GMI Review

Abstract:Global Market Index or GMI is one of the known online leveraged Forex trading providers, that was established in Shanghai and then due to expansion opened several representative offices within China, also in Auckland and enabled office in the financial hub – London.

What is GMI?

Global Market Index or GMI is one of the known online leveraged Forex trading providers, that was established in Shanghai and then due to expansion opened several representative offices within China, also in Auckland and enabled office in the financial hub – London.

The company profile is determined as a technology driven brokerage solution along with transparent pricing, cutting-edge systems, multiple customer support and numerous proposals of software. The product offering states a pure ECN, STP connection that brings direct, light-fast connectivity to multiple top-tier liquidity providers with deep liquidity and tailor-made trading solutions.

GMI Pros and Cons

GMI is a reliable broker with good quality trading proposal including Institutions and Money managers. There is great selection between trading platform, MT5 bridges, technology and tool available at GMI. There are various options to deposit or withdraw funds.

On the negative side there is no 24/7 support, and education is rather basic.

Awards

Apart from the retail traders offering, the GMI brings an advanced proprietary software that includes MT4 and MT5 bridges, tailored partnership programs for Institutional Trader, Money Managers, White Label and APIs via FIX connectivity network.

Indeed, it is obvious that the main pro of GMI is a technology and software, which also was recognized by many awards received for special achievements within the industry and overall ratings.

Is GMI safe or a scam

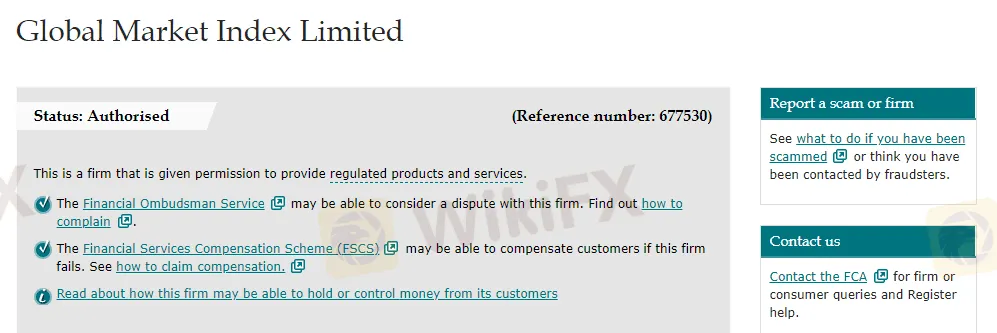

GMI is not a scam, but a regulated broker with top-tier authorization from FCA.

GMI Group of companies includes the firms and entities that are registered in several jurisdictions while using the shortcut-trading name of Global Market Index Limited. GMIUK is a trading name of the Global Market Index that is based in London and authorized by the Financial Conduct Authority.

Other brands including GMINZ a trading name of the company registered in New Zealand, the GMIVN is a company registered in Vanuatu, and the GMI Limited is registered in Hong Kong.

While the broker is regulated by one of the most reputable world authority UK‘s FCA, the traders can keep peace in mind, knowing the broker is fully compliant in regards to the operations and how it manages traders. Furthermore, the client’s funds are secured at all times, kept in leading Banks segregated accounts and protected by the compensation schemes in case of insolvency.

Leverage

Leverage levels offered by GMI of course depending on the regulatory requirements and the entity of GMI you are trading with. This happens due to various safety measures each authority applies in order to eliminate the risks, specifically for retail traders.

Therefore, trading with a UK brokerage the set of rules established by the European ESMA and allows only lower leverage levels of up to 1:30 for Forex instruments, 1:20 for minor currency pairs and even 1:10 for Commodities.

However, if you open an account with Hong Kong or Vanuatu entities levels are jumping to the high leverage up to 1:200 or even 1:300, yet check carefully with customer support under which regulation you particularly will fall.

Account types

There are 4 account types designed by GMI, while three of them are MT4 Accounts with STP connection, and the last one is offering ECN bridging technology. The trading accounts were designed through ultra customizable mode, while you may choose between flexible leverage and trading size along with ultra-tight floating spreads and rapid connectivity to the market.

Each of the accounts diverse by the initial deposit, and trading size accordingly allowing to choose the best suitable version along with more competitive pricing built into the spread only or with interbank spread and commission per order.

Deposits and Withdrawals

In order to start Live trading, of course, you should deposit an initial balance requirement, which is set at different levels according to the account type you chose. Transfer options including various payment methods alike Credit and Debit Cards, Bank Transfers and e-payment Skrill.

Minimum deposit

The GMI minimum deposit amount starts at 2,000$, which is quite high for beginning traders, but a reasonable amount for professional ones. Actually, due to super developed technology of GMI this broker is considered a choice for professionals or active traders.

GMI minimum deposit vs other brokers

| GMI | Most Other Brokers | |

| Minimum Deposit | $2,000 | $500 |

Withdrawal

GMI does not charge any additional fees for deposits or withdrawals, however the payment provider may treat the deposits as a cash advance hence will add extra fees, which require your check on the issue.

Conclusion

Overall the Global Market Index or GMI Review concludes well regulated firm, which serves offices in the world leading financial centers and offering transparent conditions through the technological connectivity. Yet, there are some Cons which are first of all lack of information on the website, no educational support along with a quite high deposit to start, which is 2,000$. However, what is pleasant at GMI very widely diverse platforms offering, which brings numerous solution to almost any demanding trader, beginner or the experienced one, institutional or retail.

Read more

STARLING GOLD - What Is Our Company?

OUR COMPANY IS A BROKER. BROKER IS AN AGENT AT THE CONSUMMATION OF VARIOUS TRANSACTIONS.

GCMASia Review – Is gcmasia.com scam or safe forex broker?

GCMAsia operates as a “marketing affiliate” of Fortrade Ltd – a UK forex broker regulated by the country’s Financial Conduct Authority (FCA). As per Fortrade’s affiliate program site, it offers CPA fees or flexible payment plans, commissions, marketing support, etc.

Binary.com Review - Is it Safe?

Binary.com is simple enough to use for beginners with minimal trading experience, while also offering enough features to satisfy even the most advanced option traders.

Mtrading Review - (mtrading.com Is a Scam)

Read our Mtrading review carefully to see why we do NOT recommend this broker for trading. Just to clear any suspicions this is a mtrading.com review.

WikiFX Broker

Latest News

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Rate Calc