easyMarkets Information

What is easyMarkets? Founded in 2001 as “easy-forex” and rebranded to easyMarkets in 2016, the broker has stuck to its “Simply Honest” philosophy for over 20 years. A global multi-asset trading platform, it serves traders of all skill levels via innovative tools, diverse platforms, and transparent terms, standing out as stable and innovative with multi-country regulation and a strong reputation.

Its development includes launching forex trading in 2001, introducing “Guaranteed Stop Loss” in 2003, expanding to stocks/cryptocurrencies post-2016, partnering with Real Madrid in 2020, and holding 5-star Trustpilot ratings plus industry awards. Regulated by CySEC, ASIC, FSCA, and FSC, it segregates client funds in banks like Barclays/HSBC. Focused on “simpler, transparent trading,” it offers 275+ instruments and multi-terminal support.

Pros and Cons

easyMarkets is a fully legitimate and compliant broker, as it holds licenses from authoritative global regulators like CySEC (≥200% capital adequacy ratio), ASIC, and FSCA (trades supervised, no compliance disputes); publishes transparent trading terms (spreads, leverage, fees) on its official website, releases regular account reports, supports third-party audits, and proactively discloses critical info to meet “investor suitability” requirements; implements a “client fund segregation system” (funds in separate bank accounts, no historical losses); and has over 20 years of operation with no major compliance issues, won awards like TradingViews “Best Forex/CFD Broker,” serves 1M+ global traders, and has above-average user retention and reinvestment rates.

What Can I Trade on easyMarkets?

easyMarkets offers 7 asset classes and over 275 tradable instruments, spanning forex (95+ pairs like EUR/USD, 0.7-200 pips spreads), global shares (U.S./European/Australian/Hong Kong stocks like Apple, Tencent, T+0 trading), cryptocurrencies (20+ coins like BTC/ETH, 24/7 trading, MT5 max 1:400 leverage), metals (Gold XAU/USD, 0.2-0.45 USD spreads for inflation hedging), commodities (Crude Oil/Gas, MT5 max 1:400 leverage for supply-demand tracking), indices (Nasdaq/Dow Jones/Hang Seng, with multiplier-based contract value), and Vanilla Options (for currency pairs/precious metals, fixed risk for volatility hedging).

Account Type

What account types does easyMarkets offer? easyMarkets offers 3 account types, with core differences based on “capital size, spread type, and leverage limit” to suit diverse trader needs:

Common Features: All accounts have no commissions or account fees, support 18 account currencies (including CNY, USD, EUR, JPY), and include the platforms core risk tools (Negative Balance Protection) and customer support services.

easyMarkets Fees

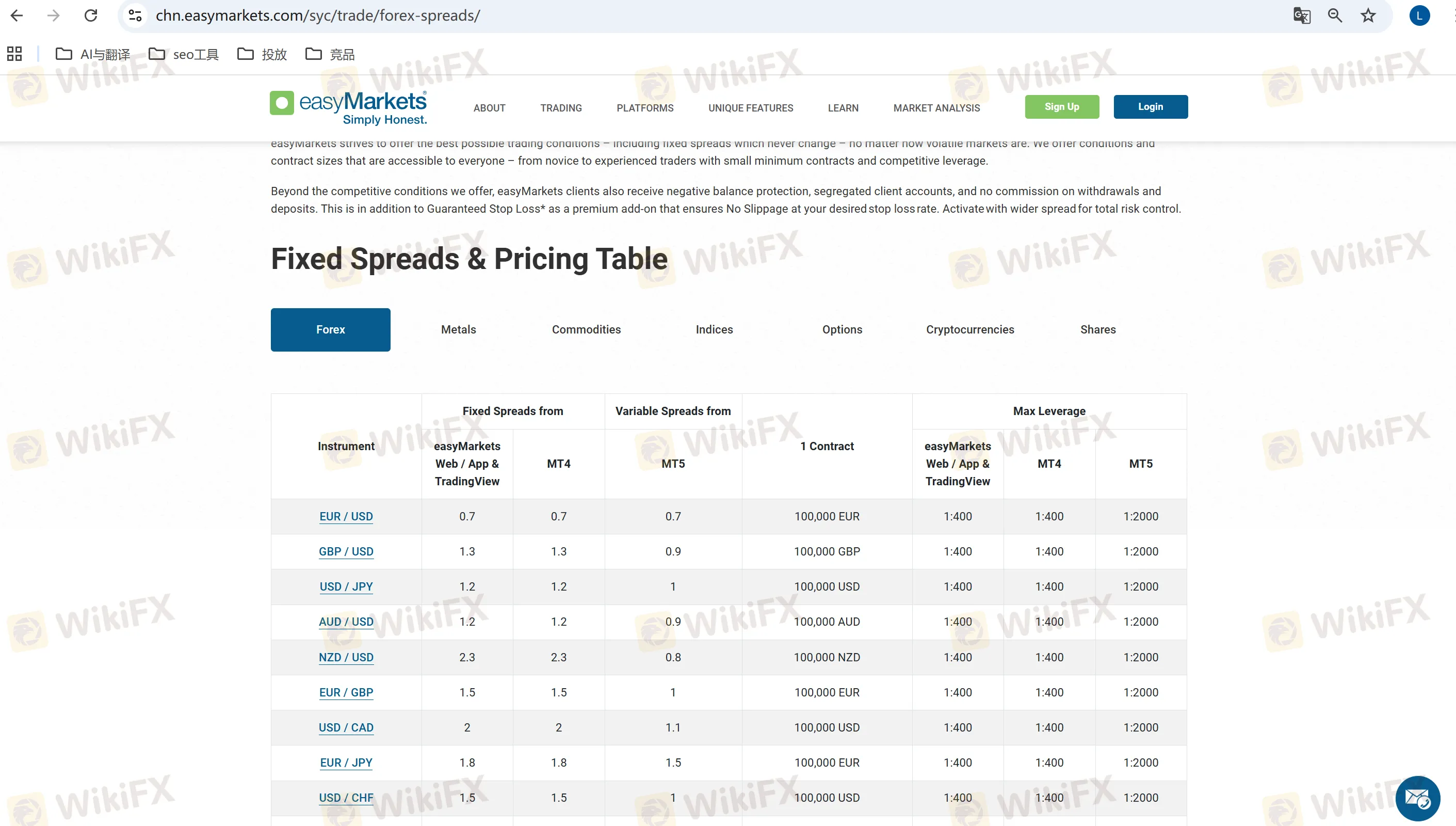

easyMarkets focuses on “no hidden fees,” with costs limited only to spreads and no additional charges in other processes. It has no trading commissions—fixed spreads (available on MT4, Web/App, and TradingView) range from 0.7–2.5 pips for major currency pairs (e.g., 0.7 pips for EUR/USD) and 7–200 pips for exotic pairs (e.g., 200 pips for USD/MXN), staying stable during market volatility; variable spreads (MT5 only) range from 0.7–1.5 pips for major pairs (e.g., 1 pip for USD/JPY) and 4.9–44.1 pips for exotic pairs (e.g., 11 pips for USD/CNH), adjusting dynamically with market liquidity.

It charges no deposit or withdrawal fees, supporting payment methods like Visa/Mastercard, bank transfers, Skrill/Neteller, and UnionPay (some regional banks may charge small transfer fees not imposed by the platform). There are also no account maintenance fees, rollover fees for overnight positions, or data usage fees, while the optional “Guaranteed Stop Loss with No Slippage” feature requires activation via wider spreads.

Leverage

What is easyMarkets leverage? easyMarkets'leverage uses a tiered system based on platform type, account equity, and regional regulations: MT4/VIP/Standard Accounts have max leverage of 1:400 (forex), 1:20 (stocks), 1:50–100 (crypto), 1:200 (metals/commodities); MT5 Accounts (unregulated regions) offer up to 1:2000 (forex), 1:40 (stocks), 1:400 (crypto/metals/commodities), plus a 5-tier dynamic mechanism (higher equity = lower leverage) adjusting all instruments margin requirements.

Trading Platform

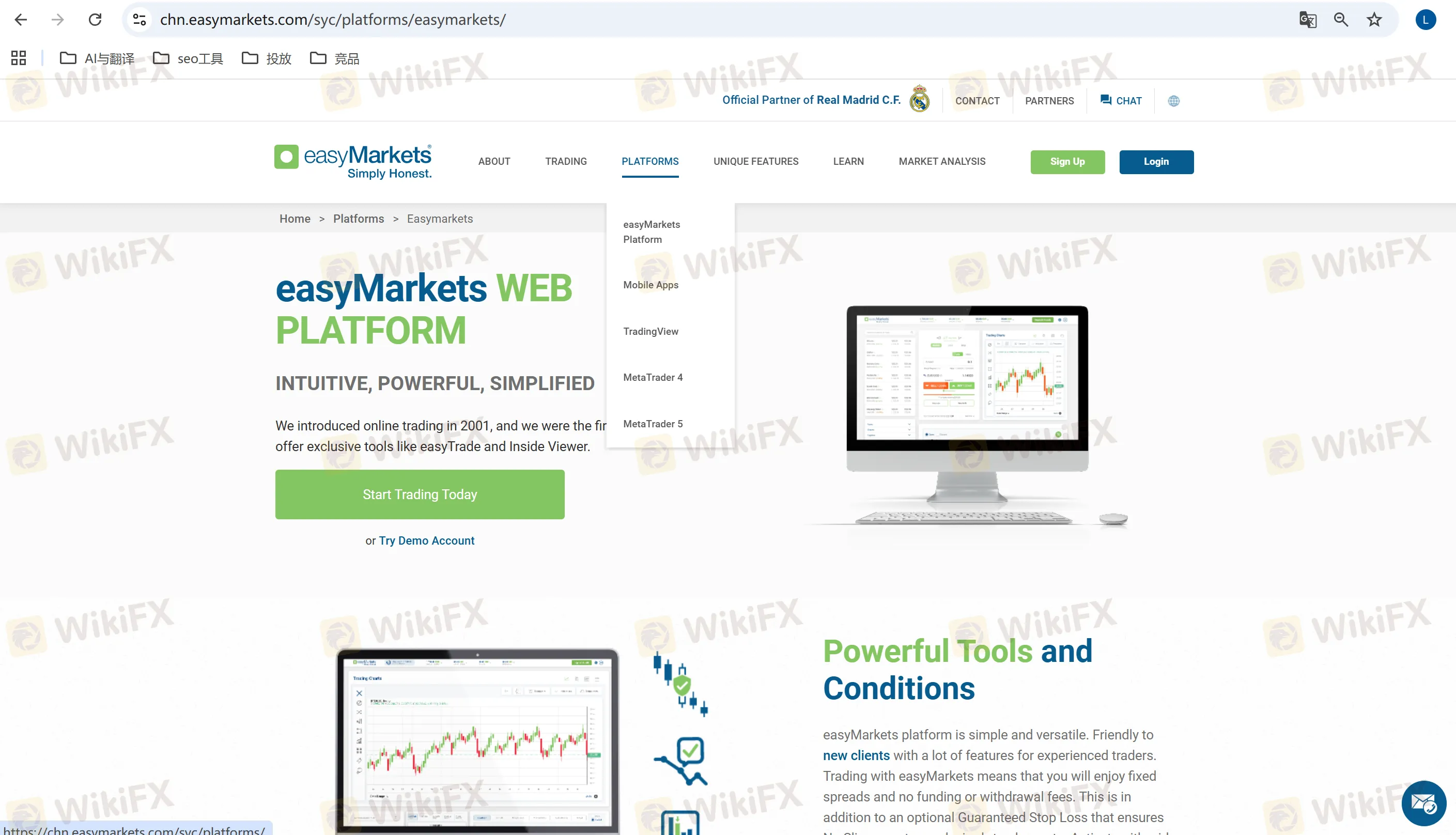

What easyMarkets Trading Platform is available? easyMarkets offers 4 major trading platforms to suit different operating habits and strategy needs, with key features as follows:

Common Features: All platforms support “demo accounts” (risk-free trials with full functionality), real-time position management, and trading signal alerts. Account funds can be managed uniformly via the easyMarkets client portal.

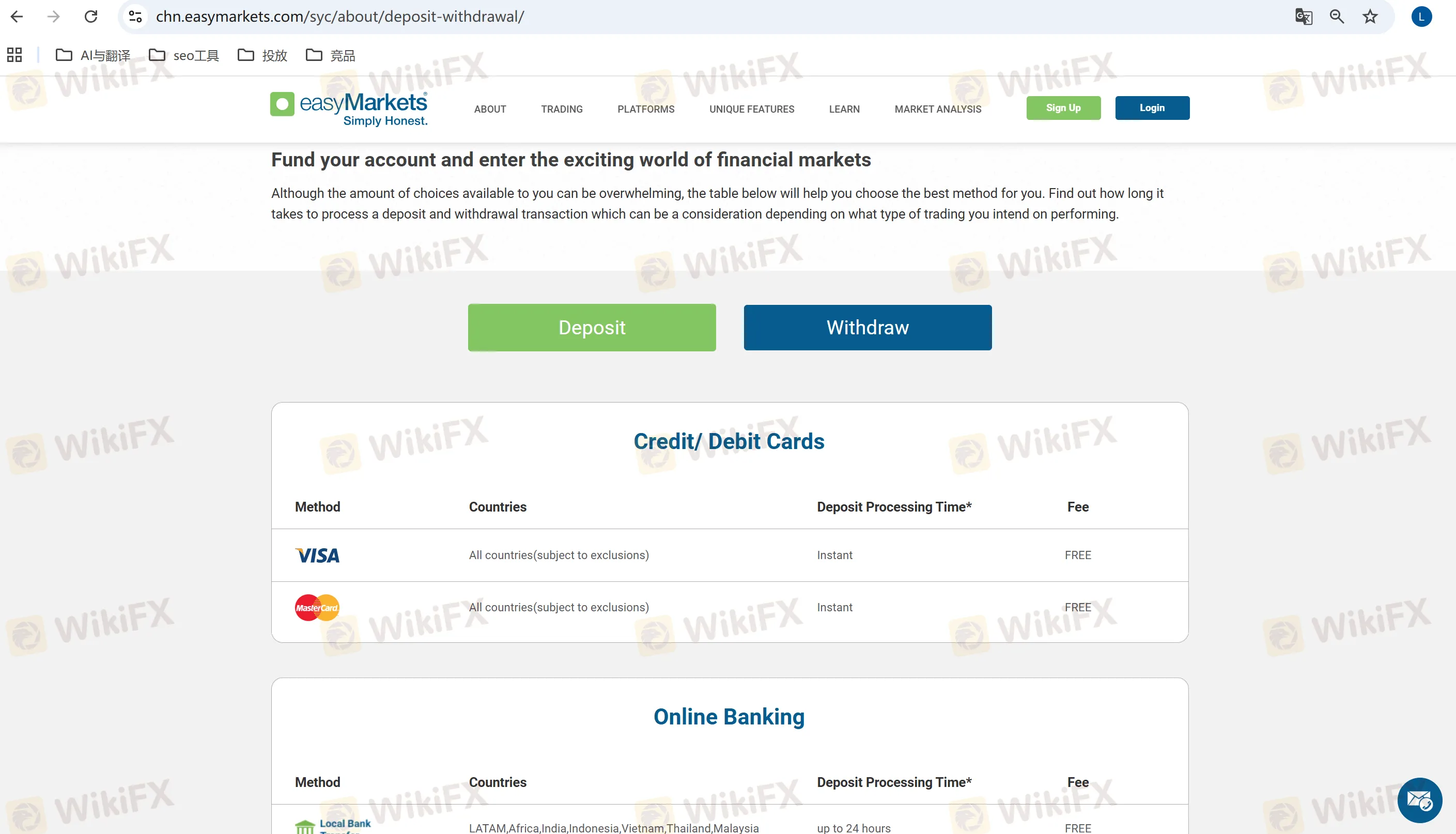

Deposit and Withdrawal

How about easyMarkets Deposit and Withdrawal details? easyMarkets has uniform deposit rules: 25 USD minimum (no max) across platforms, with deposit methods including instant credit cards, 1–5 business day bank transfers, 1–3 day e-wallets (Skrill/Neteller), and 1–2 day local methods (e.g., UnionPay), though deposit currency must match account currency to avoid small exchange costs; withdrawals require matching deposit methods (no min limit), take 1–3 days (e-wallets), 3–7 days (bank transfers) or 1–5 days (credit cards), with requests reviewed in 1–2 days, and client funds are secured in regulated segregated bank accounts.

Copy Trading

easyMarkets doesn't have a dedicated “Copy Trading (auto-copy trading)” feature, but offers alternatives: traders can view other users'public trading records/strategies via TradingView integration (manual reference, risk judgment needed), all accounts get daily Trading Central technical analysis emails and fundamental reports (beginners adjust directions with this), and account managers provide personalized strategy advice (e.g., swing trading levels) as “manual copy trading” support for beginners.

Bonus

easyMarkets designs three types of bonus programs around “new client acquisition, existing client retention, and channel promotion,” with transparent rules and no mandatory trading requirements:

First Deposit Bonus:

Rules: New clients receive a 50% bonus on their first deposit.

Above 20 years

Above 20 years

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX