Let's start here:

Forex.com is a major player in forex trading, providing various options including forex, indices, stocks, cryptos, gold, oil & commodities, and bullion. Their platforms, like the popular MetaTrader 4 and MetaTrader 5, are available worldwide to meet different trader preferences. Backed by robust regulation and a strong focus on security, Forex.com is a favored choice for professionals looking for an all-encompassing trading experience. Now, let's delve deeper to verify if Forex.com lives up to its reputation.

Forex.com Information

Forex.com is one of the most respected and trusted forex brokers in the foreign exchange trading industry. Founded in 2001, Forex.com is a global company licensed and regulated by several reputable regulatory authorities, including ASIC in Australia, FCA in the UK, FSA in Japan, NFA in the USA, CIRO in Canada, and MAS in Singapore.

Pros & Cons

Is Forex.com Legit?

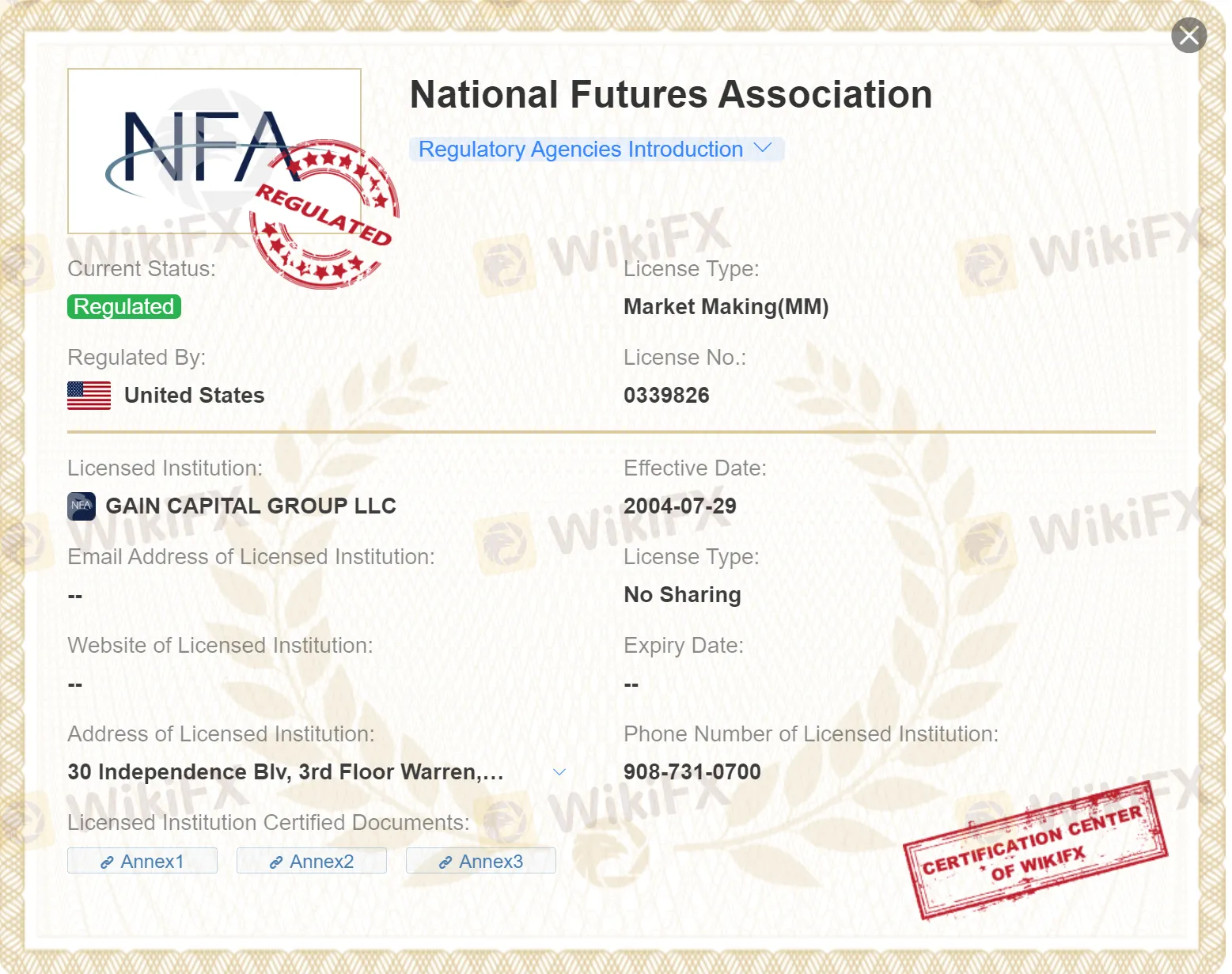

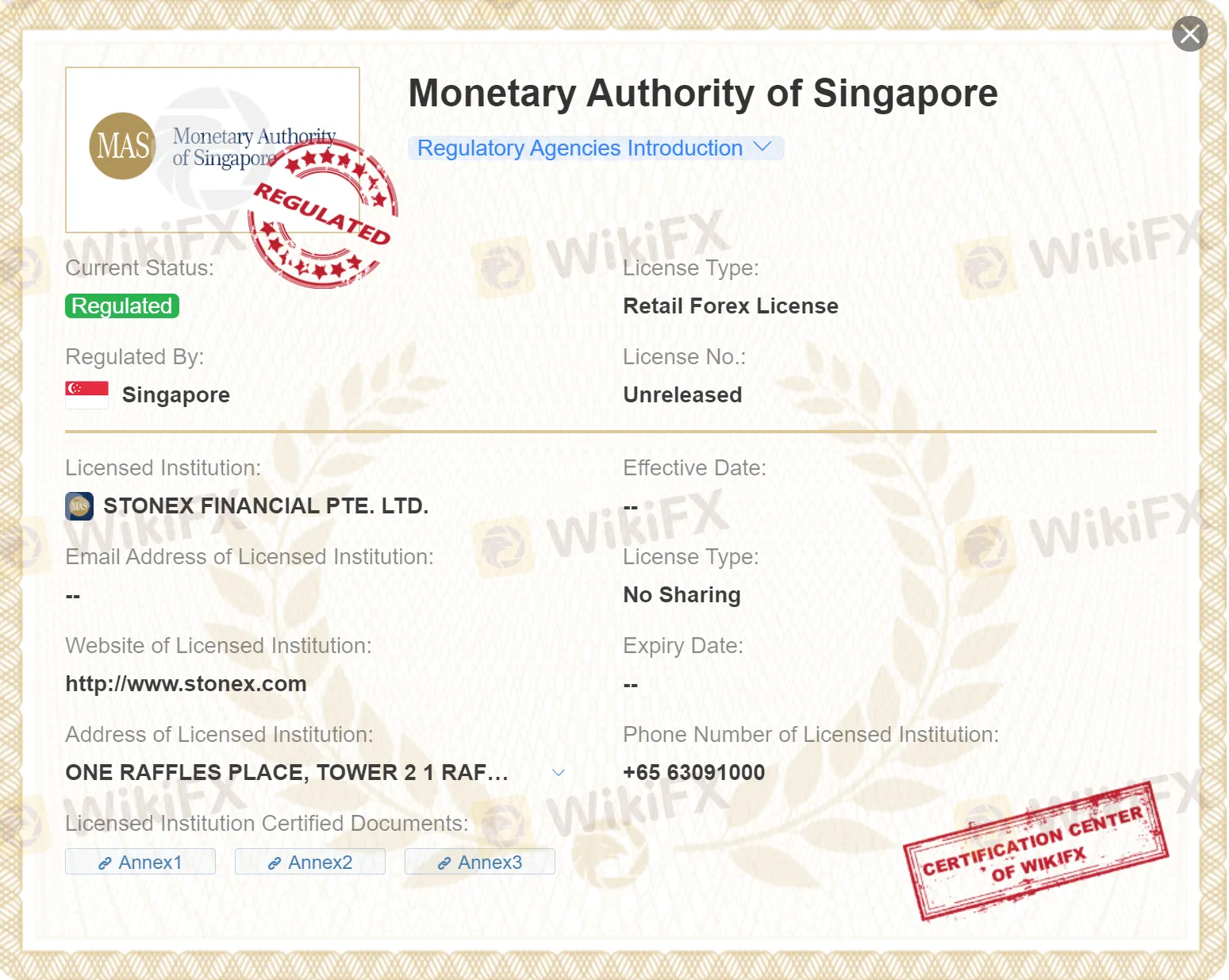

Yes, Forex.com operates legally. Forex.com, a globally recognized broker, is part of an international holding company regulated by reputable authorities worldwide, including ASIC (Australia), FCA (UK), FSA (Japan), NFA(USA), CySEC (Cyprus), CIRO (Canada), and MAS (Singapore).

Forex.com's Australian entity, STONEX FINANCIAL PTY LTD, regulated by the ASIC in Asutralia under regulatory number 345646,holding a license for Market Making (MM).

Forex.com's UK entity, Gain Capital UK Limited, regulated by tier-one regulatory FCA under regulatory number 113942, holding a license for Market Making(MM).

The entity based in Japan, GAIN Capital Japan Co., Ltd, regulated by FSA under regulatory number 関東財務局長(金商)第291号, holding a license for Retail Forex License.

GAIN CAPITAL GROUP LLC, the US entity, regulated by the NFA under regulatory number0339826, holding a license for Market Making (MM).

Cyprus entity, StoneX Europe Ltd,is regulated by CySEC, holding a license for Market Making (MM), with license No. 400/21.

Candian entity, GAIN Capital - FOREX.com Canada Ltd., is regulated by the IIROC, holding a license for Market Making (MM), with license unreleased.

STONEX FINANCIAL PTE. LTD., the entity in Singapore, regulated by the MAS in Singapore, holding a license for retail forex.

Additionally, Forex.com offers negative balance protection on all of its trading accounts. This means that clients cannot lose more money than they have in their account, providing an additional layer of security and peace of mind in trading. In the event that an extreme market situation occurs and a position moves against the client, Forex.com will automatically close the position before the account balance falls below zero. This protection helps limit risk for clients and is an important feature to consider when choosing a forex broker.

Market Instruments

Forex.com offers a wide variety of trading instruments, including forex, indices, stocks, cryptos, gold, oil & commodities, and bullion. Traders have a wide range of options to choose from and can find opportunities in a variety of markets.

Minimum Deposit

The minimum deposit amount required to register a Forex.com Standard live trading account is $100, which is quite friendly to most investors.

Here is the table showing the comparison of Forex.com minimum deposit with other brokers:

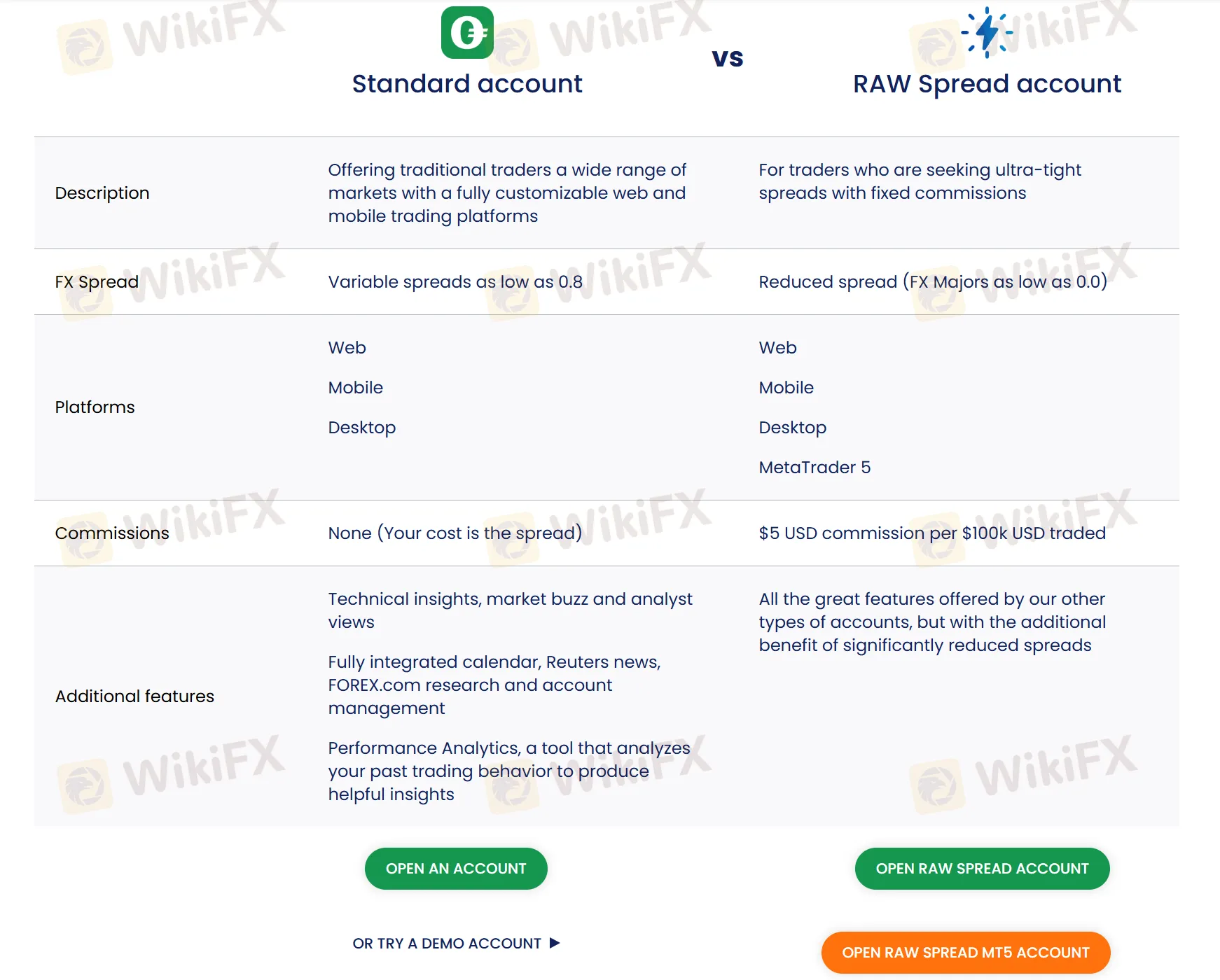

Account Type

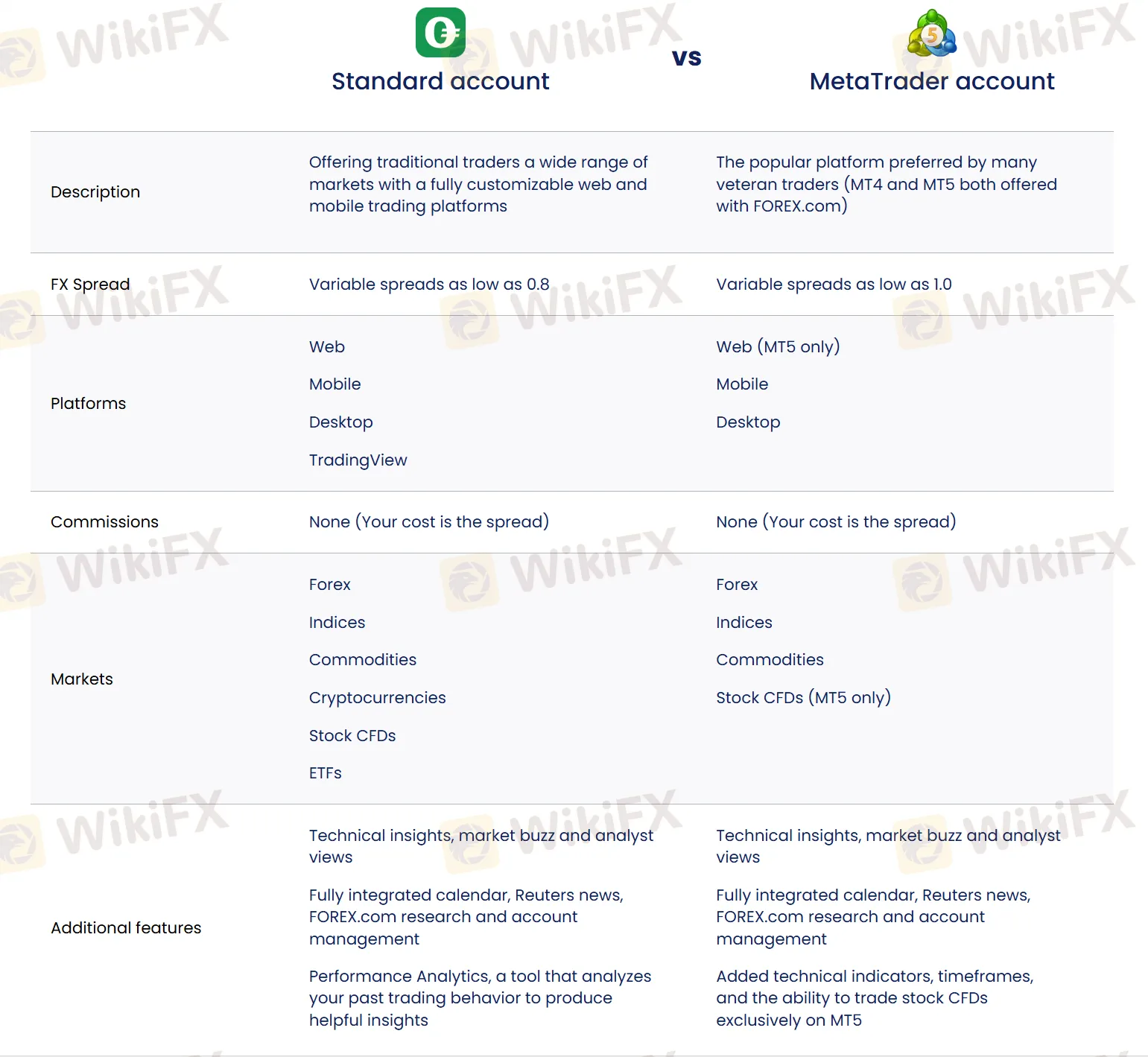

Forex.com offers three account types, including Standard, MetaTrader, and Raw Spread accounts.

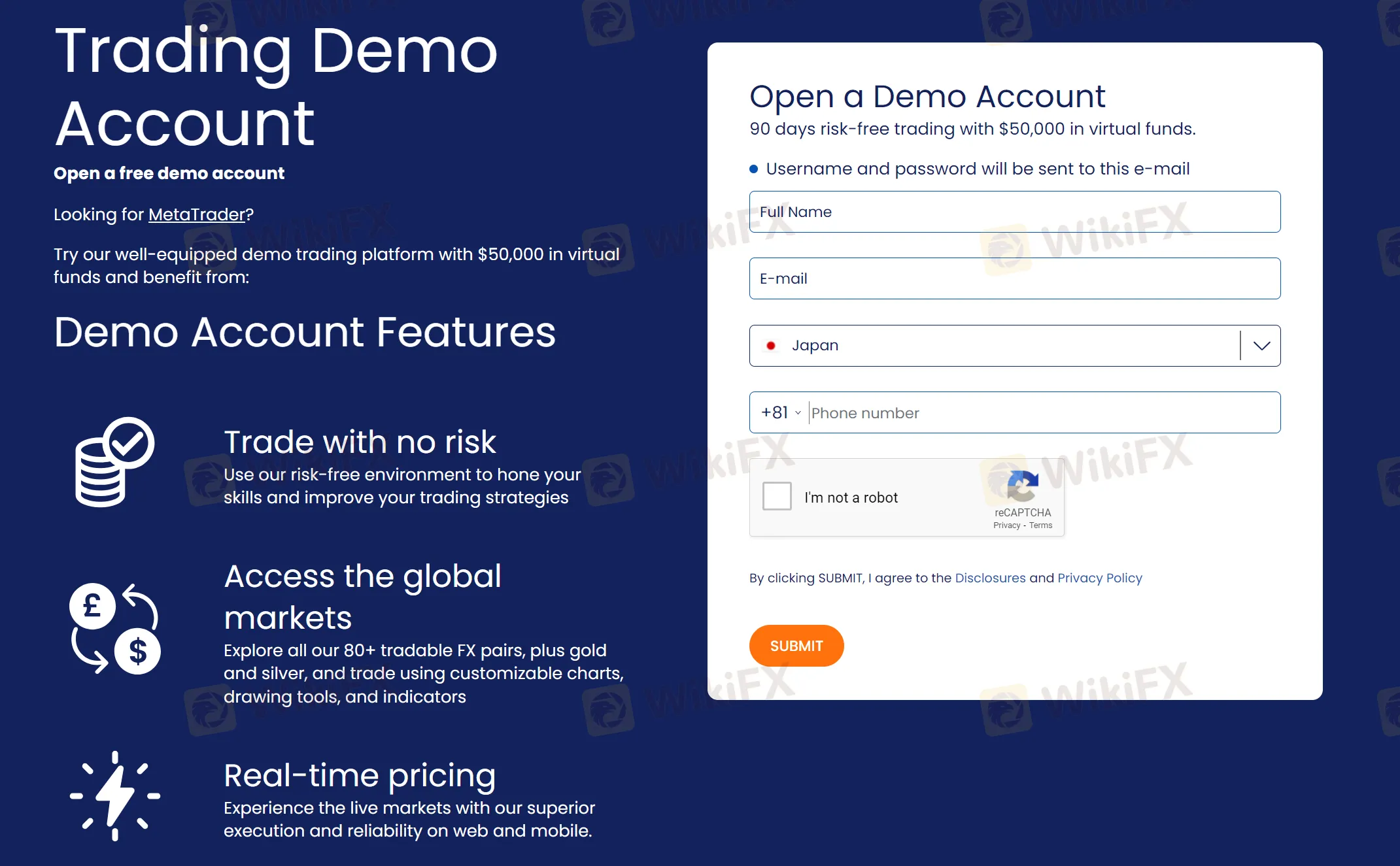

Demo Account

Forex.com also provides beginners with demo accounts, allowing them to practice in a real trading setting without any financial risks. Demo accounts come with $50,000 in virtual funds and are active for 90 days from the time of registration. Please be aware that once this period ends, you won't be able to access the demo account with the same login details. Notably, each email address can only be used to open one demo account for each type, whether it's on FOREX.com platforms or MetaTrader.

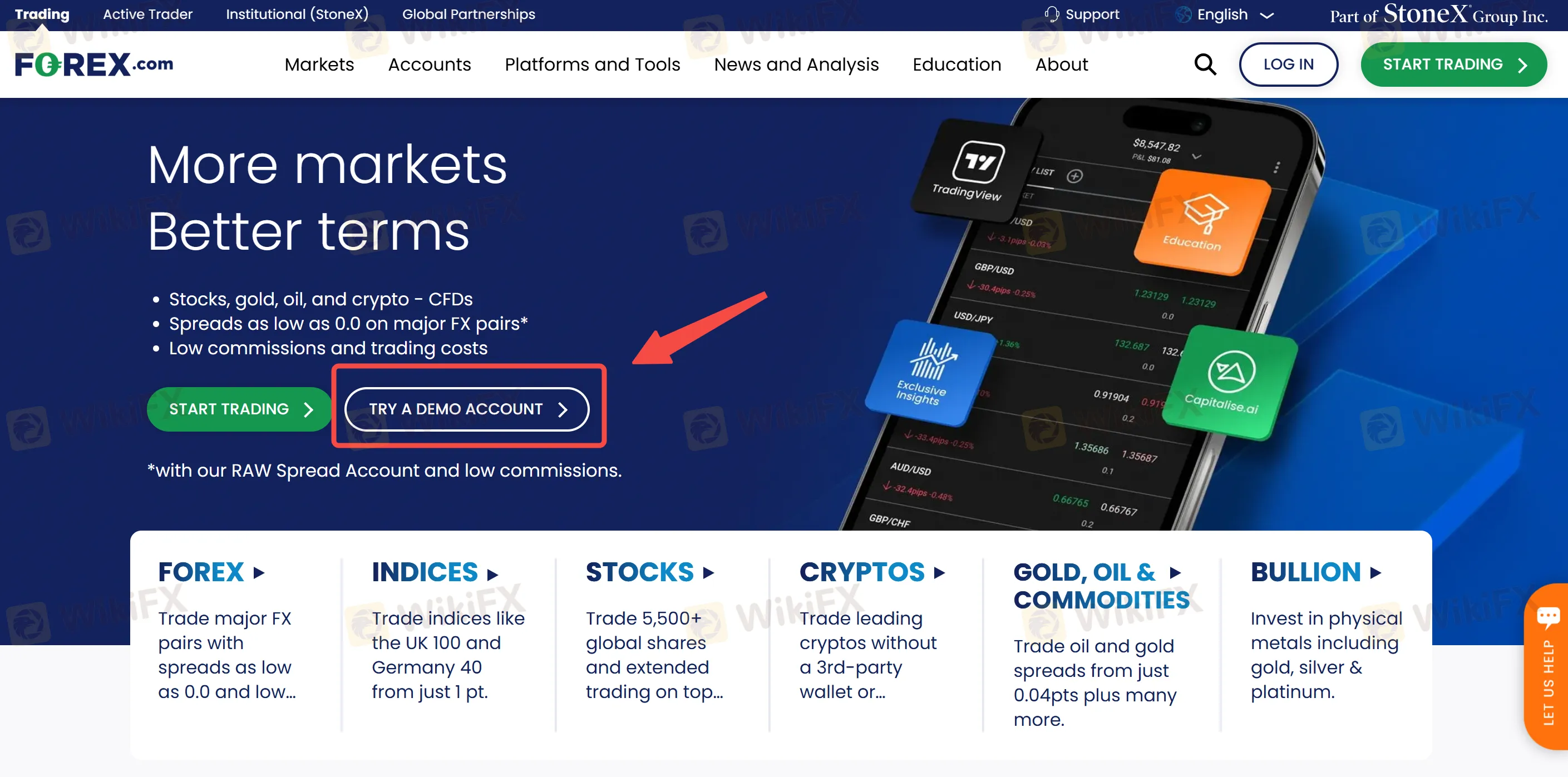

Here is the simple demo account sign-up process for you to follow:

Step 1: Click the “TRY A DEMO ACCOUNT” button on Forex.com's homepage.

Step 2: Fill in your full name, email and phone number in the form, and then click I'm not a robot for verification.

Step 3: After a simple registration, you can use the demo account and start trading.

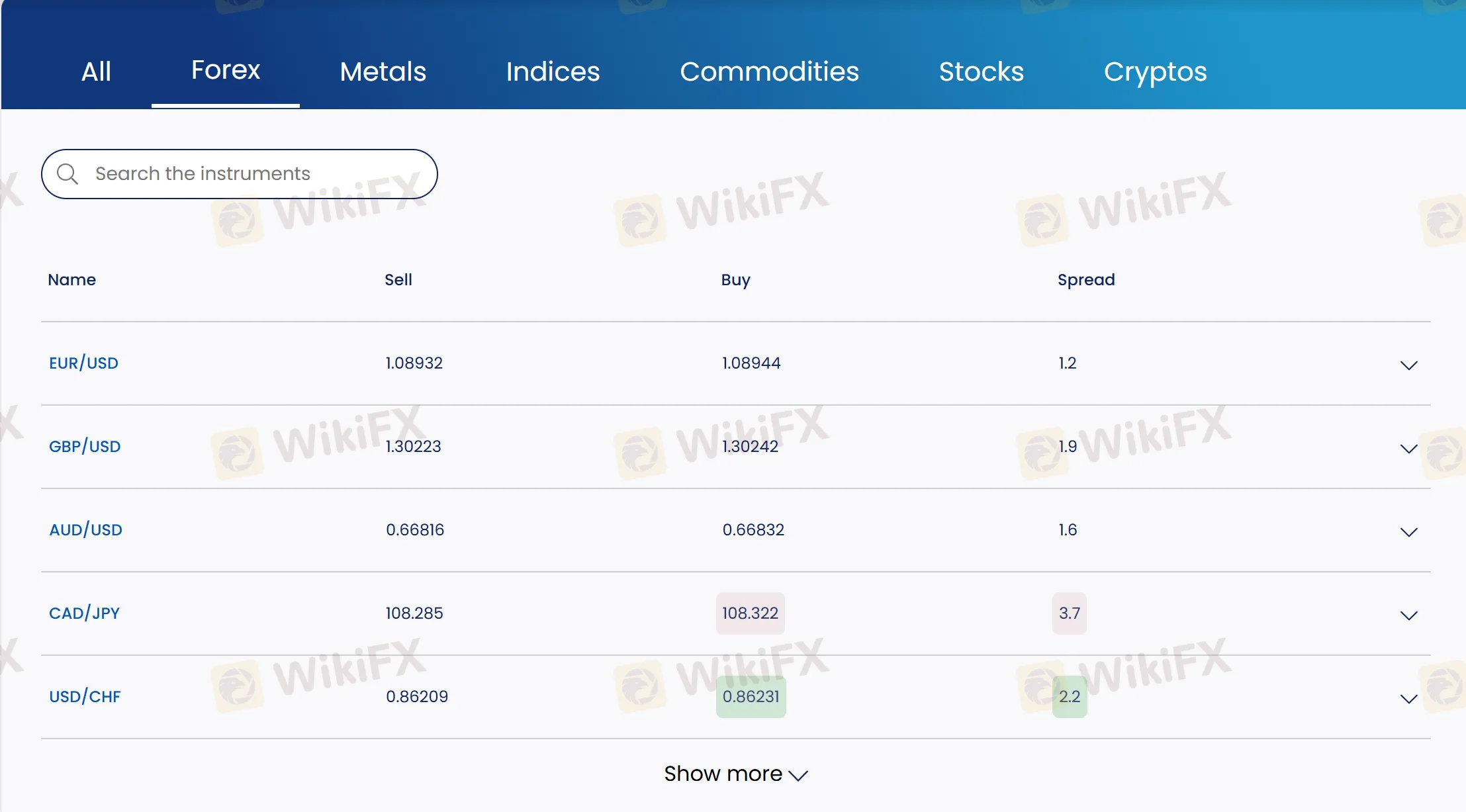

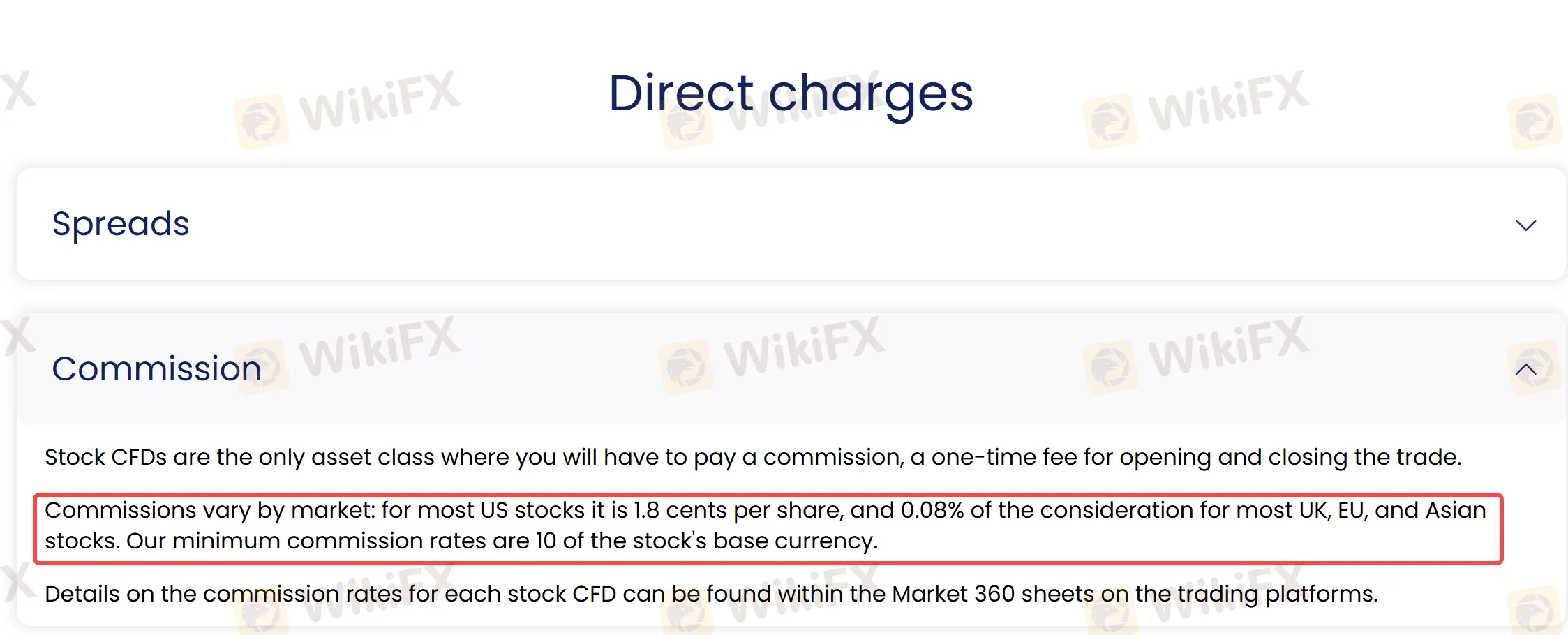

Spreads & Commissions

Forex.com offers competitive spreads and low commissions on a wide range of trading instruments. Spreads for the EUR/USD currency pair is floating around 1.2 pips, which is very low compared to other brokers. You can find spreads on other pairs in the screenshot below:

Commissions vary by market: for most US stocks it is 1.8 cents per share, and 0.08% of the consideration for most UK, EU, and Asian stocks. The minimum commission rates are 10 of the stock's base currency.

Trading Platforms

FOREX.com offers a variety of trading platforms designed to cater to the diverse needs of its traders, from beginners to experienced market participants.

MetaTrader 4 (MT4): Widely recognized as the industry standard for forex trading, MT4 is favored for its advanced charting capabilities, automated trading features through Expert Advisors (EAs), and extensive back-testing environment. FOREX.com enhances MT4 with additional tools and research to optimize trading.

MetaTrader 5 (MT5): As the successor to MT4, MT5 offers all the admired features of MT4 but with additional capabilities such as more timeframes, more technical indicators, advanced charting tools, and supports trading in stocks, commodities, and futures markets along with forex.

TradingView: TradingView is a premium business utility that offers a free demo of its trade charting platform. The app is simple for beginners and effective for technical analysis experts.

Web Trading Platform: Accessible directly from a web browser without the need to download or install any software, this platform is built on HTML5 and offers a rich set of features including powerful charts, a suite of trading tools, and integrated trading strategies.

Mobile Trading Apps: FOREX.com provides mobile applications compatible with Android and iOS devices, allowing traders to manage their accounts on the go. These apps offer full trading capabilities, complex order types, and interactive charts.

Deposit & Withdrawal

Forex.com offers several payment methods for depositing and withdrawing funds, such as local online transfers, credit/debit card, wire transfer, Neteller, and Skrill. Deposits are processed within 24 hours, which means traders can start trading quickly. Withdrawals are also fast, usually taking 1-2 business days to process. It is important to note that Forex.com does not charge any additional fees for deposits or withdrawals, but payment service providers may impose their own fees.

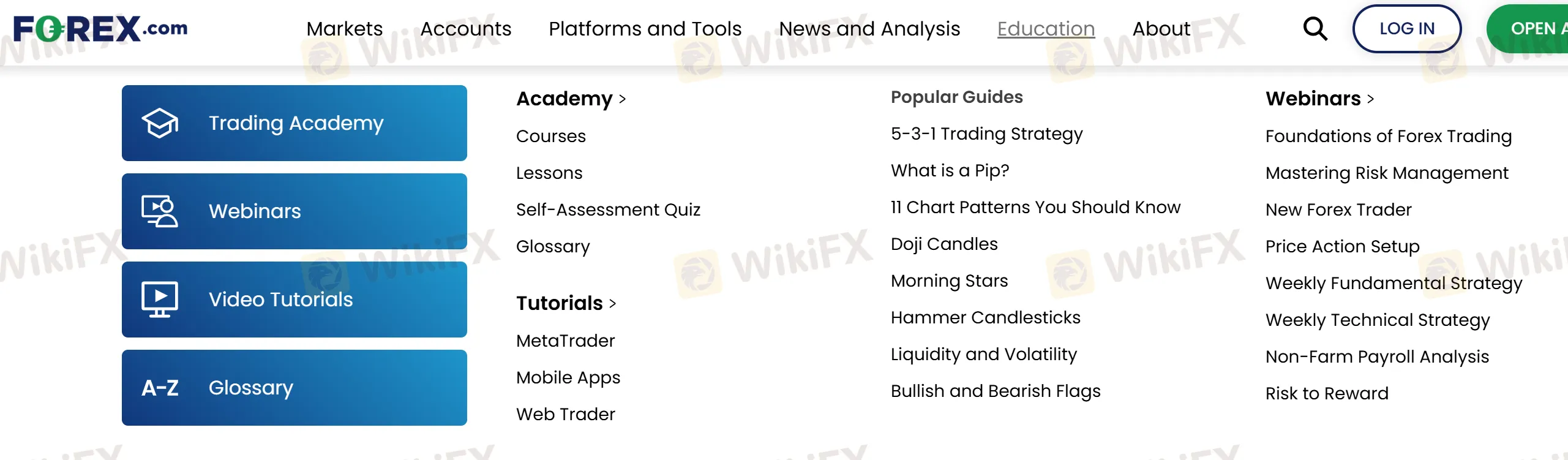

Education

Forex.com offers different educational resources for different traders. If you are just a beginner, you can choose “new to trading”, and then you can find beginner-friendly educational resources. If you are professional, you can choose “an experienced trader”, then you can go to more advanced educational resources. Academy, tutorials, webinars, and free demo accounts are all available to practice and improve trading skills.

Conclusion

In summary, Forex.com is a well-regulated and respected broker with a wide variety of trading instruments and easy-to-use trading platforms. With its solid reputation in the industry and its focus on security and protection of client funds, Forex.com is an attractive option for traders looking for a reliable and secure broker.

Frequently Asked Questions (FAQs)

Does Forex.com offer a demo account for practice?

Yes. Demo accounts are available for 90 days with $50,000 in virtual funds.

What is the minimum deposit to open an account at Forex.com?

$100.

Does Forex.com charge commissions for trades?

Forex.com charges commissions for some trades, such as stock trading. However, it does not charge commissions in most markets. Instead, Forex.com earns profits through the spread between the bid and ask prices of assets.

Does Forex.com have any kind of training or education program for traders?

Yes, Forex.com offers a wide variety of educational resources for traders of all levels, including live webinars, seminars, trading guides, articles and educational videos.

What payment methods does Forex.com accept?

Forex.com accepts various payment methods, including credit and debit cards, bank transfers, as well as electronic payment systems such as Skrill and Neteller.

Above 20 years

Above 20 years

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX

WikiFX