User Reviews

More

User comment

1

CommentsWrite a review

2024-03-28 21:20

2024-03-28 21:20

Score

15-20 years

15-20 yearsRegulated in Japan

Retail Forex License

Medium potential risk

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index7.83

Business Index8.89

Risk Management Index8.90

Software Index7.05

License Index7.83

Single Core

1G

40G

| YM Securities Review Summary | |

| Founded | 2007 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading Products | Stocks, Bonds, and Investment trusts |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | / |

YM Securities is a securities company under Japan's Yamaguchi Financial Group (YMFG), headquartered in Japan. It primarily offers trading in stocks, bonds, and investment trusts.

| Pros | Cons |

| Regulated by FSA | Complex fee structure |

| Long operational history | High membership threshold |

| Membership benefit system (80% discount for pre-deposited assets over 10,000,000 JPY) | Japanese content mainly |

| Limited types of trading products | |

| Unclear customer support channels |

YM Securities is a legally registered securities brokerage in Japan, regulatedby the Financial Services Agency (FSA). Its registration number is 中国財務局長(金商)第8号.

YM Securities offers domestic and foreign stocks, bonds, and investment trusts (funds) that invest in themes such as domestic and foreign stocks, bonds, and real estate, and supports regular savings plans (investment trust accumulation).

| Trading Products | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

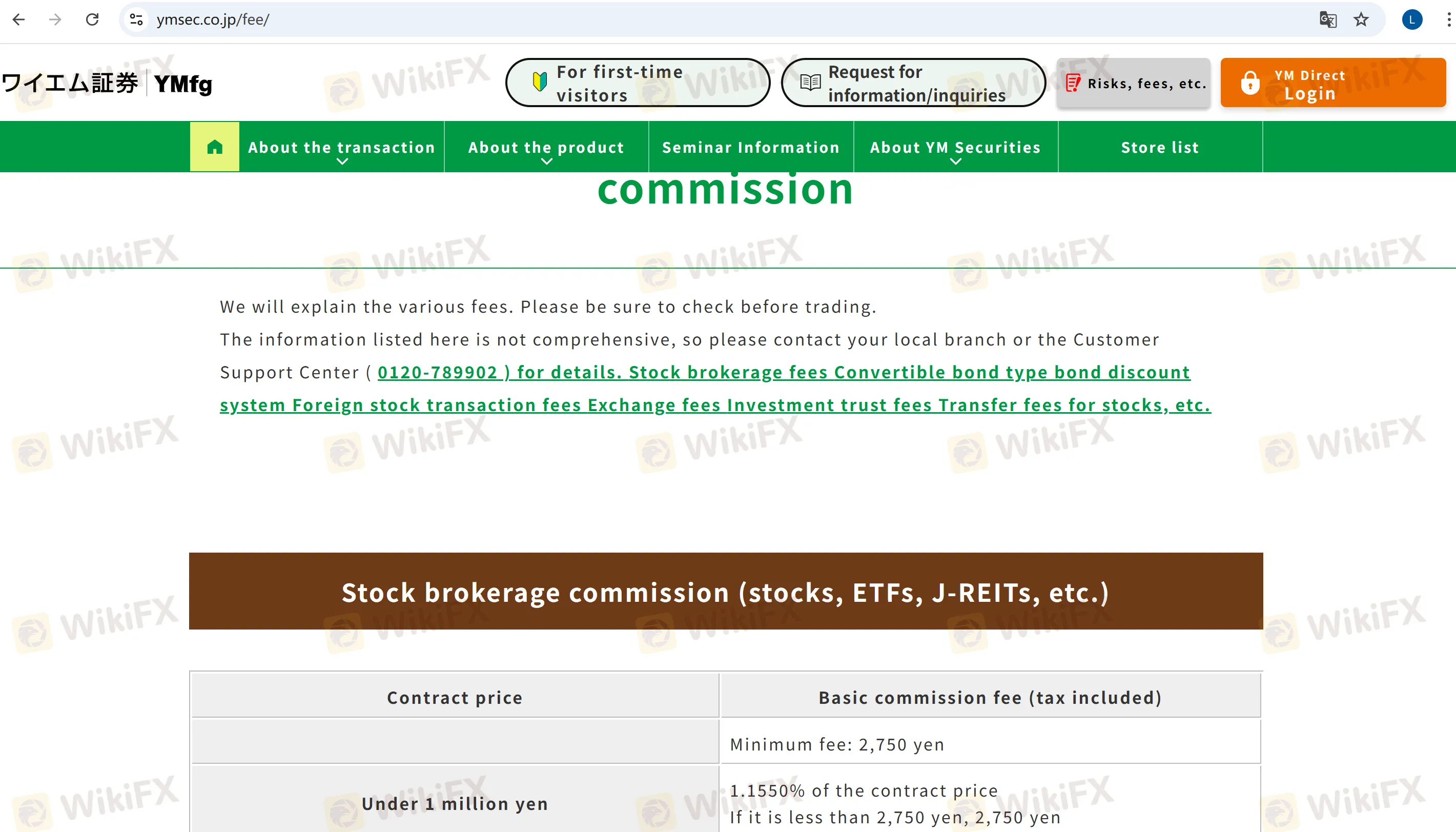

The main fees of YM Securities are as follows:

Stock Trading Fees (Domestic Stocks, ETFs, etc.): Minimum 2,750 JPY (tax included), charged in tiers based on transaction amount (e.g., 1.155% for amounts under 1,000,000 JPY; 0.88% + 2,750 JPY for 1,000,000–5,000,000 JPY). A 20% discount is available for members.

Foreign Stock Trading Fees: Includes local fees (e.g., exchange fees) and domestic agency fees (e.g., 1.43% for amounts under 1,000,000 JPY).

Bond Trading Fees: Convertible bond-type products have a minimum fee of 2,750 JPY, charged in tiers based on transaction amount (e.g., 1.1% for amounts under 1,000,000 JPY).

Other Fees: Account transfer fee: Starts at 1,100 JPY per unit, with a maximum of 6,600 JPY.

Deposit

Bank Transfer: Supports accounts at Yamaguchi Bank, Momiji Bank, and Kitakyushu Bank. Handling fees are generally covered by brokerage.

EASY NET: A free instant fund transfer service linked to group banks, operable via the online platform or telephone instructions.

Withdrawal

Requests can be made via the online platform or telephone, and funds will be automatically transferred to the pre-registered bank account. You can specify a working day from the next day for the funds to arrive.

More

User comment

1

CommentsWrite a review

2024-03-28 21:20

2024-03-28 21:20