Fortrade: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Fortrade and its licenses.

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Fortrade and its licenses.

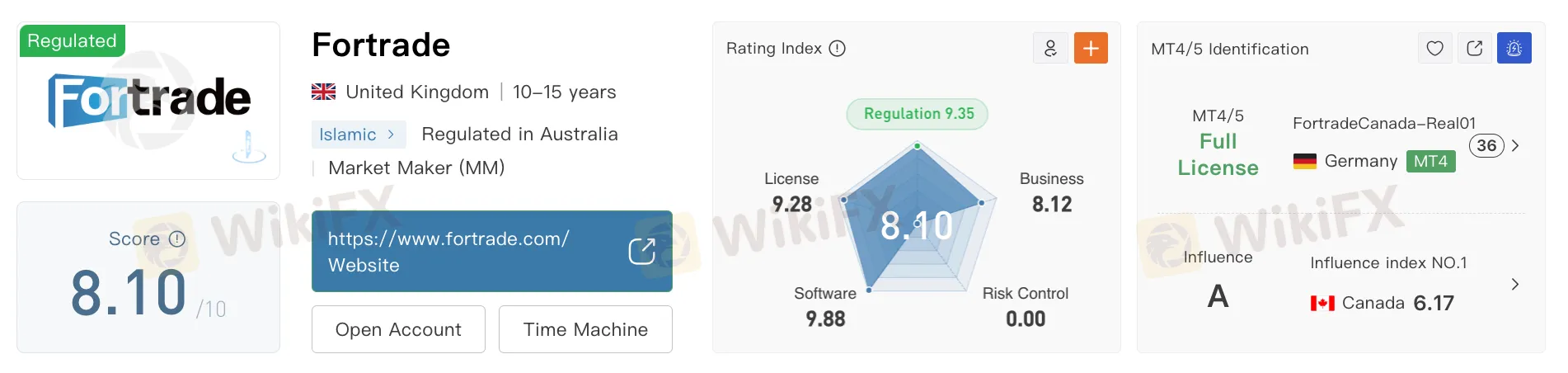

At first glance, Fortrade looks like one of the more reliable brokers in the trading world. It holds licenses from some of the world‘s toughest financial regulators, giving it an image of strength, trust, and legal compliance. Traders are often reassured by its approvals from the UK’s FCA, Australia‘s ASIC, Cyprus’s CySEC, and Canadas CIRO, which are widely known for their strong rules and protection for investors.

In the UK, Fortrade is licensed by the Financial Conduct Authority (FCA) as a Market Maker (License No. 609970). The FCA is known for strict standards in consumer protection and business practices, especially for brokers dealing with everyday traders. It requires high levels of transparency, strong financial health, and fair treatment of clients. These are the rules that help weed out weak or dishonest brokers.

In Australia, Fortrade is regulated by ASIC (License No. 493520), another respected authority. ASIC ensures brokers handle client funds properly, follow fair trading rules, and meet financial standards. Its also active in stopping misleading advertising and unsafe trading practices. Being licensed by both the FCA and ASIC gives Fortrade a strong reputation.

Fortrade also holds a license from CySEC in Cyprus (License No. 385/20). Although CySEC is sometimes seen as slightly less strict than the FCA or ASIC, it still follows EU laws under MiFID II. That means Fortrade must meet rules for capital reserves, risk management, and transparency. This adds to its credibility in Europe.

In North America, Fortrade operates under Canada‘s CIRO, a new regulatory body formed by merging IIROC and MFDA. Although the license number isn’t public, CIRO is known for its careful and investor-focused approach. It watches over brokers and trading platforms across the country, helping to keep the Canadian market safe.

However, despite this strong global regulatory presence, one issue stands out: a revoked license in Belarus.

Fortrade was once licensed by the National Bank of the Republic of Belarus (NBRB), under license No. 193075810. That license has now been revoked. This isn‘t a routine event like ending operations or letting a license expire, as it usually means the broker broke the rules or failed to meet the regulator’s requirements.

Revoking a license isn‘t done lightly. It often follows a pattern of non-compliance, missed deadlines, or problems uncovered during audits. While we don’t know exactly why Fortrade lost this license, the lack of public information makes it more concerning. Without answers, traders are left guessing.

Read more

10 Best MUST- READ Books on Forex Trading

Traders neglect the basic education about the forex market and end up losing money. It is one of the common mistakes they do. It is unsaid rule that If you're enter in the jungle of forex, you must read, learn, and understand before you start trading. In this article, you'll get to know about the books on forex trading that you must read.

Inefex: Mastering the Art of Duping Forex Investors

Fallen prey to high-return promises made by Inefex through social media and other platforms? Facing constant pressure from it to deposit funds despite consistent losses in trade? Most probably, Inefex has scammed you like many others. The constant foul play in its operation has been grabbing attention on forex broker review platforms. Check out some of their reviews.

Top 4 Forex Scam Tactics Fake Brokers Use to Trap Investors

Fake forex brokers always have multiple plans to dupe investors, including even the experienced ones. The constant complaints surrounding too-good-to-be-true schemes duping investors have made headlines in many forex journals. It’s time to stay vigilant against forex scam tactics that fraudulent brokers usually employ to defraud investors. In this article, we will talk about the top four forex scam tactics.

Which Currency Pairs are Most Commonly Traded in India?

Currency pairs play a crucial role in forex trading. To effectively participate in the forex market, it's important to understand which currency pairs are most relevant in your country. For traders in India, knowing the actively traded currency pairs is essential.

WikiFX Broker

Latest News

Fortrade: A Closer Look at Its Licenses

FRAUD ALERT! Spanish Regulator, CNMV Exposed Scam Brokers

Euro zone economy ekes out better-than-expected 0.1% growth in second quarter

Adidas to raise prices as US tariffs cost €200m

Top 4 Forex Scam Tactics Fake Brokers Use to Trap Investors

10 Best MUST- READ Books on Forex Trading

Inefex: Mastering the Art of Duping Forex Investors

Companies from Stanley Black & Decker to Conagra are saying tariffs will cost them hundreds of millions

Trump's tariffs could soon bring higher food prices for some Americans, analysis finds

iFourX: So Many Red Flags You Can’t Ignore

Rate Calc