Housewife Scammed of RM68,242 in Online Investment Scam

Abstract:A 54-year-old housewife has fallen victim to an online investment scam after being misled by an advertisement on social media, resulting in a total loss of RM68,242 over 13 separate transactions.

A 54-year-old housewife has fallen victim to an online investment scam after being misled by an advertisement on social media, resulting in a total loss of RM68,242 over 13 separate transactions.

The incident occurred in June when the woman came across an investment advertisement on Facebook, allegedly promoted by a company. Intrigued by the promise of high returns, she reached out to a Malay female agent claiming to represent the company.

According to the agent, the investment scheme was based on Bitcoin exchange rates and promised substantial returns.

Persuaded by the agent‘s assurances, the victim proceeded to invest. Following the agent’s instructions, she transferred funds in 13 separate transactions to 10 different bank accounts, amounting to a total of RM68,242. The funds came from three of the victims personal savings accounts.

However, by mid-July, the woman had yet to receive any returns or reimbursements. Her suspicions grew when the agent continued to request additional payments under various pretexts.

Realizing she may have been deceived, the victim lodged a police report to seek assistance.

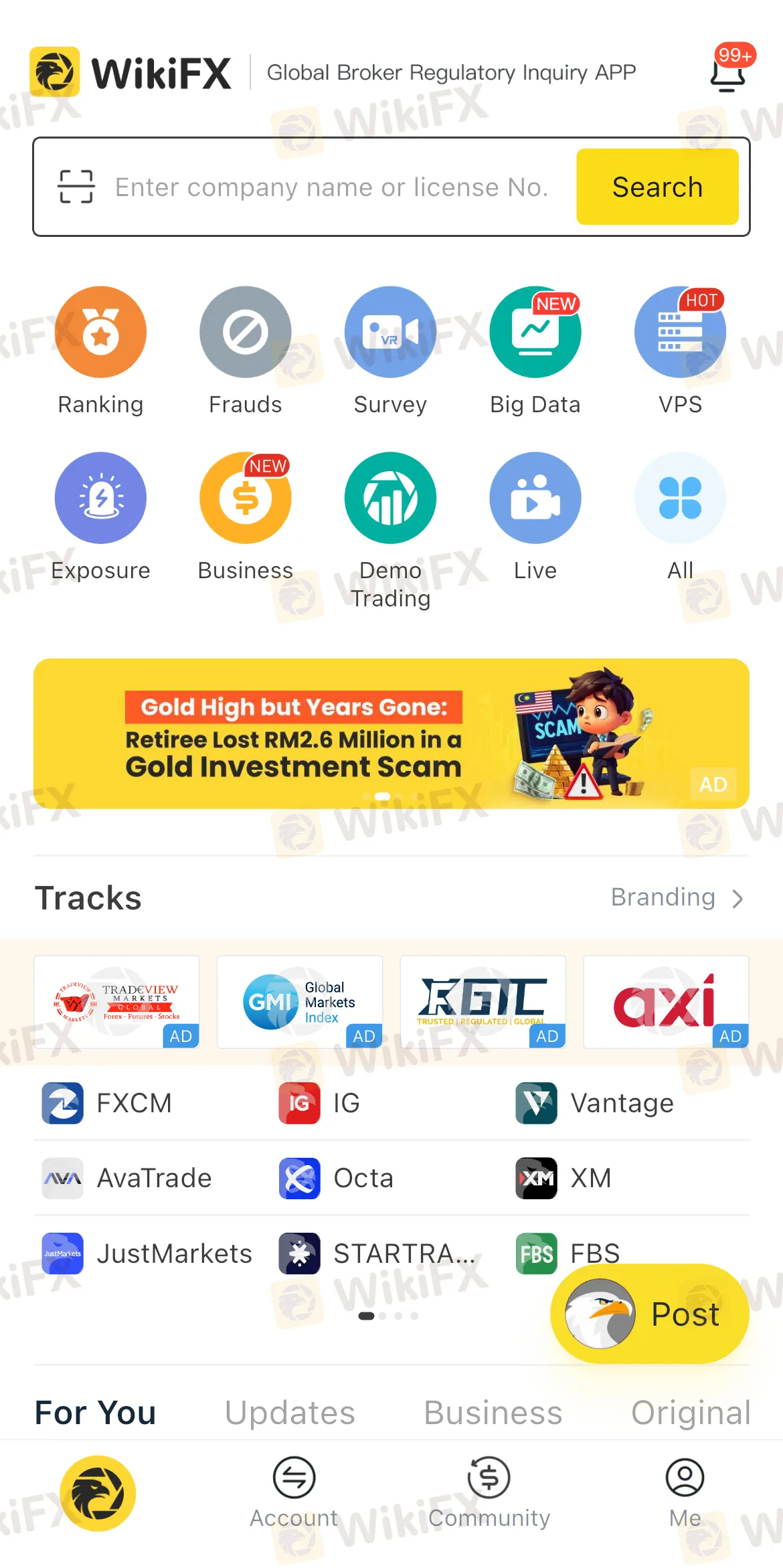

Under no circumstances should you engage with an investment scheme advertised on social media that promises high returns or sounds too good to be true without exercising caution. If in doubt, download the free WikiFX mobile application from Google Play or the App Store. This global broker regulatory query platform, at your fingertips, provides detailed information about brokers, including their regulatory status, customer reviews, and safety ratings. It allows users to verify the legitimacy of investment platforms before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the tools to make informed decisions and steer clear of unauthorised or unlicensed entities. By using WikiFX, users can safeguard their savings and avoid the costly traps of fraudulent investment syndicates.

Read more

From Charts to Profits: Unleashing the Power of Forex Trading Tools

Want in-depth insights into the forex trading market so that you can make an informed investment call? Start unleashing the power of forex trading tools. These tools, comprising both fundamental analysis and technical charts, lay the foundation for successful forex outcomes.

FCA Publishes New Warning List! Check It Now to Stay Safe

FRAUD ALERT! – All investors and traders should be careful. The UK’s financial regulator, the Financial Conduct Authority (FCA), has warned people about fake brokers that are working without a license. These scam brokers take people’s money and disappear. The FCA shares a list of these fake brokers every day to help people stay safe. Checkout the List below to Stay Safe.

New to Forex Trading? Check Out These 6 Key Features of Taurex

If you're just stepping into the forex market and feeling confused about which broker to choose, you might consider giving a chance to a regulated forex broker like Taurex. You may wonder why we are specifically mentioning this broker. It is because of several strong reasons outlined in the article below.

EC Markets: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about EC Markets and its licenses.

WikiFX Broker

Latest News

Forex Hedging Strategies - Calming You Amid Market Chaos

Key Events This Week: ISM, Trade Balance And More Earnings

What Is Forex Currency Trading? Explained Simply

A Beginner’s Guide to Trading Forex During News Releases

Ultima Markets enters the UK and gains the FCA license

LSEG Announces £1 Billion Share Buyback Program

SEC Lawsuit Targets Real Estate Fraud Scheme by Joseph Nantomah

ASIC Regulated Forex Brokers: Why Licensing Still Matters in 2025

FCA Publishes New Warning List! Check It Now to Stay Safe

EC Markets: A Closer Look at Its Licenses

Rate Calc