USD/NOK Eyeing Norway CPI - Slower EU Growth May Hurt Nordics

Abstract:The Norwegian Krone will be closely eyeing tomorrow‘s CPI data as the European economy slows down and may begin to weigh on Norway’s performance.

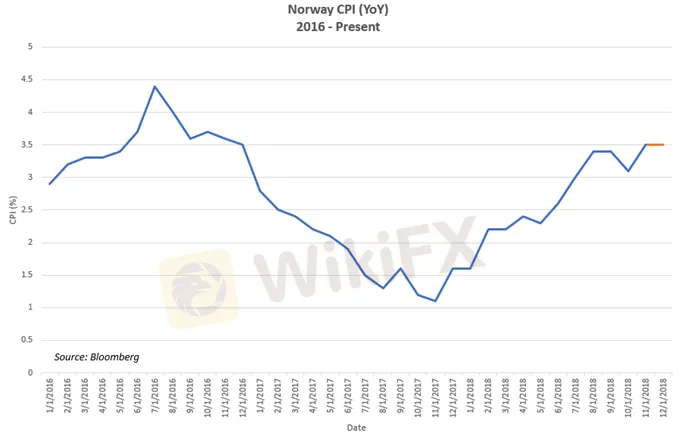

Norwegian Krone traders may be closely watching tomorrows scheduled release of year-on-year CPI data. The current forecast stands at 3.3 percent with the previous at 3.5 percent. Despite reaching its highest point since December 2016, the most recent price data has stalled as most GDP reports on Friday fell short of expectations.

On the same day, the OBX – Norways benchmark equity index – shaved off almost two percent, the biggest drop since December 27. The slower economic activity suggests CPI data may fall short of expectations and hurt the Norwegian Krone.

OBX Equity Index – Daily Chart

This comes during a time when the European economy is beginning to slow down as risks associated with political turmoil are rising. The third largest eurozone economy is in a technical recession with Germany not far behind as France deals with domestic protests that are weighing on the economys performance.

With most economic activity in Norway being dependent on Europe‘s growth, it is possible that the de-acceleration in the EU could begin to weigh on the performance in the Nordic countries. Norway especially could be susceptible to a European fall in demand due to the Scandinavian country’s huge petroleum sector that is sensitive to changes in the business cycle. It also accounts for 31 percent of all the EUs natural gas imports.

Since its last policy meeting, the Norges Bank – Norways central bank – has stated it will “most likely” raise rates in March. However, policymakers must be careful not to tighten credit conditions at a time when economic activity is slowing and uncertainty looms over matters such as Brexit and the US-China trade war.

Conversely, the central bank may want to squeeze in a rate hike so there is more room to cut if economic conditions warrant such an action. Given the outlook provided by the World Bank and IMF, such a policy measure is not entirely outlandish.

USD/NOK has closed higher for a week straight, bulldozing through several support levels and has gained over 2.5 percent since January 31. The pair is now trading above a key support at 8.6323, with the fundamental outlook suggesting the pair possibly has significant upward potential. In the short term, the pair may experience some resistance at 8.6244.

USD/NOK – Daily Chart

Read more

KVB Market Analysis | 28 August: Yen Strengthens on BoJ Rate Hike Hints; USD/JPY Faces Uncertainty

The Japanese Yen rose 0.7% against the US Dollar after BoJ Governor Kazuo Ueda hinted at potential rate hikes. This coincided with a recovery in Asian markets, aided by stronger Chinese stocks. With the July FOMC minutes already pointing to a September rate cut, the US Dollar might edge higher into the weekend.

KVB Market Analysis | 27 August: AUD/USD Holds Below Seven-Month High Amid Divergent Central Bank Policies

The Australian Dollar (AUD) traded sideways against the US Dollar (USD) on Tuesday, staying just below the seven-month high of 0.6798 reached on Monday. The downside for the AUD/USD pair is expected to be limited due to differing policy outlooks between the Reserve Bank of Australia (RBA) and the US Federal Reserve. The RBA Minutes indicated that a rate cut is unlikely soon, and Governor Michele Bullock affirmed the central bank's readiness to raise rates again if necessary to combat inflation.

KVB Market Analysis | 23 August: JPY Gains Ground Against USD as BoJ Signals Possible Rate Hike

JPY strengthened against the USD, pushing USD/JPY near 145.00, driven by strong inflation data and BoJ rate hike expectations. Japan's strong Q2 GDP growth added support. However, USD gains may be limited by expectations of a Fed rate cut in September.

KVB Market Analysis | 22 August: Gold Stays Strong Above $2,500 as Fed Rate Cut Hints Loom

Gold prices remain above $2,500, near record highs, as investors await the Federal Open Market Committee minutes for confirmation of a potential Fed rate cut in September. The Fed's dovish shift, prioritizing employment over inflation, has weakened the US Dollar, boosting gold. A recent revision showing the US created 818,000 fewer jobs than initially reported also strengthens the case for a rate cut.

WikiFX Broker

Latest News

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

Evest Broker Review: Regulated, but Complaints Persist

Is Eightcap Safe or Scam? Eightcap User Reputation : Looking at Real User Reviews

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

Rate Calc