User Reviews

More

User comment

5

CommentsWrite a review

2025-07-28 10:00

2025-07-28 10:00

2024-03-27 15:49

2024-03-27 15:49

Score

5-10 years

5-10 yearsRegulated in Australia

Market Maker (MM)

Self-developed

Global Business

Influence

Add brokers

Comparison

Expose

Exposure

Score

Regulatory Index8.11

Business Index7.51

Risk Management Index9.70

Software Index7.30

License Index8.12

Single Core

1G

40G

More

Company Name

OzForex Limited

Company Abbreviation

OFX

Platform registered country and region

Australia

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Features | OFX |

| Company Name | OFX (Previously known as OzForex) |

| Registered in | Australia |

| Regulated | Yes (By ASIC in Australia) |

| Years of Establishment | Since 1998 |

| Trading Instruments | Currency Exchange, International Payments |

| Account Types | Small Business, Medium Business, Online Sellers |

| Minimum Initial Deposit | Not Applicable (Focuses on currency exchange, not trading) |

| Minimum Spread | Not Applicable (Offers competitive spreads in currency exchange) |

| Trading Platform | Proprietary Web and Mobile App |

| Deposit and Withdrawal Method | Bank Transfers, Credit/Debit Cards |

| Customer Service | 24/7, Email, Telephone, Social Media |

OFX is an Australian-based financial services company, founded with the aim of providing a more efficient and equitable solution for international money transfers. Established over 25 years ago, OFX has served over 1 million customers, facilitating transfers in 55+ currencies to 197 countries.

Beyond competitive exchange rates, OFX provides personalized 24/7 customer support.

OFX claims to operate under the supervision of over 50 global regulators and collaborates with a carefully selected network of banking partners to ensure secure and reliable money transfers.

OFX is entirely legitimate and not a scam. It is regulated by ASIC in Market Making(MM) business.

They have physical offices in several countries around the world, including well-regulated financial markets like the United States and the United Kingdom. This not only provides a physical presence but also implies adherence to the regulatory requirements of these jurisdictions.

Furthermore, OFX has been in business for several years, gaining endorsements and partnerships with well-known entities like Travelex, MoneyGram, Xero, and Capital One 360, among others. These long-standing relationships add another layer of credibility to the firm.

Additionally, their website is encrypted, ensuring that your data is kept secure.

| Pros | Cons |

| Multi-currency support (over 50 currencies) | User interface could be improved |

| 24/7 customer support | Limited educational resources |

| Competitive exchange rates | No other financial instruments (stocks, cryptocurrencies) |

| Reputation and reliability | |

| Business-friendly features |

OFX specializes in currency exchange and international money transfers. The company does not offer a wide array of financial instruments like stocks, bonds, commodities, or cryptocurrencies. Their primary focus is to facilitate international money transfers at competitive rates and with transparent fee structures. This makes them highly specialized but also limited in scope if you're interested in a broader range of trading options.

The company supports over 50 currencies and allows transfers to more than 190 countries. This extensive support makes them a significant player in the global foreign exchange market. Whether you're a business that needs to pay overseas suppliers in different currencies or an individual looking to transfer funds internationally, OFX provides a dedicated platform for your needs.

OFX offers a variety of account types designed to meet the diverse needs of their customer base, from individuals and small businesses to medium enterprises and online sellers.

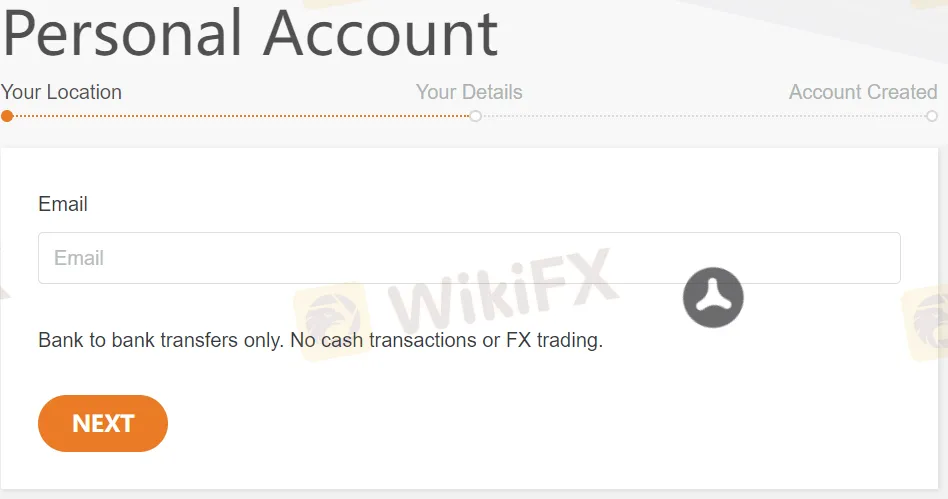

Here's a generalized step by step guide on how to open an account on a website like OFX:

OFX primarily deals with currency exchange and international payments, and as such, does not offer leveraged trading. Their services are tailored for direct currency conversion and transfer, making them a safer but less flexible option compared to typical forex trading platforms that offer leverage.

OFX aims to provide transparent and competitive pricing for its customers. Unlike many traditional banks, which often charge a markup of up to 5% on the interbank rate, OFX maintains much lower margins. Their revenue comes from the spread between the interbank rate and the rate they offer their customers. This allows OFX to offer competitive exchange rates, especially beneficial for businesses and individuals who frequently need to convert large sums of money.

The OFX trading platform is accessible through their website and mobile applications. While it does not offer the advanced charting tools, algorithms, or trading capabilities that specialized trading platforms do, it serves its primary purpose of facilitating currency exchange and international payments well. The interface is straightforward, with easy navigation, though some users might find it less user-friendly compared to platforms designed with trading in mind.

OFX's deposit and withdrawal methods are somewhat limited but are designed to be secure and efficient. Most transactions are conducted via bank transfers, ensuring the safety of funds. However, this might mean that transactions could take longer to process compared to platforms that accept credit or debit cards or e-wallets.

OFX offers a comprehensive customer support system to ensure that its customers' needs and inquiries are promptly attended to. Here are some of the key details:

Office Address: Their office is located at Fitzwilliams Court, 2 Leeson Close, Dublin 2, D02 YW24, Ireland.

Email: They can be contacted via email at customer.service@ofx.com for both personal and business clients. For business development, partnerships and strategic alliance queries, the contact email is solutionsemea@ofx.com.

Telephone: OFX provides dedicated phone lines for client support, available 24/7. The international number is +353 1 582 5307. They also have dedicated lines for Ireland (1 800 948 364), Germany (0800 181 7242), Spain (900 838628), and France (0805 080584).

| Features/ Broker | OFX | IronFX | OctaFX |

| Headquarters | Sydney, Australia | Limassol, Cyprus | Saint Vincent and the Grenadines |

| Specialization | Currency Exchange, International Payments | Forex, CFDs | Forex, CFDs, Cryptocurrencies |

| Account Types | Small Business, Medium Business, Online Sellers | Micro, Premium, VIP | Micro, Pro, ECN |

| Leverage | Not Available | Up to 1:1000 | Up to 1:500 |

| Spreads & Commissions | Competitive Spreads, No Commissions | Variable Spreads, Some Commissions | Low Spreads, No Commissions |

| Trading Platforms | Proprietary Web and Mobile App | MetaTrader 4, MetaTrader 5 | MetaTrader 4, MetaTrader 5, cTrader |

| Educational Resources | Limited | Extensive | Moderate |

When it comes to educational resources, OFX falls a bit short compared to other brokers and financial service providers. While they offer some basic guides and FAQs on currency exchange and international money transfers, they do not offer extensive educational materials, tutorials, or webinars that some other platforms provide. If you're new to the world of forex and international money transfers, you might find the educational offerings of OFX to be limited.

OFX is a legitimate and reliable option for individuals and businesses looking for specialized services in currency exchange and international payments. With a multi-country presence, a strong reputation, and the backing of several high-profile corporate partners, the company stands as a credible financial services provider. While it may not offer the diverse range of financial instruments or trading features that some other brokers provide, its specialization in foreign exchange makes it an excellent choice for those specific needs.

Its pros outweigh its cons, especially for businesses and individuals who don't require an expansive range of financial services but are seeking a specialized, reliable solution for their currency exchange and international money transfer needs.

A: While OFX does not offer traditional trading tools like stop-loss orders or leverage, it does provide forward contracts that allow you to lock in exchange rates for future transactions, which can be a useful risk management strategy.

A: OFX typically has a minimum transfer amount of around $1,000 or its equivalent in other currencies, making it more suitable for traders and businesses looking to move substantial sums internationally.

A: Yes, OFX provides API support that can enable automated currency transfers and conversions, which can be integrated into existing business systems for seamless financial operations.

A: Transaction speed depends on the currency pairs involved and the receiving bank. While OFX aims to complete transactions as quickly as possible, it is advisable to allow 1-2 business days for the funds to be received.

A: OFX's exchange rates are variable and influenced by the interbank exchange rates. However, once you lock in a rate for a specific transaction, it remains fixed for that particular deal.

A: Yes, OFX offers a Global Currency Account that allows you to hold, pay, and receive in multiple currencies, which can be beneficial for traders and businesses engaged in international commerce.

OFX is an Australian-based financial services company founded to provide a more efficient and equitable solution for international money transfers. Established over 25 years ago, OFX has served over 1 million customers and facilitated transfers in 55+ currencies to 197 countries.

WikiFX

WikiFX

The Association of Tennis Professionals (ATP), a tennis group, recently announced a collaboration with OFX to boost financial services.

WikiFX

WikiFX

The Australian financial services provider OFX has extended its presence in Germany by launching a new regional team across several German cities.

WikiFX

WikiFX

The AI-powered neobank Douugh (ASX: DOU), which recently acquired the share trading app Goodments, has announced a strategic alliance with OFX (ASX: OFX) to enhance foreign exchange services on the newly integrated platform.

WikiFX

WikiFX

More

User comment

5

CommentsWrite a review

2025-07-28 10:00

2025-07-28 10:00

2024-03-27 15:49

2024-03-27 15:49