RISEFX Spreads, leverage, minimum deposit Revealed

Abstract:RISE FX is a brokerage firm registered in St. Vincent and the Grenadines and offers Forex Commodities, Indices, Stocks, Energies, Cryptocurrency as financial instruments to its clients. However, RISE FX currently has no valid regulations from any recognized financial bodies.

| RISE FX Review Summary in 9 Points | |

| Registered Country/Region | St. Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex Commodities, Indices, Stocks, Energies, Cryptocurrency |

| Demo Account | Not Available |

| Leverage | Up to 1:1000 |

| EUR/USD Spread | From 0.0 pips |

| Trading Platforms | MT5 |

| Minimum Deposit | USD10 |

| Customer Support | Email, address, contact us form, Facebook, Twitter, LinkedIn, Instagram, YouTube, WhatsApp |

What is RISE FX?

RISE FX is a brokerage firm registered in St. Vincent and the Grenadines and offers Forex Commodities, Indices, Stocks, Energies, Cryptocurrency as financial instruments to its clients. However, RISE FX currently has no valid regulations from any recognized financial bodies.

In the upcoming article, we will comprehensively analyze this broker's attributes from various angles, delivering clear and well-organized information. If you find this topic intriguing, we encourage you to continue reading. At the conclusion of the article, we will provide a concise summary to offer you a quick grasp of the broker's key features.

Pros & Cons

| Pros | Cons |

| Tiered accounts | Unregulated |

| Tight starting spreads from 0 pips | Commissions charged for for PRO and VIP accounts |

| MT5 trading platform | |

| Zero commission for for Standard and Classic accounts | |

| Acceptable minimum deposit |

Pros:

Tiered accounts: RISE FX offers 4 tiered accounts catering to various trading needs and experience levels, ensuring tailored services for all types of traders.

Tight starting spreads from 0 pips: Competitive spreads from the start provide favorable trading conditions, enhancing profit potential for traders.

MT5 trading platform: Utilizing the renowned MT5 platform grants access to advanced trading features and technical analysis tools, empowering traders to make informed decisions.

Zero commission for Standard and Classic accounts: Commission-free trading for these accounts reduces trading costs, allowing traders to keep more of their profits.

Acceptable minimum deposit: With reasonable minimum deposit requirements from $10, RISE FX offers accessibility to traders of different financial backgrounds.

Cons:

Unregulated: The lack of regulation poses risks for traders in terms of fund security and legal protection, affecting trust and reliability.

Commissions charged for PRO and VIP accounts: Although these accounts offer enhanced features, the imposition of commissions increases trading costs for users, impacting profitability.

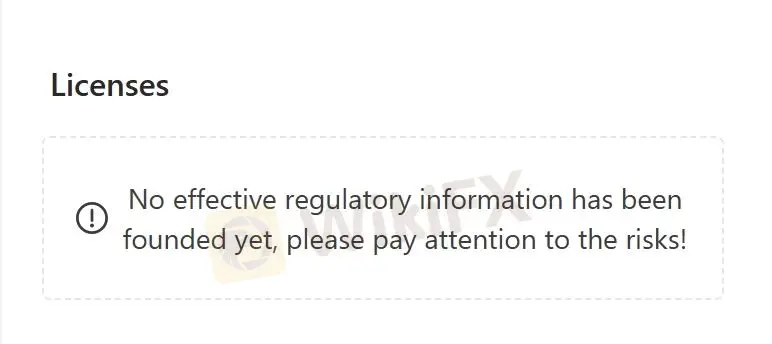

Is RISE FX Legit or a Scam?

When considering the safety of a brokerage like RISE FX or any other platform, it's important to conduct thorough research and consider various factors.

Regulatory sight: The absence of valid regulations under which the broker operates signifies potential risks, as it lacks the guarantee of comprehensive protection for traders engaging on its platform.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedback from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: RISE FX prioritizes data security through their privacy policy. This entails outlining practices for information collection, storage, and use, adhering to industry standards to safeguard your personal information.

Ultimately, the choice to trade with RISE FX is a personal decision. It is important to thoroughly assess the risks and benefits before arriving at a conclusion.

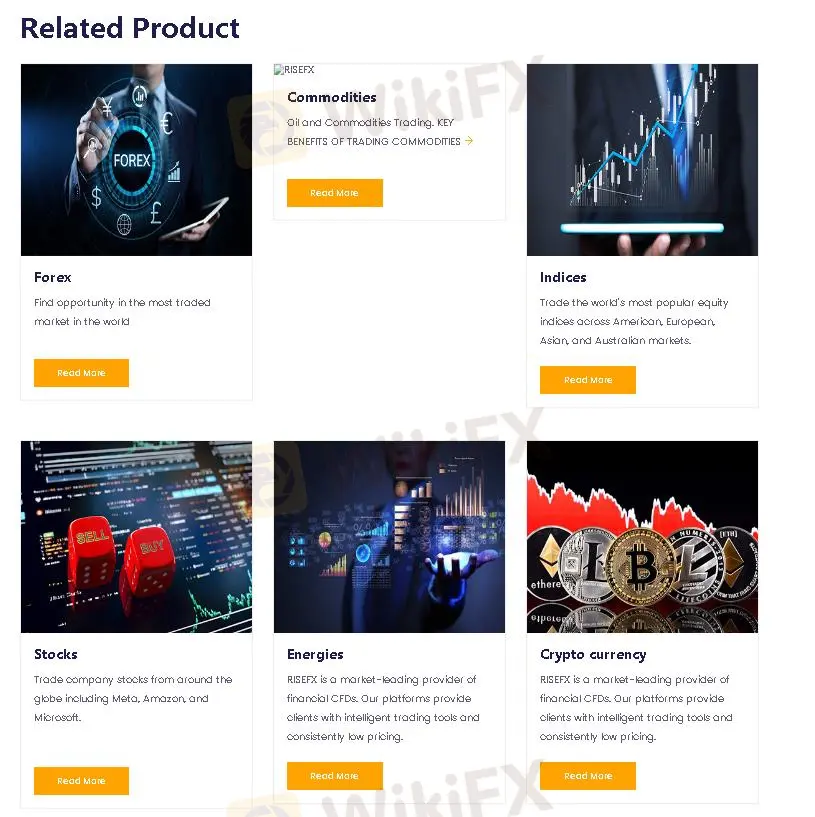

Market Instruments

RISE FX offers a diverse range of financial instruments to suit your trading preferences。

From the highly liquid and dynamic Forex market to commodities such as oil, gold, and agricultural products, traders can seize opportunities across various asset classes.

Additionally, RISE FX offers access to popular equity indices from American, European, Asian, and Australian markets, allowing traders to diversify their portfolios globally.

Moreover, clients can trade stocks of renowned companies like Meta, Amazon, and Microsoft, further expanding their investment options.

Furthermore, RISE FX enables traders to engage in the energy market, including crude oil and natural gas, providing exposure to vital sectors of the global economy.

Additionally, with the rising popularity of cryptocurrencies, RISE FX offers trading opportunities in digital assets like Bitcoin, Ethereum, and others, leveraging its expertise in financial CFDs.

Account Types

The broker provides a range of account types tailored to meet the diverse needs of traders.

| Account Type | Minimum Deposit |

| Standard | $10 |

| Classic | $500 |

| Pro | $2,000 |

| VIP | $5,000 |

The Standard account, requiring a minimum deposit of just $10, offers accessibility to those starting out in the market.

For traders seeking more features and capabilities, the Classic account demands a minimum deposit of $500, providing a step-up in benefits while still remaining accessible.

Moving up the ladder, the Pro account, requiring a minimum deposit of $2000, caters to experienced traders with enhanced features and opportunities. Finally, for elite traders seeking top-tier benefits, the VIP account demands a minimum deposit of $5000, granting access to premium services and exclusive advantages.

How to Open an Account?

To open an account with RISE FX, you have to follow below steps:

Visit the RISE FX website, locate and click on the 'Open Account' button on the mainpage.

Fill in the necessary personal details required and choose an account type.

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

Leverage

In terms of leverage, the broker offers a progressive scale across its account types.

| Account Type | Maximum Leverage |

| Standard | 1:200 |

| Classic | 1:300 |

| Pro | 1:500 |

| VIP | 1:1000 |

The Standard account provides leverage up to 1:200, offering moderate leverage suitable for beginners and cautious traders.

The Classic account extends this leverage to up to 1:300, providing a slightly higher level of leverage for more experienced traders.

Stepping into the Pro account, traders can access leverage up to 1:500, offering significant flexibility and potential for seasoned professionals.

For elite traders opting for the VIP account, leverage goes up to an impressive 1:1000, providing unparalleled opportunities for advanced strategies and positions.

However, we recommend you to use leverage cautiously since it not only magnify profits, but also risks and losses.

Spread & Commission

When it comes to spreads and commissions, the broker offers competitive offerings across its account types.

The Standard account starts with spreads from 1.5 pips, providing a reasonable starting point for entry-level traders. With the Classic account, spreads start from 1 pip, offering tighter spreads for enhanced trading conditions. The Pro account boasts spreads from 0.7 pips and VIP account spreads from 0.0 pips, catering to traders who demand precision and efficiency in their trades.

In terms of commissions, the Pro and VIP accounts incur commissions, aligning with their advanced features and benefits, while the Standard and Classic accounts operate on a commission-free model, ensuring straightforward pricing for traders at different levels.

| Account Type | Spread | Commission |

| Standard | From 1.5 pips | Free |

| Classic | From 1 pips | Free |

| Pro | From 0.7 pips | Yes |

| VIP | From 0 pip | Yes |

Trading Platforms

RISE FX offers the renowned MT5 platform, known for its professional-grade features and user-friendly interface, making it suitable for both experienced and novice traders alike.

As one of the world's most popular trading platforms, MT5 provides stability and simplicity, along with a plethora of trading and technical analysis tools. Whether you're looking for pre-built trading strategies or prefer to implement your own, MT5 caters to your needs with its customizable options.

With access to a wide range of indicators and technical analysis tools like Simple Moving Averages, Fibonacci Retracement, and Moving Average Crossovers, traders can make informed decisions and execute trades with confidence.

However, there's no download link or access entry to the platform on the broker's webpage, it's important to confirm with the broker before engaging in trading activities about this.

Customer Service

RISE FX provides comprehensive customer service avenues including email, address, and a contact us form for efficient communication. Additionally, they engage with clients through social media platforms such as Facebook, Twitter, LinkedIn, Instagram, and YouTube, and offer direct support via WhatsApp, ensuring accessibility and support across various channels.

Address: P. O. Box 1912, Beachmont Kingstown St, Vincent and the Grenadines.

Email: enquiry@therisefx.com.

Conclusion

RISE FX, a brokerage firm registered in St. Vincent and the Grenadines, offers Forex Commodities, Indices, Stocks, Energies and Cryptocurrency as market instruments to traders. However, the current lack of regulation from recognized authorities should prompt concerns for investors.

Therefore, individuals considering RISE FX as their broker should be cautious, do own research and explore alternative, regulated brokers that prioritize transparency, security, and client protection

Frequently Asked Questions

| Question 1: | Is RISE FX regulated? |

| Answer 1: | No. It has been verified that this broker is currently under no valid regulation. |

| Question 2: | Does RISE FX offer demo account? |

| Answer 2: | No. |

| Question 3: | Is RISE FX a good broker for beginners? |

| Answer 3: | No. It is not a good choice for beginners because it is unregulated by any recognized financial authorities. |

| Question 4: | Does RISE FX offer the industry leading MT4 & MT5? |

| Answer 4: | Yes, it offers MT5 but no access entry on its website, which requires direct clarification from the broker. |

| Question 5: | Whats the minimum deposit does RISE FX request? |

| Answer 5: | RISE FX requires a minimum deposit from USD10. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Latest News

Spot Forex Trading Explained: Definition, How It Works and Key Factors to Know

AssetsFX Review 2025: Is This Broker Safe or a Red Flag?

Webull UK announces its new offer

RM66 Million Lost in Ponzi Scheme Allegedly Tied to Datuk Businessman

Starmer meets Modi on his first visit to India

FXONET Exposed: Traders Report Scam Allegations & Major Capital Losses

ScoreCM Faces Traders’ Wrath: Unprofessional Behavior & Withdrawal Delays Spoil Investment Mood

Kazakhstan Cracks Down Unlicensed Crypto Exchanges

Traders Expose Major Flaws in Moomoo’s Operations: Payout Issues, Poor Support & More

How to Spot and Avoid Financial Scams

Rate Calc