Atlanta Capital Markets Spreads, leverage, minimum deposit Revealed

Abstract:Atlanta Capital Markets is an unregulated brokerage firm registered in the United Kingdom. The company offers a range of investment options including forex, indices, precious metals, share CFDs, energies, cryptocurrencies through its advanced trading platforms such as AAT, MT5 and MT4.

| Atlanta Capital Markets Review Summary | |

| Founded | 1-2 years |

| Registered Country/Region | United Kingdom |

| Regulation | Not regulated |

| Market Instruments | Forex, Indices, Precious metals, Share CFDs, Energies, Cryptocurrencies |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| Spread | From 0 pip |

| Trading Platform | AAT, MT5, MT4 |

| Min Deposit | $100 |

| Customer Support | Phone: +44 0 20 2266 9720Email: support@acmimarkets.comAddress: ACMMarkets UK HQ 78 Basinghall str., City of London, EC2V 5BQ, UK |

Atlanta Capital Markets Information

Atlanta Capital Markets is an unregulated brokerage firm registered in the United Kingdom. The company offers a range of investment options including forex, indices, precious metals, share CFDs, energies, cryptocurrencies through its advanced trading platforms such as AAT, MT5 and MT4.

Pros and Cons

| Pros | Cons |

| Leverage options available (up to 1:500) | No valid regulatory certificates |

| Various trading platforms (AAT, MT5, MT4) | Shared CFDs are only available on ECN accounts |

| Demo account available | Higher spreads for STP accounts |

Is Atlanta Capital Markets Legit?

Atlanta Capital Markets is currently in a state of no effective supervision. Therefore, there is a high risk of investment with Atlanta Capital Markets.

What Can I Trade on Atlanta Capital Markets?

Atlanta Capital Markets offers more than 180 tradable instruments. It provides traders the opportunity to trade Forex, Indices, Precious metals, Share CFDs, Energies, and Cryptocurrencies.

| Tradable Instruments | Supported |

| Commodities | ❌ |

| Indices | ✔ |

| Currencies | ❌ |

| Crypto currencies | ✔ |

| Shares CFDs | ✔ |

| Forex | ✔ |

| Energies | ✔ |

| Precious metals | ✔ |

| Futures | ❌ |

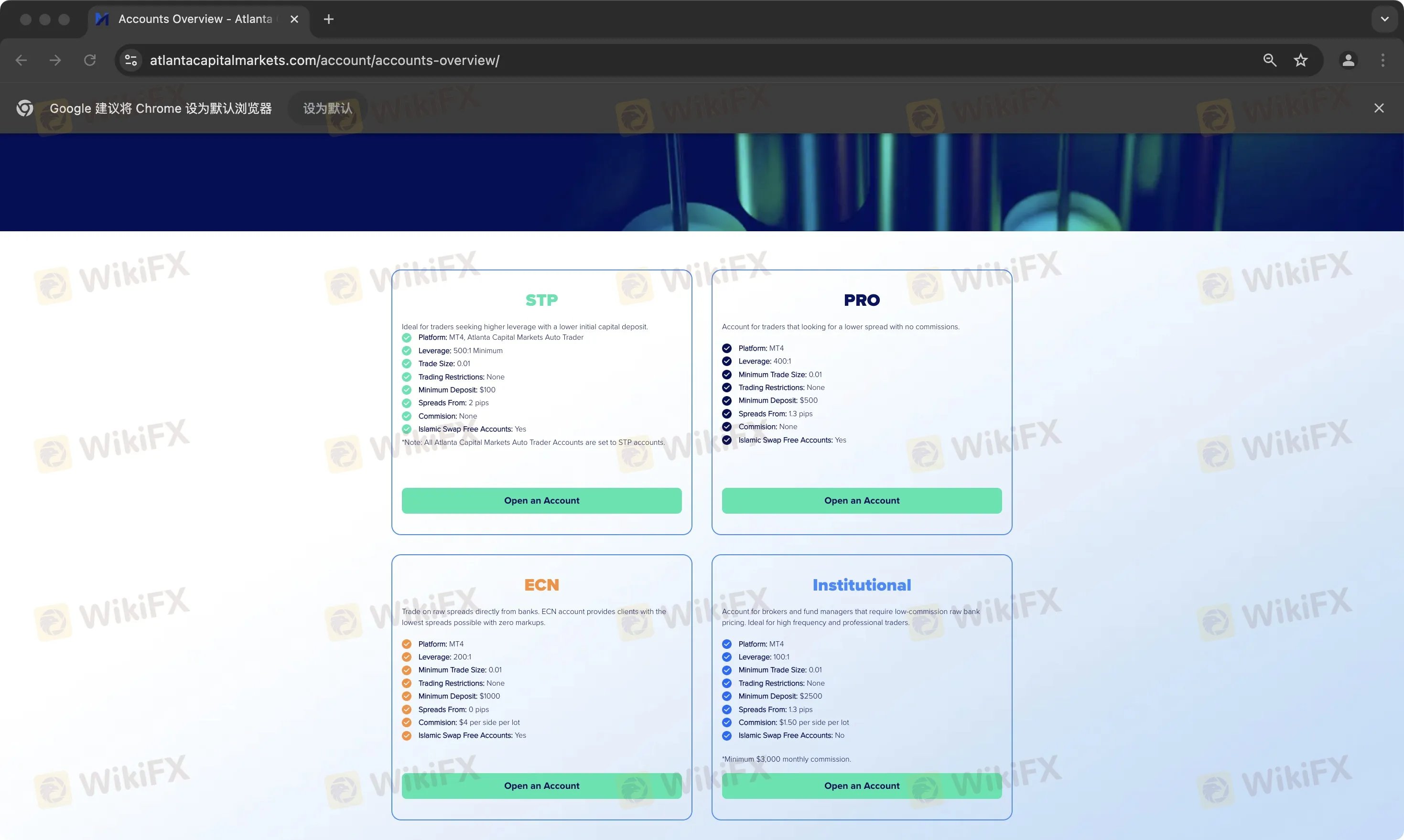

Account Types

Atlanta Capital Markets offers four live account types, namely STP account, PRO account, ECN account and Institutional account.

In addition, Atlanta Capital Markets also offers demo accounts.

Besides, shared CFDS are only available for ECN accounts.

| Account Type | STP | PRO | ECN | Institutional |

| Minimum Trade Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Trading Restrictions | None | None | None | None |

| Minimum Deposit | $100 | $500 | $1,000 | $2,500 |

| Spreads From | 2 pips | 1.3 pips | 0 pips | 1.3 pips |

| Commission | None | None | $4 per side per lot | $1.50 per side per lot |

| Islamic Swap Free Accounts | Yes | Yes | Yes | No (minimum $3,000 monthly commission) |

Leverage

The leverage ratio varies between different account types, with 500:1 for STP accounts, 400:1 for PRO accounts, 200:1 for ECN accounts, and 100:1 for Institutional accounts

| Account Type | STP | PRO | ECN | Institutional |

| Leverage | 500:1 | 400:1 | 200:1 | 100:1 |

Atlanta Capital Markets Fees

STP, PRO, ECN and Institutional accounts are different in terms of speads. STP spreads start at 2.0, PRO spreads start at 1.3, and ECN account spreads start at 0.0. Institutional account spreads start at 1.3 pips. STP and PRO commissions are free. Fees for ECN accounts and institutional accounts are 4 and 1.5 respectively. Finally, STP, PRO, ECN accounts are swap-free, except for institutional accounts.

| Account type | Fees |

| STP | Spreads From 2.0 pips, commission-free, swap-free |

| PRO | Spreads From 1.3 pips, commission-free, swap-free |

| ECN | Spreads From 0.0 pips, commission: $4 per side per lot, swap-free |

| Institutional | Spreads From 1.3 pips, commission: $1.50 per side per lot, no swap-free |

Trading Platform

Atlanta Capital Markets offers its proprietary platform, namely the Atlanta Capital Markets Automated Trader (AAT). This platform is designed for novice traders or traders who do not have time to trade. Other popular platforms such as MT5 and MT4 are also available here.

| Trading Platform | Supported | Available Devices | Suitable for |

| Atlanta Capital Markets Auto Trader | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

| MT5 | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

| MT4 | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

Deposit and Withdrawal

Atlanta Capital Markets offers clients nine options for deposit and withdrawal . Financing via Swift, Dragonpay or credit and debit cards (Zotapay) may take up to 1 business day. Other deposit options support instant financing.

Withdrawals are processed within 24 hours on weekdays. Depending on the withdrawal method, the funds will usually reach your account within a few hours.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Credit & Debit Card (VISA, Mastercard) | N/A | No Commission | Instant funding |

| Bank Transfer (SWIFT) | N/A | No deposit fees charged from ACM Markets. Atlanta Capital Markets will cover your International fees up to 50 USD for deposit greater than 10,000 USD | 1 business day |

| Neteller | N/A | No Commission | Instant funding |

| Skrill | N/A | No Commission | Instant funding |

| Local Bank Transfer (PayTrust88) | N/A | No Commission | Instant funding |

| Credit & Debit Card | N/A | No Commission | Instant funding |

| Dragonpay | N/A | No Commission | 1 business day |

| Credit & Debit Card (Fasapay, Zotapay) | N/A | No Commission | Instant funding |

| Credit & Debit Card (Zotapay) | N/A | No Commission | 1 business day |

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Credit & Debit Card (VISA, Mastercard) | N/A | No Commission | Within 24 hours |

| Bank Transfer (SWIFT) | N/A | No Commission | Within 24 hours |

| Neteller | N/A | No Commission | Within 24 hours |

| Skrill | N/A | No Commission | Within 24 hours |

| Local Bank Transfer (PayTrust88) | N/A | No Commission | Within 24 hours |

| Credit & Debit Card | N/A | No Commission | Within 24 hours |

| Dragonpay | N/A | No Commission | Within 24 hours |

| Credit & Debit Card (Fasapay, Zotapay) | N/A | No Commission | Within 24 hours |

| Credit & Debit Card (Zotapay) | N/A | No Commission | Within 24 hours |

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

The Problem With GDP

Plus500 Allegations Exposed in Real Trader Cases

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

US Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

HEADWAY: The Fast Track to Financial Dead-Ends?

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

Rate Calc