What WikiFX Found When It Looked Into BGC

Abstract:In the complex world of online trading, verified licenses and confirmed operational presence offer important reference points for evaluating a broker. BGC is one such firm that holds regulatory licenses in multiple countries, though questions remain about its physical operations.

In the complex world of online trading, verified licenses and confirmed operational presence offer important reference points for evaluating a broker. BGC is one such firm that holds regulatory licenses in multiple countries, though questions remain about its physical operations.

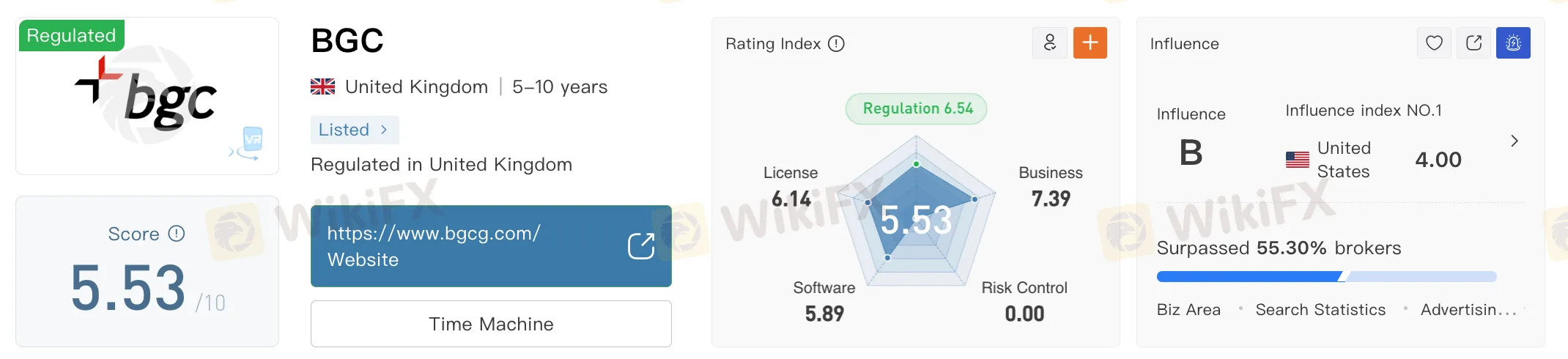

BGC is a broker that holds licenses from two major financial regulators, but its operational presence at the registered address could not be verified. For many traders and investors, confirming whether a broker is both licensed and actively operating at its claimed location is an essential part of assessing credibility.

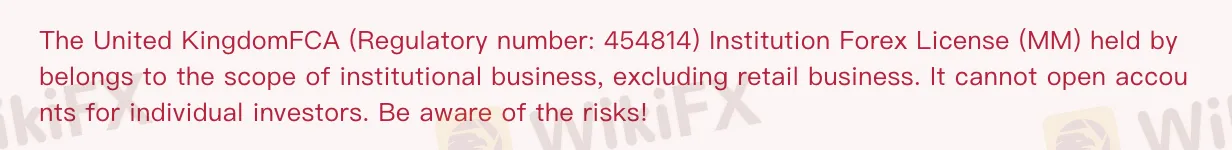

BGC is licensed by the United Kingdoms Financial Conduct Authority (FCA) under license number 454814. The license is categorized as an Institution Forex License. The FCA is a leading financial regulatory body in the UK, responsible for regulating conduct in financial markets and protecting consumers. It is known for enforcing strict compliance standards, including transparency, risk control, and financial reporting. However, it is worth noting that the FCA license held by BGC belongs to the scope of institutional business, which means the broker is not authorized to provide services to retail (individual) investors. As such, the license permits BGC to operate only within the institutional market segment.

In addition to its UK license, BGC is also regulated by South Korea‘s Financial Supervisory Service (FSS). The FSS is a national regulatory authority tasked with supervising the country’s entire financial sector. BGC holds a Financial Service license under this agency, adding another layer of regulatory oversight to its operations.

According to WikiFX, a global broker regulatory query platform, BGC has a WikiScore of 5.53 out of 10. This score is derived from several factors, including license status, trading software, platform environment, risk control measures, and business operations. A score in this range suggests a broker with basic regulatory credentials but also indicates areas where transparency or operational practices may require further scrutiny.

To evaluate the broker‘s actual operational presence, WikiFX conducted a field survey at BGC’s registered address: 5 Churchill Place, London E14 5HU, UNITED KINGDOM.

However, the survey team did not find any BGC office or visible signs of activity at this location.

Physical verification helps establish whether a broker is genuinely operating from the address listed in its public registration. This distinction that WikiFX provides exclusively is important in identifying firms that maintain a real office versus those that may rely on virtual or placeholder addresses for appearances. In many cases, brokers may still hold valid licenses but choose to operate without substantial infrastructure, especially in jurisdictions where regulatory oversight may be more limited or segmented. WikiFXs field surveys aim to bridge this information gap by confirming whether a broker is truly functioning from its declared location. This approach provides traders and investors with an added layer of insight when reviewing brokers, particularly those operating across multiple countries or offering services primarily online.

Read more

Trade Journal 2.0: What Experienced Traders Track That Beginners Often Ignore

A Trading Journal is more than a basic record of trades. It’s a learning and improvement tool. Beginners often jot down only price and time. Experienced traders add deeper insight that helps them get better over time. Here's what they track:

Thailand-Cambodia War Pressures Thai Baht in Forex Market

The ongoing conflict between Thailand and Cambodia has put immense pressure on the Thai Baht, impacting the forex market and investor sentiment. Read on for more.

6 Red Flags to Notice Before Investing in Neuron Markets

Investment scams have been rising over the last 5–6 years. Therefore, you need to be alert in the forex market, as many scam brokers are active and waiting to exploit inexperienced investors and traders. Neuron Markets is one such broker that appears genuine and makes big promises but ends up swindling investors’ money. Checkout red Flags and stay Safe

Future of Forex in India: Growth or Global Domination?

Every Trader or Investor in India who wants to invest in the dynamic forex market must read this important article. It explores the future of the forex market in India and answers a common question: Forex market will rise or crash in India ? Checkout the article below.

WikiFX Broker

Latest News

Samsung Electronics signs $16.5 billion chip-supply contract; shares rise

Does XS.com Hold Leading Forex Regulatory Licenses?

European stocks set to rise after the U.S. and EU strike trade agreement

Elon Musk confirms Tesla has signed a $16.5 billion chip contract with Samsung Electronics

Chile Bumps Up Copper Price Forecast and Flags Lagging Collahuasi Output

Top Wall Street analysts recommend these dividend stocks for regular income

Stock futures rise as U.S.-EU trade deal kicks off a hectic week for markets: Live updates

Treasury yields tick lower as investors look ahead to Fed's interest rate decision

Thailand-Cambodia War Pressures Thai Baht in Forex Market

Investors Accuse Duttfx Markets of Scam: What You Should Know

Rate Calc