03/08 Market report

Abstract:XAUUSD / USOIL / Dow Jones Index USA30 / EURUSD

【XAUUSD】

The data of the CFTC of the US Commodity Futures Trading Commission shows that the number of speculative long orders of gold increased by 4081 and the number of short orders decreased by 10393. The overall net long increased by 14474. This shows that investors in the market have recently increased their sense of risk aversion to gold. Due to the continuous rise of gold, many investors who were caught short had urgently stopped losses.

At present, due to the poor performance of the stock market and the escalation of the Ukrainian-Russian war factors, a strong buying market was formed by many investors. The price of gold soared as high as 2,000 USD per ounce yesterday.

At present, Alligator shows a golden cross and KD is still at the high end. The buyer's strength in the current market is very strong but due to the excessive volatility, investors should not chase losing orders. It is more appropriate to follow the trend.

XAUUSD – D1

Resistance point 1: 1990.00 / Resistance point 2: 2000.00 / Resistance point 3: 2020.00

Support point 1: 1970.00 / support point 2: 1950.00 / support point 3: 1920.00

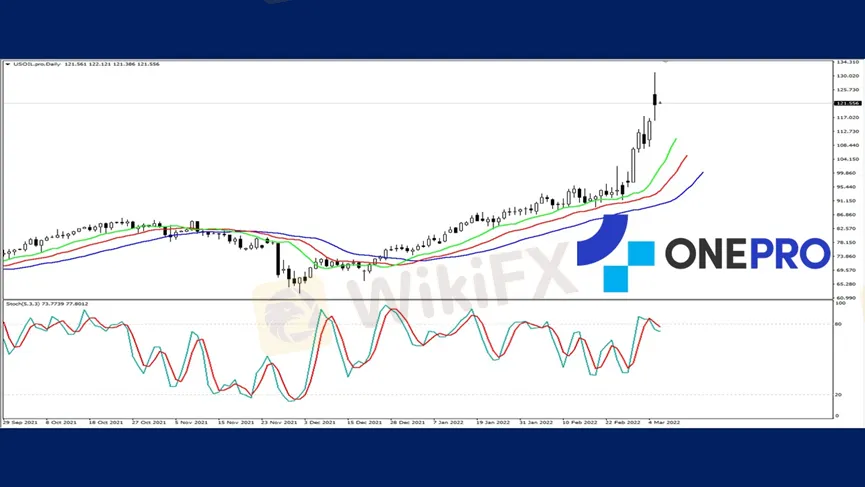

【USOIL】

At this stage, Europe and the United States and other countries are thinking about whether to fully boycott Russian oil. Although the US Secretary of State and the Chairman of the European Commission have issued a non-exclusion, the goal of Europe and the United States and other countries is to reduce the demand for Russian crude oil.

At the same time as the war escalated, the price of crude oil rushed all the way up and broke through 130USD per barrel. Although it continued to fluctuate since then, the sharp fluctuations in crude oil prices between 130USD and 120USD per barrel have kept investors busy.

From the data of the CFTC of the US Commodity Futures Commission, it can be seen that the long orders of crude oil increased by 2363 and the short order decreased by 6359. This indicates that institutional investors still believe that the chances of crude oil continuing to rise are relatively high.

From the technical line, Alligator shows a golden cross but KD has begun to walk into the death cross. This shows the possibility of a high-end rest. This rest does not necessarily represent a decline. the high-end oscillations are common in recent times.

USOIL – D1

Resistance point 1: 126.500 / Resistance point 2: 128.500 / Resistance point 3: 131.800

Support 1: 123.200 / Support 2: 120.500 / Support 3: 117.800

【Dow Jones Index USA30】

As the time of the dollar interest rate decision gets closer, the Dow Jones index fell 800 points again. This is due to sentiments of raising interest rates and high oil prices caused by the escalation of the war. This caused investors to panic and transfer funds to bonds, gold, raw materials. As we can see, the stock market has been gradually showing a withdrawal by investors' funds.

At this stage, the Dow Jones Index is about to fall near the swing low of 32200 where some buys can be seen. The opening of the Alligator death cross is very large, and the death cross of KD has gradually entered the low-end area. This shows that the selling pressure of the Dow Jones Index is still relatively strong and the focus would be whether the swing low has been held.

USA30 –D1

Resistance point 1: 33200 / Resistance point 2: 33800 / Resistance point 3: 34500

Support point 1: 32500 / support point 2: 32200 / support point 3: 31800

【EURUSD】

From the data of the CFTC of the US Commodity Futures Commission, it can be seen that the euro's long orders increased by 14190, and the short order increased by 8557. This indicates that institutional investors have begun to increase their investment in the euro significantly.

Ever since Russia attacked Ukraine, the euro against the dollar and fell by 4% to the price lows. Recently, the euro continued to fall for 5 consecutive days and caused the technical line of the Alligator to show a death crossover. The opening prices also expanded and drove the KD to a low-end area. This shows that the market selling pressure gradually strengthened. After all, the United States is going to start raising interest rates this month, and the euro has no plans for this at present.

When investors trade the euro, it is advisable to avoid using a range-bound strategy. This is more so in the evening of Asian time where there is more news out in Europe and the United States.

EURUSD – D1

Resistance point 1: 1.09200 / Resistance point 2: 1.09800 / Resistance point 3: 1.10200

Support point 1: 1.08500 / support point 2: 1.08000 / support point 3: 1.07500

OnePro Special Analyst

Buy or sell or copy trade crypto CFDs atwww.oneproglobal.com

The foregoing is a personal opinion only and does not represent any opinion of OnePro Global, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

Read more

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Renewable Grid Integration: Economics and Technology

Gold Rally Validated as Miners Forecast Doubled Earnings

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Rate Calc