Forex Candles - What Value Do They Add to Your Trading Experience?

Abstract:Wondering where you can see the forex price movement information? Easy, it’s all there on forex candles, which demonstrate different market sentiments to help traders make informed decisions. Keep reading to learn more.

Wondering where you can see the forex price movement information? Easy, its all there on forex candles, which can even be called a candlestick. It forms a critical component of technical analysis that traders use to access price information quickly from a few price bars. Forex candles on a daily chart come with three basic features:

Body - Representing the Open-to-Close Range

Shadow - Indicating the Lows and Highs of Intra-day Trading

Color - A green color shows upward movement, while a red color denotes downward price movement.

Forex Candle Patterns Become Elaborate with Time

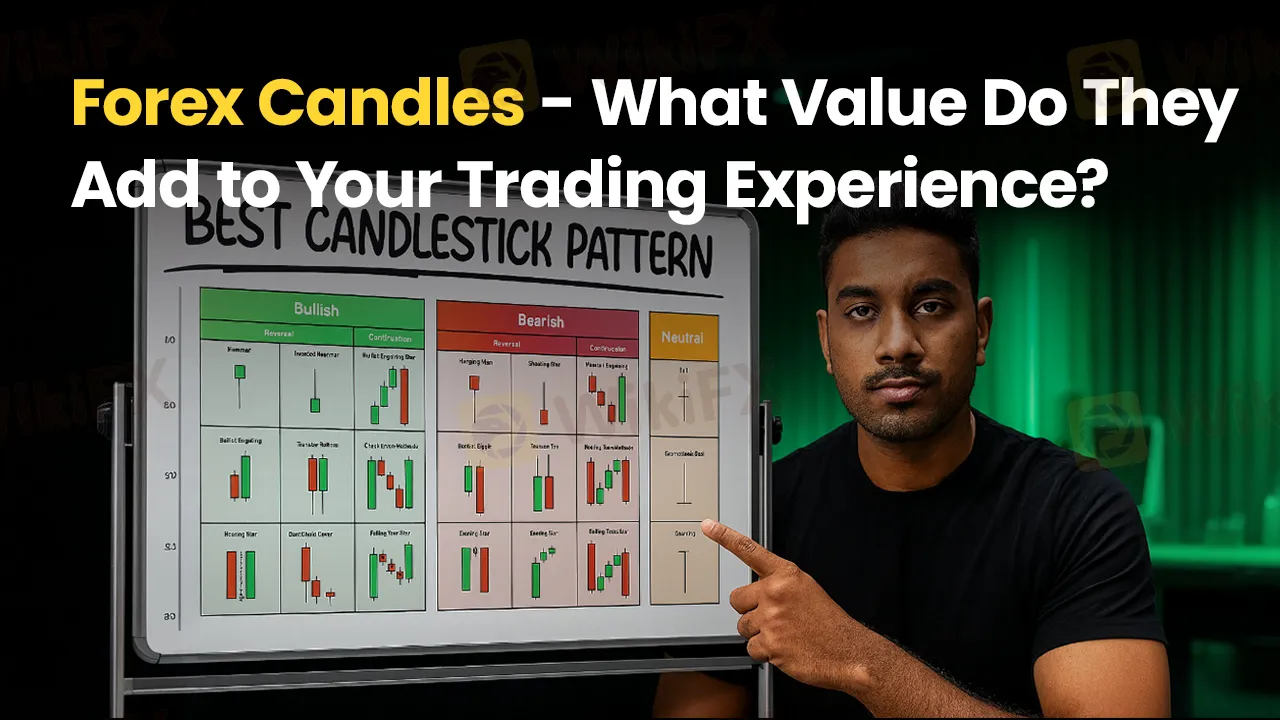

As time goes on, different forex candle patterns will be displayed, allowing traders to know several support and resistance levels. Many candlestick patterns hint at an opportunity that traders can maximize. Some patterns share details regarding the balance between selling and buying pressures, while others detect market indecision or continuation patterns. Forex candle patterns can express bullish or bearish market sentiments.

Bullish Forex Candles

After a market downtrend, bullish patterns may form and indicate price movement reversals. They indicate to traders the potential to earn profit from an upward trajectory by opening a long position. Here are some bullish forex candles to look at.

Hammer

The hammer candlestick pattern demonstrates a short body with a long lower shadow. You can find this at the lowest point of a downward trend. The lower shadow must account for at least twice the body length. A hammer demonstrates that despite selling pressures during the day. Ultimately, the buying pressure lifted the price. While the body color can change, green hammers point out a stronger bullish signal compared to red hammers. The next day needs to be bullish to be assured of the reversal pattern.

Inverted Hammer

It is a less bullish pattern with just one difference. The upper shadow remains long and forms around twice the body length, along with a short lower shadow. Forex candles demonstrating inverted hammer are a sign of buying pressure followed by a not-so-intense selling pressure to lower market prices. While the inverted hammer may show buyers with increased market control soon, its not a reliable metric to make decisions.

Bullish Engulfing

Two candlesticks - showcasing how a short red body is engulfed by a larger green candle - are used in the bullish engulfing pattern. Even though the second day starts on a lower note than the first, the bullish market raises the price and helps buyers maximize.

Piercing Line

It‘s a two-candlestick pattern built from a long red and green candle. Usually, you can witness a considerable gap between the closing price of the red candlestick and the opening price of the green candlestick. This indicates a strong buying pressure as the price goes up to or beyond the previous day’s mid-price.

Morning Star

This forex candle pattern showcases hope in a bleak market. It features three candle patterns with a short-bodied candle placed between two long red and green candles. Conventionally speaking, the ‘star’ will not undergo overlapping with longer bodies. The reason is that the market gaps, both on open and close. It hints at the subsiding of the selling pressure, and a bullish reversal is on the cards.

Three White Soldiers

This forex candle pattern is visible for over three days. The pattern demonstrates consecutive long green or white candles with small shadows. These demonstrate progressively higher opening and closing of forex compared to the day before. Its a very strong bullish signal appearing after a downtrend.

Bearish Forex Candles

Following an uptrend, bearish candlestick patterns usually appear. This signals the resistance level. The pessimism that ensued about the market price often makes traders close their long positions. They thus open a short position to benefit from the falling price.

Hanging Man

It remains the bearish equivalent of a hammer with the same shape but appears at the close of an uptrend. Just as the hammer, the lower shadow should be a minimum of twice the body length. This forex candle pattern hints at a tremendous sell-off during the trading day.

Shooting Star

Featuring the same shape as the inverted hammer, the Shooting Star appears in an uptrend. It features a small lower body and a long upper shadow of at least twice the body length. Generally, the market will gap a bit higher on opening and witness an intra-day high before settling at a price just above the opening price. This gives a feel of a falling star.

Bearish Engulfing

You will find this pattern at the bottom of an uptrend. Its first candle features a small green body engulfed by a long red candle. It demonstrates an impending market downturn.

Evening Star

A three-candlestick pattern, the ‘evening star’ is made from a short candle sandwiched between two long red and green candles, indicating the upward trend reversal.

Continuation Candlestick Patterns

These patterns do not point out market direction changes. They are continuation patterns that help traders spot a rest period in the market amid neutral price movement.

Doji

When the market opens and closes at virtually the same price point, the candlestick remains a plus or cross sign. This hints at a struggle between sellers and buyers, with neither of them receiving gains.

Spinning Top

With a short body centred between equally long shadows, the spinning top forex candle pattern showcases indecision prevailing in the market, leading to no meaningful price changes.

Falling Three Methods

It is a continual bearish market trend demonstrated by a long red body, then three small green bodies, and finally another red body. The green candles are all within the bearish body range. It indicates to traders that bulls have run out of steam to reverse the trend.

Rising Three Methods

The rising three-method candlestick pattern contains three short red candles sandwiched within two long green candles. This demonstrates that buyers are retaining market control even with some selling pressure.

Conclusion

We hope it has been an interesting read on forex candles and the immense value they add to traders. Keep watching the pattern carefully and place your bets correctly to keep winning the forex trading challenge.

For more captivating information on forex, download the WikiFX App.

You can also join the WikiFX India community on Telegram.

Read more

Risky Choice? What Traders Should Know About Bold Prime

Risk exists everywhere — even well-known brokers are not exceptions. But they often don’t talk about the risks. Instead, they highlight their strengths and try to attract customers while hiding the potential downsides. However, in this article, you’ll learn about the risks involved with Bold Prime.

Forex vs Stocks - Which Can Generate Maximum Earnings for You?

When looking to build wealth at a faster pace, stocks and forex emerge as two powerful alternatives. But which holds more profit potential? Which of the two is riskier? Find out the answers here.

From Novice to Pro: Why Investors Trust Land Prime?

If you're passionate about forex trading and ready to begin your journey as a trader, this article is worth exploring. It highlights the key features that Land Prime offers to both traders and investors.

Five Positive Signs That Make BCR Reliable Broker

Thinking of investing? Exploring Brokers and Have you come across BCR Forex Broker but feel confused? Is it a great choice or a bad decision? Hold on . Check out the article and know why this broker could be a trustworthy choice for you.

WikiFX Broker

Latest News

Top Wall Street analysts are upbeat about these dividend-paying stocks

Singapore's economy grows 4.3% in second quarter, beating expectations

What WikiFX Found When It Looked Into Emar Markets

MT4 vs MT5 Which Forex Trading Platform Fits Your Needs in 2025?

Stock futures slide on more Trump tariff letters, but are off worst levels of session: Live updates

Short or Long Term: Which to Choose for Double-Digit Returns from Gold Investments?

Gold Soars Above $3,350 as XAU/USD Rallies on Trade Tensions

Asia-Pacific markets trade mixed as investors assess Trump's latest tariff threats; bitcoin hits new highs

What is Forex Trading Simulator?

Switzerland tourism boosted as women's soccer continues record-breaking rise

Rate Calc