Top 5 Events: May Eurozone Inflation Report & EURJPY Price Forecast

Abstract:The initial May Eurozone inflation report us due on Tuesday, June 4 at 09:00 GMT.

Eurozone Inflation Report Talking Points:

The initial May Eurozone inflation report is due on Tuesday, June 4 at 09:00 GMT.

Soft inflation readings will underscore the necessity for the European Central Bank to take dovish policy actions at the June ECB rate decision.

Recent changes in retail trader positioning suggest that EURJPY could decline further in the days ahead.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

06/04 TUESDAY | 09:00 GMT | EUR Eurozone Consumer Price Index (MAY A)

{7}

The preliminary May Eurozone Consumer Price Index is due on Tuesday, just days before European Central Bank policymakers meet for their June policy meeting. According to Bloomberg News, the headline Eurozone inflation reading is due in at 1.3% from 1.7% (y/y), while the core reading is due in at 0.9% from 1.3% (y/y).

{7}{8}

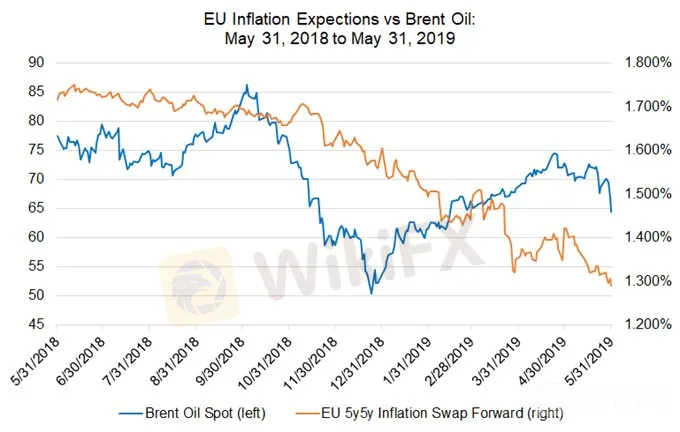

With inflation expectations falling precipitously in the past few weeks – since May 5, the 5y5y inflation swap forwards have declined by 10-bps from 1.404% to 1.291% – its seems highly likely that the May inflation report will not only be weak, but it will be used as the basis for more dovish policy action by the ECB at their June meeting.

{8}

Eurozone Inflation Expectations Have Plunged Despite Brent Oil Holding Steady

Pairs to Watch: EURGBP, EURJPY, EURUSD

{12}

EURJPY Technical Analysis: Daily Price Chart January 2018 to May 2019) (Chart 2)

{12}

The bearish breakout from the symmetrical triangle continues to drive EURJPY prices lower. Price has closed below the daily 21-EMA every session since April 23, and the drop to fresh yearly lows at the end of May portends to more weakness at the start of June.

From a momentum basis, there is no reason to be bullish. EURJPY price is below the daily 8-, 13-, and 21-EMA envelope. Meanwhile, both daily MACD and Slow Stochastics continue to trend lower in bearish territory; the latter of which has sustained an oversold condition, typically a sign of strong bearish momentum. The rising trendline from the 2012 and 2016 swing lows is now in focus near 120.50.

IG Client Sentiment Index: EURJPY (May 31, 2019) (Chart 3)

EURJPY: Retail trader data shows 71.8% of traders are net-long with the ratio of traders long to short at 2.55 to 1. In fact, traders have remained net-long since Apr 25 when EURJPY traded near 125.814; price has moved 3.8% lower since then. The number of traders net-long is 2.4% lower than yesterday and 2.9% lower from last week, while the number of traders net-short is 33.8% lower than yesterday and 27.4% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURJPY prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURJPY-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX

Read more

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

EUR/USD is mixed to bearish, influenced by resistance levels and upcoming data. GBP/USD is bullish with the pound at four-month highs on positive UK data and hawkish BoE comments. EUR/GBP remains volatile, reflecting diverging economic conditions in the Eurozone and the UK.

Europe Analysis: EUR/USD, GBP/USD, EUR/GBP

European trading is subdued due to the U.S. holiday, with the euro benefiting from weak U.S. data. The pound rises ahead of the UK election, supported by market sentiment. ECB President Christine Lagarde's comments on interest rates support the euro. Overall, mixed sentiment prevails with cautious trading expected. Key economic events include Eurozone retail sales, Germany's industrial production, and UK services PMI.

Rate Rumble: RBNZ, BoC, and ECB Take Centre Stage

The New Zealand central bank maintain its benchmark interest rate at 5.50% as expected during its previous meeting. While there was no surprise of the central bank paused rates, the less hawkish tone was a surprise as 23% of the market surveyed by Reuters predicted an interest rate hike. In February, the rate of consumer price growth in the United States picked up pace with the reading came in at 3.2%, surpassing expectations of 3.1% for underlying inflation.

Forex Market Recap: USD Rebounds, Eurozone Inflation Surges, Bitcoin Plunges

A snapshot of Thursday's forex market trends, including the U.S. dollar's rebound, Eurozone inflation data, and Bitcoin's price movement.

WikiFX Broker

Latest News

Short-Term Pressure Mounts on Gold as Risk Sentiment Improves

How Will the U.S.-China Trade Deal Affect the Dollar and Global Markets?

Radiant DAO Proposes Compensation Plan for Wallet Losses

BitGo Secures MiCA License, Expands Crypto Services Across the EU

Big Changes at Saxo Bank: What Traders and Partners Need to Know

Traders Warned to Stay Alert Amid Growing Exposures for INGOT Brokers

WELTRADE's transformation from Reliable to a Problematic Broker

How UK-China Financial Cooperation Is Shaping Global Resilience

Deriv Review 2025: A Growing Force in Online Trading

WikiFX Broker Assessment Series | WCG Markets: Is It Trustworthy?

Rate Calc