: 02039513219, 02039513209

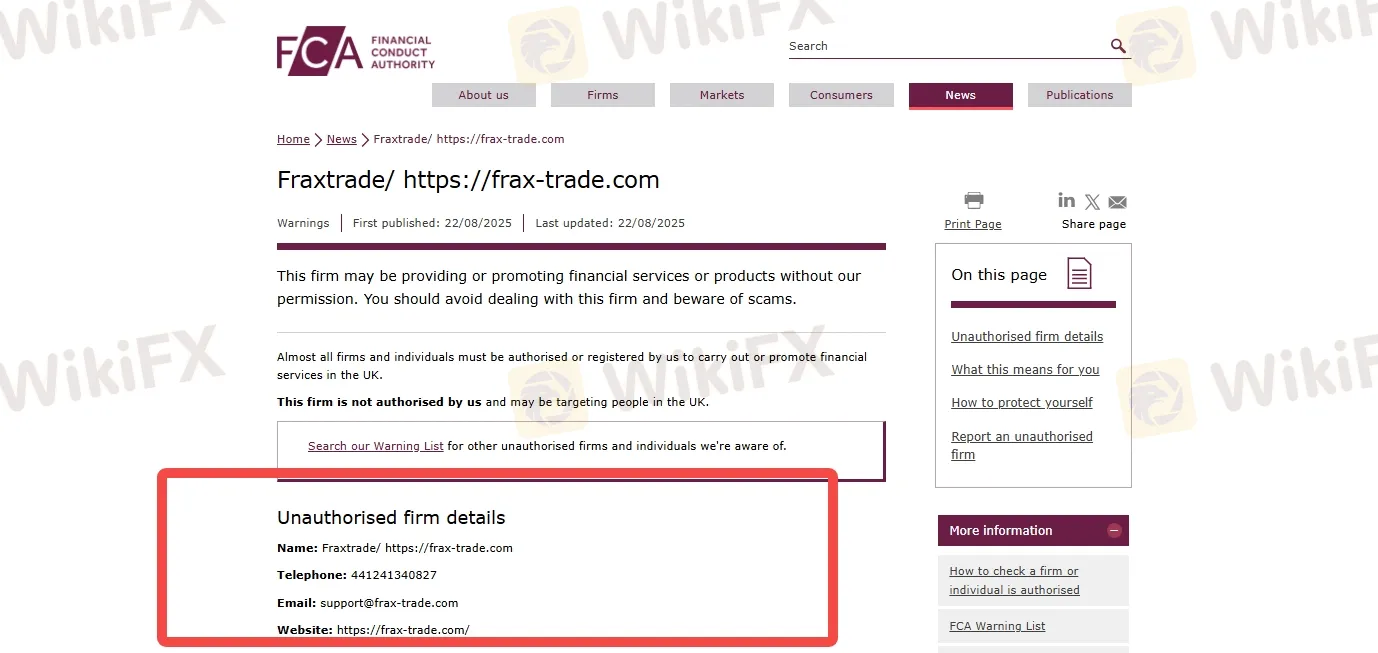

5. Name: Fraxtrade/ https://frax-trade.com

Telephone: 441241340827

Email: support@frax-trade.com

Website: https://frax-trade.com/

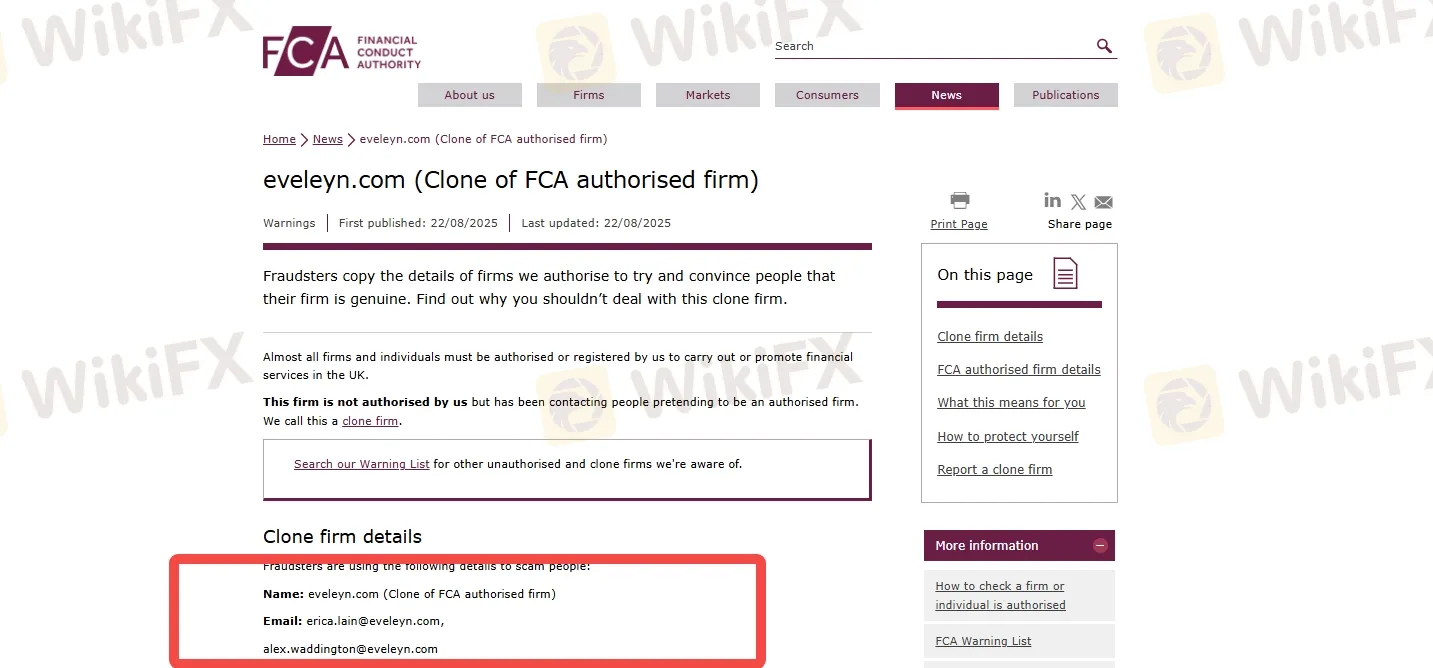

6. Name: eveleyn.com (Clone of FCA authorised firm)

Email: erica.lain@eveleyn.com,

alex.waddington@eveleyn.com

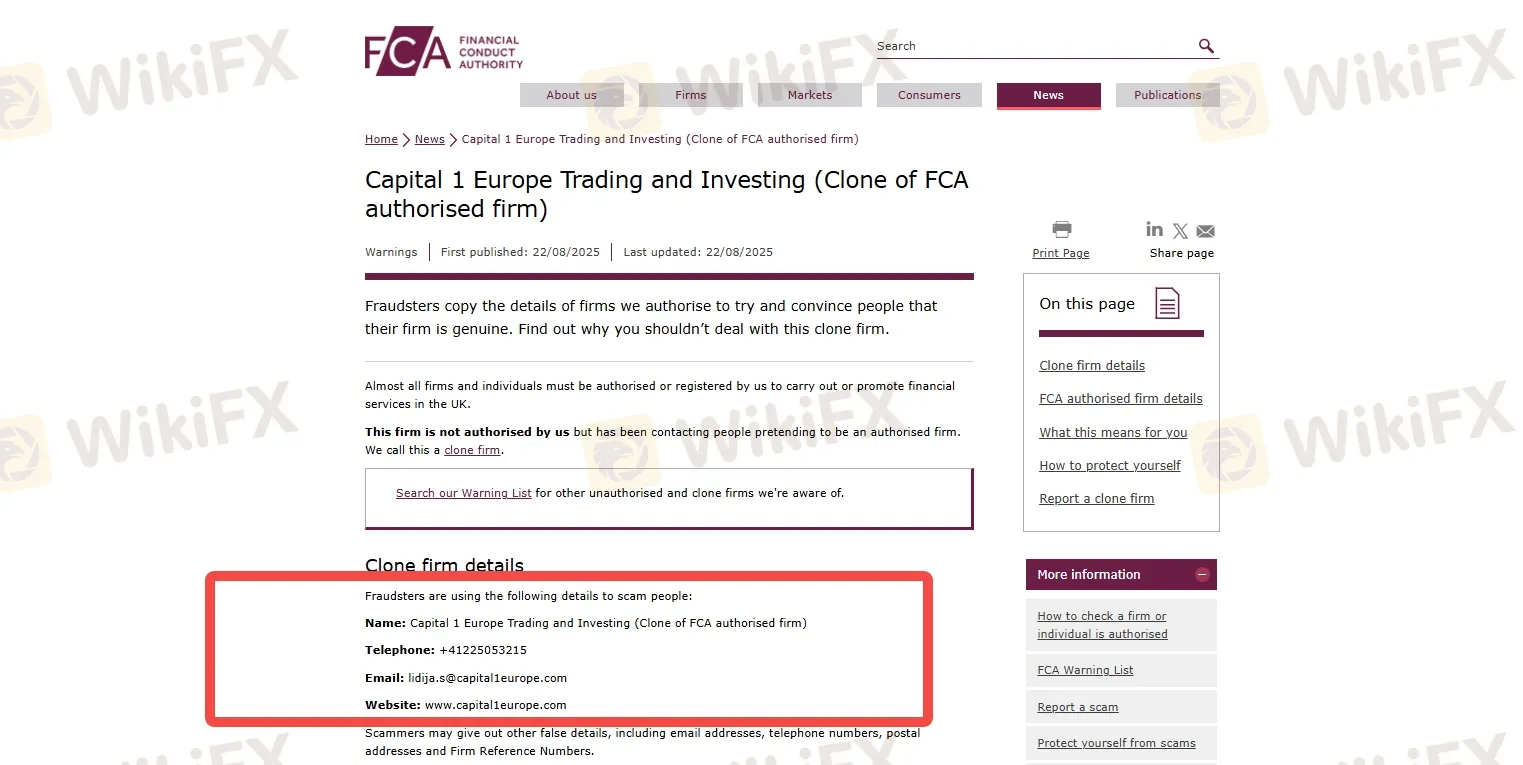

7. Name: Capital 1 Europe Trading and Investing (Clone of FCA authorised firm)

Telephone: +41225053215

Email: lidija.s@capital1europe.com

Website: www.capital1europe.com

FCA Warns the Public Against Unregulated Brokers

FCA regularly updates its warning list to help traders avoid fraudulent platforms posing as legitimate firms. If a forex broker is not listed on the FCA register or appears on the FCAs warning list, it's a red flag. Scam brokers typically use cloned websites, aggressive sales tactics, and unrealistic profit guarantees to trick investors. To stay safe in the forex market, conduct thorough due diligence, use regulated trading platforms, and stay informed about the latest scam alerts. Remember: if it sounds too good to be true, it probably is.

Why FCA Warning Matters?

An FCA (Financial Conduct Authority) warning is a serious alert that a broker or financial service is operating without proper authorization in the UK. The FCA is one of the worlds most respected financial regulators, and its role is to protect investors from fraud, scams, and unethical practices.

If a broker receives an FCA warning, it means:

1. The broker is not licensed or regulated by the FCA.

2. It is not allowed to offer financial services in the UK.

3. Your funds are not protected under UK financial laws.

4. You have no legal recourse if the broker disappears or refuses withdrawals.

How to Protect Yourself from Scam Brokers?

1. Verify the License of the brokers

2. Avoid Unregulated Brokers

3. Cross-Check Contact Information

4. Do not Fall for “Too Good to Be True” Promises

5. Test with a Demo Account First

6. Read Online Reviews

7. Do Your Research

8. Do not Rush

9. Report Suspicious Activity

10. Keep Records

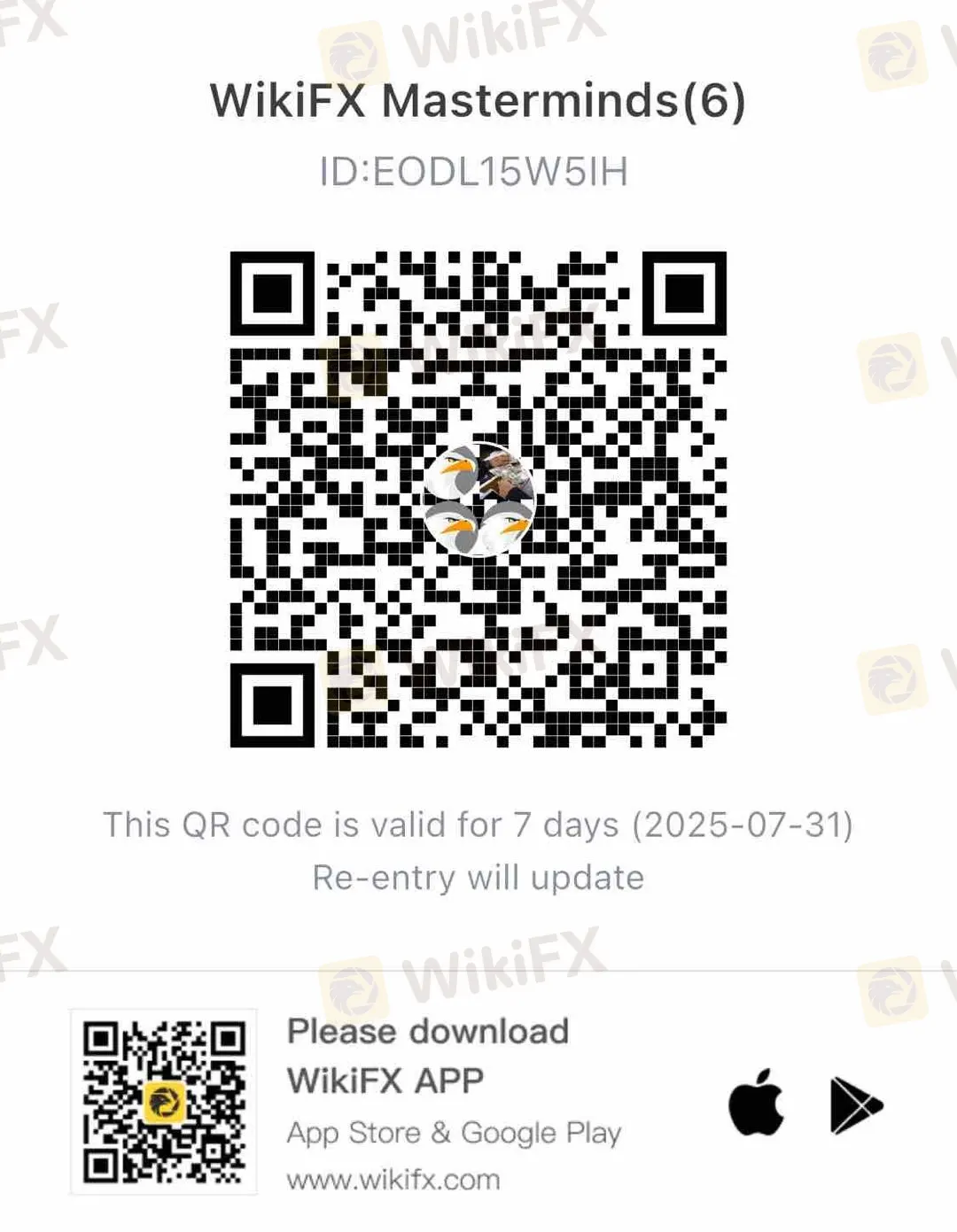

Join WikiFX Community

Be attentive and stay updated with WikiFX. You can get all the information you need to know about the Forex market, fraud alerts, and the latest news related to Forex trading all in one place. Join the WikiFX Community by scanning the QR code at the bottom.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!

Read more

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

Quadcode Markets HK Withdrawal Scam

HK victims slam Quadcode Markets: Jan 2025 delays, frozen accounts, no replies; “withdrawal too long!” Report scam, recover funds now!

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

ThinkMarkets has 83/93 negative cases, with withdrawal delays and scam alerts. Check regulation and details on the WikiFX App before trading.

FBS Forex Scam Alert: High Complaint Ratio

FBS shows 188 negative cases out of 205 on WikiFX, despite regulation—a major red flag for withdrawals & profits. Uncover risks & protect funds before trading now!

WikiFX Broker

Latest News

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

Rate Calc