GemForex | Crude Oil (WTI)

Abstract:Crude Oil (WTI) - Rebound in the offing?

WTI: The $100 mark should hold the downside

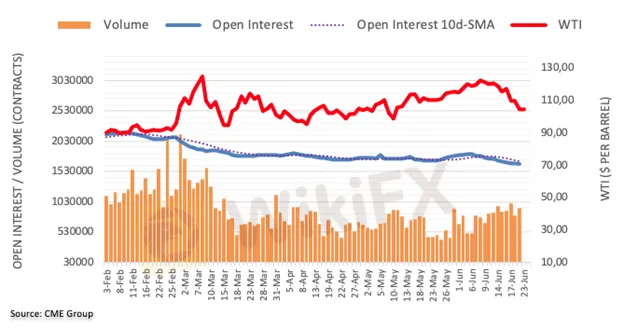

Prices of the WTI retreated sharply and revisited the $101.00 region on Wednesday. The strong downtick was due to shrinking open interest in the futures market, giving the hint that a deeper pullback is not favored in the near term.

The further downside in prices of the commodity should meet tough support around the $100.00 area.

That said, the black gold is on the downtrend for the second consecutive day, down 1.0% around $102.90, amid early European morning on Thursday.Aclear downside break signal of the three-month-old support line, near $101.00 by the press time, appears necessary for the bears.

Read more

Oil Prices Drop as OPEC+ Pauses Supply Hikes Amid Oversupply Fears

Oil prices fell as OPEC+ paused supply hikes for early 2026, fueling oversupply concerns. A stronger U.S. dollar added to pressure on WTI crude.

Oil Prices Drop as OPEC+ Considers Raising Production

Oil prices fell sharply this week as traders worried that OPEC+ might decide to pump more oil into the market at its upcoming meeting.

50% Tariff Imposed on India: The Sectors That Will Be Hit the Hardest

Finally, the day (August 27, 2025) arrived that India did not want. The imposition of 50% tariff by the US administration on most products exported from India. As per the US, the tariff is largely due to India continuing to purchase Russian oil. The extra 25% duty was added over 25% imposed at the beginning of August 2025 as India refused to stop purchasing Russian crude and defence hardware. Check out the sectors that will be hit the hardest with this tariff increase.

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

WikiFX Broker

Latest News

Retail Trading Momentum Extends into 2026, Reshaping FX and CFD Activity

Stock Trading Guru Scams Contractor Out of RM1.2 Million with ‘Guaranteed Profits’

FX SmartBull Regulation: Understanding Their Licenses and Company Information

CONSOB Blocks Five More Unauthorised Investment Websites as Online Scam Tactics Evolve

Neptune Securities Exposure: Real Forex Scam Warnings

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

Rate Calc