BlackBull: A Closer Look at Its Licenses

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about BlackBull and its licenses.

BlackBull is a New Zealand-based broker offering financial services under multiple registrations.

BlackBull is licensed by the Financial Markets Authority (FMA) in New Zealand under license number 403326. The FMA is New Zealand‘s official government agency overseeing financial markets, securities, and financial service providers. A license from the FMA generally signals a broker’s compliance with local regulatory standards, including client fund protection and transparent reporting.

In addition to its FMA license, BlackBull is also registered with the New Zealand Financial Service Providers Register (FSPR) under license number 1002113. The FSPR is a registry rather than a licensing authority. While it allows businesses to offer financial services, it does not supervise or regulate forex trading directly. Furthermore, WikiFX notes that BlackBulls activities may exceed the business scope covered by this registration. Traders should remain aware of this limitation when considering the level of oversight involved.

BlackBull also holds an offshore license from the Seychelles Financial Services Authority (FSA) under license number SD045. The FSA provides regulatory services for non-bank financial institutions but is generally considered to have less stringent supervision compared to onshore authorities. Offshore licenses can offer operational flexibility, but may also involve increased risks for retail traders due to limited investor protections.

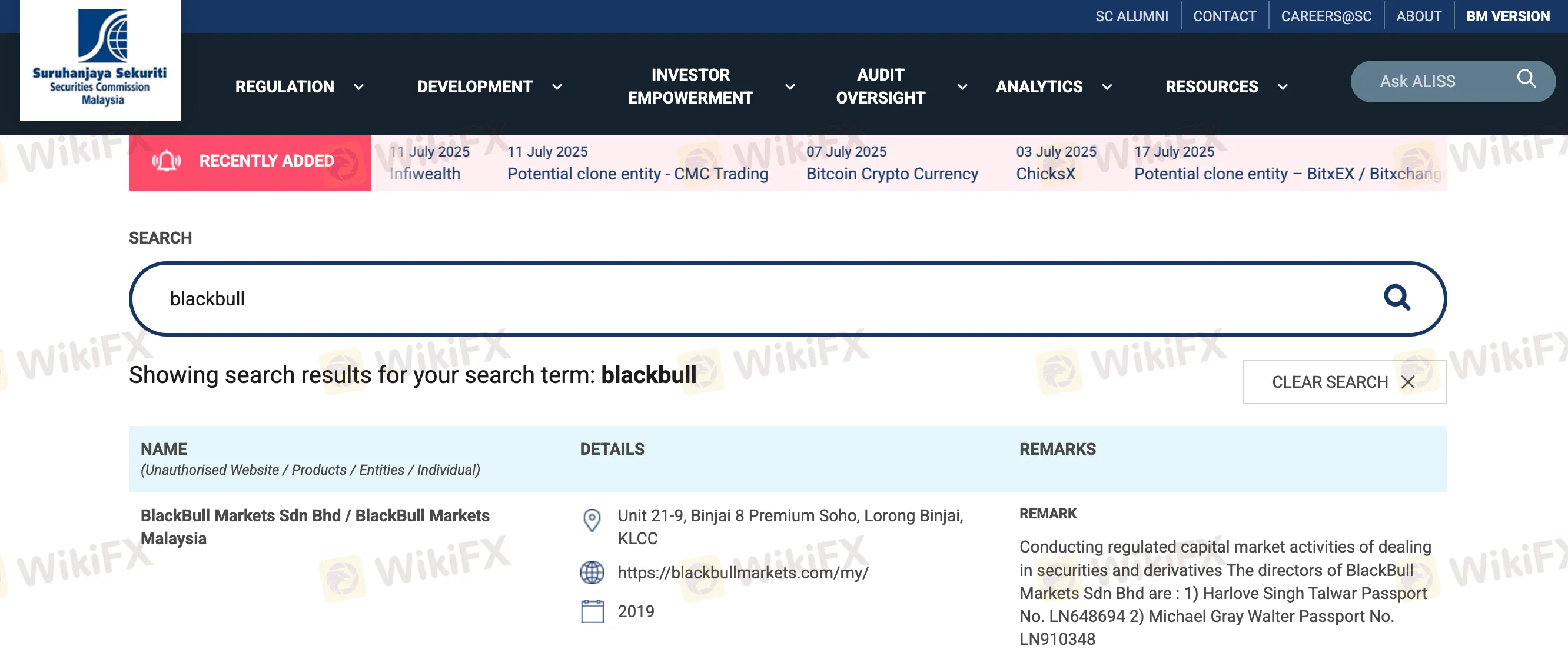

According to WikiFX, it has also been verified that BlackBull has been disclosed by The Securities Commission Malaysia, although specific details regarding this disclosure are not provided. Such listings typically occur when a broker is found operating in a region without appropriate local licensing.

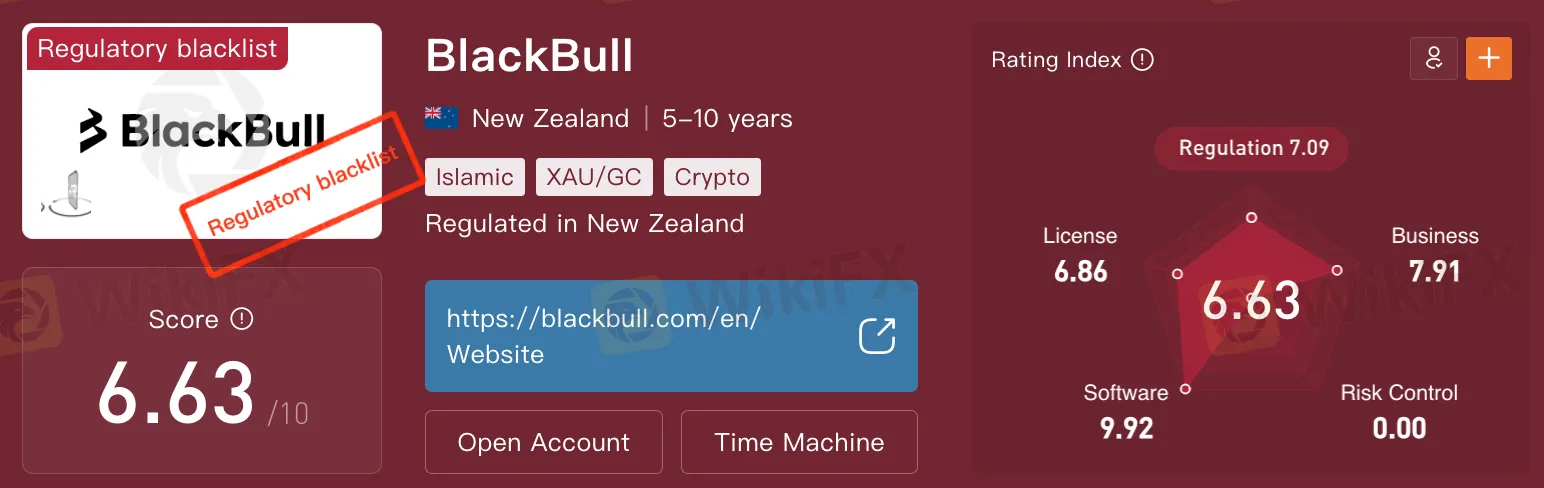

BlackBull has received a WikiScore of 6.63/10 on WikiFX. This rating reflects a mixture of strong and weak indicators. The presence of a valid FMA license supports regulatory confidence, but the use of offshore structures and exceeded business scope on the FSPR may warrant further scrutiny. WikiFX evaluates brokers based on regulatory status, operational transparency, trading environment, risk control, and customer feedback.

BlackBull offers financial services under multiple regulatory frameworks. While its FMA license adds credibility, the reliance on offshore licenses and the scope of activity beyond the FSPR listing raise important considerations for traders. Anyone considering opening an account with BlackBull is encouraged to fully understand the structure of its licensing and the nature of protections available. As always, thorough due diligence is a key step in selecting a reliable trading platform.

Read more

Dark Side of AETOS: They Don’t Want You to Know

AETOS is an Australia-based broker. All over the internet, you will find positive reviews about this broker, but no one is talking about the risks involved with AETOS. However, we have exposed the hidden risks associated with AETOS

Contemplating Investments in Quotex? Abandon Your Plan Before You Lose All Your Funds

Have you received calls from Quotex executives claiming to offer you returns of over 50% per month? Do you face both deposit and withdrawal issues at this company? Or have you faced a complete scam trading with this forex broker? You're not alone. Here is the exposure story.

15 Brokers FCA Says "Are Operating Illegally" Beware!

If a reputable regulator issues a warning about unlicensed brokers, it's important to take it seriously — whether you're a trader or an investor. Here is a list you can check out- be cautious and avoid getting involved with these scam brokers.

Scam Alert: Revealing Top Four Forex Scam Tactics Employed to Dupe Investors

Gaining and losing on forex trades is normal, but not scams that siphon out millions in no time! In this article, we will reveal forex scam tactics. Read on!

WikiFX Broker

Latest News

SHFE Tin Prices Stabilise in the Night Session After Initial Decline

Major U.S. Banks Plan Stablecoin Launch Amid Crypto Regulations

Lead Prices Remain in the Doldrums Despite Seasonal Expectations

Myanmar Tin Ore Shipments from Wa Region Set to Resume

Different Forex Market Regulators But One Common Goal - Investor Safety

Do You Really Understand Your Trading Costs?

Forex Trading Simulator vs Demo Account: Key Differences

5 Reasons Why Some Traders Choose XChief

Treasury yields rise as Trump denies plans to fire Fed Chair Powell

Harsh Truths About ATC Brokers Every Trader Must Know

Rate Calc