Brent oil is predicted of bullish repricing by Goldman Sach

Abstract:According to Goldman Sachs' head of energy research, a nuclear deal between the U.S. and Iran could send energy prices higher - even if it means more supply in the oil markets. Talks are ongoing in Vienna between Iran and the six world powers - the U.S., China, Russia, France, U.K., and Germany - trying to salvage the 2015 landmark deal. Officials say there's been progress, but the conclusion of the negotiations remains unclear and oil prices have been soaring as a result.

According to Goldman Sachs' head of energy research, a nuclear deal between the U.S. and Iran could send energy prices higher - even if it means more supply in the oil markets.

Talks are ongoing in Vienna between Iran and the six world powers - the U.S., China, Russia, France, U.K., and Germany - trying to salvage the 2015 landmark deal. Officials say there's been progress, but the conclusion of the negotiations remains unclear and oil prices have been soaring as a result.

According to a report on CNBC regarding energy, Damien Courvalin, head of Energy Research at Goldman Sachs explained his rationale.

“He pointed to how oil prices rose in April after OPEC+ said they would gradually raise output from May by adding back 350,000 barrels a day.” CNBC

“An increase in production … is announced that is above anyones expectations — ours included. And yet prices rally, volatility comes down,” he said.

“Why? Because we lifted an uncertainty that was weighing on the market since last year,” he told CNBCs “Squawk Box Asia” last week.

Investors wondered if OPEC would end up in a price war when it tried to increase production, but the oil cartel presented a “convincing path going forward,” Courvalin said.

“You could argue the same for Iran,” he added. Simply knowing will likely “lift some of that uncertainty.”

“If that announcement comes in the next few weeks, in our view, it actually starts that bullish repricing,” he said at that time.

Supply may lag demand

Goldman Sachs predicts the international benchmark could hit $80 by the third quarter of this year, as the price of Brent rises at a fast pace.

“Courvalin noted that Asias oil demand has been revised lower due to new waves of the virus, and that has been offset by upside surprises in the U.S. and Europe.” CNBC

“It really paints a picture where, once vaccination rates progress sufficiently, you really see pent-up mobility get unleashed, and a significant increase in oil demand,” he said. “Thats … the root of the bullish view.”

“He said supply will likely lag the pop in demand, and there will be ”plenty of room“ to absorb oil from Iran.” CNBC

“In fact, if you told me Irans not coming back, our $80 forecast is way too low relative to where the oil market is heading by 2022,” he added.

Concerns over an Iran deal and the pandemic may have “masked a fast-tightening oil market,” Courvalin said.

Technical Analysis

While fundamentals favor the increase in the price of Brent oil, technical analysis also indicates that Brent oil price could rise further.

The price of Brent oil is now trading above 2020's high and looking to extend its growth beyond the current price level. The current supply level isn't holding price enough and is not pulling many threats to stop the bullish run.

Brent oil fell to $64.60 from $70 to pick support before the price rebounds and rises above $70 for the first time this year. Brent's price hits a new high of $72 as the market opens for the week during the Asia session in the early trading hours on Monday.

The gap between the 200-day and 50-day MA continues to widen as the price of Brent oil hits $72 per barrel. A break above $75 could see the price of Brent oil hits $80 or above in the next coming weeks.

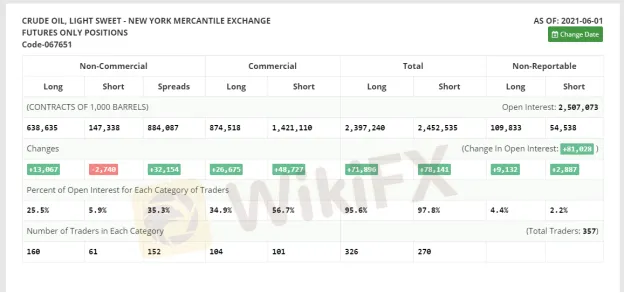

More long contracts were added by the non-commercials, according to the Commitment of Trader's report that was published last Friday.

Here is the link to the last article on oil -https://www.wikifx.com/za_en/newsdetail/202105187964695385.html

Read more

Key Forex Strategies

New to forex trading and looking for simple and effective trading strategies? We got you covered! In this quick guide, we'll explain some of the key forex strategies which are easy to digest. So, let's start!

Fundamental vs Technical Analysis

Fundamental and technical analysis play some of the most influential and critical roles in making trading decisions amongst traders today. They are widely accepted by stock, foreign exchange, indices and cryptocurrency traders worldwide. Traders use either or both of the methods to make key trading decisions in their respective markets.

Going Short of JPY Is Boosted by Yellen’s Remark on Interest-Rate Hikes Again

When interviewed by Bloomberg, Yellen, the U.S. Treasury Secretary, indicated that the USD 4-trillion budget released by Biden would be beneficial to America even if it may increase inflation and interest rates.

EUR/USD Preview of the new week: US-China Trade Talks May Signal Wake-up Call

The European currency paired with the US dollar is mostly in one place in the last three weeks. It is despite the impressive drop this Thursday. It can not be called a classic flat. However, the quotes are in a minimal range. At the same time, the pair corrected slightly against the last round of the upward movement. However, this correction is very weak.

WikiFX Broker

Latest News

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

BitPania Review 2026: Is this Broker Safe?

GFS Review: Reported Allegations of Fund Scams & Withdrawal Denials

XTB Analysis Report

Is EXTREDE Regulated? A 2026 Investigation into Warning Signs and Licensing Claims

Key Events This Week: PPI, Iran Talks, Nvidia Earnings, Fed Speakers Galore And State Of The Union

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

SOOLIKE Review 2026: Is this Forex Broker Legit or a Scam?

Macron's India Trip Exposes EU Tech Overreach And Policy Failures

Rate Calc