SimpleFX Scam Alert: Here’s Why You Should it?

Abstract: While you are free to choose the broker that suits your needs, it is crucial to remain cautious during the selection process. Many brokers may appear genuine at first glance, but in reality, they operate fraudulently. SimplyFX is one such broker that raises serious concerns. Read this article to understand why we consider SimplyFX to be a potential scam broker.

There are numerous forex brokers available in the market, offering a wide range of services to traders. While you are free to choose the one that best suits your needs, it is crucial to remain cautious during the selection process. Many brokers may appear genuine at first glance, but in reality, they operate fraudulently. SimplyFX is one such broker that raises serious concerns. Read this article to understand why we consider SimplyFX to be a potential scam broker.

1. Only SimpleFX App Available

One of the major drawbacks of SimplyFX is its limited trading platform options. In todays trading world, almost every trusted forex broker provides popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are well-known for their advanced tools, user-friendly interface, and reliability. SimplyFX only offers its app, which raises questions. Why would a broker not provide MT4 or MT5 which are widely used and trusted trading platforms globally? This is not just inconvenient for experienced traders, but also suspicious. This warning should not be ignored.

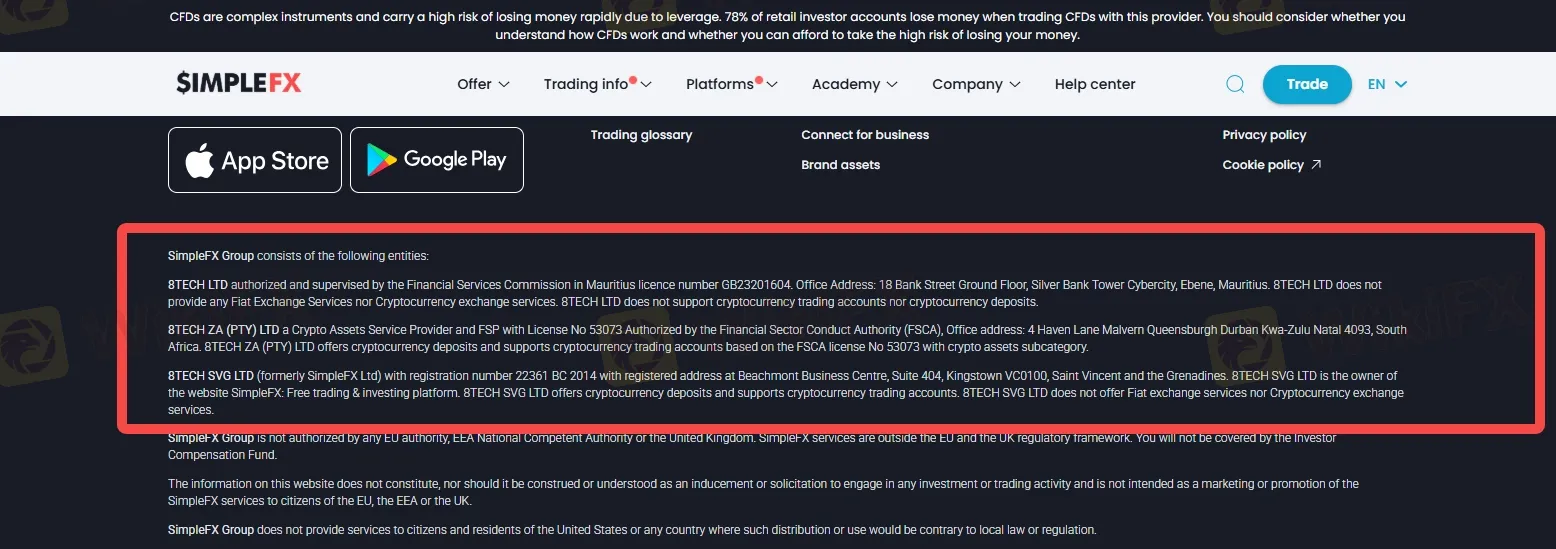

2. Poorly Regulated Broker

Regulation is one of the most important factors to consider before investing with any forex broker. We investigated SimplyFX regulatory status and found that it is regulated by a lenient offshore authority such as FSC , FSCA with little to no enforcement power. These types of regulators do not follow strict compliance rules, do not offer reliable investor protection, and do not guarantee the safety of your funds.

This raises a serious concern. A broker operating under weak regulation is essentially unaccountable, and that puts your investment at risk.

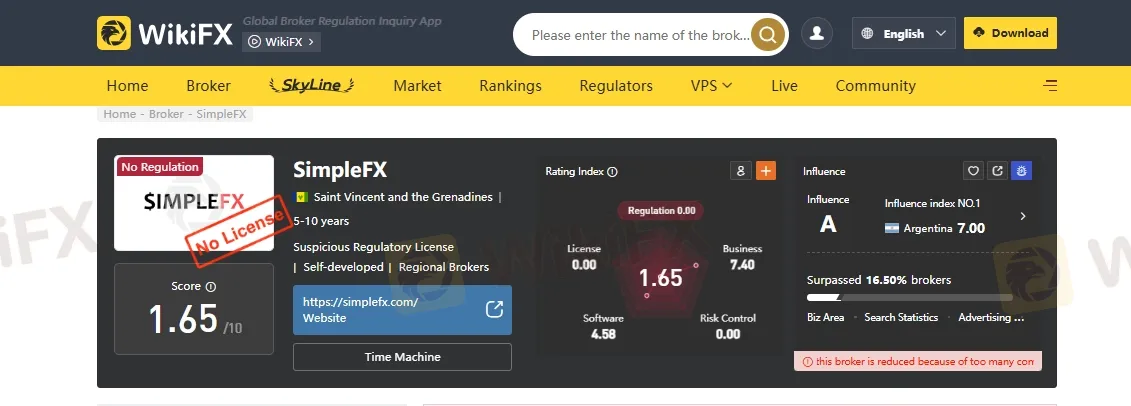

3. Low Score – Just 1.65/10

SimplyFX has a low score of just 1.65 out of 10 . This score reflects poor performance in key areas such as transparency, customer support, withdrawal process, and platform quality. A rating this low is a clear warning sign that the broker may not be safe or reliable for new or experienced traders.

4. No Islamic Accounts

Another notable limitation of SimplyFX is the lack of Islamic trading accounts, also known as swap-free accounts. These accounts are designed for Muslim traders who wish to follow Sharia law, which prohibits earning or paying interest. Most reputable brokers offer Islamic accounts to accommodate traders from different backgrounds and religious beliefs. The absence of this option indicates that SimplyFX is not committed to being inclusive or client-oriented.

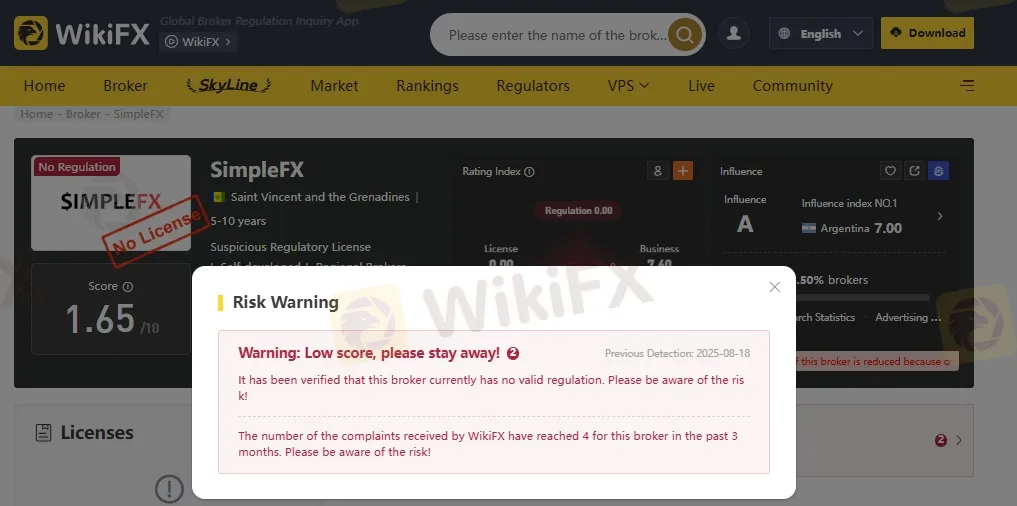

5. Major Scam Warning from WikiFX

WikiFX has also issued a major warning against SimplyFX. Their evaluation shows the broker has a low credibility score, and theyve advised traders to stay away. WikiFX states that -

Warning: Low score, please stay away!

It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Stay Updated—Join WikiFX Community

Want to stay informed about the latest forex news and scam alerts in the forex market? Whether you're a beginner or an experienced trader, join our Telegram community: WikiFX India. We focus solely on educational updates, forex news, and market insights. We focus solely on educational updates, forex news, market insights, and verified promotional alerts related to the global forex market.

Read more

Bybit Exposed: Traders Hit Hard by Withdrawal Denials, Account Bans & More

Is your forex trading experience with Bybit far from ideal? Do you continue to face withdrawal denials? Does Bybit ban your account without any reason? Have you failed to receive the reward on winning the trading challenges? We must say, you have made the wrong move by partnering with Bybit, which has been scamming traders. In this article, we will share multiple complaints that traders have made against the scam forex broker. Keep reading!

Advanced Markets Exposed: Slippage, Copy Trade Errors & Losses

Have you made profits using the copy trade strategy implemented by Advanced Markets? But did the withdrawal stop as the company cited questionable trades? Have you failed to receive any email from this broker regarding the investigation it claimed? Are high slippages and trade losses regular with Advanced Markets? These are nothing but scams. Many traders have openly criticized the UK-based broker for these suspicious forex trading activities. In this article, we will share trader comments against the broker. Keep reading!

Plus500 Launches $90 Million Share Buyback Programme

Plus500 has officially launched a $90 million share buyback programme. The initiative forms part of the company’s wider plan to distribute $165 million to investors.

An In-depth Guide to Forex Spread Calculation

While the calculation of the forex spread (the difference between the exchange rate at which a forex broker buys and sells the currency) is simple, yet some of us are left confused. To make it clear, we have come up with calculation and realistic examples to make you understand it better. Read on!

WikiFX Broker

Latest News

European leaders to join Zelensky at White House meeting with Trump

Where is ThinkMarkets Broker Licensed to Operate?

Plus500 Launches $90 Million Share Buyback Programme

BlackBull Markets and CopyTrade Market Formalise Integration

IG Japan Ends Discount Program on Aug 17

Strongest Level for MYR Coming Soon?!

Trader in Thane Duped of ₹4.11 Cr in Online Scam

Fraud Alert: FCA Warns Against 10 Unlicensed Brokers

An In-depth Guide to Forex Spread Calculation

IG Securities' “Introductory Programme” Comes to an End!

Rate Calc