US Crypto Fraud Losses Jump 66% in 2024, Reaching Alarming Highs

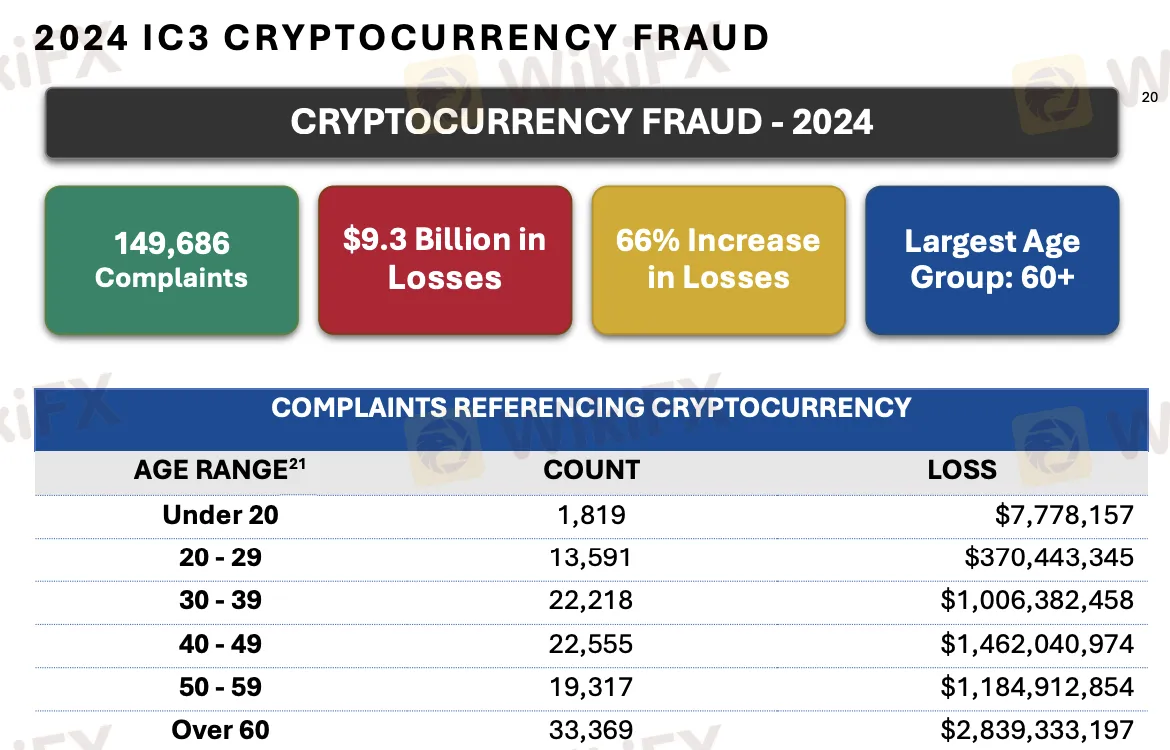

Abstract:Crypto-related scams cost U.S. investors $9.3 billion in 2024, marking a 66% surge from the previous year, with seniors and fake investment schemes among the hardest hit.

The U.S. Federal Bureau of Investigation (FBI) has released its 2024 Internet Crime Complaint Center (IC3) annual report, and the numbers are startling. Losses linked to cryptocurrency scams reached $9.3 billion last year, up 66% from $5.6 billion in 2023, signaling a major escalation in the scale and sophistication of digital asset fraud.

Surge in Victims and Senior Citizens Hit Hardest

More than 140,000 complaints involving cryptocurrency were filed to the IC3 in 2024, with individuals over the age of 60 comprising a large and growing share of victims. The report states that seniors accounted for over 33,000 cases, with total reported losses of $2.8 billion—a near tripling compared to the figure five years ago.

These scams often leveraged sophisticated narratives promising high returns or falsely claimed regulatory backing to gain investor trust. One of the most common methods involved fake investment platforms that encouraged users to deposit crypto into wallets controlled by scammers.

New Tactics: Sextortion, AI Deepfakes, and Crypto ATMs

While investment fraud accounted for the largest monetary losses, the IC3 noted that “sextortion” schemes were the most frequently reported. In these scams, attackers manipulated images or videos to create explicit content, then extorted victims for cryptocurrency payments. Additionally, fraud involving crypto ATMs and kiosks saw a notable uptick.

With generative AI becoming more accessible, the FBI expects a rise in convincing deepfake scams and manipulated voice impersonation cases in 2025. According to Chainalysis, illicit crypto transaction volume globally reached $41 billion in 2024, with a quarter of it tied to fraud, extortion, or hacks.

FBI Enforcement and Global Coordination

In 2024 alone, the FBIs “Operation Level Up” initiative helped prevent an estimated $285 million in losses by intercepting ongoing scams. Despite such efforts, the agency cautions that recovery is often difficult once funds are transferred through complex crypto laundering schemes involving cross-border actors.

Authorities are calling for broader consumer education and enhanced KYC (Know Your Customer) standards across platforms. The report also reiterates the importance of reporting suspicious activity as early as possible.

Conclusion

Cryptocurrency remains a double-edged sword—empowering innovation while opening doors to abuse. As scammers adopt more advanced methods and target vulnerable demographics, education, early reporting, and platform accountability will be key to curbing further losses. Authorities recommend that users verify the legitimacy of all investment opportunities and avoid sending crypto assets to unknown parties.

Read more

UN Warns Asian Scam Operations are Spreading Worldwide

UN report reveals Asian scam operations expanding globally, targeting Africa, Latin America with cyberfraud, generating billions amid crackdowns.

Why Binance Tightens Crypto Transfer Rules for South Africans?

Binance enforces stricter crypto transfer rules for South African users starting April 30, requiring sender and beneficiary details for compliance.

KuCoin Thailand Launches as Top Crypto Exchange in 2025

KuCoin Thailand launches with SEC approval, offering secure crypto exchange services and digital asset trading in Thailand with enhanced technology and safety.

PayPal Opens Regional Hub in Dubai, Expands Middle East Reach

PayPal opens Dubai hub as Middle East HQ & offers 3.7% PYUSD stablecoin yield, enhancing global commerce and digital assets in 2025.

WikiFX Broker

Latest News

Germany’s April PMI Falls Below 50 as Service Sector Stumbles

PayPal Opens Regional Hub in Dubai, Expands Middle East Reach

FINRA fines SpeedRoute for alleged rule violations

RM15,000 Profit Turned into RM1.1 Million Loss for Engineer!

New to FX Trading? Stop! Read These Warnings First

Prop Trading Firms vs. CFD Brokers: Who’s Winning the Retail Trading Race?

TRADE.com UK Sold to NAGA Group Amid 2024 Revenue Drop

Why Binance Tightens Crypto Transfer Rules for South Africans?

Coinbase Eyes U.S. Federal Bank Charter for Crypto Growth

Why People Fall for Online Trading Scams

Rate Calc