Exness Halts New India Accounts Amid Regulatory Change

Abstract:Exness suspends India registration for new clients amid SEBI UPI verification changes and evolving forex regulations in India 2025. Find out more.

Retail forex broker Exness has enacted an India registration ban, catching much of the trading community off guard. Effective immediately, the broker has blocked access to the account opening process for all users based in India, with new registrations from Indian IP addresses met by a simplified login page and a message stating, “registration is not allowed from your region”.

This Exness account opening blocked India move has come without a formal explanation from the company, and no clear statement has been issued regarding whether the ban is temporary or permanent. Despite a prolonged push to make India one of its key growth markets, Exness has halted onboarding of new Indian clients, leaving many to speculate on why Exness stopped accepting new accounts in India.

The change has left a large network of introducing brokers (IBs) and active traders with unanswered questions. As Musaddaq Shabir, Business Development Manager at Neex, remarked, “For many whove grown with the platform, this change may raise concerns, especially for IBs managing active client networks…having a clear and stable path forward is crucial”.

While Exness continues to allow trading for existing account holders, concerns linger, particularly as the landscape for offshore forex brokers operating in India tightens. No announcement has been made regarding similar restrictions in other regions.

India's forex trading regulations 2025 are at the center of this shift. The Securities and Exchange Board of India (SEBI) recently introduced a robust new UPI payment verification system to protect retail investors from unauthorized brokers. All intermediaries must now use a standardized UPI payment handle ending with “@valid,” and a green triangle with a thumbs-up icon will confirm the registration status of intermediaries during fund transfers. This SEBI UPI verification forex brokers system is designed to curb unregistered broker activity and increase trust in digital transactions.

Historically, the Indian forex market has remained highly regulated. Only currency pairs involving the Indian Rupee (INR) may legally be traded, and strictly through SEBI-regulated, recognized domestic platforms7. Trading non-INR pairs or via unregulated or offshore brokers exposes traders to legal and financial risk, as clarified by the Reserve Bank of India and SEBI. Indian stock exchanges have repeatedly warned against trading unregulated derivative products, like contracts for difference (CFDs) and binary options, which are strictly not permitted.

About Exness

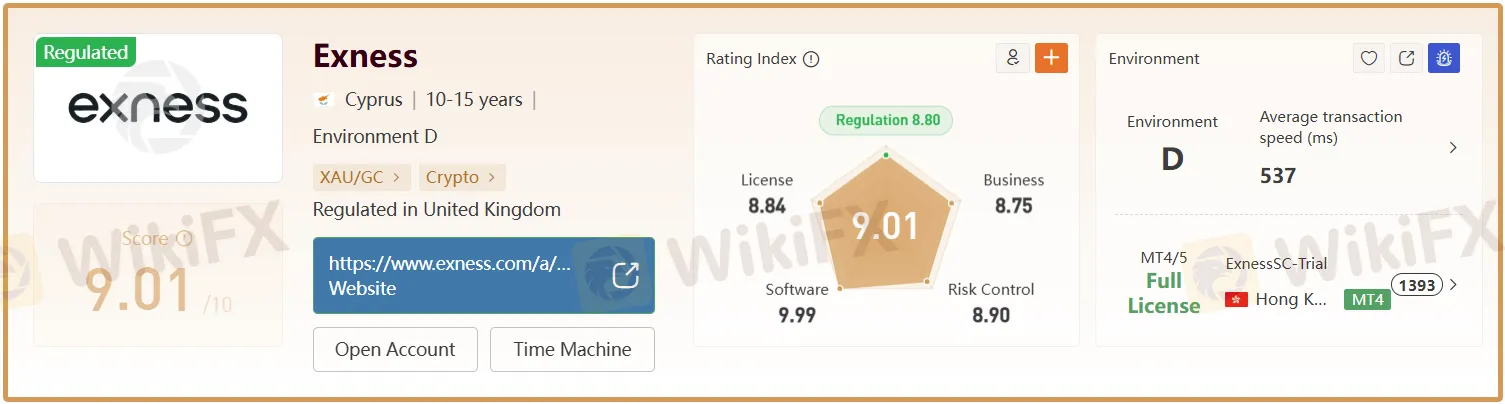

Exness is a global forex and CFD broker, established in 2008 and regulated internationally. The company is known for its competitive spreads, high leverage, fast withdrawals, and broad range of trading instruments. Headquartered in Cyprus, Exness serves millions of clients across more than 180 countries. In India, the broker had operated via affiliates and introducing brokers before the recent registration halt.

You can access Exness' broker's page for more details: https://www.wikifx.com/en/dealer/0001390005.html

Read more

15 Brokers FCA Says "Are Operating Illegally" Beware!

If a reputable regulator issues a warning about unlicensed brokers, it's important to take it seriously — whether you're a trader or an investor. Here is a list you can check out- be cautious and avoid getting involved with these scam brokers.

Scam Alert: Revealing Top Four Forex Scam Tactics Employed to Dupe Investors

Gaining and losing on forex trades is normal, but not scams that siphon out millions in no time! In this article, we will reveal forex scam tactics. Read on!

6 Effective Forex Strategies for Unstable Market Trends

Forex market is unpredictable and affected by global events, central bank policies, geopolitical tensions, and even unexpected news releases .This volatility can be challenging for traders. However, those with a solid plan and strong strategies are less affected by market fluctuations..To avoid losses and stay stable in volatile conditions, it’s crucial to understand these 6 effective strategies. Theyll help you navigate market trends.

What Time Does the London Forex Market Open for Traders?

Know the London Forex market hours, factors influencing its trading time, and how the London session opening impacts traders' strategies worldwide.

WikiFX Broker

Latest News

PrimeXBT Launches MT5 PRO Account for Active Traders

eToro Expands into Singapore with MAS CMS Licence

Renault shares plunge 16% after French carmaker lowers guidance, appoints new interim CEO

Darwinex Launches INDX: A Revolutionary Investment Strategy for Traders

Top Forex Trading Scams to Watch Out for in 2025

Real Risk Factors with Admiral Markets ! Explained

5 Reasons to Know Why INFINOX Is a Standout Broker?

5 things to know before the stock market opens Wednesday

Trump's big beautiful bill' caps student loans. Here's what it means for borrowers

Weekly mortgage demand plummets 10%, as rates and economic concerns rise

Rate Calc