Top Forex Trading Scams to Watch Out for in 2025

Abstract:Stay informed about the top Forex trading scams in 2025 and learn how to protect yourself from fraudsters. Discover key warning signs and regulatory actions.

Identifying the Most Common Forex Scam Tactics

In the fast-paced world of Forex trading, scams are a significant threat to both novice and experienced traders. As the market continues to grow and attract new participants, scammers evolve their tactics to take advantage of unsuspecting investors. Understanding the most common Forex scam tactics can help you recognize and avoid falling victim to these fraudulent schemes.

- Ponzi Schemes: In a Ponzi scheme, scammers promise high returns with little to no risk. They lure traders by using initial investors' funds to pay profits to earlier investors, creating the illusion of a successful trading strategy. However, these scams eventually collapse when there are not enough new investors to pay out the promised returns.

- Signal Seller Scams: Many Forex traders are attracted to buying trading signals, but some fraudsters exploit this desire. Signal sellers promise high win rates and consistent profits, but in reality, their signals often lead to losses. These scammers use fake testimonials and inflated win rates to lure in new customers.

- High-Leverage Scams: Some scammers offer excessive leverage, enticing traders with the promise of substantial profits from small trades. While leverage can amplify profits, it also increases the risk. Scammers offering high leverage often fail to disclose the full risks involved, leading traders into dangerous situations that result in significant losses.

- Fake Broker Scams: Fraudulent brokers often operate under the guise of legitimate Forex firms, offering enticing bonuses and guarantees. These brokers may manipulate trading platforms or execute trades at unfavorable rates, ensuring traders lose their capital. They may also refuse to process withdrawals once funds are deposited, trapping traders' money.

- Phantom Trading Platforms: In this scam, fraudsters create fake trading platforms to steal traders' funds. These platforms often look like legitimate Forex brokers, but they are designed to deceive users into depositing money. After depositing funds, the scammer either locks the account or disappears entirely, taking the money with them.

How to Protect Yourself from Forex Fraudsters

With the rise of online trading, Forex traders need to be vigilant and take proactive measures to protect themselves from fraudsters. Here are some essential steps you can take to minimize your risk:

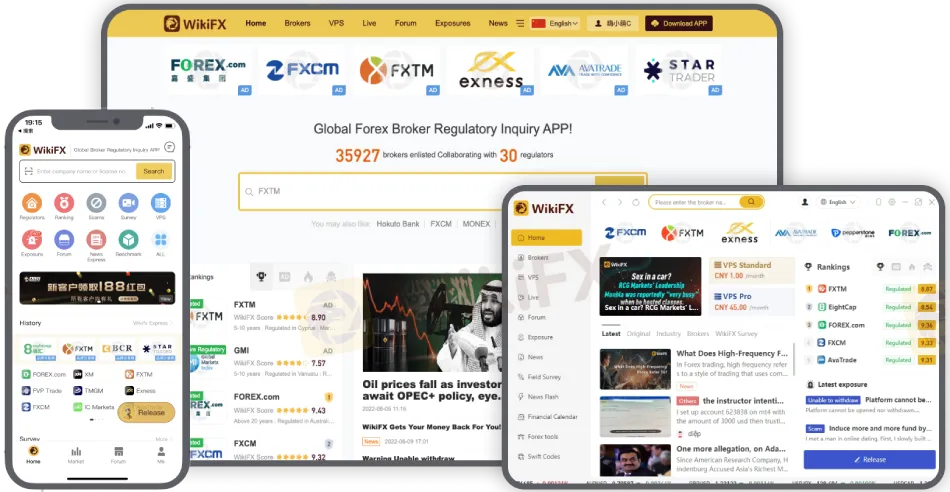

- Do Thorough Research: Before investing in any Forex broker or signal provider, take the time to research their reputation. Look for reviews, check their regulatory status, and verify that they are licensed by a reputable authority. Regulatory bodies such as the Financial Conduct Authority (FCA) or the U.S. Commodity Futures Trading Commission (CFTC) ensure that brokers follow strict guidelines to protect investors. A helpful tool to assist in this process is the WikiFX App. The WikiFX app provides detailed information on brokers, including their regulatory status, reviews, and ratings. This app allows traders to verify the authenticity of Forex brokers before engaging in any transactions, helping ensure you're dealing with a legitimate provider.

- Avoid Unsolicited Offers: If you receive unsolicited emails, phone calls, or messages promoting high-return trading opportunities, be cautious. Fraudsters often target traders through these channels, offering lucrative deals that sound too good to be true. Legitimate brokers and signal providers typically dont reach out to potential customers in this way.

- Be Skeptical of Unrealistic Promises: If something sounds too good to be true, it probably is. Be wary of brokers or signal sellers promising guaranteed profits or “no-risk” trading. Forex trading inherently involves risk, and no one can accurately predict market movements with 100% certainty. Always be cautious if someone is offering “risk-free” strategies or exaggerated returns.

- Use Trusted Payment Methods: When funding your trading account, choose reliable payment methods like bank transfers, credit cards, or well-known e-wallet services. Avoid using wire transfer services like Western Union, which are often associated with fraud, as these payments are harder to trace.

- Check for Transparency: A reputable broker should be transparent about its fees, trading conditions, and risks involved. Ensure that you fully understand the terms before committing any funds. If a broker is unwilling to provide clear and concise information, it's a red flag that they may be operating dishonestly.

Warning Signs of Unregulated Forex Brokers

Unregulated Forex brokers pose significant risks to traders. Without proper oversight from regulatory authorities, these brokers can manipulate markets, refuse withdrawals, or even disappear with traders' funds. Here are some warning signs that can help you identify an unregulated broker:

- Lack of Transparency: Unregulated brokers often have vague or incomplete information on their websites. They may not provide any information about their regulatory status, or the information they provide may be inconsistent. Legitimate brokers will proudly display their regulatory licenses and contact details.

- High Minimum Deposit Requirements: Some unregulated brokers lure traders with high minimum deposit requirements, claiming that they are offering exclusive trading conditions. This tactic is often used to intimidate traders into depositing more money than they are comfortable with.

- Inability to Withdraw Funds: A key warning sign of an unregulated broker is difficulty in withdrawing funds. Scammers often create fake platforms that prevent users from accessing their accounts or withdrawing profits once they‘ve deposited money. If a broker has a history of delayed or rejected withdrawals, it’s a red flag.

- No Customer Support: Reputable brokers typically offer 24/7 customer support and have a dedicated team to assist traders with their queries. If you find that a broker is difficult to contact or offers limited customer support, this could indicate that they are unregulated and not trustworthy.

- Unclear or Excessive Fees: Unregulated brokers often hide fees or impose excessive charges that are not disclosed upfront. If you encounter a broker who is not transparent about their fee structure, it's a strong indication that they may not be operating legally.

Impact of Forex Scams on Retail Traders

Forex scams have a profound impact on retail traders, often leading to financial ruin and shattered trust in the Forex market. The psychological and financial toll of falling victim to a scam can be severe:

- Financial Losses: The most obvious impact of Forex scams is the loss of money. Traders who fall victim to fraudulent schemes often lose their entire investment, and in some cases, scammers may drain accounts by making unauthorized trades or preventing withdrawals.

- Loss of Confidence: Scams can make traders hesitant to engage in Forex trading again. After losing money to a fraudulent broker or signal provider, many traders feel betrayed and lose faith in legitimate opportunities. This loss of confidence can prevent them from returning to the market or seeking more reliable trading platforms.

- Legal and Financial Consequences: In some cases, traders who fall victim to Forex scams may face legal challenges when attempting to recover their funds. Fraudulent brokers often operate in jurisdictions with weak legal protections, making it difficult for victims to pursue legal action and recover their losses.

- Reputation Damage: For brokers and signal providers involved in scams, the damage to their reputation can be severe. Word-of-mouth and online reviews can quickly spread information about fraudulent activities, leading to a loss of clients and trust in the industry.

Regulatory Measures to Combat Forex Fraud

Regulatory bodies play a crucial role in protecting traders from Forex fraud. In 2025, regulators continue to strengthen their efforts to combat scams and ensure a safer trading environment. Some of the most significant regulatory measures include:

- Tightened Regulations on Leverage: To prevent brokers from offering excessive leverage that can lead to significant losses, regulators have started imposing stricter limits on leverage. This move helps ensure that traders are not exposed to risks they cannot afford.

- Increased Scrutiny of Broker Practices: Regulatory authorities are conducting more thorough inspections of Forex brokers and their practices. Brokers must adhere to strict guidelines regarding transparency, client funds protection, and market manipulation to obtain and maintain a valid license.

- Enhanced Investor Education: Many regulatory bodies are focusing on educating investors about the risks of Forex trading and the warning signs of scams. By offering educational resources, webinars, and tools, these regulators aim to help traders make informed decisions and avoid falling victim to fraud.

- Stronger Enforcement of Anti-Money Laundering (AML) Policies: To prevent fraudsters from using Forex markets for money laundering, regulatory bodies have introduced stricter AML policies. These measures require brokers to implement robust identity verification processes and report suspicious activities.

Conclusion

As Forex trading continues to grow in 2025, traders must remain vigilant and protect themselves from scams. By understanding the most common Forex scam tactics, recognizing the warning signs of unregulated brokers, and taking advantage of regulatory measures, traders can minimize their risk and enjoy a safer trading experience. Always ensure that you conduct thorough research, use reliable platforms, and stay informed to avoid falling prey to fraudsters.

Read more

Buying US Dollars in India Made Simple - Take a Look!

Want to make a trip to the US but don't have dollars with you? Don't fret, you can easily buy US dollars in India through various channels such as banks. Read this article to learn more.

How to Protect Your Account: 3 Proven Ways to Outsmart Phishing Scams

Cyber threats are evolving fast—phishing scams now look more real than ever. Here’s how you can reduce your risk and stay in control of your online security.

Wondering Why Your International Earnings Come Less Than Expected? It's Because of Forex Markup Fees

You worked for an international project but received payments less than agreed upon. You start wondering whether I remained absent or the client has deliberately reduced the amount. Well, it could be due to forex markup that banks debit. Explore this article to learn more about it.

How AI and Machine Learning are Shaping Automated Forex Trading

Discover how AI and machine learning are transforming forex trading by enhancing data processing, improving forecasting, and providing emotion-free, automated strategies.

WikiFX Broker

Latest News

What WikiFX Found When It Looked Into Emar Markets

MT4 vs MT5 Which Forex Trading Platform Fits Your Needs in 2025?

Short or Long Term: Which to Choose for Double-Digit Returns from Gold Investments?

Gold Soars Above $3,350 as XAU/USD Rallies on Trade Tensions

What is Forex Trading Simulator?

Switzerland tourism boosted as women's soccer continues record-breaking rise

Alchemy Markets: A Closer Look at Its Licenses

Wondering Why Your International Earnings Come Less Than Expected? It's Because of Forex Markup Fees

FCA to modernise rules to unlock investment

How Fake News Sites Are Fueling a Global Investment Scam Epidemic

Rate Calc