Retired Man Loses Life Savings to ‘Sister Duo’ in Forex Scam

Abstract:A 77-year-old retiree lost his entire life savings after being persuaded by two women, known to him as “Kelly” and “Lydia,” to invest in a non-existent foreign exchange (forex) trading scheme promising high returns.

A 77-year-old retiree lost his entire life savings (amounting to RM104,844) after being persuaded by two women, known to him as “Kelly” and “Lydia,” to invest in a non-existent foreign exchange (forex) trading scheme promising high returns.

Kuala Terengganu District Police Chief, Assistant Commissioner Azli Mohamad Noor, revealed that the victim lodged a police report at 4:47 p.m. yesterday, claiming he had been duped in what turned out to be a fraudulent investment.

According to the police report, the victim first came into contact with a woman identifying herself as Kelly through Facebook at the end of May this year.

During their initial conversations, Kelly allegedly told the victim that her “sister” was making substantial profits through forex trading.

Subsequently, on May 28, a woman claiming to be Lydia, Kellys sister, contacted the victim directly. Lydia introduced a forex investment opportunity and asked the victim to transfer the capital, assuring him that she would handle the trading process herself.

As the investment appeared to generate substantial profits on the account presented to him, the retiree attempted to withdraw the earnings. However, Lydia informed him that in order to access the funds, he would first need to make additional payments.

She claimed the profits had triggered anti-money laundering alerts, and that further payments were required to prevent the funds from being frozen or confiscated.

Believing this to be true, the victim proceeded to make three transactions, withdrawing a total of RM35,844 from his personal savings, thus comprising both capital and supposed profits.

Eventually, the victim became suspicious, especially after he had already deposited a total of RM104,844 into the fraudulent account and was still being asked to make further payments. It was only then that he realized he had been scammed. The case is currently under investigation by the Kuala Terengganu police.

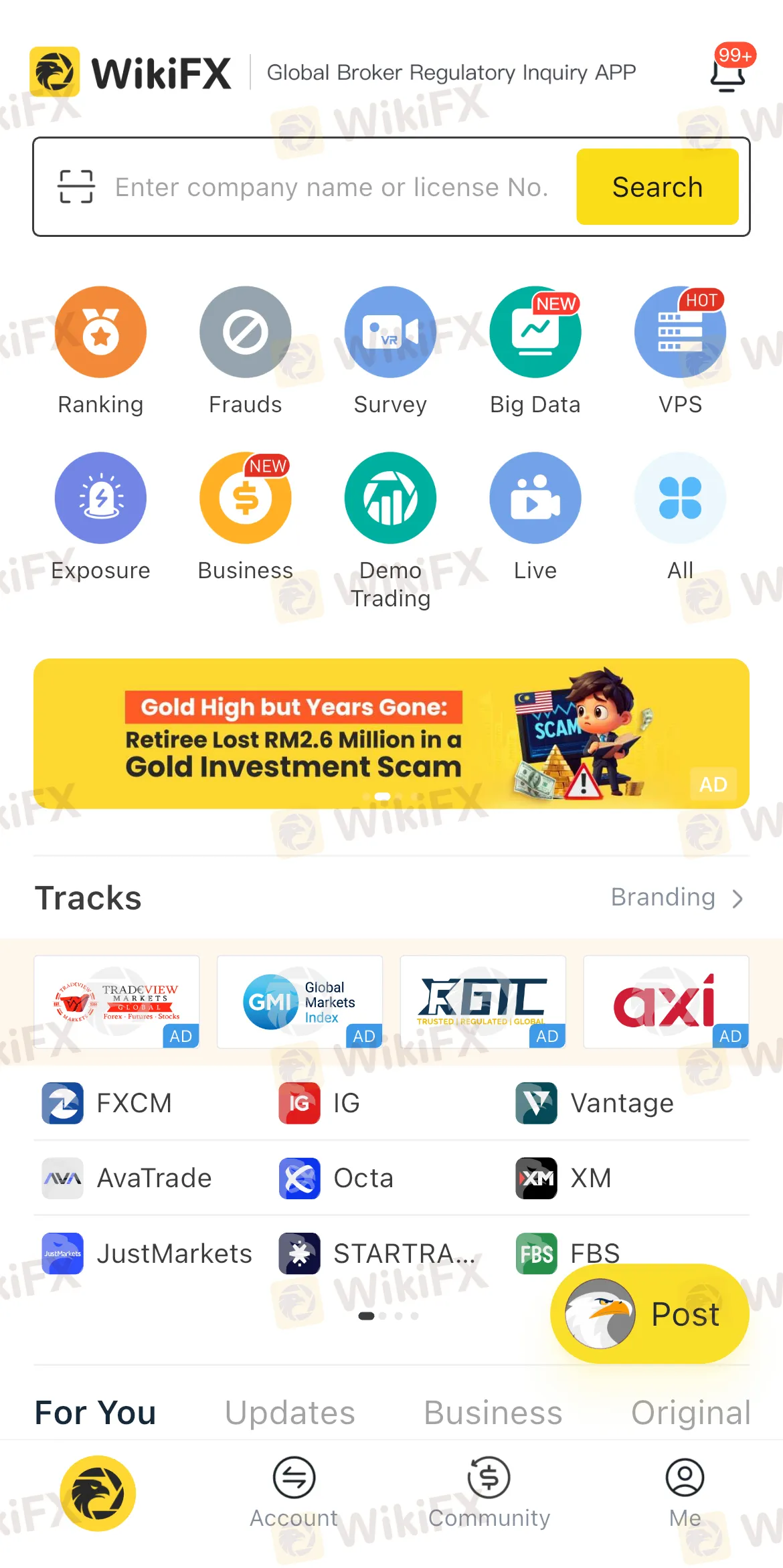

Under no circumstances should you engage with an investment scam advertised on social media that promises high returns or sounds too good to be true without exercising caution. If in doubt, download the free WikiFX mobile application from Google Play or the App Store. This global broker regulatory query platform, at your fingertips, provides detailed information about brokers, including their regulatory status, customer reviews, and safety ratings. It allows users to verify the legitimacy of investment platforms before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the tools to make informed decisions and steer clear of unauthorised or unlicensed entities. By using WikiFX, users can safeguard their savings and avoid the costly traps of fraudulent investment syndicates.

Read more

Investment Scam Alert: FCA Identifies 15 Scam Brokers

UK Financial regulator, FCA (Financial Conduct Authority) has issued warnings against 15 forex brokers operating without proper authorization. Checkout the list below & Be Scam ALERT .

SEC Implements New Rules for Crypto-Asset Service Providers

The SEC enforces new 2025 rules and guidelines for Crypto-Asset Service Providers (CASPs) to strengthen regulation, compliance, and investor protection in the Philippines.

Moneta Markets Receives FCA Approval for VIBHS Financial in the UK

Moneta Markets' VIBHS Financial Ltd gains FCA approval to offer CFD and ETF trading in the UK, boosting the firm's expansion into regulated financial services.

Telegram vs WhatsApp vs Discord: Which Platform Is Best for Forex Signals?

With the rise of online communities and instant messaging apps, signal providers now deliver forex signals directly to traders through popular platforms like Telegram, WhatsApp, and Discord. In this article, we compare Telegram, WhatsApp, and Discord across key categories to help you decide which platform is best for forex signals.

WikiFX Broker

Latest News

XS.com Broker Partnership Expands Liquidity with Centroid Integration

EC Markets: A Closer Look at Its Licenses

Housewife Scammed of RM68,242 in Online Investment Scam

From Charts to Profits: Unleashing the Power of Forex Trading Tools

FCA Publishes New Warning List! Check It Now to Stay Safe

Beware of Fake RS Finance: How to Spot Scams

Fortune Wave Solution: SEC Warns of Investment Scam

D. Boral Capital agrees to a fine as a settlement with FINRA

Is TD Ameritrade Safe? How to Spot Fake URLs and Stay Protected

Before You Trade with Quest: 6 Warning Signs to Know

Rate Calc