US personal savings rate increases due to lowered spending amid social distancing - Business Insider

Abstract:The US personal savings rate increased from 8% in February to 13.1% in March due to lowered spending from social distancing.

This story was delivered to Business Insider Intelligence Banking Briefing subscribers earlier this morning.To get this story plus others to your inbox each day, hours before they're published on Business Insider, click here.Stay up-to-date with our latest coverage on the impacts of coronavirus on technology, marketing, and the digital economy here.The US personal savings rate (personal saving as a percentage of disposable personal income) increased to 13.1% in March, up from 8% in February, according a study from the Bureau of Economic Analysis (BEA). Consumers put $2.17 trillion into savings, marking the highest rate since 1981.

Business Insider Intelligence

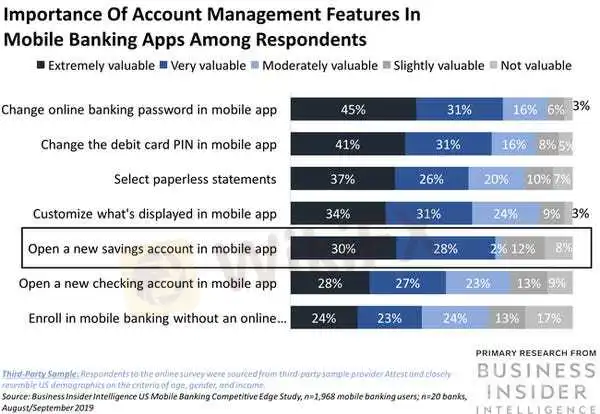

Spending fell 7.5% in March, as consumers “canceled, restricted, or redirected their spending,” per BEA, due to social distancing measures related to the coronavirus pandemic. The personal savings rate has been rising the past couple of years as people likely anticipated a recession — and this rate will likely increase further as consumers continue to social distance and receive their stimulus checks. This shift in consumer spending and saving patterns gives banks and neobanks alike the opportunity to highlight their savings accounts and tools.Neobanks can aggressively market their high-yield savings accounts. In recent years, lowering interest rates have contributed to consumer dissatisfaction with savings accounts from incumbent banks. Digital-only banks have stepped in to fill the gap, and high-yield savings accounts are now one of their main selling points: For example, compared with the national average of 0.07% annual percentage yield (APY), Goldman Sachs' digital-only offshoot Marcus offers a savings accounts with a 1.55% APY, and neobanks like Chime and N26 offer above-average APYs too.Though the Fed slashing interest rates to zero toward the start of the coronavirus crisis took some wind out of their sails in terms of the APYs they're offering, neobanks should still look to increase awareness of their high-yield savings account offerings. Some consumers may be looking for ways to maximize their newfound savings, and promoting the benefits of their offerings via marketing campaigns could pay off for neobanks in increased signups and deposits — especially if continued social distancing means that consumers will continue saving more.Big banks can introduce customers to their personal finance management (PFM) features. With savings on the rise, there could be an increased appetite among consumers for tools that help them manage their money and put their savings to good use. Consumers largely want these tools through their banking channels: Over 75% of respondents to an RFi study said they would prefer to use PFM tools from their primary financial services provider — typically a bank — while just 6% said they'd prefer PFM tools from fintechs or neobanks.This makes it an ideal time for banks to increase awareness around their available tools, such as by prompting customers with the tools when they get a deposit or move money into savings. By increasing adoption of these tools, banks could encourage the formation of savings habits that will last beyond the current crisis: Chase, for example, offers Autosave, a digital feature that allows customers to set a savings goal as well as the frequency and amount they'd like to contribute to that goal. Banks should streamline their digital account opening processes in response to the higher personal savings rate. As consumers shelter in place and banks close branches or modify hours, the majority of banking services are being offered remotely, which means consumers looking to open a new savings account likely must do so digitally.Even prior to the pandemic, digital account opening was in demand: 58% of mobile banking users who responded to Business Insider Intelligence's US Mobile Banking Competitive Edge Study 2019 (enterprise only) called the ability to open a new savings account in a mobile banking app “extremely” or “very” valuable. Chase, for example, saw over 2 million accounts opened digitally in 2019, and that number could be higher this year.To avoid discouraging any customer who is interested in opening a savings account during this time, banks should ensure that digital account opening processes are available, reliable, and easy to use — otherwise they could miss out on a potential silver lining of the coronavirus crisis.

Read more

AUS GLOBAL partners with the United Nations to promote Global Sustainable Development

We are honored to share that AUS GLOBAL, as an invited guest of the United Nations forum on Science, Technology and Innovation (UNSTI), successfully completed the important mission of this event on June 20, 2024 at the Palais des Nations in Geneva, Switzerland.The forum brought together dignitaries and renowned business people from around the world to discuss important topics such as global fintech development and environmental protection.

Bank of America hires Citi exec Diane Daley for AI governance role - Business Insider

Diane Daley spent over two decades at Citigroup, eventually serving as a managing director and the head of finance and risk management infrastructure.

Outlook for real estate markets, jobs, and opportunities - Business Insider

Flex-office firms are struggling, and companies are rethinking leases for offices. Here's how real-estate markets, jobs, and deals are being impacted.

Warren Buffett's lack of stock purchases worries Leon Cooperman - Business Insider

The hedge fund boss said the restraint shown by the "greatest investor in my generation" is a red flag for investors.

WikiFX Broker

Latest News

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Eurozone Economy Stalls as Demand Evaporates

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Nigeria Outlook: FX Stability Critical to Growth as Fiscal Revenue Surges

AUD/JPY Divergence: Aussie Service Boom Contrasts with Japan's Fiscal "Truss Moment"

ZarVista Regulatory Status: A Deep Look into Licenses and High-Risk Warnings

KODDPA Review: Safety, Regulation & Forex Trading Details

Rate Calc